MicroStrategy acquired approximately 18,300 Bitcoin for $1.1 billion between Aug. 6 and Sept. 12 at an average price of $60,408 per BTC, according to a Sept. 13 filing with the US Securities and Exchange Commission (SEC).

Coinflip data shows the company’s latest purchase already has a paper loss of $2.2 million due to the top digital asset’s current volatility.

Funding

The firm stated that the purchase was funded by selling more than 8 million company shares via a sales agreement with several financial institutions, including TD Securities, The Benchmark Company, BTIG, Canaccord Genuity, Maxim Group, and SG Americas Securities.

The capital raised from these sales was directly used to expand its Bitcoin holdings.

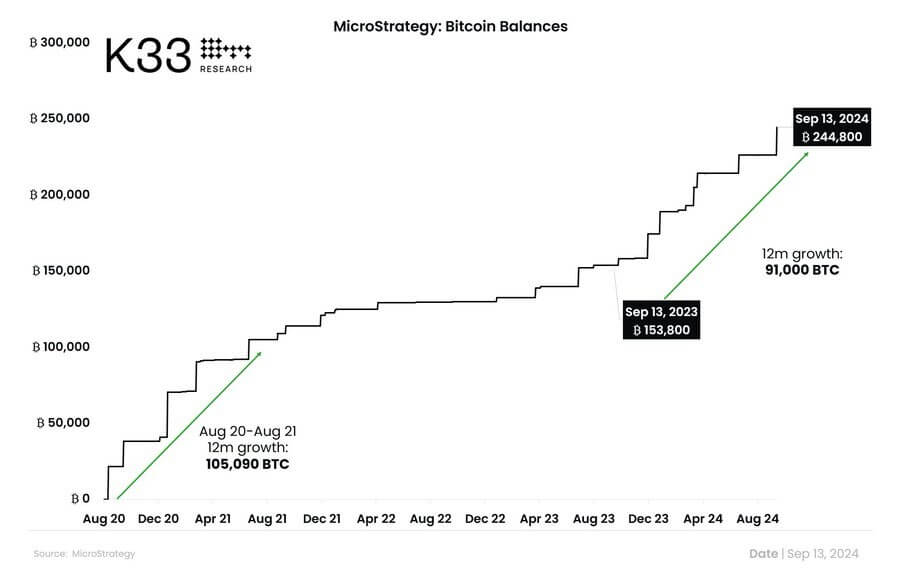

Notably, the firm has pursued this funding strategy aggressively during the past year to accumulate the top digital asset. K33 Research stated that the firm has bought around 91,000 BTC between Sept. 2023 and today.

It added:

“August 2020-21 is the only period featuring a higher YoY growth in MSTR’s BTC exposure of 105,090 BTC.”

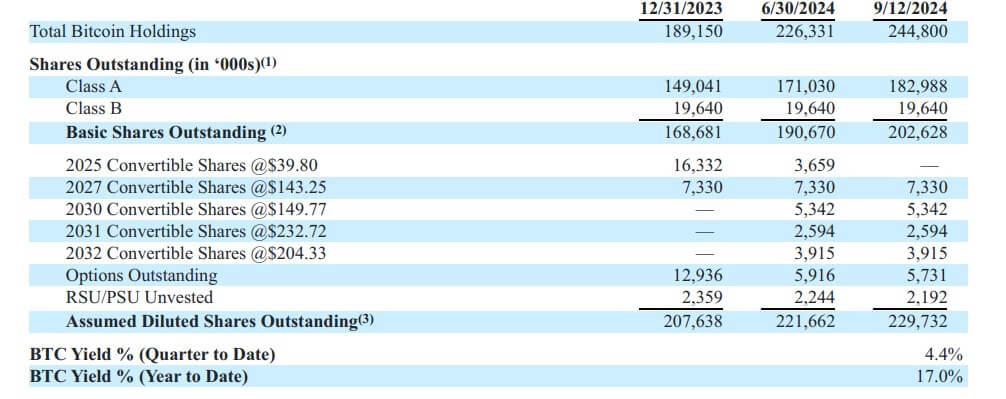

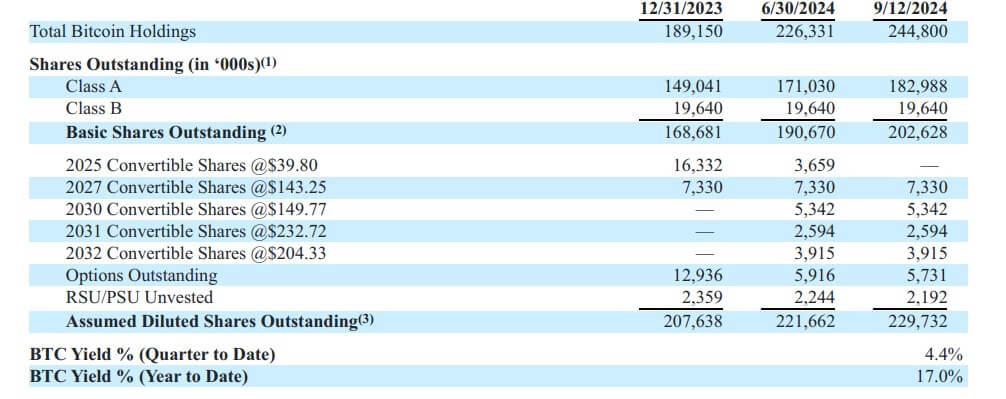

Meanwhile, this latest acquisition brought MicroStrategy’s total Bitcoin holdings to 244,800 BTC, valued at over $14 billion at current prices. The company’s total investment in Bitcoin is $9.45 billion, with an average purchase price of $38,585 per Bitcoin.

Saylortracker data indicates the firm holds an unrealized profit of more than $4 billion.

Bitcoin yield

MicroStrategy Executive Chairman Michael Saylor reported a Bitcoin yield of 4.4% for this quarter and 17% year-to-date on its holdings.

According to the SEC filing, this key performance indicator (KPI) helps assess the firm’s strategy for acquiring Bitcoin. The BTC yield metric tracks the percentage change over time in the ratio of MicroStrategy Bitcoin holdings to diluted shares.

The company believes this measure can enhance investors’ understanding of its decision to fund Bitcoin purchases through issuing additional shares or convertible instruments.

Despite news of the latest purchase, MicroStrategy’s shares remain flat in premarket trading. However, it has risen 91% year-to-date.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Chainlink

Chainlink  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Hyperliquid

Hyperliquid  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  sUSDS

sUSDS  USDT0

USDT0  Dai

Dai  Mantle

Mantle  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  PayPal USD

PayPal USD  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Polkadot

Polkadot  MemeCore

MemeCore  Aave

Aave  Bittensor

Bittensor  USD1

USD1  Canton

Canton  Rain

Rain