Quick Take

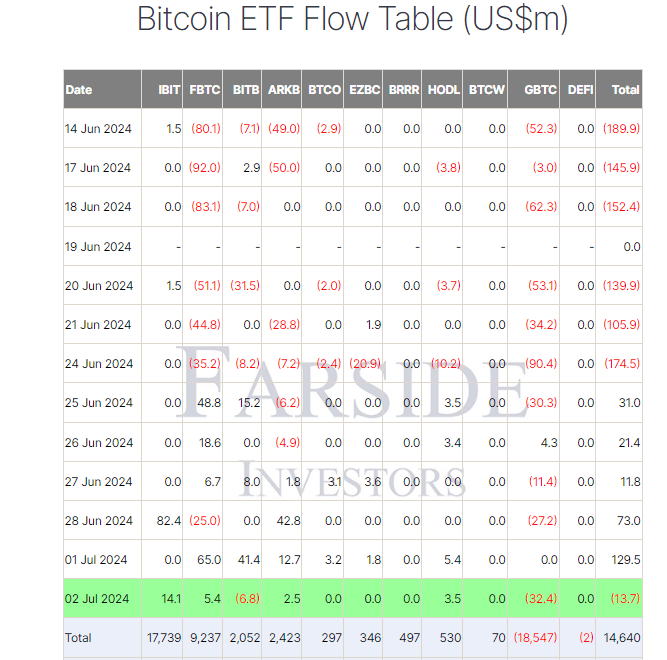

On July 2, Bitcoin (BTC) exchange-traded funds (ETFs) experienced their first outflow of July, as reported by Farside. The day saw a $13.7 million outflow, breaking a five-day trading streak of consecutive inflows. Leading the day’s activity was Grayscale’s GBTC, which recorded a substantial $32.4 million outflow, bringing its total net outflow to a staggering $18.5 billion.

Farside data reports that Bitwise’s BITB also saw a modest outflow of $6.8 million, although its total net inflow still stands at $2.1 billion. In contrast, BlackRock’s IBIT received an inflow of $14.1 million, pushing its total net inflow to an impressive $17.7 billion. Fidelity’s FBTC followed suit with a $5.4 million inflow, increasing its total net inflow to $9.2 billion. Despite the daily fluctuations, Bitcoin ETFs have collectively achieved a total inflow of $14.6 billion since launch.

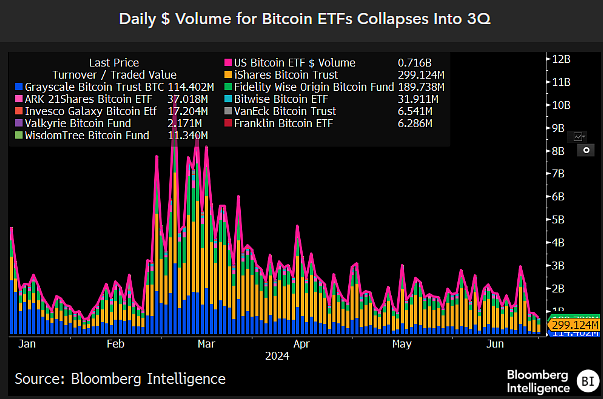

Bloomberg ETF analyst James Seyffart observed that ETF trading volumes have been on a downtrend, not reaching $3 billion since mid-May.

The post ETF trading volumes on decline, failing to hit $3 billion since mid-May appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Hedera

Hedera  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle  MemeCore

MemeCore