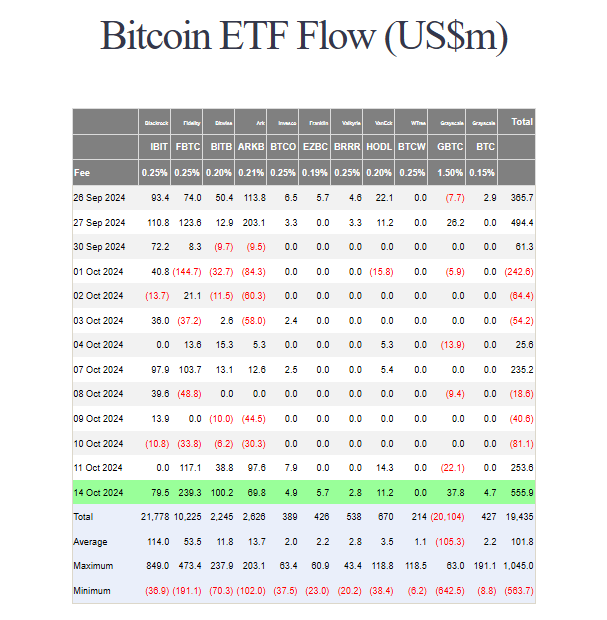

Spot Bitcoin US exchange-traded funds (ETFs) are roaring today, recording the highest inflow in four months as a total sum of $556 million streamed into 12 funds. Coincidentally, by the time the inflow was received, Bitcoin was rebounding as it touched a two-week high at $66,500.

The highest single-day flow, at $239 million, came in through Farside (FBTC), the highest since June. Others performing well include Bitwise (BITB) at $100 million and BlackRock (IBIT) which managed to attract new investors to the rake in $79.51 million.

Increased Activity Across Funds

Several funds posted inflows as the market continued to rally. The shares of ARK Invest and 21Shares (ARKB) stood at nearly $70 million, while Grayscale (GBTC), the bitcoin trust, recorded its first inflow since September at a little over $37 million even if the trust struggled with massive cumulative outflows of $20 billion since its inception.

Source: Farside Investors

Other small funds that posted inflows included: HODL, EZBC, BTCO, Grayscale BTC Mini Trust, and Valkyrie whose inflows totaled over $29 million.

Their growing action also pushed the trading volumes of these 12 Bitcoin ETFs up to $2.61 billion. Analysts project that this new rise will push such funds further by using the net inflows achieved in the past 10 months which is currently at $19.36 billion. This could also be due to Bitcoin ETFs also taking more than gold-based products, reaping $1.5 billion in net inflows this year.

BTC market cap currently at $1.29 trillion. Chart: TradingView.com

Ethereum ETFs Lag Behind Bitcoin

Bitcoin ETFs rose to the highest degree as compared to Ethereum ETFs, which responded relatively better. Net inflows into Ethereum ETFs stood at $17 million led by BlackRock (ETHA) with $14 million.

Image: Regtechtimes

Other funds in Fidelity (FETH), Invesco (QETH), and 21Shares (CETH) received flows ranging from $393,690 to $1.30 million. Trading volumes for Ethereum ETFs also rose to $210 million from $143.54 million the previous day. In fact, since their launch in July, Ethereum ETFs have seen net outflows of $542 million.

The total cryptocurrency market also started to recover from its losses with Bitcoin trading at $65,268. Meanwhile, Ethereum increased by almost 3% to hit the $2,594 level by the end of the day.

As Nate Geraci, President of ETF Store, said, this day was a “monster day” for spot Bitcoin ETFs, as the crypto investment product continues to gain mass appeal ahead of traditional and safer assets, such as gold.

Featured image from Global Finance Magazine, chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  Canton

Canton  Uniswap

Uniswap  PayPal USD

PayPal USD  Mantle

Mantle  Cronos

Cronos  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Aave

Aave  Rain

Rain  Bitget Token

Bitget Token  MemeCore

MemeCore