Crypto exchanges play a major role in today’s market, and Binance and Binance.US are the two best platforms worth exploring. Binance is a leading global exchange best for its wide range of features and services available across the world. Binance.US is its U.S.-based version, designed to follow American regulations and offer a much simpler experience.

In this guide, we will compare Binance vs Binance US based on fees, trading features, products, and eligibility to help you select the best platform for your needs.

What is Binance?

Binance is a global company that operates the largest cryptocurrency exchange by daily trading volume. It was founded in 2017 by Changpeng Zhao. The exchange started in China but moved to Japan due to China’s cryptocurrency restrictions. It later relocated to Malta and now has no official headquarters.

The platform supports over 350 cryptocurrencies and its own token, Binance Coin (BNB). Binance offers various services beyond trading. It provides spot trading with fees as low as 0.1%, reducible to 0.075% using BNB. The exchange also supports futures trading with up to 125x leverage, staking via Binance Earn, and a Visa card for spending crypto. Binance Pay allows instant global payments with zero fees.

Binance is known for its security measures. It uses two-factor authentication, cold storage for most assets, and the Secure Asset Fund for Users (SAFU) to protect users. Binance faces regulatory challenges. The U.S. SEC sued it in 2023 for unregistered operations, and it pleaded guilty to money laundering charges, paying $4.3 billion in penalties. Changpeng Zhao stepped down as CEO and was replaced by Richard Teng. Read our in-depth Binance review here.

What is Binance US?

Binance.US is a separate platform and the best cryptocurrency exchange for users in the United States. It was launched in September 2019 as a separate entity from Binance to comply with U.S. regulations.

The platform is operated by BAM Trading Services, based in San Francisco, California, and partnered with Binance for technology and branding. Binance.US serves customers in 34 states, excluding Washington, New York, Texas, and Vermont.

The exchange offers trading for over 160 cryptocurrencies. Binance.US charges a 0.4% maker and 0.6% taker spot trading fee for regular users. It also offers free Bitcoin trading. The platform supports staking, allowing users to earn rewards on assets like Cardano (ADA) and Solana (SOL), with annual yields up to 12%.

Binance vs Binance US: Comparison Table

| Binance | Binance.US | |

| Availability | Global (180+ countries) | U.S. only (34 states) |

| Regulation | Multiple jurisdictions (22 Licenses) | U.S. (SEC, FinCEN) |

| Supported Cryptos | 350+ | 160+ |

| Spot Trading Fees | 0.1% maker/taker | 0.4% maker and 0.6% taker |

| Payment Methods | Crypto, card, bank, P2P, 100+ other | Crypto, ACH, wire, debit card, and more |

| Trading Volume | Very High | Low |

| Liquidity | High | Moderate |

| User Base | 250M+ global | U.S.-focused |

| Instant Buy/Sell | Yes | Yes |

| Futures Trading | Yes (125x leverage) | No |

| Options Trading | Yes (European Style) | No |

| Margin Trading | Yes (10x leverage) | No |

| P2P Trading | Yes | No |

Binance vs Binance US: Trading Features

Binance provides a comprehensive trading ecosystem for all levels. It supports spot trading with over 350 cryptocurrencies and 1,400+ pairs, featuring limit, market, stop-limit, and OCO (one-cancels-the-other) orders.

You can trade perpetual futures contracts with up to 125x leverage and use margin trading with borrowed funds at 0.01% daily interest. Options trading offers European-style contracts for BTC and ETH, while advanced charting via TradingView includes moving averages and real-time data. Binance also provides P2P trading for direct user-to-user trades and an OTC desk for large orders.

Binance.US focuses on simplicity and compliance for U.S. users. It offers spot trading with basic buy/sell features. Advanced charting mirrors Binance’s TradingView integration, but futures, margin, and options trading are absent due to U.S. regulations.

Winner: Binance, for its extensive, advanced trading features like futures trading, margin trading, and options trading.

Binance vs Binance US: Fees

Trading Fees

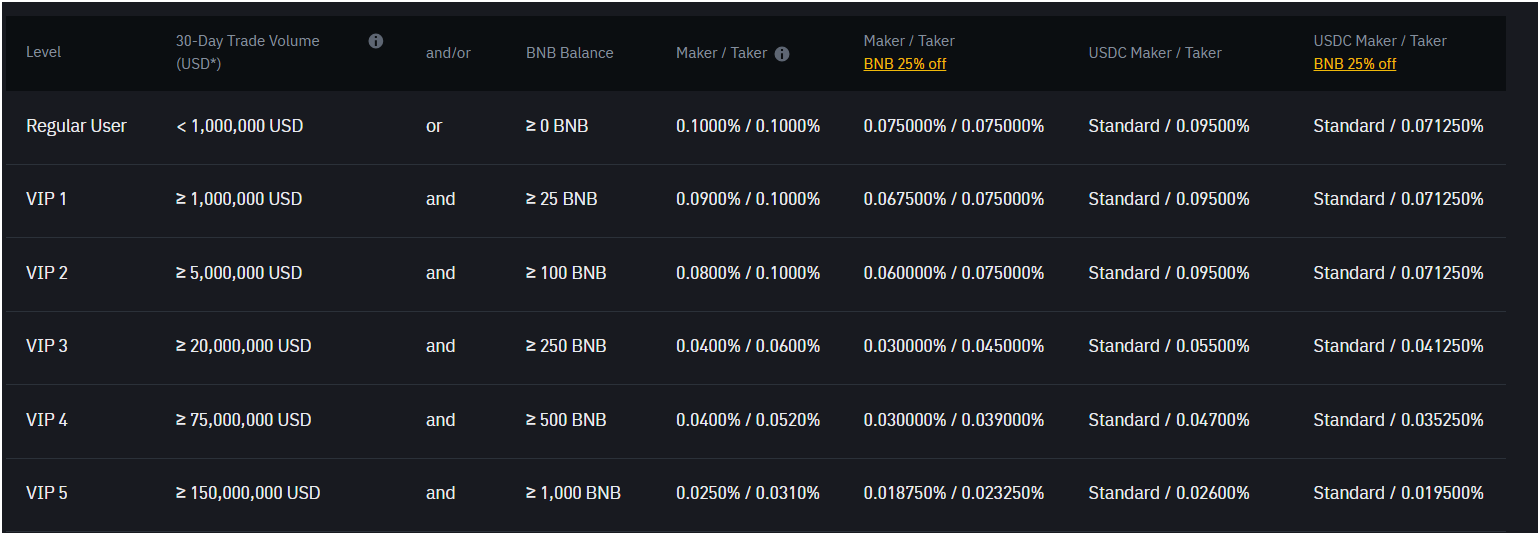

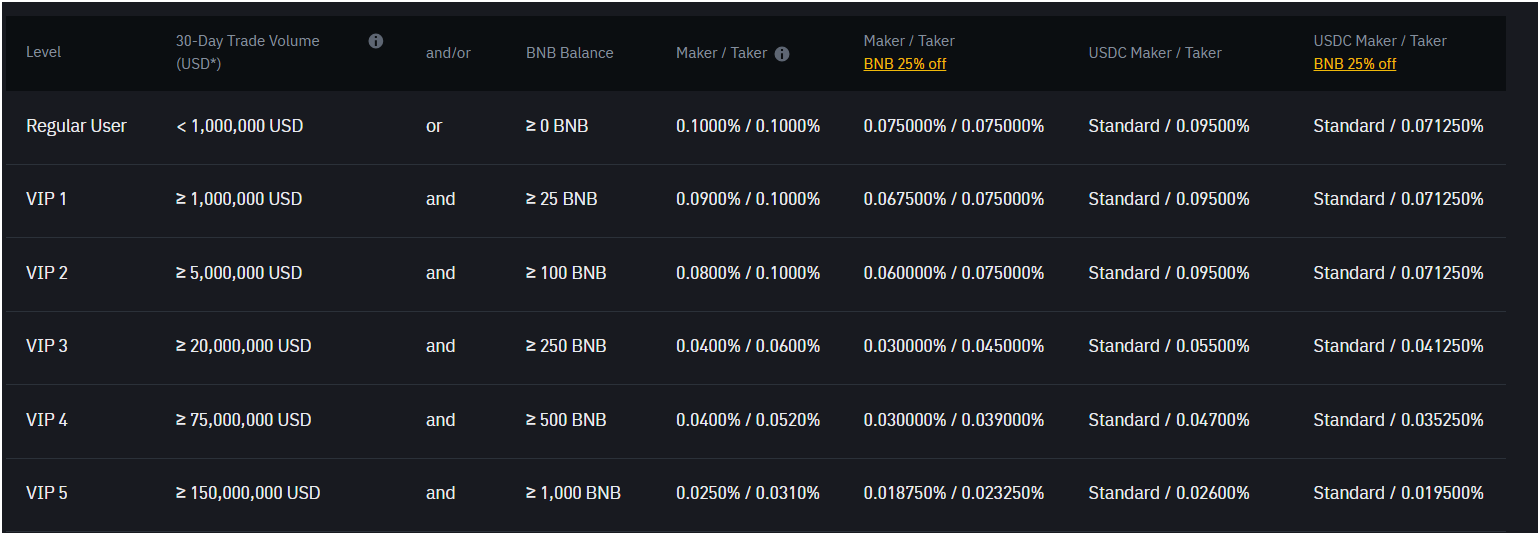

Binance offers some of the lowest trading fees in the industry. It charges a standard 0.1% maker and taker fee for spot trading for users with a 30-day trading volume under $1M.

You can reduce this by 25% (to 0.075%) by paying with Binance Coin (BNB). Higher-volume traders unlock VIP tiers – e.g., VIP 1 (over $1M volume) drops fees to 0.09% maker and 0.1% taker, down to 0.011% maker and 0.023% taker at VIP 9 ($4B+ volume).

Binance futures trading fees start at 0.02% maker and 0.05% taker, also tiered by volume. This structure benefits active global traders with flexibility and discounts.

Binance.US fees are higher and less forgiving. For 30-day volumes under $10,000 (VIP 1), Tier 1 pairs charge 0.4% maker and 0.6% taker – four to six times Binance’s base rate.

Tier 0 pairs (BTC/USD, BTC/USDT, BTC/USDC, BTC/BUSD) are free, but most trades fall under Tier 1. Above $10,000, fees drop – e.g., VIP 2 ($10,000-$50,000) is 0.25% maker and 0.4% taker, down to 0.08% maker and 0.18% taker at VIP 5 ($1M-$20M).

A 5% BNB discount applies, which is far less generous than Binance’s 25%. No futures trading exists due to U.S. rules.

Winner: Binance’s fees are consistently lower and more scalable, while Binance.US’s high Tier 1 rates overshadow its zero-fee BTC pairs. Binance wins for cost efficiency.

Deposits and Withdrawals Fees

Binance offers free crypto deposits for all 350+ assets. Withdrawal fees vary based on network congestion. Fiat deposits (e.g., USD via bank transfer) are often free via partners, but card purchases hit 3.75%. Fiat withdrawals like USD vary by region. You benefit from low crypto fees and P2P trading with zero costs in some cases.

Binance.US also provides free crypto deposits. Withdrawal fees are sometimes high compared to global Binance users. Also, Binance.US does not charge fees for USD deposits or withdrawals using bank transfers (ACH).

Binance vs Binance US: Available Cryptocurrencies

Binance offers access to over 350 cryptocurrencies for trading. It includes popular coins like Bitcoin, Ethereum, and Binance Coin (BNB), as well as lesser-known altcoins such as Solana, Algorand, and Matic. You can trade hundreds of pairs. Binance constantly updates its listings and often adds coins through its Launchpad program.

Binance.US provides a much smaller selection, with about 160 cryptocurrencies available. It includes major coins like Bitcoin, Ethereum, and Litecoin but lacks the extensive range of altcoins found on Binance. The platform focuses on popular, established tokens to comply with strict U.S. rules. You won’t find as many niche or new cryptocurrencies here because it prioritizes regulatory safety over variety.

Winner: Binance, because it offers more than double the cryptocurrency options (350 vs. 160).

Binance vs Binance US: Regulation & Availability

Binance is an international platform that operates globally but faces some regulatory challenges. The exchange is banned in the U.S., Iran, North Korea, and Thailand due to strict laws. You can’t use Binance in the U.S. because it doesn’t meet federal requirements. It holds 22 licenses in places like Bahrain, Dubai, India, and France, but it’s under scrutiny from regulators like the U.S. Department of Justice for past issues like money laundering allegations in 2023.

Binance.US is designed specifically for the U.S. market. The platform is available in 34 states but not in Hawaii, New York, Texas, or Vermont due to state-specific rules. You can trade legally here if you’re in an allowed state, and it’s registered with the U.S. Financial Crimes Enforcement Network (FinCEN). It avoids the global bans Binance faces by tailoring its operations to U.S. laws. About availability, Binance is available in 180+ countries, but Binance.US is specifically designed for U.S. users only.

Winner: Binance is regulated in over 22 countries, whereas Binance.US is built for and registered in the United States only.

Binance vs Binance US: Security

The major security measures of the Binance global cryptocurrency exchange platform are:

- Two-factor authentication (2FA) adds an extra step to logging in or withdrawing funds. You enter a code from your phone or a device like a YubiKey on top of your password, so even if someone gets your password, they can’t access your account without that second code.

- Withdrawal address whitelisting lets you set a list of trusted wallet addresses for withdrawals. You can only send funds to these pre-approved addresses, which stops hackers from withdrawing your money to their own wallets if they break into your account.

- Anti-phishing code is a unique set of letters and numbers you create. Binance includes this code in all real emails they send you, so you can tell if an email is fake if the code is missing or wrong. It helps you avoid scams pretending to be Binance.

- Secure Asset Fund for Users (SAFU) is an emergency fund that Binance started in July 2018. The exchange sets aside 10% of trading fees to grow this fund, valued at $1 billion.

- Cold storage means Binance keeps most user funds offline in secure devices. These devices aren’t connected to the internet, so hackers can’t reach them, and the private keys are encrypted for extra safety.

Binance Hacking Issues:

Binance has experienced a notable security breach in the past. The most significant incident occurred in 2019 when hackers stole 7,000 Bitcoin (BTC), worth about $40 million at the time, from the exchange’s hot wallet.

Another major event tied to Binance happened in 2022 when a cross-chain bridge on the Binance Smart Chain (now BNB Chain) was hacked. Hackers exploited a flaw, minting 2 million BNB tokens valued at $570 million. Binance paused the chain and, with community help, froze $7 million of the stolen funds.

Binance.US Security:

Binance.US matches many of these features for U.S. users. It also uses 2FA and cold storage for 95% of assets and has its own insurance fund. The exchange emphasizes U.S.-based storage facilities for added trust.

You won’t find a history of major breaches here, unlike its parent company. It ranks high on security reviews, like CER’s list, even above Coinbase. The platform focuses on keeping your assets safe in a regulated environment.

Winner: Both exchanges are highly secure, but Binance.US has never faced a security breach.

Binance vs Binance US: Trading Volume and Liquidity

Binance leads the world in trading volume, with $50 billion+ daily spot trading volume. It serves 250 million users across 180+ countries, making it the most liquid exchange globally. You can execute trades fast with minimal price slippage because of its massive user base and deep order books. The platform handles thousands of trading pairs, ensuring high liquidity even for obscure coins.

Binance.US trails far behind, with a trading volume of around $30 million per day. It caters to a smaller U.S. audience, and you might notice slower trades or wider spreads on less popular pairs due to lower liquidity. The exchange supports fewer assets, so it can’t match the depth of its global counterpart.

Winner: Binance, for its unmatched trading volume and liquidity.

Binance vs Binance US: Products & Services

Here are the top Binance Products & Services

- Spot Trading: Binance supports over 350 cryptocurrencies and 1,400+ trading pairs, including BTC, ETH, and altcoins like Solana.

- Futures Trading: It offers perpetual and quarterly futures with up to 125x leverage on assets like BTC and ETH.

- Margin Trading: Binance lets you borrow funds with interest rates starting at 0.01% daily. You can access this for over 100 coins.

- Options Trading: It provides European-style options for BTC and ETH with flexible expiration dates.

- Crypto Staking: You can lock coins like ETH or BNB to earn 5-20% APR, depending on terms (30-120 days). It’s a passive income tool with over 300 supported assets.

- Savings Accounts: The Binance exchange platform offers flexible (withdraw anytime) or fixed (higher yield) savings for 50+ coins. You earn up to 10% APR, balancing liquidity and returns.

- P2P Marketplace: It enables direct crypto trades with users globally, supporting 50+ fiat currencies. It charges 0% fees for P2P trades.

- NFT Marketplace: Binance hosts NFT trading, minting, and auctions for digital assets. You engage with unique collectibles, a growing crypto niche.

- Crypto Loans: You can borrow against crypto collateral for 7-180 days, with rates from 2-10%. It’s a quick liquidity option without selling assets.

- Binance Visa Card: It converts crypto to fiat for spending at 60 million+ merchants worldwide. You get up to 8% cashback in BNB, blending crypto with daily use.

- Launchpad: Binance lets you invest in new token projects before public listing. You commit BNB for allocations, targeting early-stage gains.

- Smart Pool: It optimizes mining power across BTC, ETH, and other coins for higher returns. You join with minimal setup, aimed at miners.

Binance.US Products & Services

- Spot Trading: Binance.US offers 160+ cryptocurrencies and 324 trading pairs, like BTC/USD and ETH/USDT. You trade with higher fees (0.4% maker, 0.6% taker) unless on free Tier 0 pairs (BTC/USD).

- Staking: It supports staking for coins like ETH and ADA, yielding 2-10% APR with fewer options.

- Crypto Swaps: Binance.US provides instant conversions between supported coins, like BTC to ETH. You can easily swap without order books.

- OTC Trading: It offers over-the-counter trades for large volumes (e.g., $10,000+). You get custom pricing, suited for institutional or high-net-worth users.

Winner: Binance has a comprehensive suite – spot, futures, margin, options, staking, savings, P2P, NFTs, loans, a card, Launchpad, and mining. Binance.US limits itself to spot trading, staking, swaps, and OTC.

Binance vs Binance US: Customer Support

Binance offers robust customer support for its global users. It provides 24/7 live chat, email support, and a detailed help center with guides. You can reach out in multiple languages, reflecting its 250 million users across 180+ countries. Response times are generally quick, often within hours, though peak times can slow things down. The platform has improved since early complaints, earning praise for responsiveness by 2025.

Binance.US provides similar options but with mixed results. It offers 24/7 live chat, email, and a support ticket system tailored to U.S. users. You might wait longer, sometimes for days, especially during verification delays. The exchange serves fewer people yet struggles with consistency. It lacks phone support, unlike some U.S. competitors like Kraken.

Winner: Binance, for faster and more reliable customer support compared to Binance.US.

Binance vs Binance US: User Interface

The international Binance platform delivers a versatile user interface for all levels. It offers a basic mode for beginners and an advanced mode with charting tools, like TradingView integration, for pros. You can trade over 350 coins across spot, margin, and futures markets, all on a clean, customizable dashboard. The mobile app mirrors this flexibility. It’s intuitive yet packed with features.

Binance.US simplifies things for U.S. users. It provides a streamlined interface with basic and advanced views, supporting 160 coins on spot trading only. You get similar charting tools but fewer options like futures or margin trading due to regulations.

The platform is user-friendly, with a mobile app rated well for ease, though some find it less dynamic than Binance’s. It suits beginners but may bore advanced traders.

Winner: Binance has a more advanced user interface, whereas Binance.US has a more basic version without any advanced tools due to regulatory compliance.

Conclusion: Which Binance is better?

To compare Binance vs. Binance.US, the differences are clear across key areas. Binance dominates globally with over 350 cryptocurrencies, a $50 billion daily trading volume, and access in 180+ countries, making it ideal for diverse, high-volume traders. Its user interface is robust, its customer support is efficient, and its security is strong despite a 2022 hack, backed by a $1 billion SAFU fund. However, it’s unavailable in the U.S. due to regulatory bans.

Binance USA version caters to Americans in 34 states, offering 160 cryptocurrencies, a $30 million trading volume, and strict U.S. compliance. It provides a simpler interface and a clean security record but lags in liquidity and support responsiveness.

The global Binance platform excels in scale and variety, while Binance.US prioritizes legality and safety for U.S. users. For global reach and features, Binance wins; for U.S.-based trading, Binance.US is the only option. Your choice depends on location and priorities. You can also check out our other comparisons, like Binance vs OKX and Binance vs Bybit.

FAQs

Who can use Binance and Binance US?

Binance can be used by global users in over 180 countries, including Europe, Asia, and Africa, and offers trading futures, spot, margin, and options. Binance.US is only for U.S. traders in 34 states. The platform focuses on compliance and simplicity, limiting features like futures or margin trading for its American audience.

Is Binance.US legal in the USA?

Yes, Binance.US is legal in the USA and designed to comply with U.S. regulations. It operates under BAM Trading Services, a U.S.-based entity registered with the Financial Crimes Enforcement Network (FinCEN). The platform adheres to federal laws, including anti-money laundering (AML) and KYC requirements, ensuring users verify their identity with government-issued IDs. You can use it in 34 states.

Which Binance app to use in the US?

You should use the Binance.US app if you’re in the United States. It’s tailored for U.S. residents, available on iOS and Android, and supports trading 160 cryptocurrencies. The app complies with U.S. laws and requires KYC verification with a U.S. ID. You download it from the App Store or Google Play, log in with a Binance.US account, and trade legally in states like California or Florida, but not New York or Texas.

What is the difference between USD and USDT on Binance?

USD on Binance refers to the U.S. dollar, a fiat currency issued by the U.S. government. It’s used in limited trading pairs, like BTC/USD, where you trade cryptocurrencies directly against real dollars. You deposit USD via bank transfers, but availability is restricted due to regulatory hurdles. Binance rarely offers USD pairs globally, but Binance.US uses USD.

USDT, or Tether, is a stablecoin pegged 1:1 to the USD and issued by Tether Limited. It’s widely used on Binance, with over 350 trading pairs like BTC/USDT. You can trade it freely without bank involvement, as it’s a cryptocurrency stored in wallets. USDT maintains stability, with each token backed by dollar reserves, making it a popular proxy for USD on exchanges.

USD involves actual cash and stricter rules, while USDT mimics USD value within the crypto ecosystem. Binance favors USDT for its flexibility and volume.

Is Binance US shutting down?

No, Binance.US is not shutting down; it remains operational, serving millions of users across 34 U.S. states. The platform faced challenges, like a $4 billion fine tied to its parent company Binance’s legal issues, and paused USD withdrawals for some time due to SEC pressure. You can still trade crypto-to-crypto pairs, and it’s licensed by FinCEN, showing commitment to U.S. compliance.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Chainlink

Chainlink  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  WETH

WETH  Wrapped eETH

Wrapped eETH  Monero

Monero  Ethena USDe

Ethena USDe  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Hedera

Hedera  Avalanche

Avalanche  Sui

Sui  Shiba Inu

Shiba Inu  Dai

Dai  World Liberty Financial

World Liberty Financial  Cronos

Cronos  sUSDS

sUSDS  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  PayPal USD

PayPal USD  USDT0

USDT0  Polkadot

Polkadot  Mantle

Mantle  Canton

Canton  Bittensor

Bittensor  Aave

Aave  USD1

USD1  Bitget Token

Bitget Token