Recently, Binance announced the addition of 10 tokens to its Monitoring Tag list, which includes tokens at high risk of being delisted. This move reflects Binance’s ongoing commitment to maintaining a robust trading environment amid growing regulatory scrutiny and market volatility.

Binance Put a Monitoring Tag on 10 Tokens

Binance recently flagged 10 tokens with a Monitoring Tag, signaling potential delisting risks due to concerns over volatility, liquidity, and regulatory compliance. The affected tokens include:

- VIB (Viberate)

- LTO (LTO Network)

- WING (Wing Finance)

- VOXEL (Voxies)

- PDA (PlayDapp)

- BSW (Biswap)

- NKN (NKN)

- PERP (Perpetual Protocol)

- ARDR (Ardor)

- FLM (Flamingo)

Read more: Binance Put “Monitoring Tags” On 10 Tokens On March 4, 2025

Simultaneously, Binance removed the Seed Tag from 03 prominent tokens—Jupiter (JUP), Starknet (STRK), and Toncoin (TON). This move indicates these projects have met the exchange’s stringent risk assessment criteria and are now considered more stable. This action follows Binance’s recent delisting measures, including the introduction of the “Vote to Delist” campaign, further intensifying the pressure on underperforming projects.

Coin Prices are Reacting Negatively

The announcement of the Monitoring Tag triggered an immediate market reaction, with all 10 tagged tokens plunging into the overwhelmed red color.

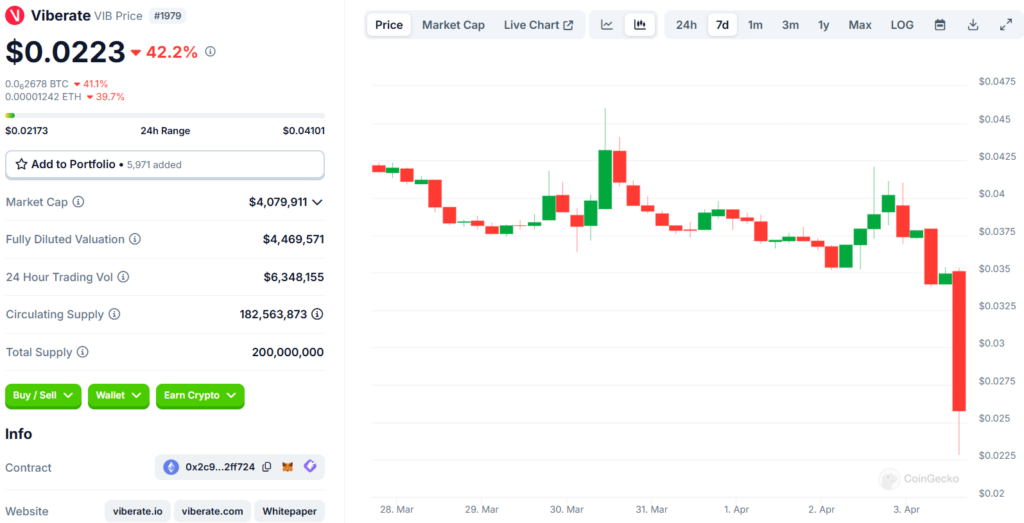

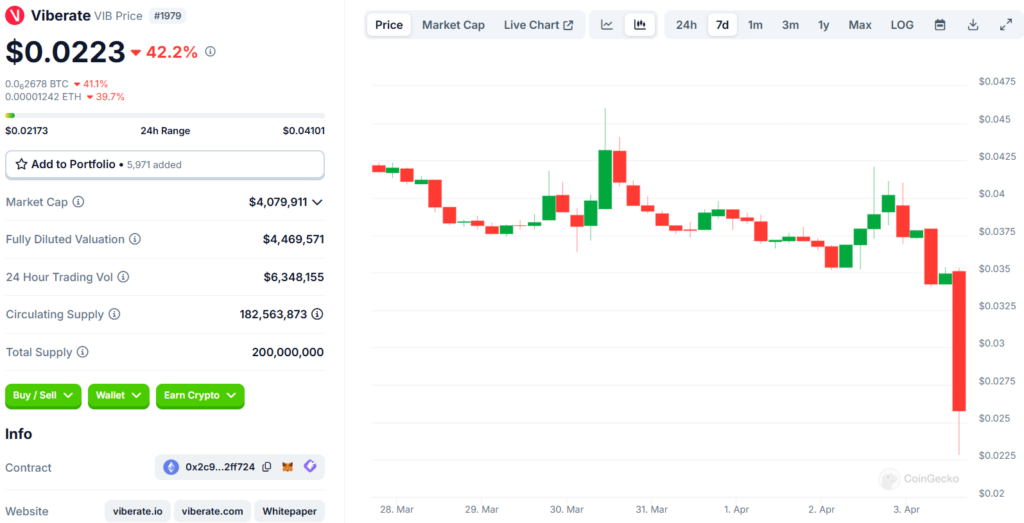

Viberate VIB suffered the most significant decline, dropping more than 40% within minutes of the news.

Source: Coingecko

Other tokens also experienced sharp losses, including WING, LTO, PDA, and BSW, all falling over 30%.

Even more resilient tokens saw substantial declines, with VOXEL, PERP, NKN, and FLM. ARDR (Ardor) was the only token to experience a relatively mild drop of 6%.

The reason for ARDR’s lesser impact lies in its larger market capitalization, which exceeds $50 million, making it the most established among the tagged tokens. In contrast, the other tokens have market caps below $50 million, with VIB’s market cap at a mere $4 million, rendering it particularly vulnerable to market sentiment and delisting fears.

About Binance Monitoring Tag

Binance uses the monitoring tag to flag high-risk tokens with low liquidity, high volatility, or regulatory issues. These tokens face regular reviews, and failing Binance’s criteria may lead to delisting within 30 days. This reflects Binance’s focus on risk management and compliance, keeping only stable projects. For investors, the tag warns of price volatility and potential removal.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  LEO Token

LEO Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  WETH

WETH  Ethena USDe

Ethena USDe  Zcash

Zcash  Canton

Canton  Sui

Sui  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Avalanche

Avalanche  World Liberty Financial

World Liberty Financial  USD1

USD1  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore  Tether Gold

Tether Gold