DeFi, or Decentralized Finance, is an approach to managing financial transactions that eliminates the need for banks or middlemen. Unlike traditional banks, DeFi works 24/7 and is open to anyone with a WiFi data or internet connection.

In this guide, we will explain what is DeFi, how it works, and why it’s becoming popular. You will learn about its benefits, risks, and how it might change the future of finance.

Key Takeaways:

- DeFi is a blockchain-based financial system that operates without centralized intermediaries like bankers, lawyers, or brokers.

- DeFi applications include decentralized exchanges, lending platforms, prediction markets, and yield farming.

- The best DeFi platforms in the crypto space are Uniswap, Aave, Lido, MakerDAO, Compound Finance, and Curve Finance.

What Is Decentralized Finance (DeFi)?

DeFi is a blockchain-based financial system that attempts to replicate and improve standard financial services without the need for centralized middlemen. Eliminating middlemen from transactions, such as banks and other traditional financial institutions, is the core principle of DeFi.

Rather, DeFi automates financial services including lending, borrowing, trading, and insurance using smart contracts, which are self-executing contracts written in code. This approach helps customers to access financial services worldwide while maintaining complete control over their assets.

DeFi aims to empower finance by establishing an open, permissionless infrastructure that anybody with an internet connection can leverage without relying on centralized authority. For example, rather than requesting a loan through a bank, you can utilize a DeFi lending protocol such as Aave to provide digital currencies as collateral and borrow directly from a liquidity pool.

How Does DeFi Work?

DeFi works on blockchain technology, where all transactions are stored on distributed ledgers, making everything clear and unchangeable.

At the heart of DeFi are smart contracts, which are pieces of code on the blockchain. These contracts automatically complete transactions when certain conditions are met, without the need for middlemen like lawyers, bankers, or brokers.

Decentralized Finance vs Centralized Finance

DeFi offers more transparency, decentralization, and control to users, but may carry risks related to security and regulatory uncertainty.

CeFi provides a more traditional, regulated system with greater trust in centralized financial institutions, but with less control for the user and potentially higher fees.

| Feature | Decentralized Finance (DeFi) | Centralized Finance (CeFi) |

| Control | Controlled by decentralized networks (blockchains, smart contracts) | Controlled by centralized entities (bank account, exchange, etc.) |

| Governance | Governed by the community, often through tokens and voting mechanisms | Governed by the company’s executives or regulators |

| Transparency | Fully transparent, as all transactions are recorded on public blockchains | Limited transparency, with users dependent on centralized institutions for information |

| Custody | Users have control over their own assets (non-custodial wallets) | Institutions hold custody of users’ assets (custodial wallets) |

| Accessibility | Open to anyone with an internet connection, no KYC required | Requires KYC (Know Your Customer) and may be restricted by geography |

| Trust Model | Trustless | Trust-based |

| Intermediaries | No intermediaries, peer-to-peer transactions via smart contracts | Requires intermediaries such as banks, brokers, or exchanges |

| Regulation | Mostly unregulated, though increasing government scrutiny | Heavily regulated by financial authorities (SEC, FCA, etc.) |

| Speed of Transactions | Fast, especially on Layer 2 solutions; depends on blockchain performance | May be slower due to intermediary approval and banking hours |

| Costs/Fees | Typically lower, but gas fees can vary depending on network usage | Often higher, with fees for services like trading, withdrawals, etc. |

| Security | Code-based security; risks include smart contract vulnerabilities | Institution-based security, including insurance but vulnerable to hacks or insolvency |

| Anonymity | Pseudonymous (transactions are public but user identities are masked) | No |

| Liquidity | Low | High |

| Yield/Interest Rates | Higher yields due to innovative mechanisms (e.g., staking, liquidity mining) | Lower yields, but often more stable and predictable |

Benefits of Using DeFi

DeFi has a few benefits over traditional financial services:

- Accessibility: Regardless of location or financial status, anybody with a WiFi or internet connection can use DeFi services. This allows users in remote areas or underbanked populations to access financial tools that were previously unavailable to them.

- Openness: All transactions are recorded on a public blockchain, providing unparalleled levels of transparency. This transparency helps build trust among users, as anyone can verify transactions and ensure that no hidden activities are taking place.

- Interoperability: DeFi protocols can readily communicate with one another, resulting in new financial products and services. This seamless integration encourages innovation and allows users to create customized financial solutions tailored to their specific needs.

- Lower costs: By removing intermediaries, DeFi may be able to provide lower financial service rates. Users can save on costs that are generally levied by banks and other financial organizations, making transactions more reasonable for everyone.

- Higher Yields: Many DeFi platforms offer lenders higher interest rates than traditional banks. This can provide you with better returns on your investments, helping you to grow your wealth more effectively over time.

- Programmability: Smart contracts enable the design of complicated financial instruments and automated operations. This programmability can reduce the need for manual intervention, leading to faster and more efficient transaction processes.

- Innovation: The open-source nature of DeFi allows quick invention and experimentation. Developers can collaborate and build on each other’s work, leading to a rapid evolution of financial technologies and services.

- Control: Users have complete control over their assets and do not rely on third-party custodians. This direct ownership minimizes the risk of loss due to third-party failures and gives users peace of mind regarding their investments.

Risks of Using DeFi

While DeFi offers many benefits, you should be aware of the risks involved:

- Vulnerabilities in Smart Contracts: You can lose your digital assets if there are errors or flaws in the programming. Hackers can exploit these vulnerabilities, thus it’s critical to thoroughly review any smart contract before utilizing it.

- Regulatory Uncertainty: The rules around DeFi are still changing, which could affect how platforms work in the future. As governments look to create regulations, these changes could impact your ability to use certain services or their legality.

- Volatility: The cryptocurrencies used in DeFi can change in value very quickly, meaning you could face significant losses. This unpredictability makes it hard to stick to a stable investment plan.

- Lack of Consumer Protections: Unlike traditional finance, DeFi does not have many of the protections that you might expect like insurance funds. This lack of safety measures means you need to be extra careful to protect your investments.

- Scalability Issues: Blockchain networks can get overloaded, causing higher transaction fees and slower processing times. This can make it hard for you to make trades quickly when market conditions change.

- Impermanent Loss: This special risk happens when you provide liquidity, and the value of your assets in a liquidity pool can go down compared to holding them separately. Knowing this risk is important, as it can affect your overall returns.

- Oracle Failures: DeFi depends on oracles to provide outside data, and if these systems fail, it can lead to wrong pricing and possible hacks. If an oracle gives incorrect information, it could greatly affect your trades and investments.

What Is an Example of DeFi?

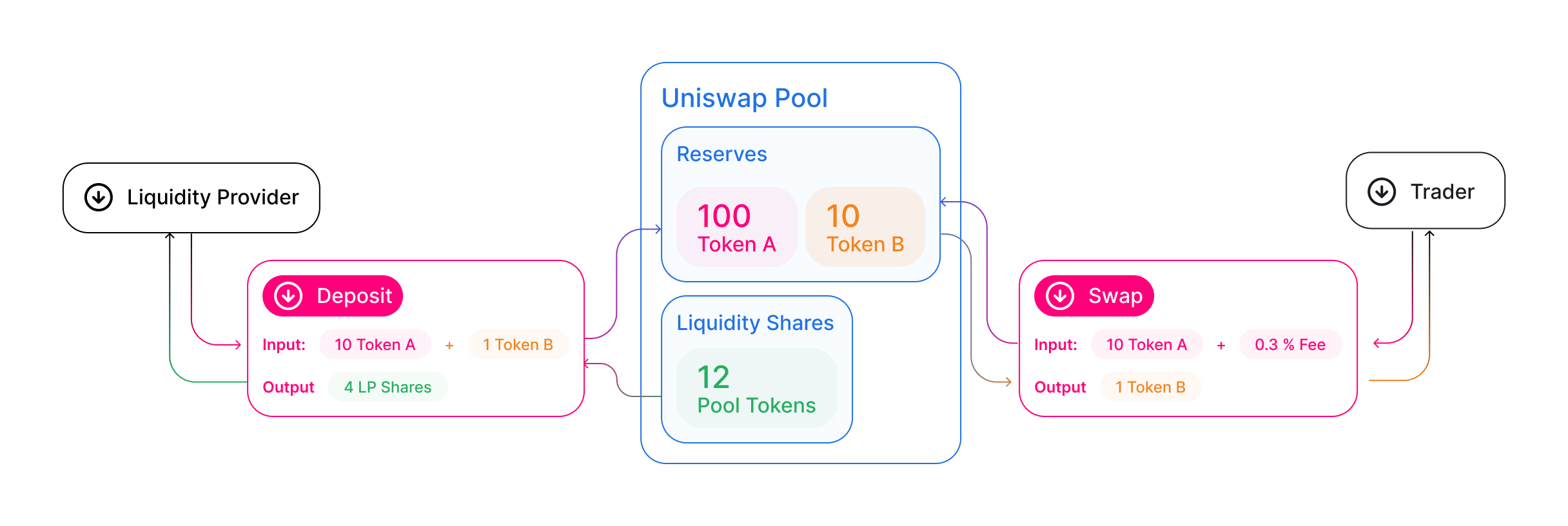

One of the most well-known examples of DeFi is Uniswap, a decentralized exchange (DEX) built on the Ethereum blockchain. Uniswap enables you to trade cryptocurrencies directly from your wallet without needing a centralized middleman.

Here’s how Uniswap works:

- Liquidity Pools: You can help the platform by adding crypto assets like ETH to liquidity pools. This is done by depositing pairs of tokens like ETH/USDT, which provide the necessary funds for trading.

- Automated Market Making: Uniswap uses an automated market maker (AMM) model to set the exchange rate between tokens. This rate is determined by the amount of each token in the liquidity pool.

- Trading: Other users can trade against these liquidity pools. The exchange rate adjusts automatically based on the size of each trade, ensuring fair pricing.

- Fees: Traders who provide liquidity earn fees from trades made on the platform. This rewards them for keeping their assets in the pools and encourages more participation.

Uniswap follows many important DeFi principles: it is open to everyone, transparent, and operates entirely through smart contracts. As a result, it has grown to be one of the largest DeFi exchanges, handling billions of dollars in trading volume.

DeFi Use Cases and Applications

Decentralized Exchanges (DEXs)

Decentralized exchanges, or DEXs, such as Uniswap, SushiSwap, and PancakeSwap, allow you to trade cryptocurrencies directly from your wallet. You do not need to rely on a central authority to make these trades.

These platforms use liquidity pools and automated market makers to help you trade, which means you have more privacy and control over your transactions compared to traditional exchanges.

DEXs also often have lower fees and fewer restrictions, making them accessible to a wider audience. By removing middlemen, DEXs can provide a faster and more efficient trading experience.

Stablecoins

Stablecoins are digital currencies designed to maintain a stable value. They are often pegged to a fiat currency (1:1) like the US dollar. Stablecoins like DAI, USDC, and USDT are a few examples.

Stablecoins are crucial to the DeFi ecosystem because they offer a stable unit of account, which facilitates trading amongst more volatile cryptocurrencies. You can use them for transactions, savings, or as collateral for loans because they minimize the dangers brought on by market changes. Many users in the DeFi space use them because of their stability.

Lending and Borrowing

Platforms such as Aave, Compound, and MakerDAO let you lend your crypto assets to others and earn interest or borrow assets by putting up collateral.

You can often find better interest rates compared to conventional lending institutions, and these platforms are available 24/7, providing greater accessibility. This means that you can manage your finances at any time without needing to meet specific requirements set by traditional banks.

With Aave, a lending and borrowing platform, you can add cryptocurrency (like Ethereum) into a pool and gradually earn interest. You can also use your ETH tokens as collateral. Then, borrow stablecoins like USDC if you need funds quickly.

Yield Farming

Yield farming is a strategy where you provide liquidity to different DeFi protocols to earn higher returns. By participating in liquidity pools or lending platforms, you can earn additional tokens or fees as rewards.

While yield farming can be very profitable, it is also complex and comes with risks. You need to carefully manage your investments and understand how each protocol works to avoid potential losses. Many yield farmers keep track of market trends and changes in the protocols to maximize their earnings, making it a more active form of investment.

Gambling/Prediction Markets

DeFi has also enabled the development of decentralized prediction markets and gambling platforms. Projects like Polymarket allow you to bet on the outcomes of real-world events without needing a central bookmaker.

These platforms use the wisdom of the crowd to determine the likelihood of different outcomes, and they automatically settle bets through smart contracts.

This means that you can place bets with confidence, knowing that the process is fair and transparent. These platforms have created new opportunities for people to engage in betting and speculation in a decentralized manner.

NFTs

While not typically seen as part of DeFi, Non-Fungible Tokens (NFTs) have begun to integrate with various DeFi protocols. Some new uses include NFT-collateralized loans, where you can borrow against the value of your NFTs, and fractional ownership, which allows multiple people to own parts of high-value NFTs.

There are also NFT-based yield farming opportunities, which connect unique digital assets with decentralized finance. This blending of NFTs and DeFi creates new possibilities for both digital art and finance.

Best DeFi Platforms to Look For

As the DeFi space keeps growing, several platforms have become popular and widely used. Here are some of the top Decentralized apps you can consider:

- Aave: Aave is a well-known decentralized platform where you can lend and borrow various cryptocurrencies. It offers unique features like flash loans, and its native token, AAVE, is used for governance and decision-making within the platform.

- Uniswap: It’s the largest decentralized exchange. It is simple to use, offers a wide range of trading pairings, and has its own governance token, UNI, which allows users to have a say in how the trading platform operates.

- Compound Finance: Compound is another major platform for lending and borrowing crypto assets. It introduced the idea of “yield farming” through its COMP token, and you can earn interest on your assets by simply lending them.

- MakerDAO: MakerDAO is known for creating the DAI stablecoin, which maintains a stable value. You can create DAI by locking up other assets as collateral, and it is one of the most trusted and established DeFi platforms.

- Curve Finance: Curve Finance focuses on stablecoin trading and offers low-slippage trades. You can also earn fees and CRV tokens by providing liquidity to the platform, making it a popular choice for stablecoin holders.

- Lido DAO: It’s a liquid staking platform. For example, when you stake Ethereum, you receive stETH, a token representing your staked ETH, which you can still use in DeFi. With Lido, you earn staking rewards while maintaining liquidity, and the platform is governed by its LDO token holders.

How to Get Involved in DeFi?

Step 1: Set Up a Crypto Wallet

Create a wallet for cryptocurrencies that works with DeFi. You can install well-known cryptocurrency wallets like Trust Wallet and MetaMask. These wallets serve as your entry point into the DeFi network. Keep the recovery phrase of your crypto wallet in a secure location. If you lose it, you lose access to your stored funds.

Step 2: Buy DeFi Coins

Purchase cryptocurrency like Ethereum (ETH) from a centralized crypto exchange, such as Binance or Coinbase. Once you have bought the crypto, transfer it from the exchange to your wallet by entering your wallet address. This will allow you to use the funds for DeFi activities.

Step 3: Connect Wallet to DeFi Platform

Link your wallet to Compound, Uniswap, or Aave, among other DeFi platforms. The “Connect Wallet” option on the majority of DeFi platforms makes it simple to connect your wallet to the service. You can use your wallet to interact with the platform’s features after you’re connected.

Step 4: Use DeFi Services

Start exploring DeFi by participating in activities such as lending, borrowing, or providing liquidity. For example, you can lend your assets on Aave to earn interest or provide liquidity on Uniswap to receive trading fees. These actions allow you to earn rewards while contributing to the DeFi ecosystem.

Final Thoughts

In a nutshell, DeFi is a big change in how people use and manage financial services, providing a system that is more open, fair, and less expensive.

However, it also has its own risks, as it is still new and not fully regulated. For those who are ready to handle the challenges and risks, DeFi offers good opportunities, but it’s important to be careful and do proper research.

FAQs

How to make money with DeFi?

You can make money with DeFi by lending, staking, or exchanging cryptocurrencies. For example, you can lend your cryptocurrency to platforms like Aave and get interest, or you can give liquidity to exchanges like Uniswap and receive a portion of the trading fees. You can also get rewards for staking your tokens or participating in yield farming. Another profitable strategy is to trade tokens based on price movements.

Is DeFi safe?

Yes, DeFi is safe but there can be issues like bugs in smart contracts, high price swings in cryptocurrencies, and unclear regulations. Also, unlike traditional banks, there are no insurances for you in DeFi. To stay safer, use well-known platforms with security checks, start with small amounts, and spread your investments across different protocols.

Is Bitcoin part of Decentralized Finance?

Yes, Bitcoin is part of the world of Decentralized Finance (DeFi), but it’s not the same as DeFi itself. This is because its blockchain doesn’t support extensive smart contracts as Ethereum does.

However, some projects aim to include Bitcoin in DeFi by using wrapped tokens, like Wrapped Bitcoin (WBTC), which can be traded on DeFi platforms. These tokens allow Bitcoin to be used in DeFi systems.

What are the top 3 DeFi coins?

The top DeFi coins are Ethereum (ETH), Chainlink (LINK), and Uniswap (UNI). Ethereum is used by most DeFi projects, Chainlink provides smart contracts with external data, and Uniswap powers a major decentralized exchange.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Wrapped eETH

Wrapped eETH  Chainlink

Chainlink  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WETH

WETH  LEO Token

LEO Token  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Sui

Sui  Ethena USDe

Ethena USDe  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Dai

Dai  sUSDS

sUSDS  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Rain

Rain  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  Aave

Aave