Bitcoin’s price action over the past week has been remarkable, marked by its milestone climb past $100,000.

While this monumental level was short-lived, with BTC quickly correcting to around $91,000 before rebounding to around $97,000, it remains a significant achievement. Since first breaching the milestone, Bitcoin has passed through the $100,000 mark several times, indicating it is already failing as either support or resistance. The market’s ability to sustain these elevated levels is a testament to the strong underlying demand for BTC.

The fact that Bitcoin hasn’t seen a sharp selloff or a return to price levels below $90,000 after failing to consolidate above $100,000 is a strong indicator that the selling pressure is being met by equally strong, if not stronger, buying interest. At this level, demand remains robust enough to counteract any attempts to lower the price. Prices around $94,000 have shown strong support, with several wicks down to these levels before rebounding.

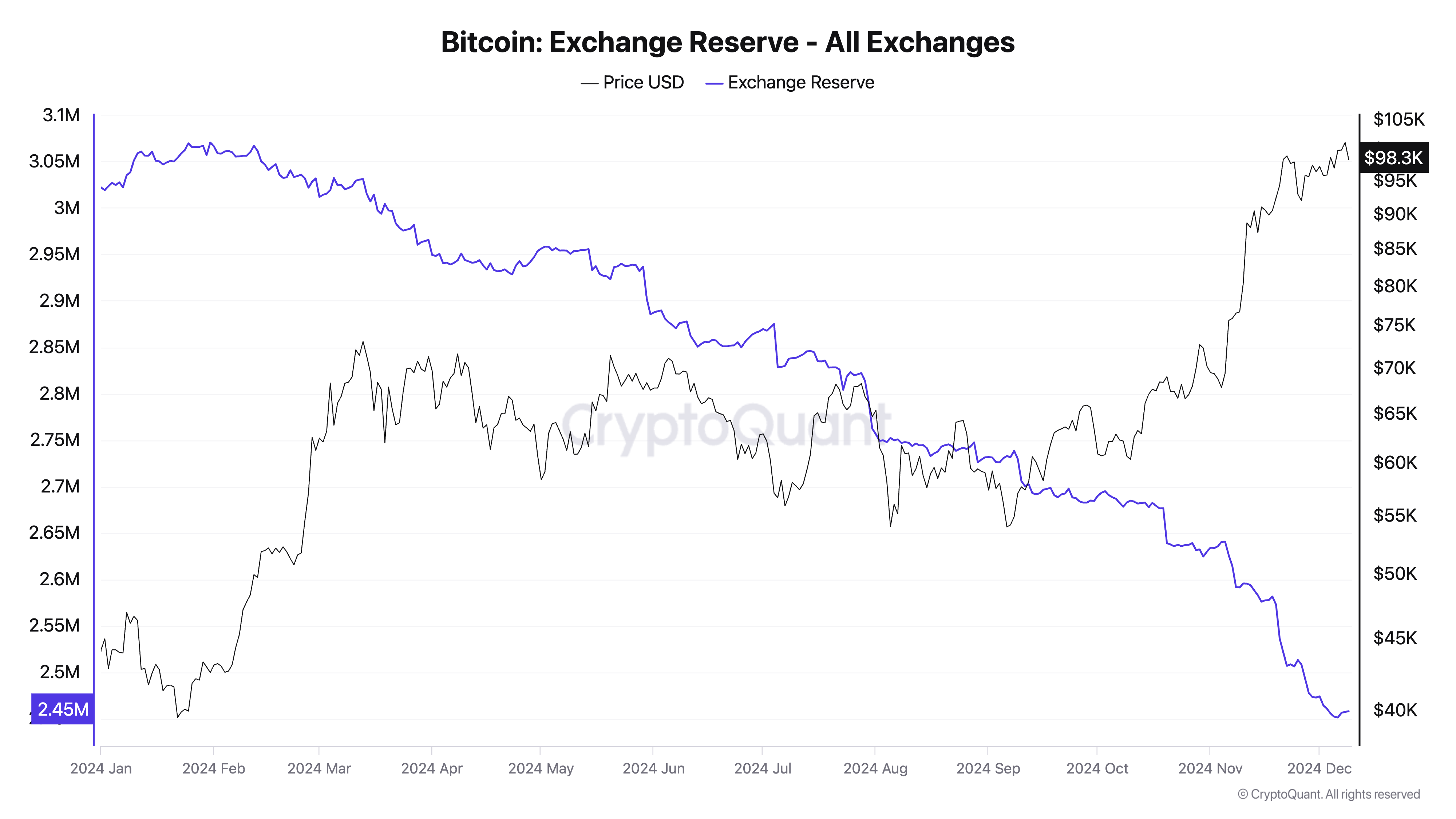

This balance between demand and supply is evident when examining the relationship between exchange reserves and exchange net flows. Exchange reserves — Bitcoin held on centralized platforms — have been steadily declining over the long term and are now at around 2.45 million BTC.

This trend reflects a clear preference among market participants to move Bitcoin into personal wallets or cold storage, signaling confidence in Bitcoin’s long-term value. Declining reserves reduce the supply of Bitcoin available for immediate sale, which usually supports price stability or upward movement.

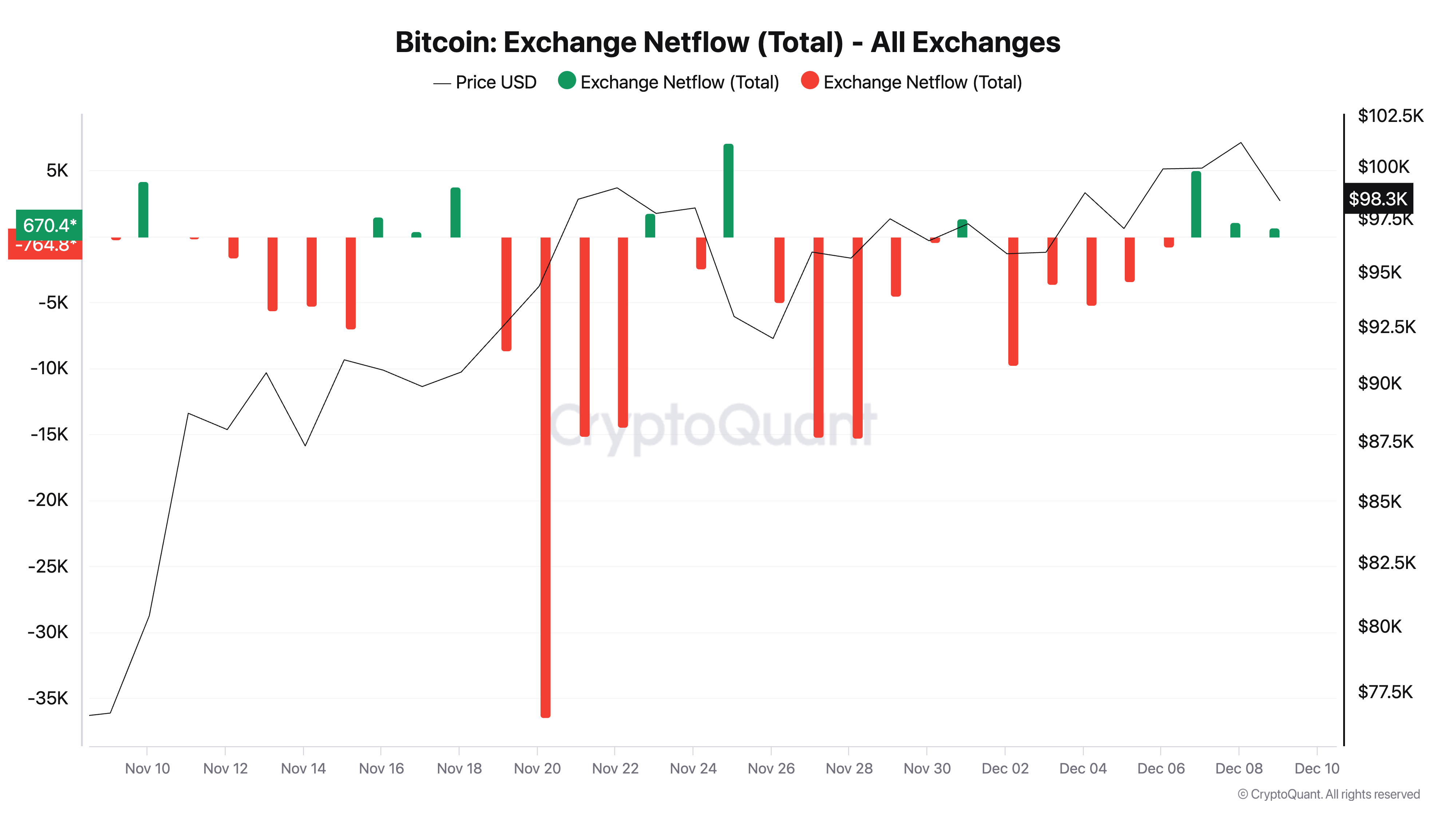

In contrast, exchange netflows paint a slightly different picture in the short term. Netflows, which measure the difference between Bitcoin inflows and outflows to exchanges, have shown occasional spikes in inflows over the past week. These spikes suggest that some investors are moving Bitcoin back to exchanges, likely to take profits following the recent price rally or to hedge their positions.

However, these inflows have not translated into significant downward pressure on the price. This aligns with a previous CryptoSlate analysis, which found that a considerable amount of downward price action comes from the derivatives market.

This implies that most of the Bitcoin being deposited onto exchanges is being absorbed by buyers, preventing any substantial price drop. The contrast between declining long-term reserves and sporadic short-term inflows highlights a balanced market where supply and demand forces are evenly matched.

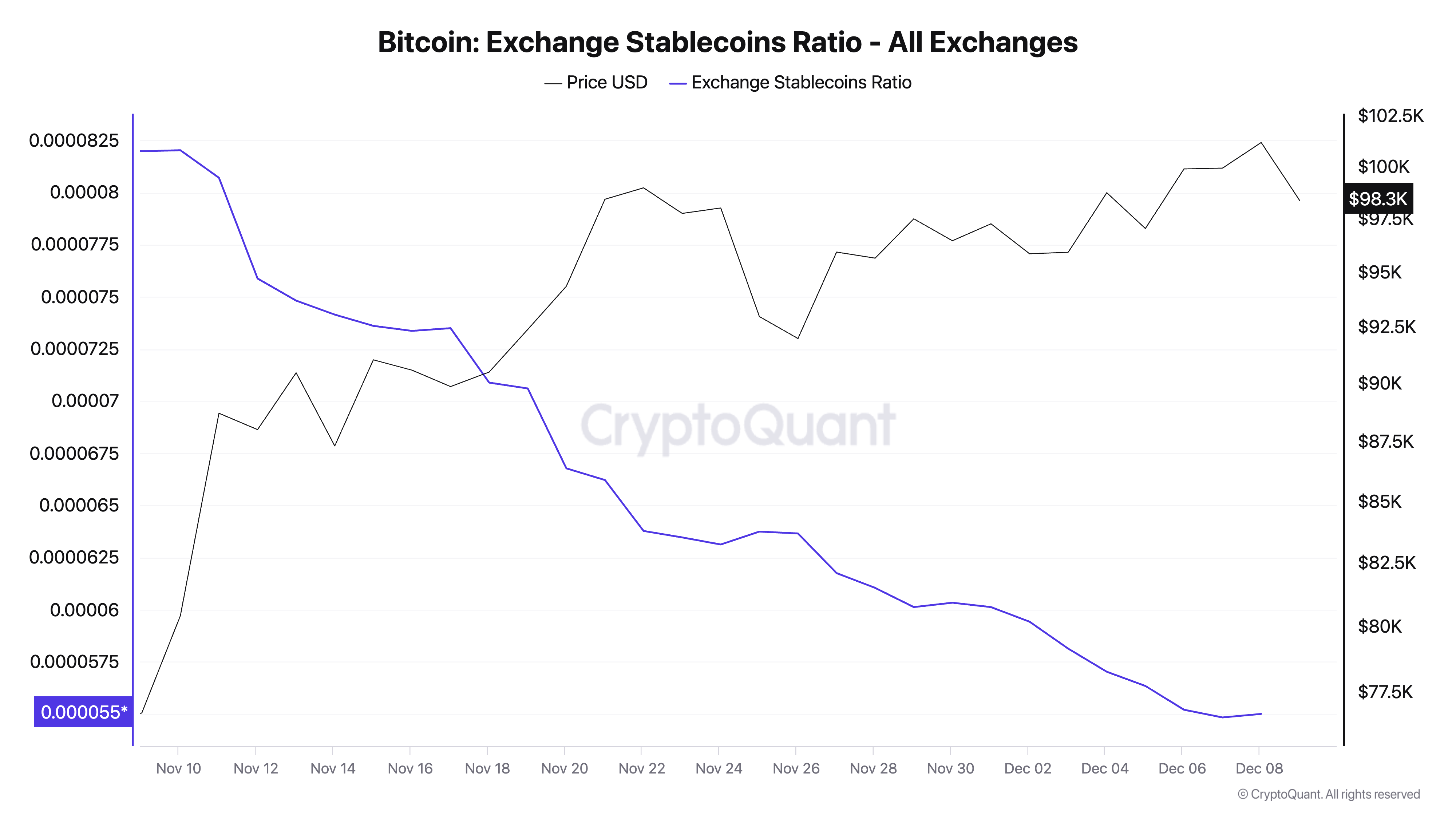

Ample buying pressure is further confirmed by looking at the exchange stablecoin ratio. Previously analyzed by CryptoSlate, this metric measures the amount of Bitcoin reserves relative to stablecoin reserves held on exchanges. A lower ratio indicates a higher proportion of stablecoins, signifying that exchanges are well-capitalized with buying power.

With the exchange stablecoin ratio currently at an all-time low, we can see that the market is flush with liquidity and ready to absorb any selling pressure from exchanges. Having a significant number of stablecoins available on exchanges enables the market to sustain demand for Bitcoin even in the face of increased selling activity—such as the one we saw when BTC passed $100,000.

The low stablecoin ratio complements the trends in exchange reserves and net flows. While reserves show a structural decline in available Bitcoin and net flows highlight short-term selling attempts, the abundance of stablecoins confirms that there is enough capital on the sidelines to absorb this selling.

Together, these metrics paint a picture of a market well-supported by liquidity, even as it navigates periods of profit-taking. This liquidity likely has kept Bitcoin between $95,000 and $99,000 despite its inability to reclaim $100,000 for now.

The declining exchange reserves point to reduced selling liquidity over the long term, creating a potential supply squeeze. At the same time, the presence of stablecoins signals that buying interest is not only present but substantial enough to counteract selling attempts.

Net flows act as a real-time gauge of short-term sentiment, and the fact that inflows haven’t led to a breakdown in price further confirms the strength of demand. This creates a feedback loop where selling pressure is mitigated by the liquidity provided by stablecoins while falling reserves ensure that even modest demand can significantly impact price.

The post Bitcoin holds steady near $100,000 as selling pressure is absorbed appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Figure Heloc

Figure Heloc  Sui

Sui  Stellar

Stellar  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Wrapped eETH

Wrapped eETH  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Hedera

Hedera  Litecoin

Litecoin  LEO Token

LEO Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  USDS

USDS  Mantle

Mantle  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Cronos

Cronos  USDT0

USDT0  Polkadot

Polkadot  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Ethena Staked USDe

Ethena Staked USDe  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  OKB

OKB  Dai

Dai  Aave

Aave  Pepe

Pepe  Ethena

Ethena  Bitget Token

Bitget Token  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Aster

Aster