On-chain data suggests around 729,400 Bitcoin wallets cleared themselves out in the last month. Here’s what could be behind this trend.

Bitcoin Wallets Carrying A Balance Have Taken A Sharp Hit In Past Month

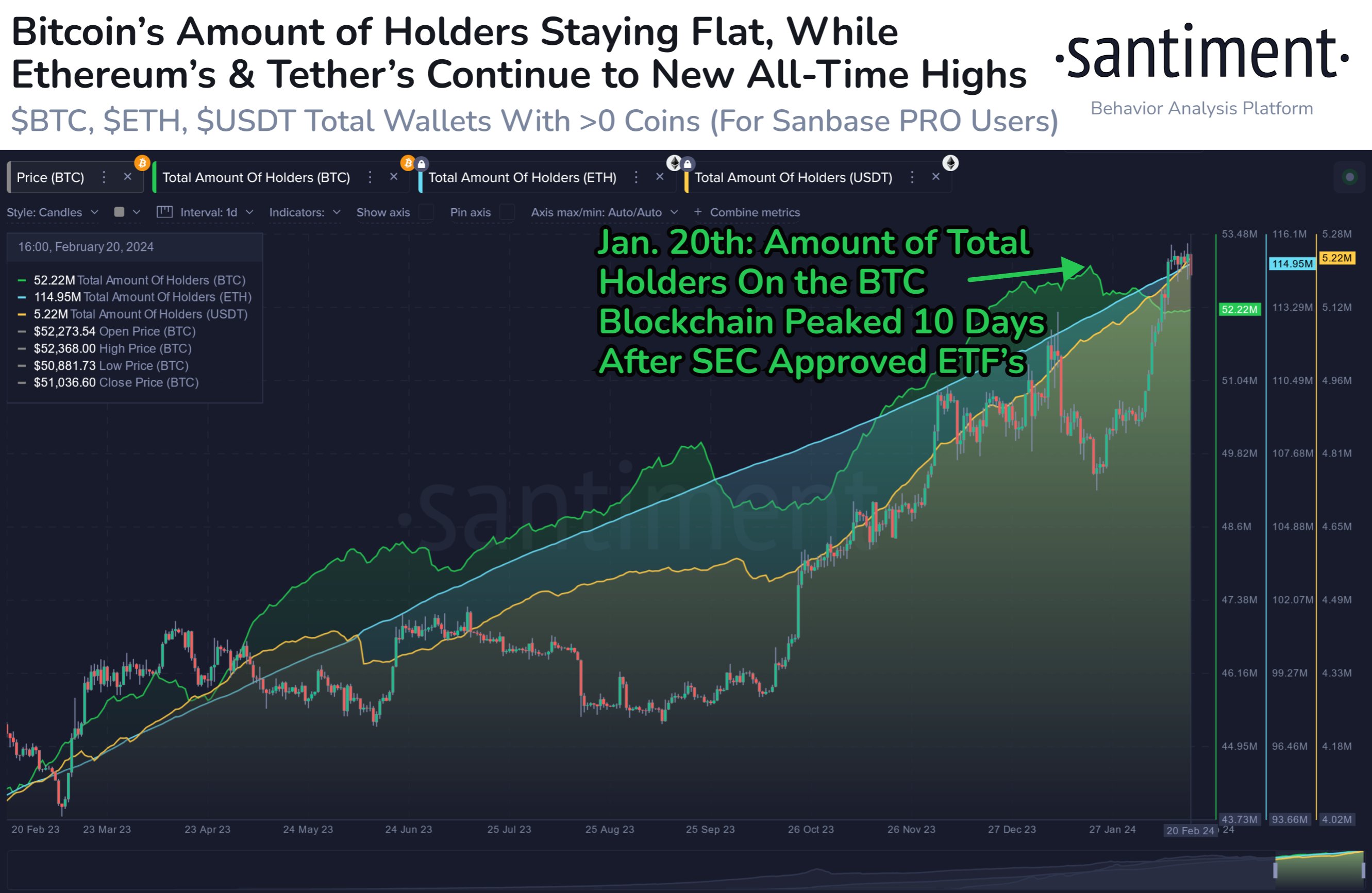

In a new post on X, the on-chain analytics firm Santiment discussed the trend in the “Total Amount of Holders” for Bitcoin and how it has differed from that of Ethereum (ETH) and Tether (USDT).

The “Total Amount of Holders” here refers to an indicator that keeps track of the total number of addresses that are carrying a non-zero balance on the blockchain.

When the value of this metric rises, it means that either brand new addresses are popping up on the network or some old investors have returned back to the cryptocurrency.

Whatever the case might be, this kind of trend can be a constructive sign for the cryptocurrency (at least in the long-term), as it suggests that more adoption is taking place.

On the other hand, the indicator going down implies some investors have decided to sell the entire amount sitting in their wallets. Such a trend suggests a net amount of holders have decided to exit the asset.

Now, here is a chart that shows the trend in the Total Amount of Holders for Bitcoin, Ethereum, and Tether over the past year:

The value of the metric seems to have gone down for BTC in recent weeks | Source: Santiment on X

As displayed in the above graph, the “Total Amount of Holders” has been heading down for Bitcoin since January 20th, while the indicator has continued to rise for Ethereum and Tether.

This would imply that an exit has been happening from BTC, while the other major assets in the sector have continued to enjoy more adoption. What’s behind this discrepancy? The answer to that may lie in an event that’s specific to only the original cryptocurrency.

On January 10, the US Securities and Exchange Commission (SEC) finally approved spot exchange-traded funds (ETFs) for Bitcoin. ETFs are investment vehicles that allow investors to gain indirect exposure to their underlying assets.

The ETFs trade on traditional markets, so they can be a more attractive option for those who are unfamiliar with how cryptocurrency wallets and exchanges work.

It’s perhaps not a coincidence that the metric hit its peak ten days after the ETFs were approved and has since been going down. “This is attributed to the increased interest in hodlers having exposure through ETF’s instead,” explains Santiment.

As this option isn’t available for the other cryptocurrencies, it’s not surprising that their adoption has only continued to further in the same period. For both Ethereum and Tether, the “Total Amount of Holders” is sitting at all-time highs of 114.95 million and 5.22 million, respectively.

“For any future asset with ETF’s, there would be an implied drop in active wallets on their respective network,” says the analytics firm.

BTC Price

Bitcoin is in a bit of a rut right now as the asset’s price has overall consolidated sideways in the past week.

Looks like the price of the asset has been stale recently | Source: BTCUSD on TradingView

Featured image from Erling Løken Andersen on Unsplash.com, Santiment.net, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Dai

Dai  USDT0

USDT0  Shiba Inu

Shiba Inu  sUSDS

sUSDS  Hedera

Hedera  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle  MemeCore

MemeCore