In the rapidly evolving world of digital payments, choosing the right platform can significantly impact both businesses and consumers.

This article provides an in-depth comparison of four prominent payment technologies: XRP (Ripple), Alchemy Pay (ACH), Stellar (XLM), and Flexa (AMP), focusing on their transaction speeds, fees, real-world applications, token utility, and ecosystem.

Technology and Consensus Mechanisms

XRP (Ripple)

Ripple Labs developed XRP to optimize cross-border transactions for financial institutions. Utilizing the XRP Ledger, a more centralized blockchain ensures fast transaction processing times of 3-5 seconds and a high throughput of 1,500 transactions per second (TPS).

Learn more: XRP Price Prediction

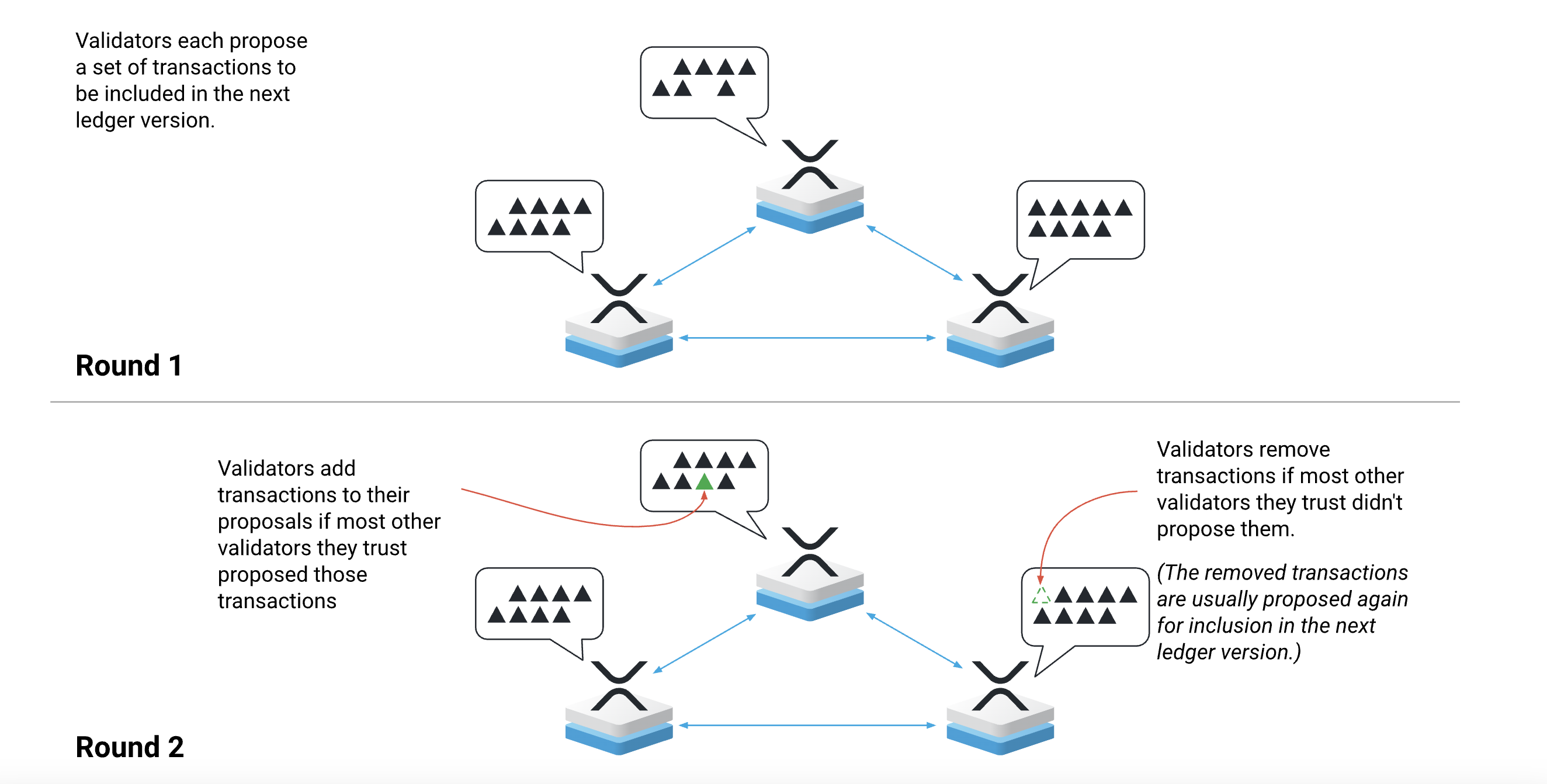

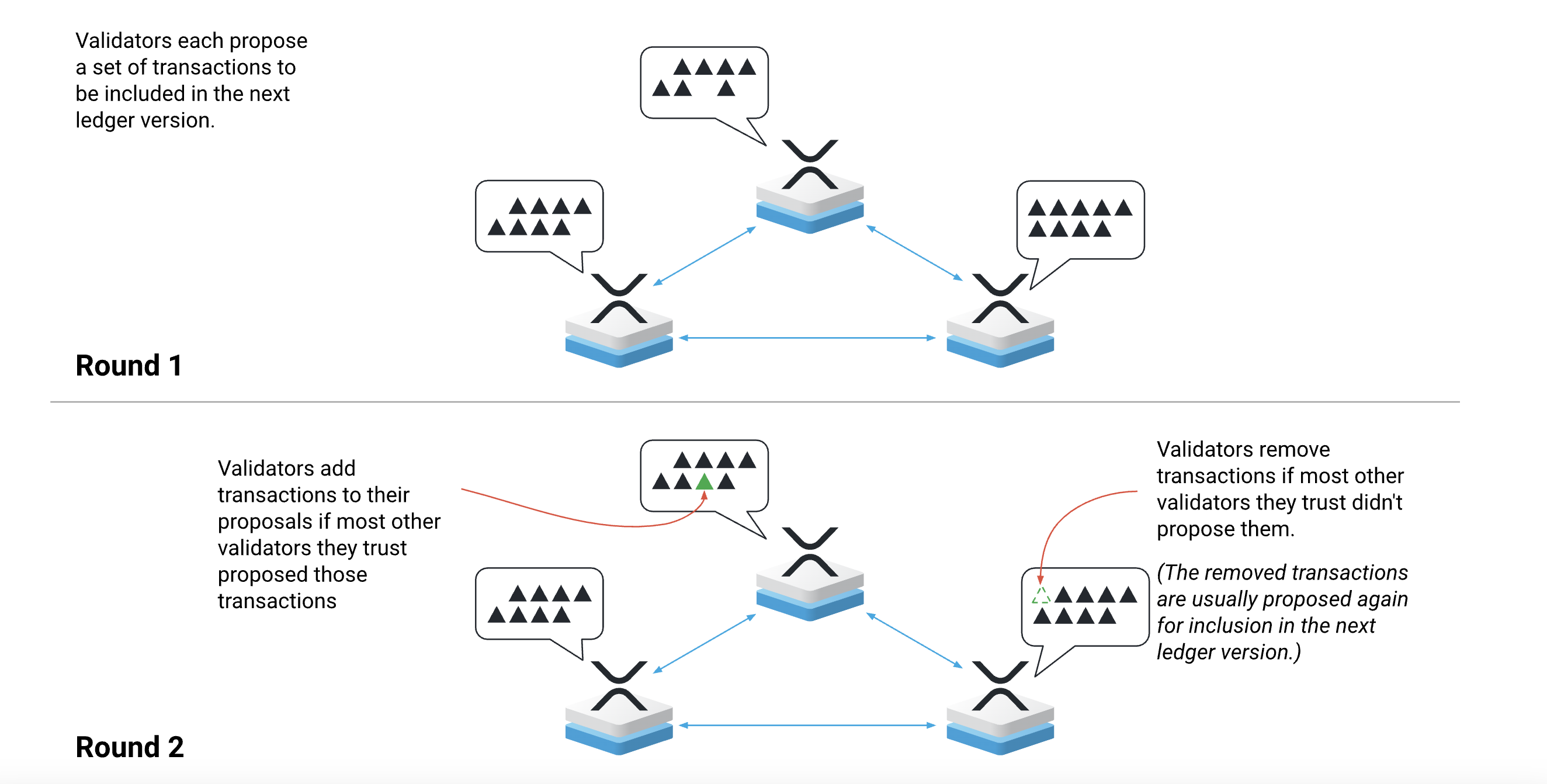

The Ripple Protocol Consensus Algorithm (RPCA) relies on a list of trusted validators to achieve consensus without the need for mining, highlighting its operational efficiency and reliability.

Source: xrp.org

Alchemy Pay (ACH)

Initially an ERC-20 token on Ethereum, Alchemy Pay ACH bridges fiat and crypto through smart contracts and off-chain solutions like the Lightning Network.

The recent development towards a Layer-1 blockchain, Alchemy Chain, aims to enhance scalability and payment processing capabilities, although it currently relies on Ethereum, affecting its transaction fees and speeds.

Stellar (XLM)

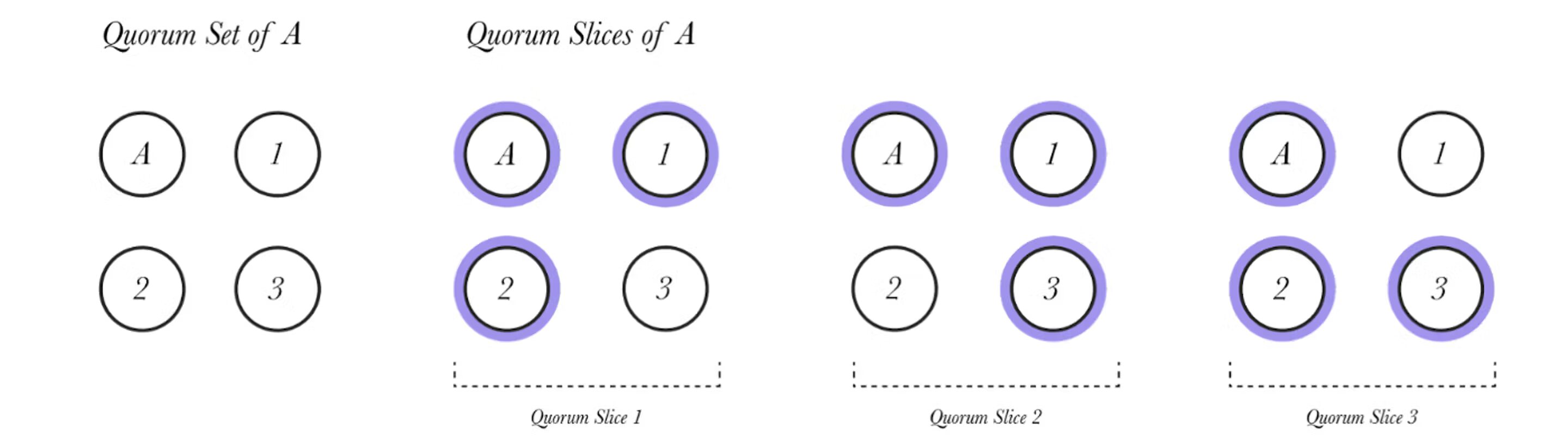

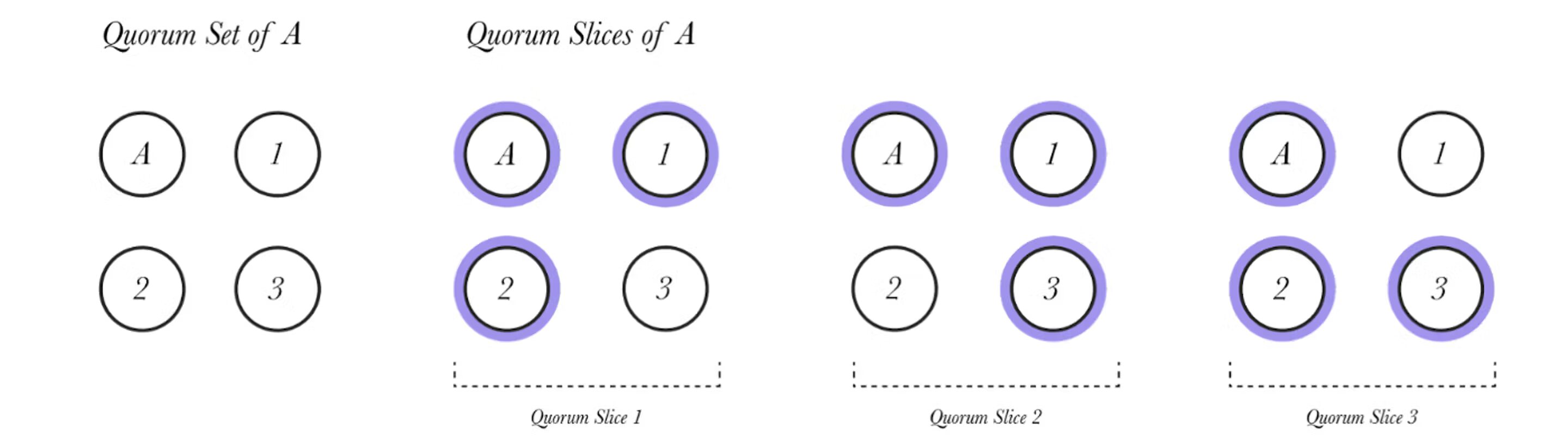

Stellar XLM operates on an open-source network that aims to increase financial inclusivity globally. Using the Stellar Consensus Protocol (SCP), a Federated Byzantine Agreement system, it achieves consensus without financial incentives for validators.

This system supports low-latency transactions, with the capability to process up to 1,000 TPS, and completes transactions in 2-5 seconds.

Source: stellar.org

Flexa (AMP)

Flexa utilizes its AMP token as collateral on its decentralized platform, ensuring instant, fraud-proof payments directly at point-of-sale. Built on Ethereum with smart contract functionality, Flexa supports over 99 digital assets across multiple blockchains, ensuring security and transaction speed typically under one second.

Transaction Speed and Fees

Each platform has tailored its technology to meet specific needs:

- XRP boasts the highest transaction throughput and minimal fees, making it ideal for international bank transfers.

- Alchemy Pay’s speed varies with Ethereum’s congestion, potentially incurring higher fees during peak times.

- Stellar offers fast, cost-effective solutions for microtransactions and cross-currency transfers with minimal fees.

- Flexa ensures near-instant payments at the retail level with competitive fees due to its unique collateralization mechanism.

Real-world Use Cases and Adoption

- XRP is widely adopted by major banks for its efficient, low-cost cross-border payment solutions, although it is facing regulatory scrutiny in the U.S.

- Alchemy Pay partners with global giants like Visa and Shopify, facilitating seamless integration of crypto payments in over 70 countries.

- Stellar is favored by non-profits and fintechs for its inclusive financial solutions, particularly in emerging markets.

- Flexa is increasingly used by merchants to accept crypto payments securely and instantly, enhancing the retail customer experience.

Token Utility and Ecosystem

- XRP functions mainly as a bridge currency in financial transactions.

- ACH is used within its ecosystem for transaction fees, staking, and rewards.

- XLM serves as a transaction fee medium and anti-spam tool while facilitating the creation of stablecoins and other digital assets.

- AMP secures payments and provides rewards through staking, integral to maintaining network integrity and security.

Target Customer Segments

XRP (Ripple)

Focuses on financial institutions, including banks, payment service providers, and crypto businesses. According to Ripple Customers, its clients include Banco Rendimento, IndusInd Bank, and Tranglo, with the goal of expanding global payments and liquidity management. XRP is suitable for institutions that need fast and low-cost international transaction solutions.

Alchemy Pay (ACH)

Targets merchants, consumers, and blockchain platforms, particularly in retail and e-commerce. According to Alchemy Pay About, ACH supports over 70 countries with 300 payment channels, serving over 2 million merchants through partnerships with Shopify and Binance, helping integrate crypto into retail systems.

Source: alchemypay.org

Stellar (XLM)

Serves both individuals and institutions, with a focus on financial inclusion, especially for the unbanked. According to the Stellar Ecosystem, Stellar supports projects such as digital wallets, DeFi, and global payments, with partners like IBM and Franklin Templeton, making it ideal for developing markets.

Source: stellar.org

Flexa (AMP)

Focuses on merchants and consumers for retail crypto payments. According to Flexa Payments, Flexa supports over 99 digital assets, with partners like InComm Payments and Blackhawk Network, helping merchants accept crypto at the point of sale (POS) and online.

Source: Flexa

Partnerships

XRP (Ripple)

Has a broad list of partners, including banks and financial institutions such as Santander, Standard Chartered, BBVA, and Nium, with over 100 partners according to Ripple Customers. These partnerships enhance cross-border payment capabilities, particularly in Asia and Latin America.

Source: Ripple Website

Alchemy Pay (ACH)

Collaborates with major platforms like Shopify, QFPay, Arcadier, Binance, Visa, and MasterCard, reaching over 2 million merchants, according to Alchemy Pay Partnerships. This helps ACH expand its global payment network, especially in e-commerce.

Source: Globenewswire

Stellar (XLM)

Partners with IBM, Franklin Templeton, Oradian, and various fintech companies, according to Stellar Partnerships. These partnerships support the deployment of payment and financial solutions for emerging markets, including tokenized mutual funds built on Stellar.

Source: stellar.org

Flexa (AMP)

Works with InComm Payments, Blackhawk Network, Citcon, GK, Rooam, and Bancoagrícola, according to Flexa Partnership News. These collaborations enable Flexa to integrate with POS systems and expand crypto acceptance in North America and El Salvador.

Level of Decentralization

XRP (Ripple)

The level of decentralization is controversial. XRP uses the Ripple Protocol Consensus Algorithm (RPCA) with trusted validators. However, Ripple controls a significant number of nodes and holds a large portion of XRP, raising concerns about centralization.

Alchemy Pay (ACH)

Currently, payment processing may be centralized, even though the ACH token is decentralized on Ethereum. The planned launch of its own blockchain (Alchemy Chain) could increase decentralization in the future, according to Alchemy Pay Layer-1.

Stellar (XLM)

Stellar is more decentralized, with an open network using the Stellar Consensus Protocol (SCP), which allows nodes to choose their own validators, as detailed in the Stellar Consensus Protocol documentation.

Flexa (AMP)

Flexa leverages decentralized technologies such as Ethereum and the Amp token, but its payment infrastructure is more centralized, as outlined in the Flexa Technology Overview.

The summary comparison table below

|

Feature |

XRP (Ripple) | ACH (Alchemy Pay) | XLM (Stellar) |

AMP (Flexa) |

| Transaction Speed | 3–5 seconds and 1,500 TPS | Dependent on Ethereum or off-chain, real-time | 2-5 seconds, 1.000 TPS | About 2–5 seconds with a capacity of up to 1,000 TPS |

| Transaction Fees | < $0.0001 | Dependent on Ethereum gas fees | ~ $0.00001 | 1% (for merchants), free for users. |

| Real-world Use Cases | Bank settlements | Merchant payments | Fintech, growing market | Retail, POS in North America |

| Token Utility | Currency bridge | Fees, staking, and rewards | Fees, anti – spam, and stablecoins | Collateral, rewards |

| Technology | XRP Ledger, RPCA | Ethereum, developing Alchemy Chain | SCP | Ethereum, AMP collateral |

| Target Customer | Financial institutions | Merchants, consumers, blockchain platforms | Individuals, organizations, unbanked users | Retail merchants and consumers |

| Partnerships | Santander, Standard Chartered, etc. | Visa, Mastercard, Shopify, etc. | IBM, Franklin Templeton, etc. | InComm Payments, Blackhawk Network, etc. |

| Level of Decentralization | Ripple controls validators | Currently centralized, with plans for its own blockchain | More decentralized with an open network | Utilizes decentralized technology, but with centralized infrastructure |

Conclusion

The choice among XRP, Alchemy Pay, Stellar, and Flexa depends on specific business needs and operational contexts. XRP and Stellar are excellent for large-scale financial transfers and inclusive financial services, respectively.

In contrast, Alchemy Pay and Flexa shine in integrating crypto payments into everyday commerce, each bringing unique strengths to digital transactions.

As these platforms evolve, they continue to redefine the possibilities within the payment sector, promising enhanced efficiency and broader accessibility.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  Canton

Canton  Uniswap

Uniswap  PayPal USD

PayPal USD  Mantle

Mantle  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Aave

Aave  Rain

Rain  Bitget Token

Bitget Token  MemeCore

MemeCore