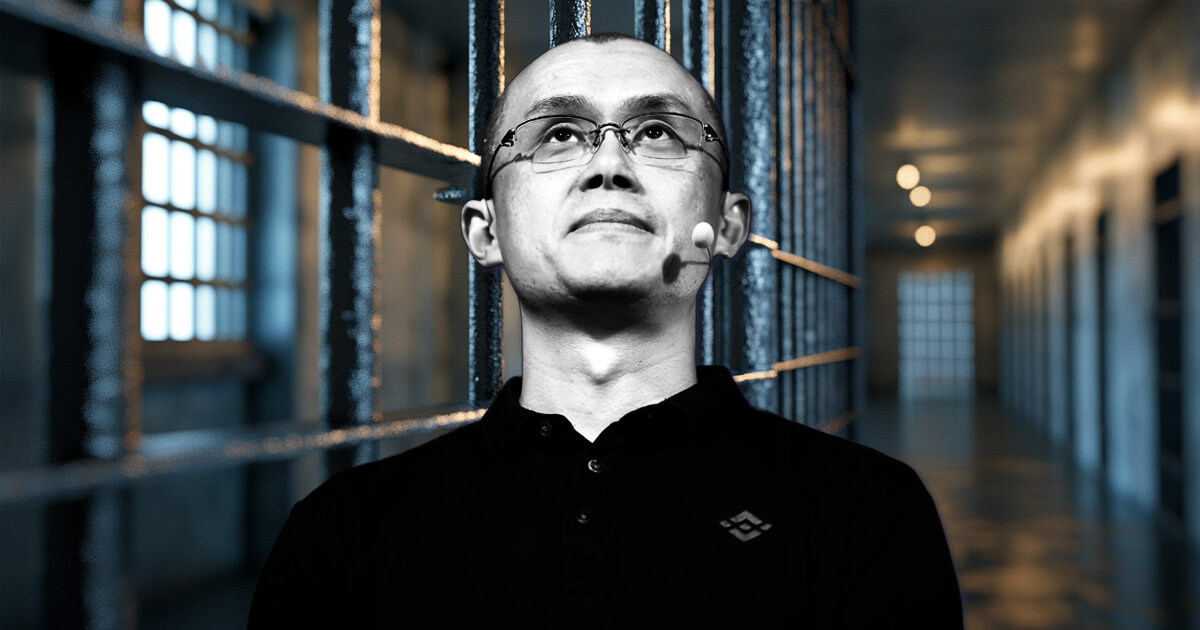

Changpeng Zhao, co-founder of Binance, is set to be released from US custody on Sept. 29, according to the US Federal Bureau of Prisons website.

Zhao is currently serving a four-month sentence and was recently transferred to the Long Beach Residential Reentry Management (RRM) facility in central California.

RRMs serve as local federal prison liaisons, assisting inmates nearing release by working with federal courts, the US Marshals Service, and local corrections.

Zhao’s legal issues

Zhao’s legal issues began in November when he and Binance pleaded guilty to breaking US federal laws.

The allegations included Zhao’s failure to implement an effective anti-money laundering program, as required by the Bank Secrecy Act. It was also alleged that Binance had processed transactions linked to unlawful activities, including those between US citizens and individuals in sanctioned regions like Iran.

As part of the settlement, Binance was ordered to pay $4.3 billion in fines, while Zhao personally agreed to pay $50 million. Zhao also stepped down as Binance’s CEO but retains an estimated 90% ownership in the company

Binance legal struggles

While Zhao’s legal troubles are nearing an end, Binance’s legal issues continue. The US Securities and Exchange Commission (SEC) filed an amended complaint against the exchange in July, reiterating its accusation that the exchange violated federal securities law.

The SEC claimed that Binance plays a key role in the crypto market by republishing and amplifying information from issuers and promoters. The filing also alleged that Binance promotes digital assets it lists and trades by sharing details on asset development, trading volumes, and price information.

Furthermore, the financial regulator reaffirmed its stance that Binance’s token, BNB, was offered and sold as a security. It also highlighted the expectation among customers, employees, and investors that BNB would increase in value due to efforts by issuers and promoters.

This comes despite a previous court decision dismissing charges related to the secondary sale of BNB by third parties.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Sui

Sui  Avalanche

Avalanche  sUSDS

sUSDS  Hedera

Hedera  Dai

Dai  Shiba Inu

Shiba Inu  USDT0

USDT0  PayPal USD

PayPal USD  Uniswap

Uniswap  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  Canton

Canton  Polkadot

Polkadot  USD1

USD1  Rain

Rain  Bitget Token

Bitget Token  MemeCore

MemeCore