Este artículo también está disponible en español.

With only a few weeks before Q4 begins, investors and market watchers remain vigilant of the market’s performance. Many expect the next quarter will kickstart the rally’s second leg up, suggesting that most altcoins will explode in the coming months.

Several analysts are bullish about the upcoming performances, hinting that the time to accumulate these cryptocurrencies is near its end and that the alt season is near.

Related Reading

Investors’ Last Call Before The Altseason

Bitcoin (BTC) and Ethereum (ETH) have taken a hit throughout Q3’s market retraces. Since July 1, the flagship cryptocurrency’s price fell more than 10%, while the “King of altcoins” plunged by over 30%.

Nonetheless, several altcoins have led the market bounces amid the volatility, displaying a remarkable performance during the shakeouts. Many of the alts have outperformed their BTC pairs, as crypto analyst Michaël van de Poppe stated.

Per the post, many technical indicators show that “the Bitcoin pairs of many of the altcoins have been crawling up.” The analyst also considers that BTC and alts have bottomed out and that a market’s next moves will “be great.”

Moreover, altcoins’ dominance seems “ready to take the spotlight.” Analyst and trader Titan of Crypto recently noted that Bitcoin dominance “is on the verge of printing a new lower high.” To the analyst, this could trigger the Altseason between Q4 2024 and Q1 2025, which could last until mid-2025.

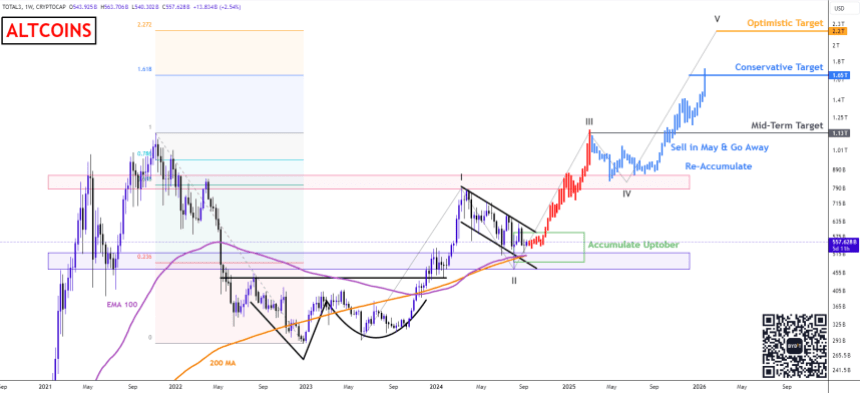

Meanwhile, crypto analyst Alex Clay suggested that investors’ chance to accumulate alts might end soon as “Uptober” approaches. To the analyst, the second correction wave of the Elliot Impulse Wave is over. As a result, cryptocurrencies, excluding BTC and ETH, are ready to begin the third bullish wave.

Clay highlighted that the second correction wave displayed a bullish flag pattern. Additionally, he noted that altcoins’ market capitalization has been supported “at the strong confluence of EMA 100 + MA 200 + Key zone.”

Based on this, he forecasted the sector’s mid-term target could hit a market capitalization of $1.3 trillion by May 2025 before the fourth wave. Clay also predicted a “conservative” long-term target of a $1.65 trillion market cap for the final impulse wave.

Will Altcoins Hit $2 Trillion?

Miky Bull highlighted Altcoins’, including ETH, market cap impulse. To the trader, the cryptocurrencies’ market cap is getting ready to break from the bullish flash pattern, potentially targeting a mark above the $1.8 trillion level.

Miky previously suggested that the alts chart follows “the 2020 blueprint.” However, he considers they will differentiate by the duration of the re-accumulation phase, as he deems this cycle’s expansion will be “longer and huge.”

Related Reading

Another crypto analyst, Moustache, noted that alts have been in a 2-year-long cup and handle pattern, which is considered extremely bullish. The pattern suggests that altcoins’ market cap will significantly increase from the handle lows.

To the trader, if this scenario plays out, alts target a $2.14 trillion market cap by 2025. As of this writing, altcoins sit at a market cap of $558 billion, a 10% decrease since Q3 began.

Featured Image from Unsplash.com, Chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  WETH

WETH  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  USDT0

USDT0  Shiba Inu

Shiba Inu  Dai

Dai  PayPal USD

PayPal USD  Uniswap

Uniswap  Mantle

Mantle  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Canton

Canton  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Rain

Rain  MemeCore

MemeCore  Aave

Aave