In a December 5 appearance on CNBC’s “The Exchange,” Galaxy CEO and founder Mike Novogratz offered insights into Bitcoin’s meteoric rise while making a striking comment that has reignited curiosity about the mysterious figure behind it all: Satoshi Nakamoto.

A Historic Milestone For Bitcoin

With Bitcoin hitting the symbolic $100,000 milestone—an extraordinary ascent from a concept in a white paper just 15 years ago—Novogratz took a moment to pay tribute to the community that has driven the digital asset’s adoption. He emphasized the grassroots nature of Bitcoin’s growth, stating: “If Satoshi was alive, because I don’t think he is, I’m sure he would have a big smile on his face.”

This remark, delivered in a matter-of-fact tone, underscores the enduring enigma of BTC’s pseudonymous creator. While Satoshi’s identity has never been confirmed, the suggestion of his death is a topic rarely addressed so directly by high-profile industry figures.

“It’s a great technology, and really the social construct that people learn to understand each other. In a lot of ways, this is the greatest example of a broad-based coalition of people coming together to do something spectacular. Before we talk about price, I want to recognize the moment $2 trillion asset in 15 years, coming out of a guy’s idea is pretty stinking spectacular,” the Galaxy CEO added.

Novogratz, an early investor in Bitcoin, discussed the immense wealth generated by digital assets. He described the last three months as potentially “the single greatest wealth gain for 25 to 45-year-olds in history” due to the doubling of BTC prices.

The CEO underscored the importance of this generational shift in wealth, asserting that it would have real economic impact: “22, 23% of wealth shocks gets spent in consumption… people are going to be buying houses and cars… It will be interesting to see if the Fed has an input of an increase in consumption from this massive wealth gain.”

Novogratz also acknowledged the unwavering conviction of many crypto holders, noting that even those who have accrued substantial gains remain reluctant to sell. He framed Bitcoin as deeply tied to belief systems rather than mere asset allocation: “It’s a belief system more so, even than a financial asset for a lot of people.”

While lauding Bitcoin’s global, coalition-based growth, he cautioned that volatility is inevitable. High leverage in the markets, he said, all but guarantees challenging moments ahead: “I can guarantee all your listeners, there will be at least one, if not two, vicious retracements which will test your soul.”

Moving to the policy landscape, Novogratz spoke optimistically about the incoming US administration’s regulatory approach. He portrayed the last period as one of “four years of horrible regulation,” asserting that the Trump administration and regulatory appointments could support growth and innovation in the digital asset sector.

He concluded: “we have a president now, like him or not, he is great for the crypto industry. He said early on he was going to be a crypto president, a Bitcoin president, a cabinet full of believers, full of people that are low on crypto.”

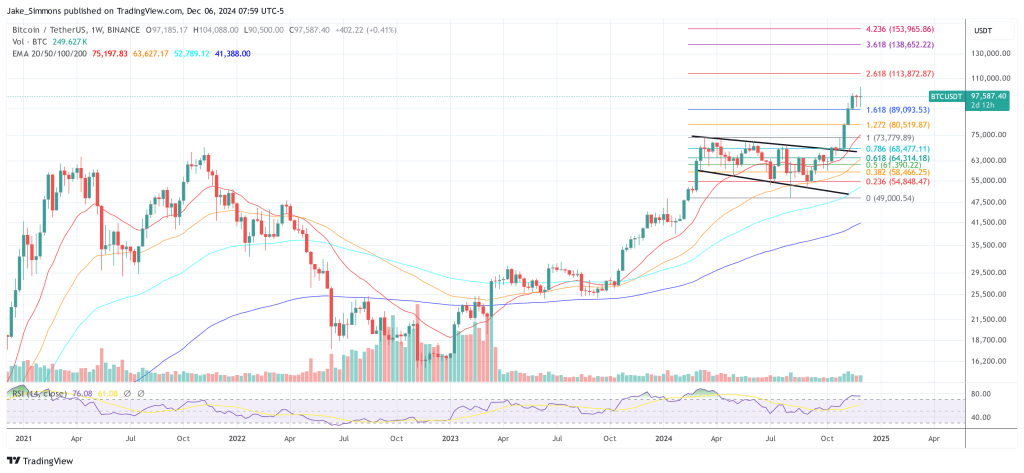

At press time, BTC traded at $97,587.

Featured image created with DALL.E, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  Canton

Canton  Uniswap

Uniswap  PayPal USD

PayPal USD  Mantle

Mantle  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Aave

Aave  Rain

Rain  Bitget Token

Bitget Token  MemeCore

MemeCore