The industry was recently rocked by the catastrophic collapse of $OM, the native token of the Mantra project, on April 14. In hours, $OM plummeted by over 90%, wiping out billions in market value and leaving investors reeling.

What began as a promising real-world asset (RWA) tokenization project quickly turned into a cautionary tale of market manipulation, questionable practices, and shattered trust. This article delves into the $OM crash, its underlying red flags, and the broader implications for the crypto space.

Mantra Dump – A Single Candle Wipes Out $6 Billion Overnight

About Mantra

Mantra is a Layer 1 blockchain focused on tokenizing real-world assets (RWAs) with a security-first approach, built on the Cosmos SDK for institutional use. Its $OM token, launched in 2020, drives governance, staking, and transactions. Centralized exchanges like Gate.io, OKX, and Binance listed $OM, enhancing liquidity through pairs like OM/USDT. The token soared to an all-time high of $6.30 in early 2025, skyrocketing 500x from its low, fueled by market hype and FOMO, though later investigations tied its rise to speculative manipulation.

Historic Collapse

On April 14, the $OM token experienced one of the most dramatic crashes in recent crypto history, plummeting over 90% in a single day. The token, which had been trading at around $6.30 just a day earlier, collapsed to a low of $0.40, reducing its market capitalization from nearly $6 billion to a mere $683 million. This sudden drop triggered over $74.7 million in liquidations, with some individual positions losing more than $1 million each.

Source: Coinmarketcap

The crash was so severe that it erased years of gains for $OM holders, many of whom had been drawn in by the token’s meteoric rise of over 500x from its all-time low. Many investors suspected that this was a rug pull and manipulation from Mantra’s team, which similarly occurred in the LUNA case before.

The similar case of LUNA’s crash – Source: TradingView

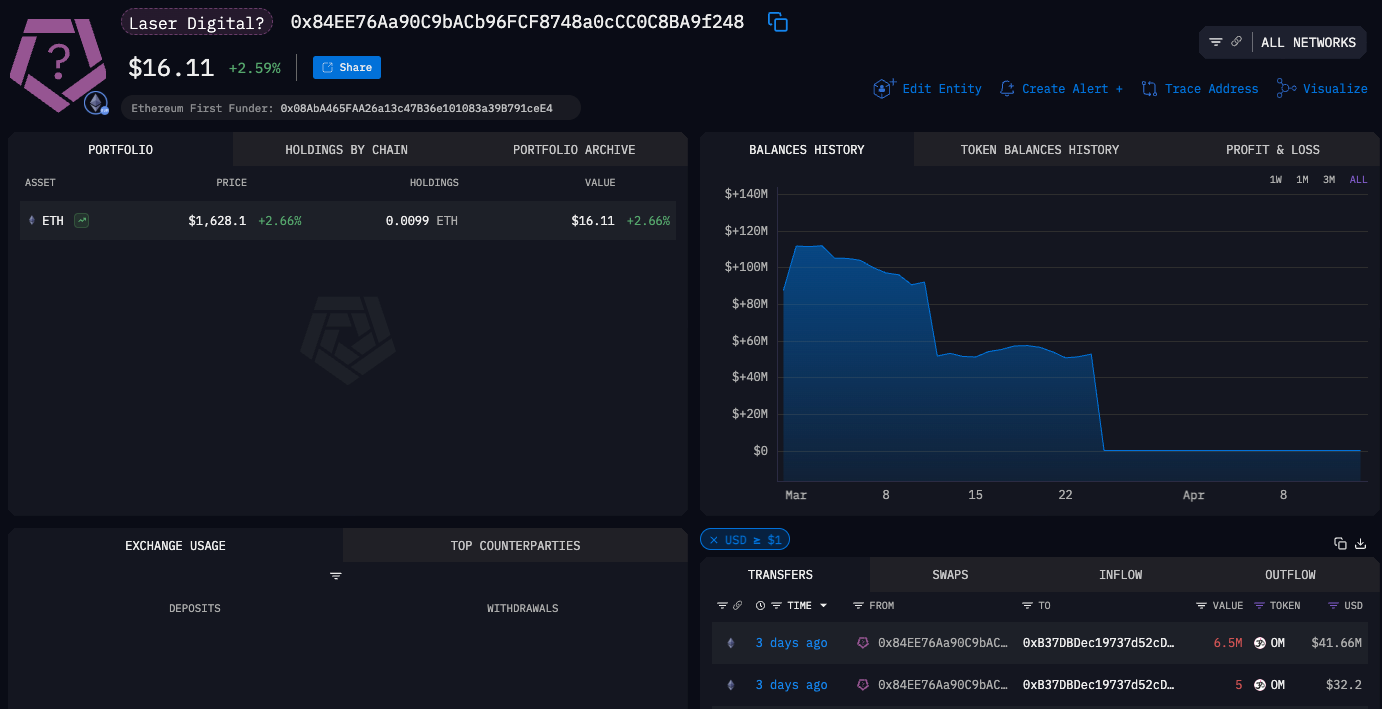

Additionally, the community uncovered a notable connection between the $OM token crash and Laser Digital, which made a strategic investment in Mantra in May 2024. Two of the 17 wallets linked to the incident were allegedly tied to Laser Digital. However, the organization quickly denied any involvement, refuting claims of interference in the matter.

2-linked wallet address from Laser Digital – Source: Arkham Intelligence

Whispers of a Shocking Rug Pull Scheme

John Patrick Mullin, the co-founder of Mantra, immediately refuted any allegations of internal manipulation or rug pull. He attributed the collapse to “reckless forced closures initiated by centralized exchanges on OM account holders,” claiming that these actions occurred without sufficient warning or margin calls. The Mantra team insisted that their token allocations remained locked and verifiable on-chain, and they were actively investigating the incident to uncover the true cause of the crash.

Sherpas, OMies, and broader crypto community,

First off, the team and I greatly appreciate the support that we have received over the past several hours, which we believe is a testament to the strong support MANTRA has among its investors and community.

We have determined that…

— JP Mullin (🕉, 🏘️) (@jp_mullin888) April 13, 2025

However, crypto investigator ZachXBT raised serious doubts about the official narrative. He pointed to two individuals allegedly tied to the Mantra incident: Denko Mancheski, the founder of Reef Finance, and a user named Fukugo Ryoshu. According to him, these individuals had been reaching out to multiple parties in the days leading up to the crash, seeking massive loans against their $OM holdings. This revelation fueled speculation of coordinated market manipulation, especially given Reef Finance’s own history of similar incidents, including a Binance delisting in October 2024 and an $80 million OTC deal with Alameda in 2021.

Read more: Mantra Disastrous Meltdown: $5.5 Billion Vanishes Overnight in Collapse Echoing Luna Disaster

The impact on the community and investors was devastating. Many users lamented the loss of $15 million and declared the industry a “scam.” Others accused the Mantra and Binance teams of orchestrating a liquidity exit. The crash obliterated financial portfolios and eroded trust in the RWA tokenization sector, raising broader questions about market stability and the integrity of centralized exchanges.

Red Flag Surrounding the Mantra Project and $OM Token

While some may have perceived the $OM crash as sudden, a closer examination of the Mantra project reveals a series of warning signs that had been building for some time. These warning signs paint a troubling picture of a project that may have been built on shaky foundations.

Suspected Team and Mantra Project Itself

First, market analysts discovered that the Mantra team controlled an alarming 90% of the token’s circulating supply. This extreme concentration of ownership gave the team significant control over the token’s price and liquidity, making it highly susceptible to manipulation. In the crypto space, such a structure often raises concerns as it enables insiders to orchestrate pumps and dumps, which can negatively impact retail investors.

The team behind Mantra DAO also has a controversial history. Reports have surfaced that some team members participated in fraudulent Initial Coin Offerings (ICOs) during the 2017 crypto boom, while others were linked to operating a casino—a detail that raised eyebrows in the community. Additionally, Mantra DAO has faced legal scrutiny in the past for failing to provide transparent financial reports, further eroding trust in its operations.

Another point of concern was Mantra’s handling of a planned airdrop. The project had announced a 50 million $OM airdrop as part of its Gendrop program, but just before the distribution, the team banned 50% of participants, claiming they were bots—without providing a clear explanation. The team subsequently delayed the airdrop, leaving many users frustrated and suspicious of the team’s intentions. Compounding this, Mantra quietly altered its tokenomics without proper communication, a move that further fueled distrust.

Massively Over-valued and Overhyped $OM Token

Rumors also circulated that the project had sold large OTC deals to investors at prices 50% below the market rate, a practice that could have allowed insiders to offload tokens while artificially inflating the token’s price. This ties into another glaring issue: the disconnect between $OM’s valuation and its fundamentals.

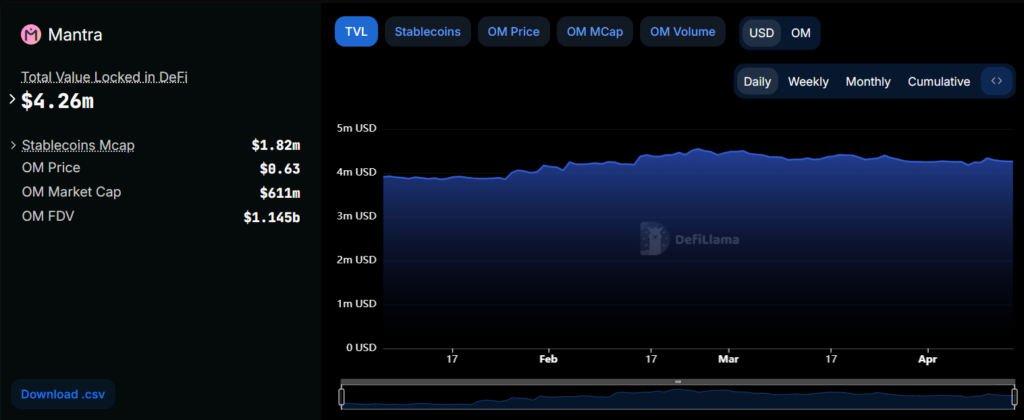

Prior to the crash, $OM had a fully diluted valuation (FDV) of approximately $10 billion, yet its total value locked (TVL) was a mere $4 million. This stark disparity shows that market manipulation, FOMO, and speculative narratives massively overhyped the token, rather than genuine demand driving its value. The price, which had surged over 500x from its all-time low, was fragile and prone to collapse due to the lack of real buying pressure.

Source: DefilLama

When the crash finally occurred, $OM’s valuation plummeted by nearly $6 billion, but the TVL only declined by just over $1 million. This observation raises a critical question: did the TVL in Mantra’s ecosystem genuinely reflect user activity, or did the project artificially inflate it? The suspiciously small TVL decline compared to the massive valuation loss indicates that the team may have manipulated the ecosystem’s activity to falsely suggest adoption and value.

The involvement of figures like Denko Mancheski, who has a history of market manipulation with Reef Finance, only adds to the suspicion. Reef itself experienced a similar pump-and-dump cycle, surging 650% before crashing 64% after a Binance delisting in 2024. The parallels between Reef and Mantra, coupled with ZachXBT’s findings, suggest that $OM’s rise and fall may have been orchestrated by experienced manipulators who exploited retail investors’ trust and FOMO.

Conclusion

The $OM token crash highlights the risks in crypto, especially in hyped projects lacking transparency. Despite Mantra’s denials, red flags like concentrated token ownership, a shady team history, and suspicious deals cast doubt. This saga stresses the need for investor diligence in a hype-driven market and calls for better regulation and safeguards as the industry matures.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  Monero

Monero  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Zcash

Zcash  Sui

Sui  Canton

Canton  Avalanche

Avalanche  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Dai

Dai  sUSDS

sUSDS  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Cronos

Cronos  Polkadot

Polkadot  USD1

USD1  Uniswap

Uniswap  Rain

Rain  Mantle

Mantle  MemeCore

MemeCore  Bitget Token

Bitget Token  Tether Gold

Tether Gold