In a technical analysis shared by noted crypto analyst Josh Olszewicz on the social platform X, there appears to be a significant bullish sentiment building around Bitcoin, particularly if it surpasses the crucial $72,000 mark. Olszewicz, leveraging both the Ichimoku Cloud and Fibonacci extensions, illustrates a scenario where breaking this key resistance level could catapult Bitcoin towards a target of $91,500.

Here’s How Bitcoin Could Skyrocket To $91,500

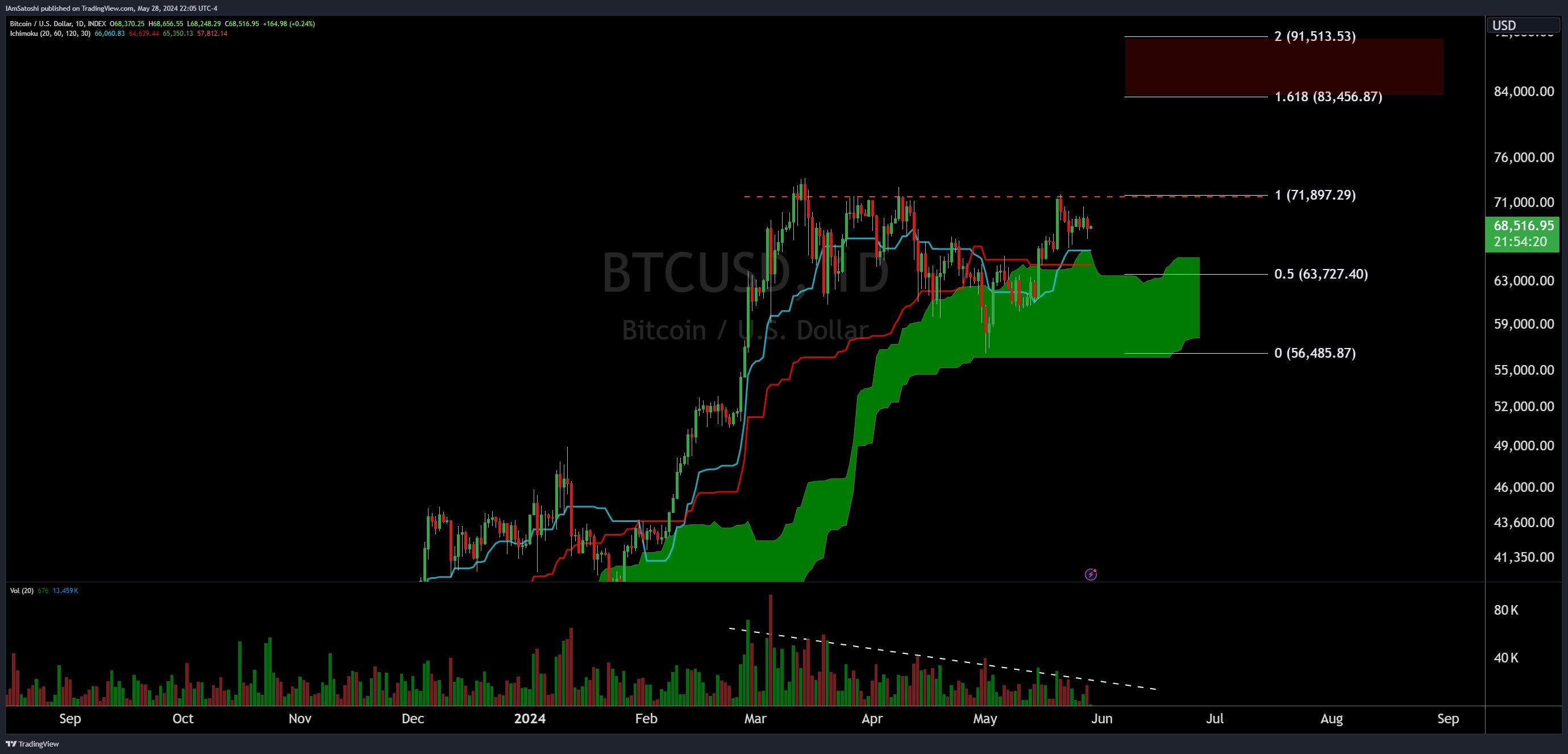

The analysis utilizes the Ichimoku Cloud, a complex technical indicator that provides insights into the market’s momentum, trend direction, and potential areas of support and resistance over different time frames. Currently, Bitcoin’s price action is depicted as being in a bullish phase, situated above the cloud. This positioning above the cloud is traditionally viewed as a bullish signal, suggesting a strong uptrend with robust support levels formed by the cloud’s lower boundaries.

In the Ichimoku setup, the conversion line (Tenkan-sen) and the baseline (Kijun-sen) cross occasionally, providing buy or sell signals based on their intersection relative to the cloud. As of the latest chart, the conversion line recently crossed above the baseline, reinforcing the bullish outlook depicted by the cloud’s positioning.

Related Reading

Adding another layer to the technical narrative, Fibonacci extension levels have been plotted from a significant low at $56,485.87 up to a high, providing potential targets and resistance levels. The 0.5 Fibonacci extension level is marked at $63,727.40, already surpassed by the current price trajectory.

The 1.0 extension finds itself at $71,897.29, closely aligning with the analyst’s noted pivotal level of $72,000. Beyond this, the 1.618 extension at $83,456.87 represents a lucrative first price target, while the ultimate 2.0 extension looms at $91,513.53.

A key observation is the volume profile, which shows a declining trend in trading volume. This decreasing volume can often indicate a period of accumulation, as less selling pressure allows prices to stabilize and potentially build a base for an upward breakout. The declining volume trend line underpins the consolidation phase seen in recent months, suggesting that a sharp movement could be imminent once accumulation concludes.

Related Reading

Olszewicz’s emphatic remark, “BTC: when this baby hits $72k you’re going to see some serious shit,” underscores the high stakes associated with this resistance level. This is not merely a technical observation but a signal to the market that once $72,000 is decisively broken, the path to much higher levels becomes increasingly probable.

Such a breakout would likely activate a flurry of trading activity, as both retail and institutional investors might see it as a confirmation of a sustained upward trend, potentially pushing the price towards the $91,500 mark indicated by the 2.0 Fibonacci extension.

At press time, BTC traded at $67,783.

Featured image created with DALL·E, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  Canton

Canton  Uniswap

Uniswap  PayPal USD

PayPal USD  Mantle

Mantle  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Aave

Aave  Rain

Rain  Bitget Token

Bitget Token