Quick Take

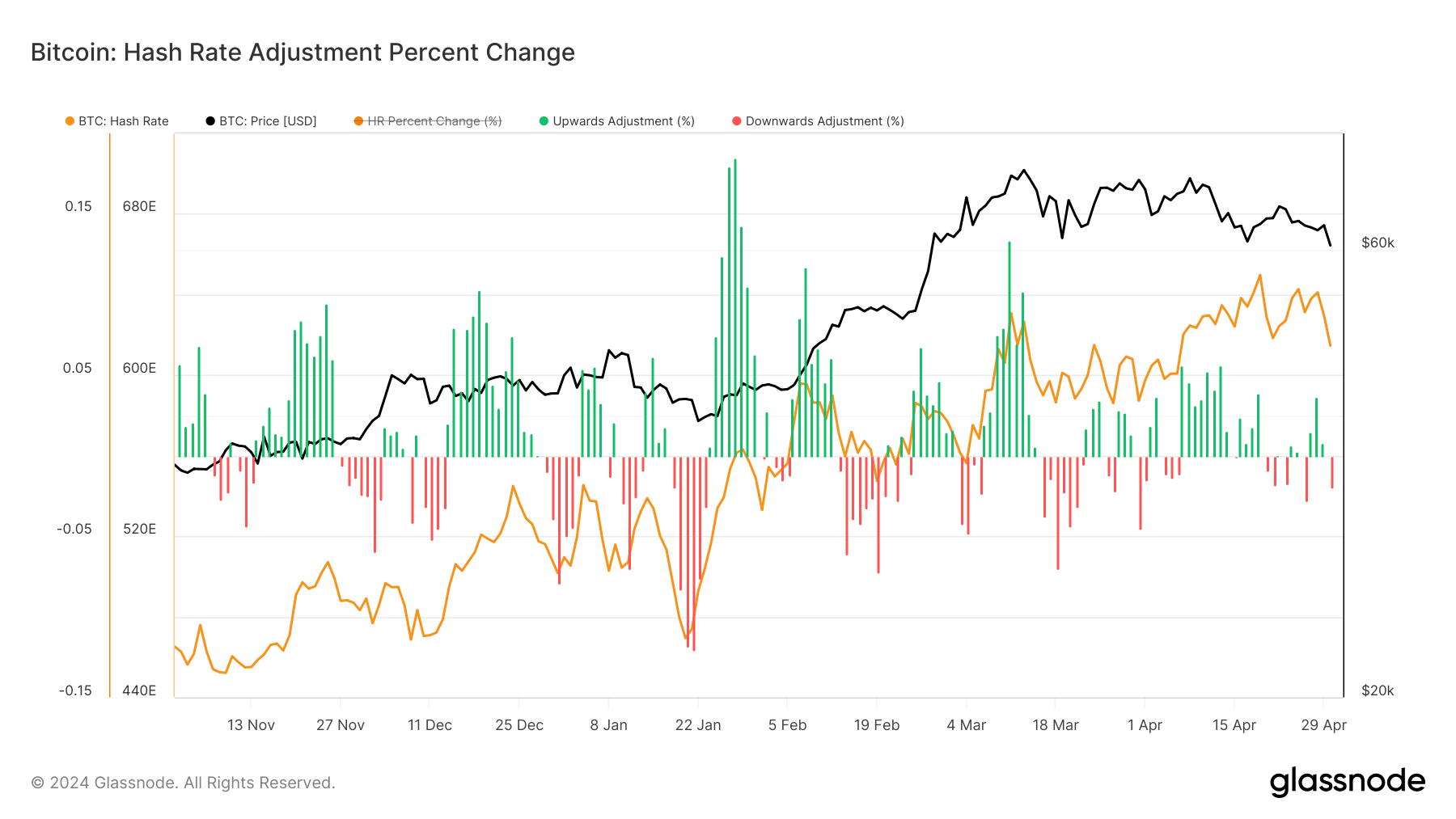

CryptoSlate’s analysis sheds light on the anticipated hash rate adjustment, with historical trends indicating a potential 20% decrease post-halving. Past cycles reflect significant hash rate corrections: 39% in 2012, 11% in 2016, and 26% in 2020. As of 2024, we’ve observed a 6% decline so far, taking the hash rate from 649 eh/s to 619 eh/s.

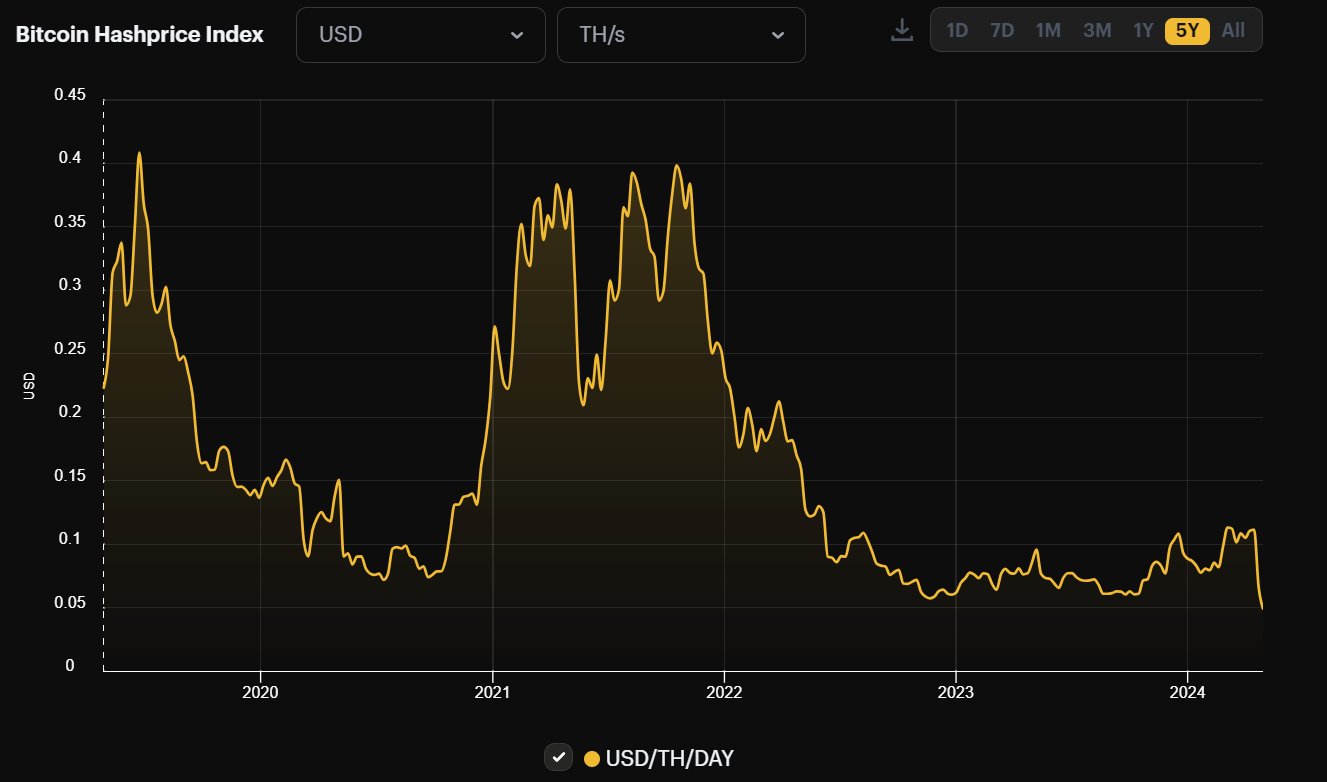

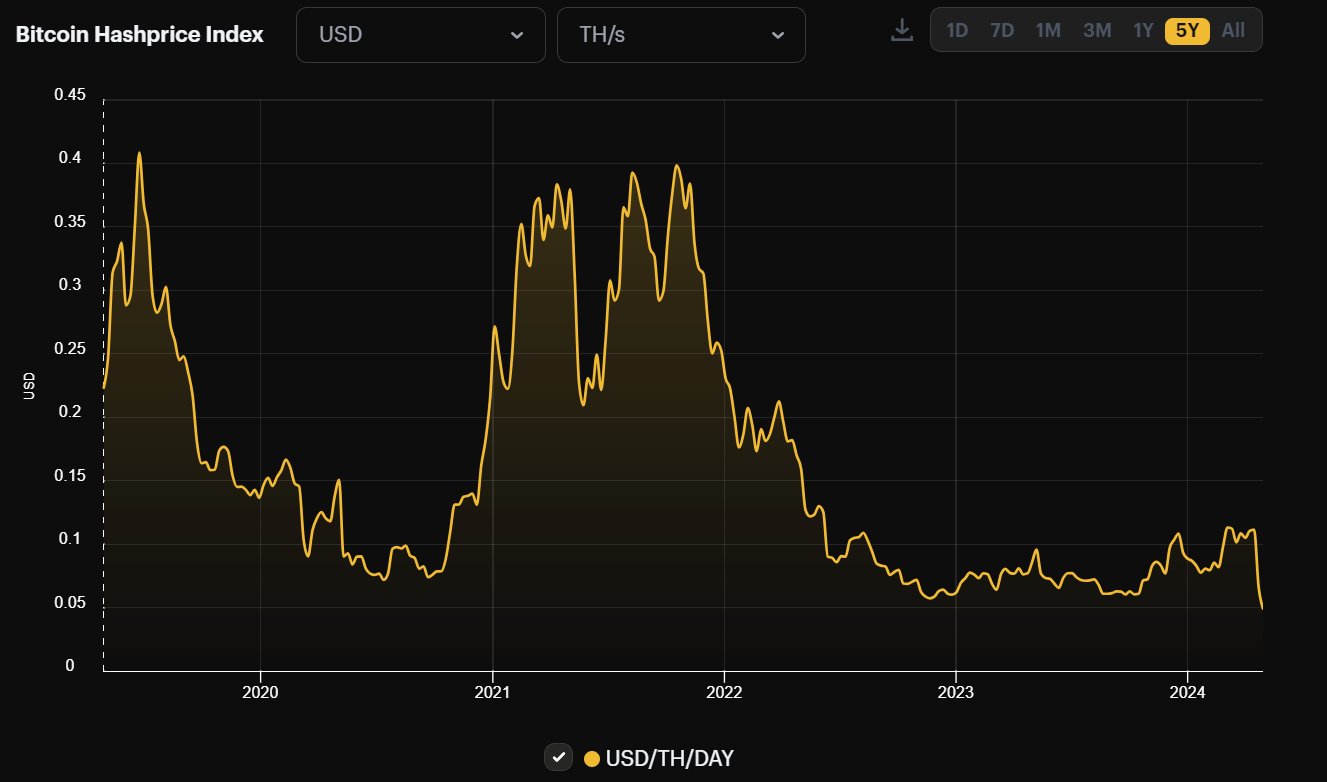

The price of Bitcoin has tumbled from its highs of around $73,500 to below $57,000, and as a result of this, further hash rate drops are expected. Luxor’s “hashprice” metric, which quantifies the expected value of 1 TH/s of hashing power per day, currently sits at a five-year low of $0.045 per terahash/second per day.

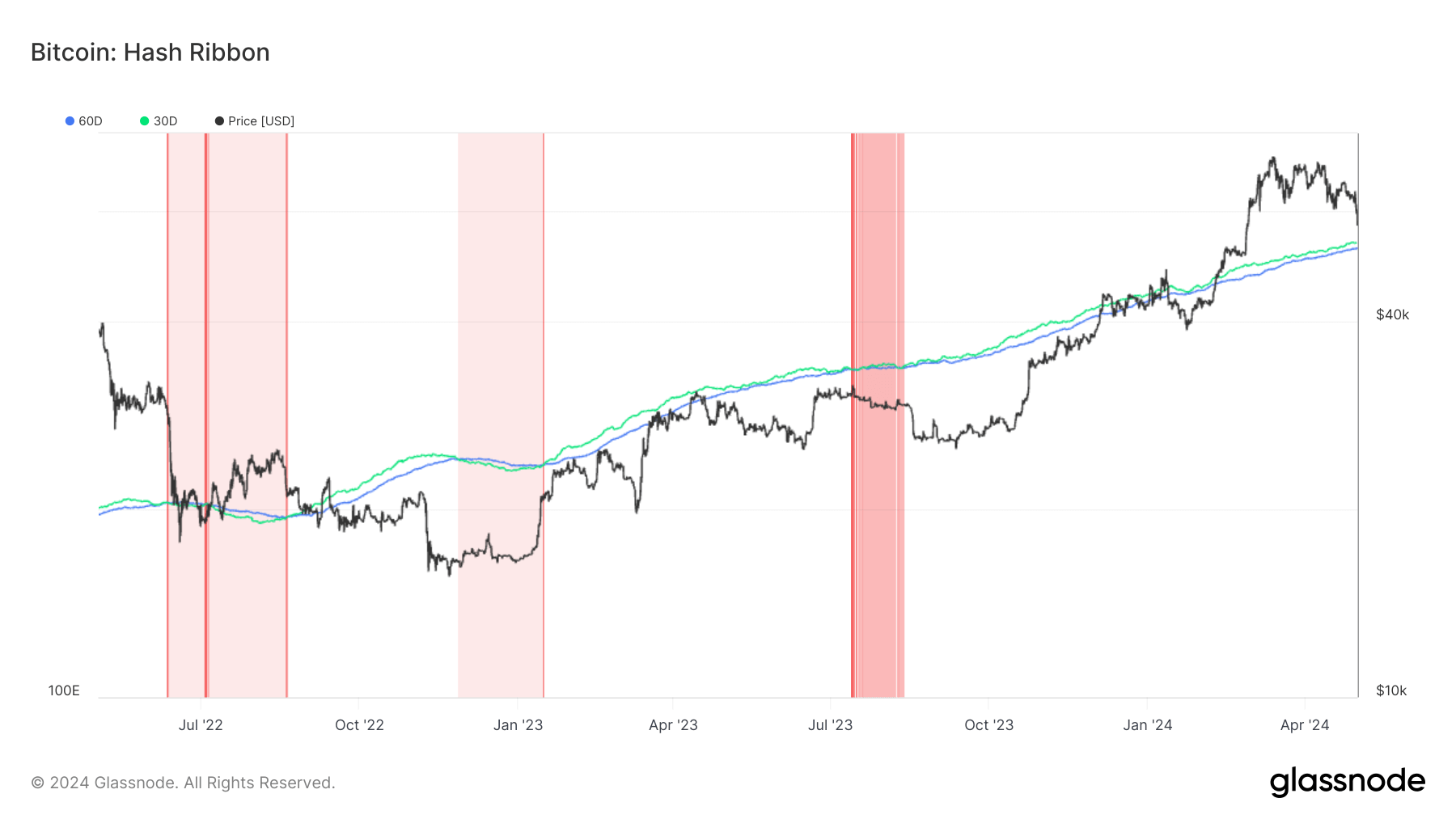

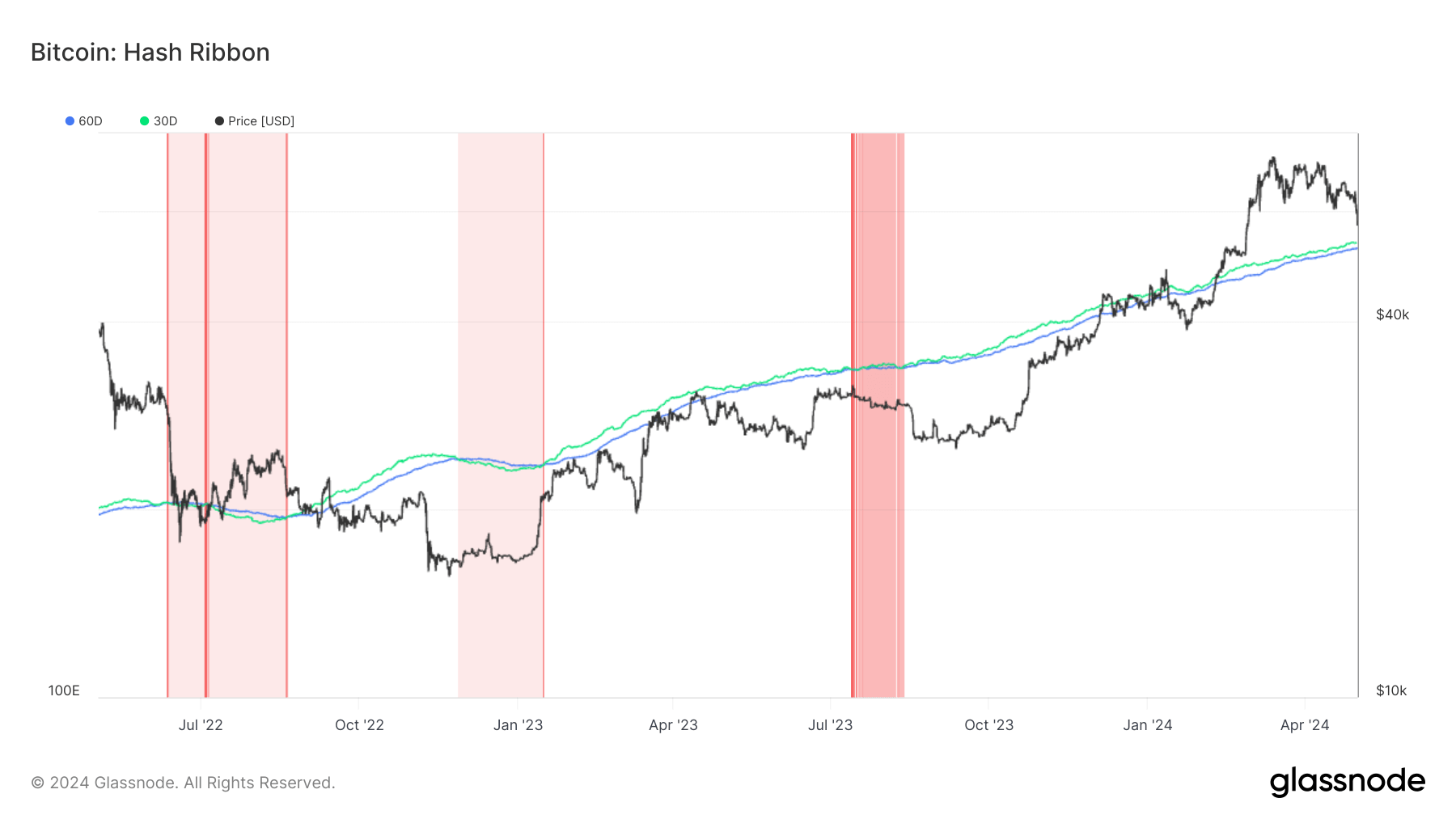

If this trend persists, the digital asset community may witness a miner capitulation event, where Bitcoin mining becomes too expensive relative to the cost of mining. This scenario is typically identified by Glassnode’s hash ribbon metric, which has historically signaled bottoms in Bitcoin cycles.

The upcoming difficulty adjustment, scheduled for May 8, is forecasted to decrease by 1.5% to 2%.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Dai

Dai  USDT0

USDT0  Shiba Inu

Shiba Inu  sUSDS

sUSDS  Hedera

Hedera  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle  MemeCore

MemeCore