On April 20, the day of the Bitcoin halving, total transaction fees paid to miners jumped to 1,257.71 BTC, the highest since December 2017.

The high amounts starkly contrasted with fees from the previous day, which amounted to only 116.94 BTC. When viewed alongside the decreased block rewards post-halving, this surge in transaction fees led to an extraordinary scenario where over 75% of miner revenue was derived from transaction fees, as previously analyzed by CryptoSlate.

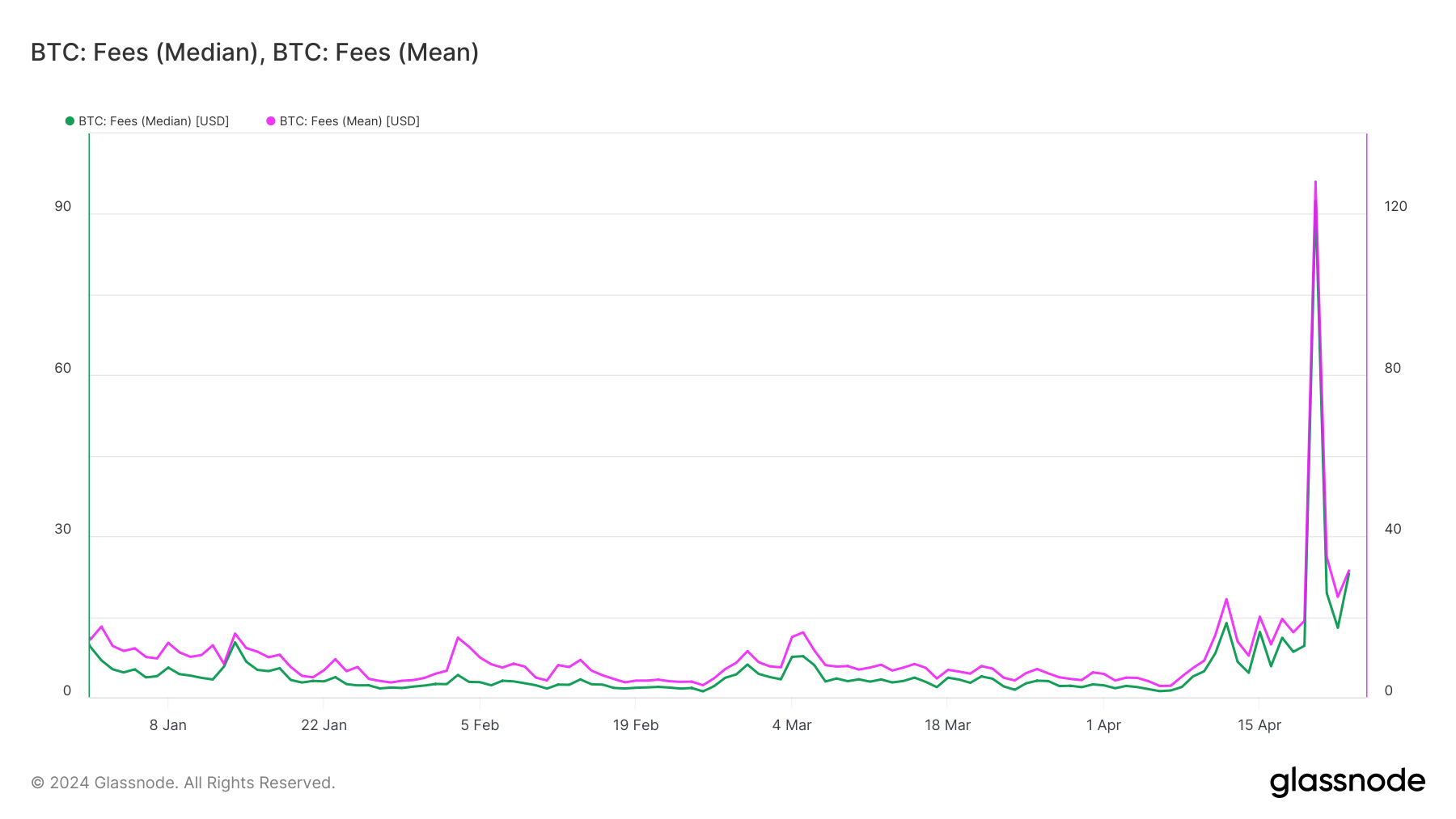

Such high fees have considerable implications for the utility of the Bitcoin blockchain. Throughout the weekend surrounding the halving, the mean transaction fee was $130, while the median fee hovered around $93, rendering the cost of settling regular financial transactions on the network prohibitively high for most users.

Consequently, only high-value transactions were feasible, where the substantial fees constituted a minor portion of the overall transaction value. The issue was further exacerbated by the introduction of Runes, which CryptoSlate analysis found played a significant role in network congestion, particularly on the day of the halving, significantly impacting network functionality.

The congestion and high fees precipitated by both Runes and the increased demand for block space during the halving had a pronounced effect on the Bitcoin network. Although the financial benefits for miners were clear, with a noticeable spike in their revenue, the network itself sustained significant non-monetary damage.

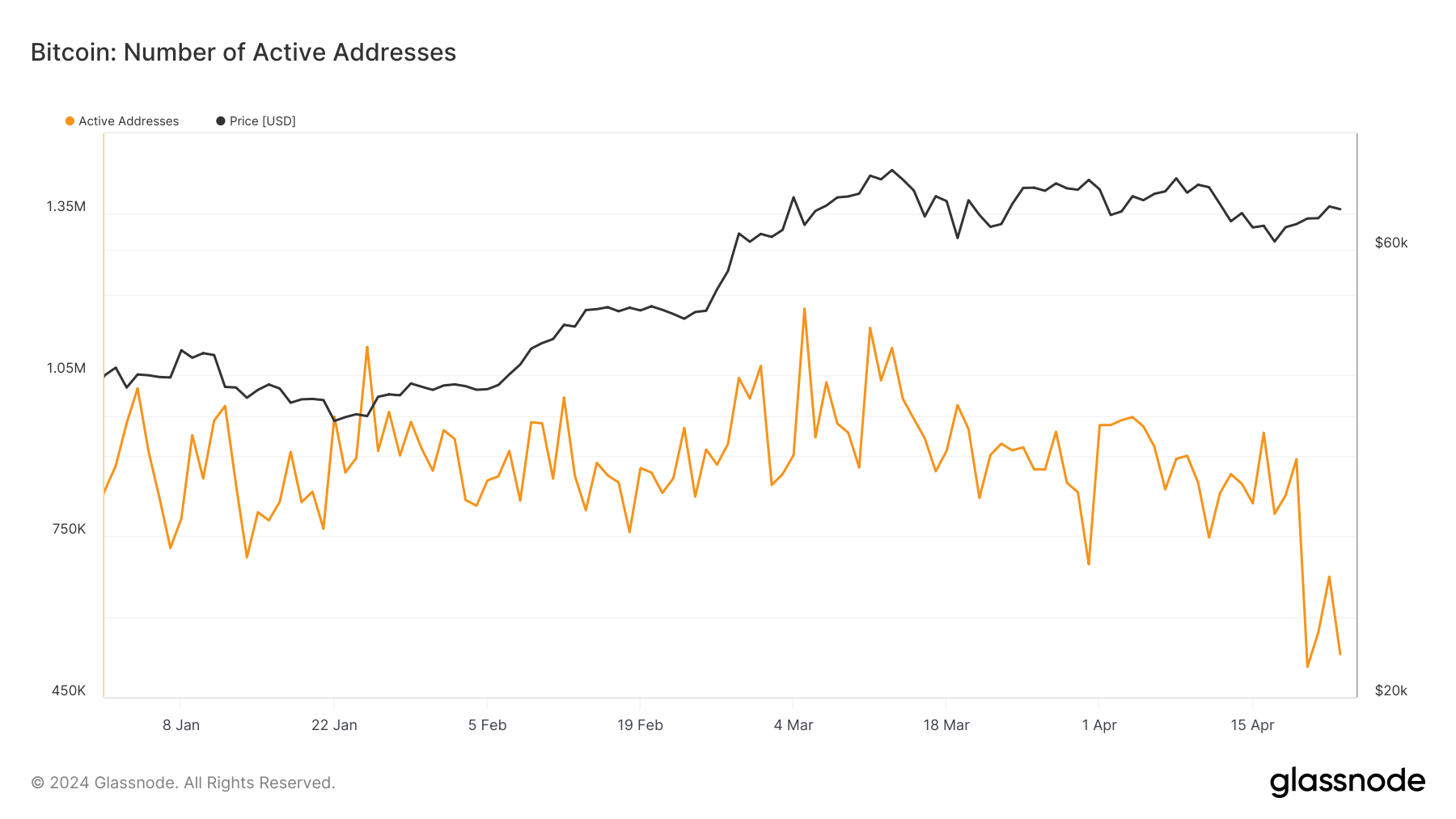

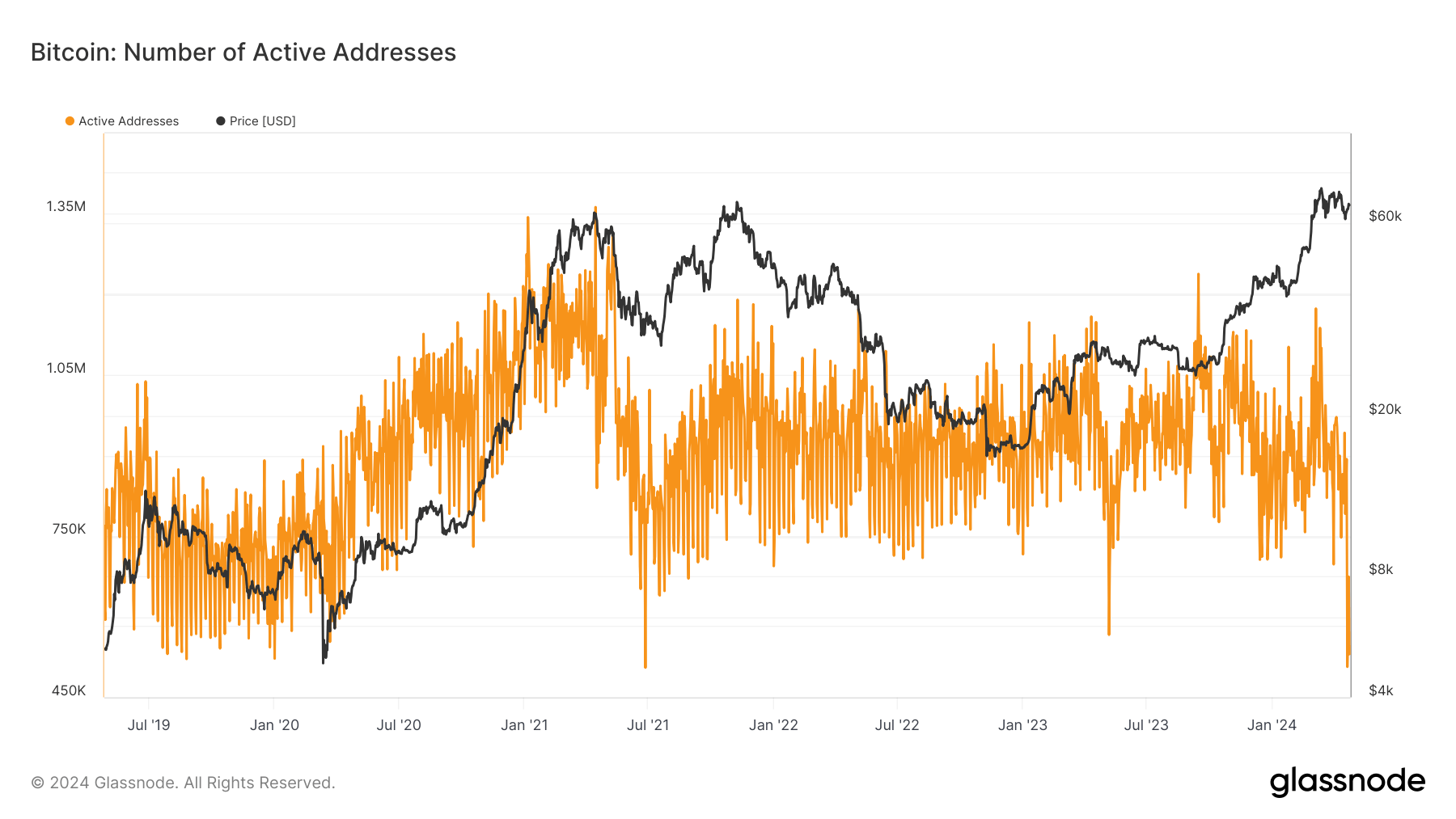

The practicality of using Bitcoin for everyday payments and transfers was severely compromised, alienating a substantial segment of its user base. This alienation was evident from the sharp decline in active addresses, a critical metric for gauging network engagement.

Active addresses represent unique addresses that were involved in the network either as senders or receivers, and only those active in successful transactions are counted. Since the beginning of the year, the number of active addresses on the Bitcoin network has fluctuated between 750,000 and 1.1 million.

However, on the eve of the halving, there were 893,528 active addresses, which plummeted to 506,862 on the day of the halving—marking the lowest in nearly three years. Although there was a slight recovery to 674,613 active addresses on April 21, the numbers fell again to 530,371 by April 22, suggesting that the network might take time to return to its average yearly activity.

From a market perspective, the drastic reduction in active addresses indicates a potential loss of confidence among smaller investors and everyday users, who may view the increased costs and network congestion as barriers to entry or continued participation.

Furthermore, the introduction of new protocols like Runes, while innovative, must be managed carefully to ensure they do not overwhelm the existing infrastructure during critical periods such as a halving.

The post High Bitcoin fees push active addresses down to 3-year low appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  Canton

Canton  Uniswap

Uniswap  PayPal USD

PayPal USD  Mantle

Mantle  Cronos

Cronos  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Aave

Aave  Rain

Rain  Bitget Token

Bitget Token