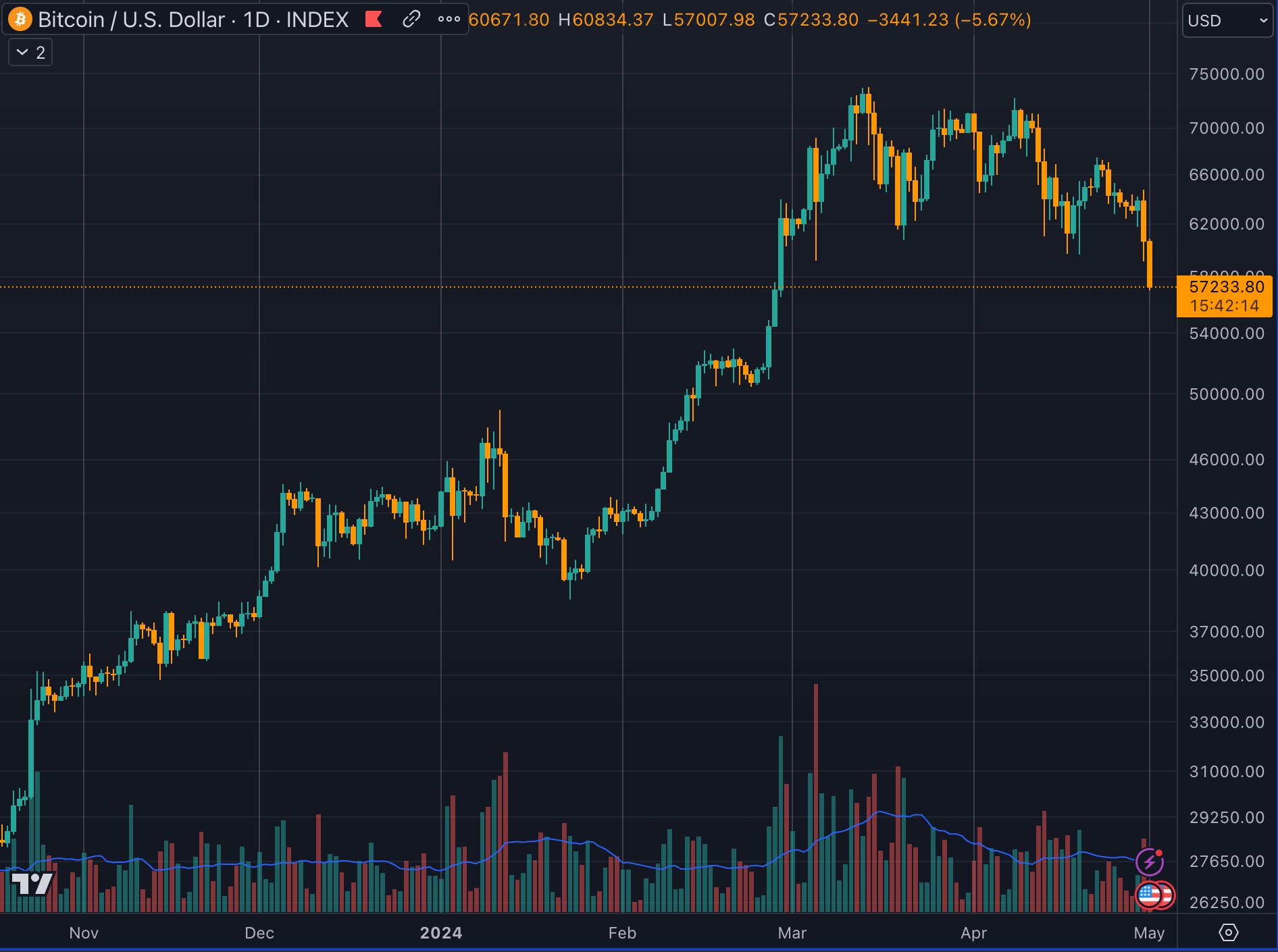

Since February, Bitcoin has fallen to its lowest price, breaking below $60,000 and hitting $56,900 as of press time. The price is now 23% below its recent pre-halving all-time high of $73,000.

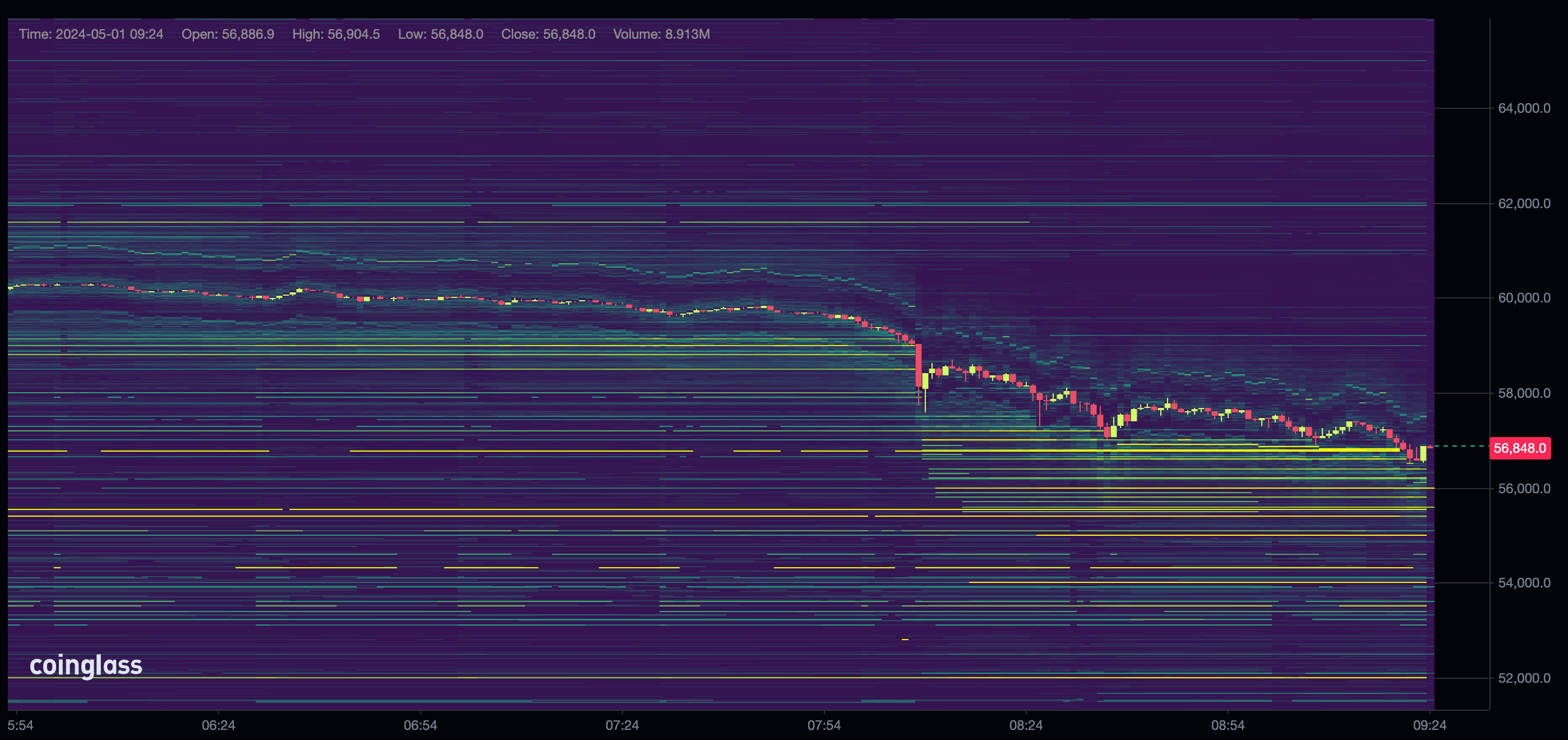

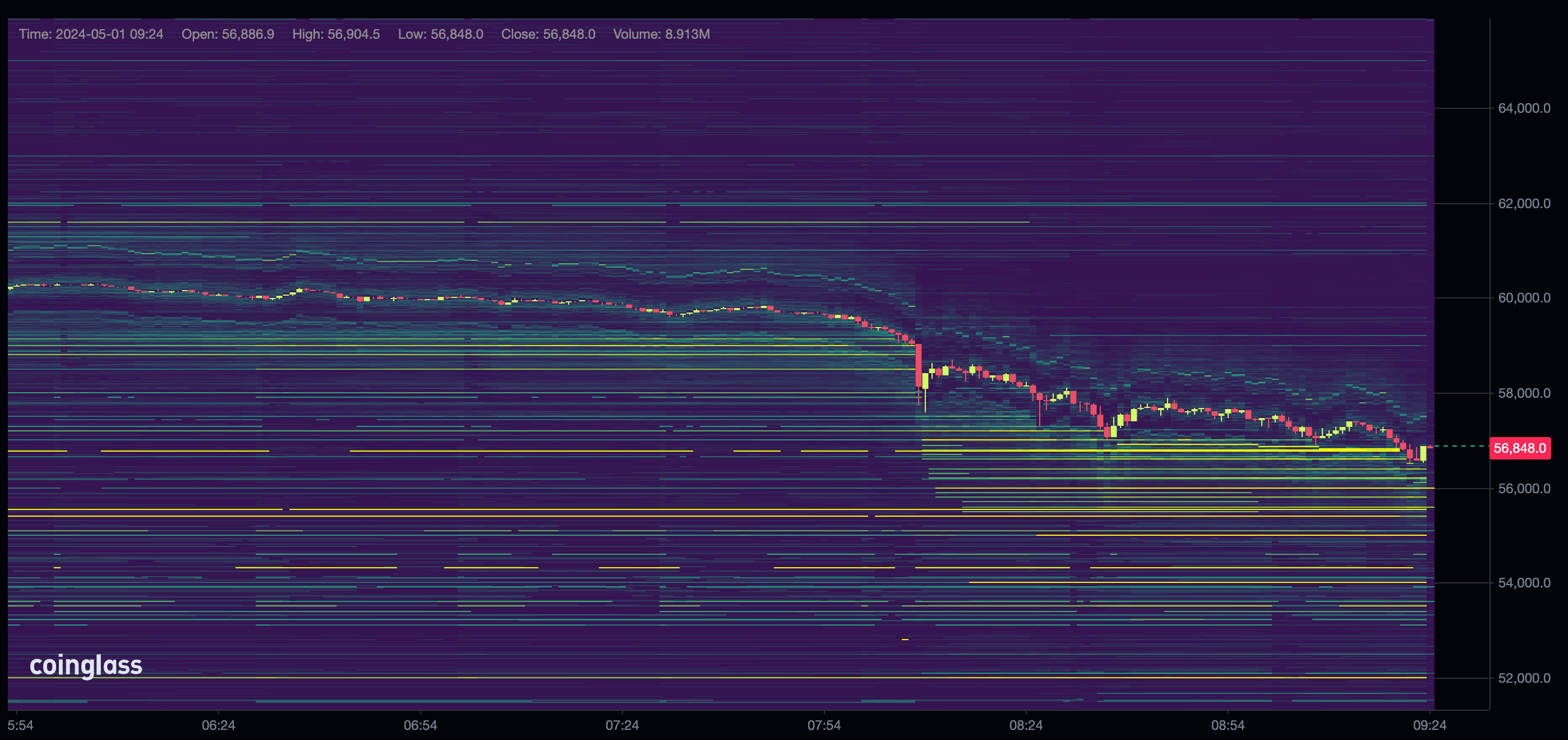

Data from Coinglass shows that Binance, the most liquid exchange for Bitcoin trading, has several buy walls in the order book down to around $50,000. Each yellow line represents at least 200 BTC in orders, roughly $11.5 million.

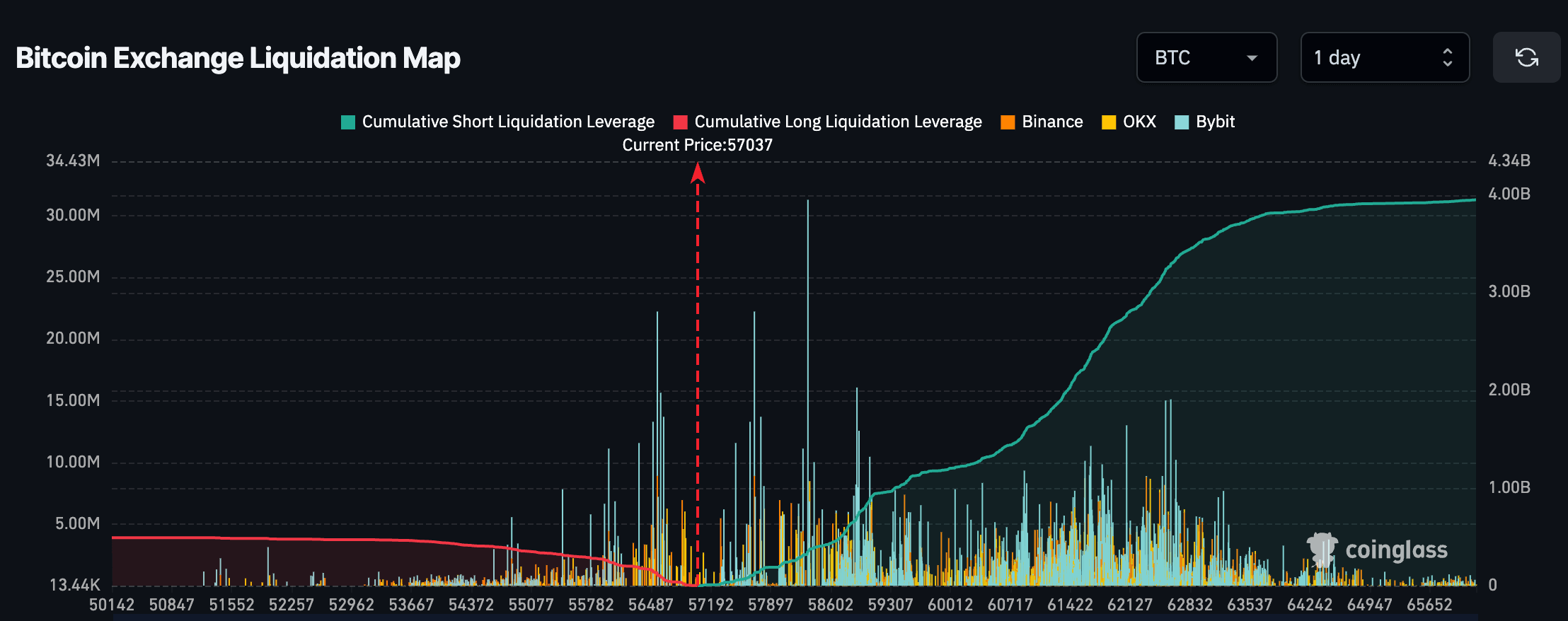

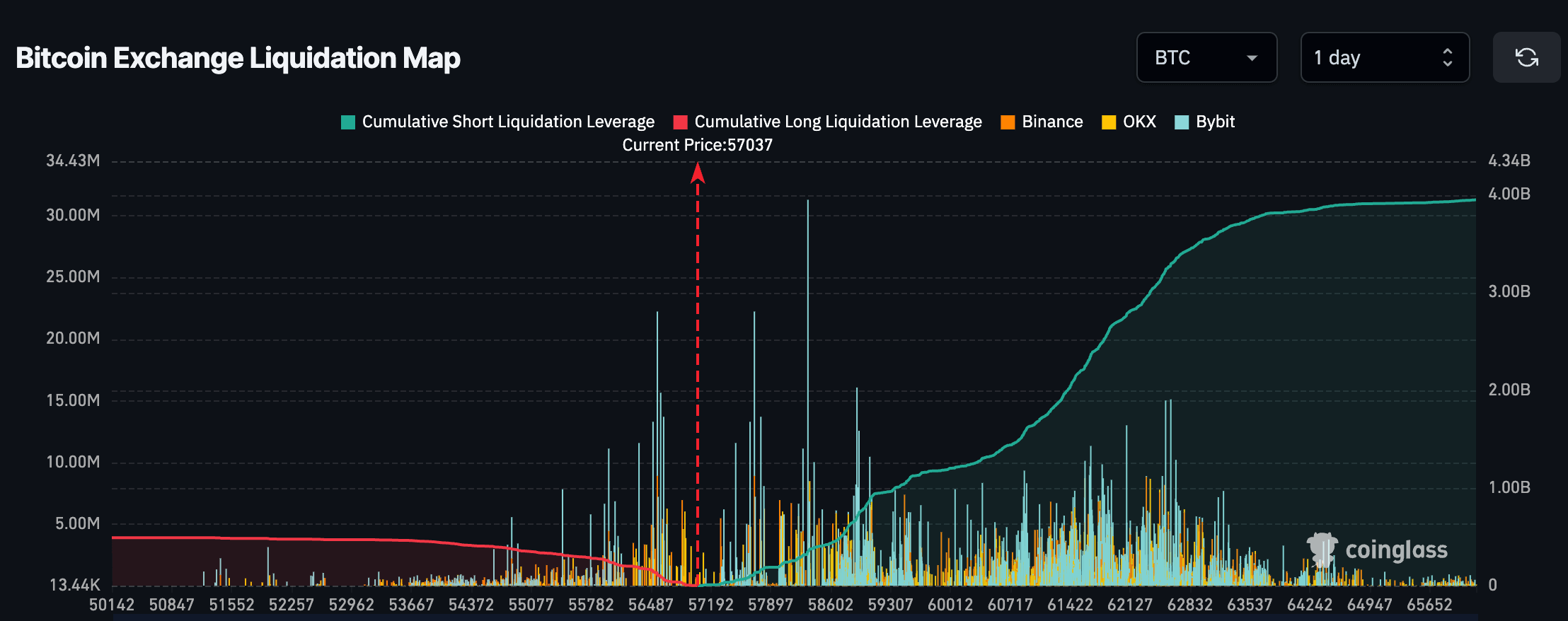

The liquidation map for Bitcoin across Binance, OKX, and Bybit shows almost $4 billion of leverage in notional value over the past day. Much of the leverage comes in the form of short positions held above $61,000.

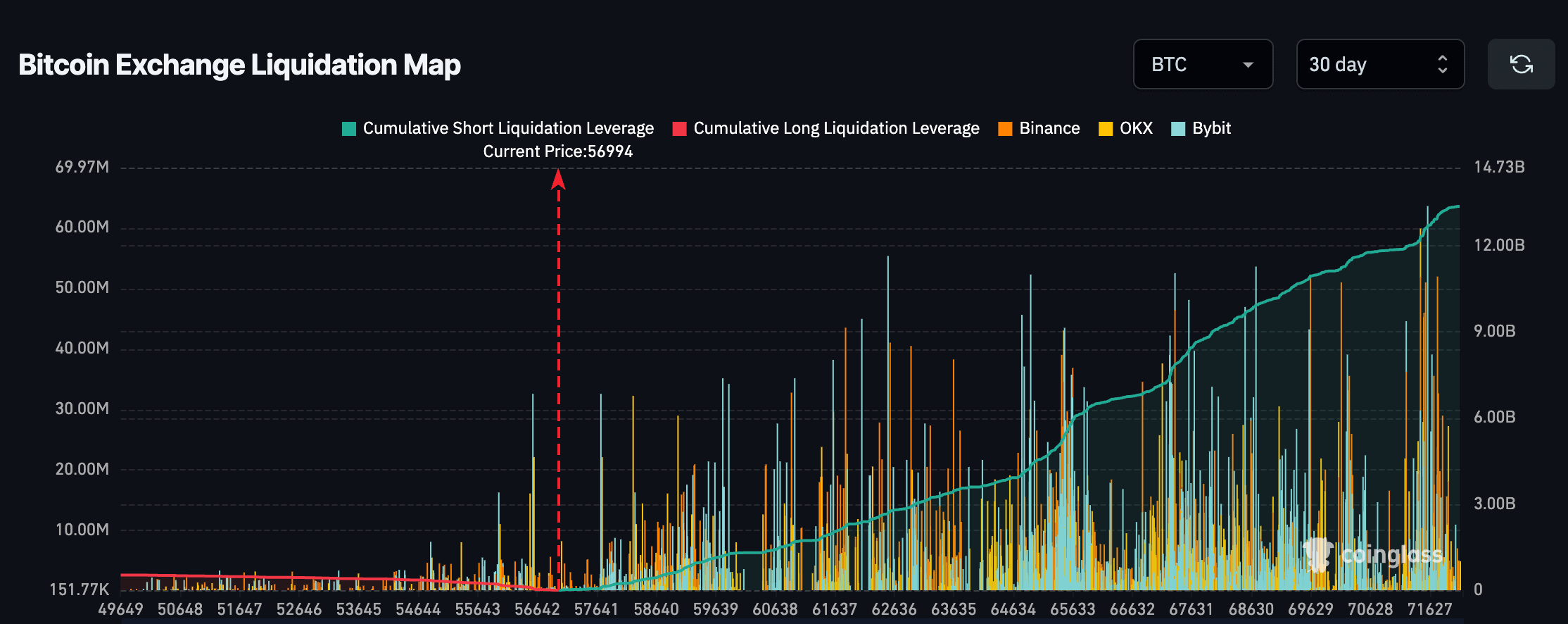

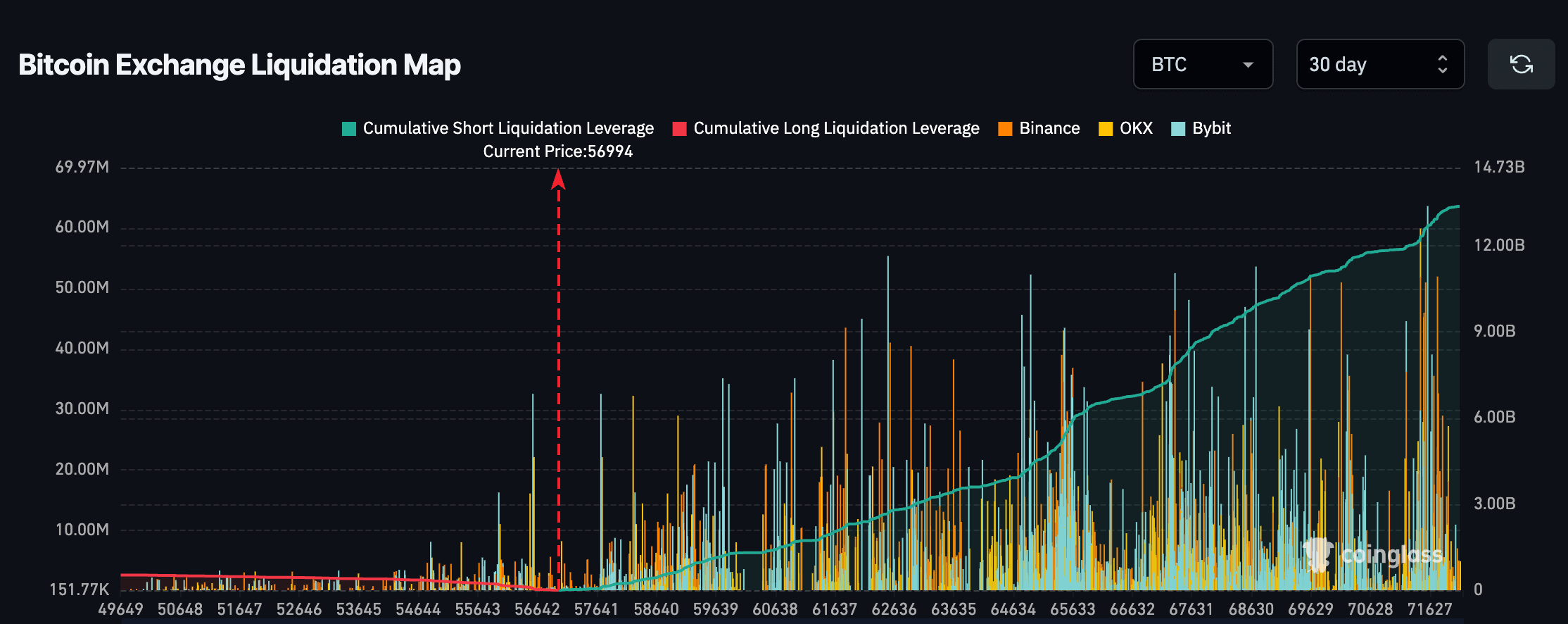

Over the past 30 days, almost $13 billion worth of leveraged short positions have been placed between $57,000 and $72,000.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  Canton

Canton  Uniswap

Uniswap  PayPal USD

PayPal USD  Mantle

Mantle  Cronos

Cronos  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Aave

Aave  Rain

Rain  Bitget Token

Bitget Token  MemeCore

MemeCore