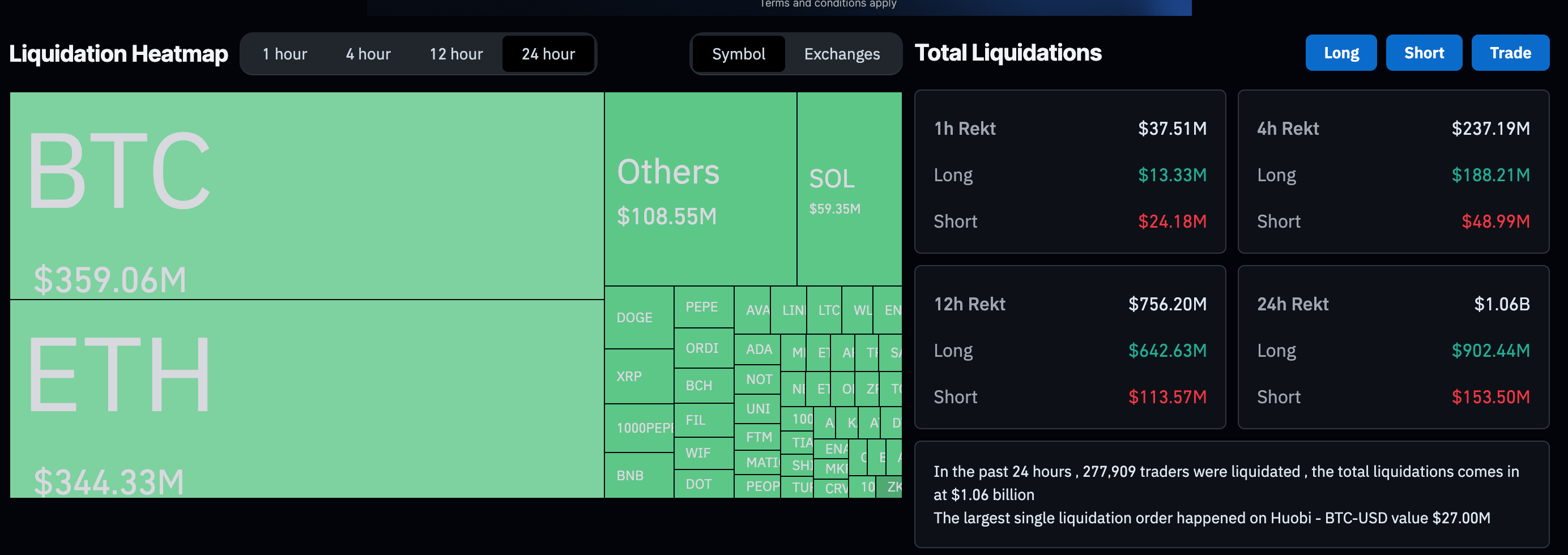

Bitcoin experienced a sharp decline from $61,000 to $49,000 within 24 hours before rebounding to approximately $52,000 as of press time. The price drop triggered significant market liquidations, with total losses reaching $1.06 billion, according to Coinglass. Long positions were heavily affected, accounting for $902.16 million, while short positions saw $153.18 million in liquidations.

Breaking down the liquidations by asset, Bitcoin positions suffered $359.06 million in liquidations, while Ethereum positions recorded $344.33 million. Ethereum declined over 20% within the same period. This data reflects a significant market correction, impacting leveraged traders. The rebound to $52,000 suggests a potential stabilization, but the recent volatility underlines the market’s inherent risks as global instability increases and the Japanese yen continues to struggle.

The Japanese yen has surged to a seven-month high, trading at around 145.25 per dollar, driven by weak US jobs data that heightened fears of an economic slowdown and expectations of deeper rate cuts by the Federal Reserve. This yen appreciation has significantly disrupted the yen carry trade, where investors borrow in low-yielding yen to invest in higher-yielding assets. The unwinding of these trades has led to a global sell-off, with Japan’s Nikkei 225 index plunging nearly 7% and other Asian markets following suit. The turmoil has extended to emerging market currencies, with the Mexican peso falling as much as 2% against the dollar.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Zcash

Zcash  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Canton

Canton  Hedera

Hedera  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Toncoin

Toncoin  Dai

Dai  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor