Nothing excites the market more than a project getting listed on Binance. It’s not just a stamp of product validation. It’s a liquidity catalyst that often propels a project into its next phase of growth. This article explores the potential Binance listings of five projects currently gaining strong attention in the Web3 space: DeepBook, Hyperlane, Gomble, MegaETH, and Aster (Astherus).

Recently, Binance’s rollout of the “Vote to Delist” program has further signaled a strategic shift: clearing out underperforming or fragmented tokens to make room for newer, high-potential projects, many of which are backed by Binance-affiliated entities like YZI Labs. This move not only streamlines liquidity across the platform but also paves the way for upcoming listings to launch with higher fully diluted valuations (FDVs).

Each project will be assessed based on four key pillars – ecosystem role, product maturity, tokenomics, and ties to Binance—to provide a comprehensive outlook on their listing potential.

MegaETH

MegaETH is an emerging Layer 2 solution optimized for ultra-fast transaction speeds, inspired by high-frequency trading (HFT) systems in traditional finance. With sub-10ms processing times, extremely low latency, and the ability to handle up to 100,000 transactions per second, MegaETH aims to become the go-to infrastructure layer for high-performance DeFi applications.

As of early 2025, the project has raised a total of $57 million, including a $20 million Series A led by Paradigm in June 2024 and a $10 million strategic round in December 2024.

First, Paradigm, one of Binance’s closest venture capital allies, backs MegaETH, a factor that carries considerable weight. Historically, projects like dYdX, Blur, and Blast — all backed by Paradigm, were listed on Binance shortly after their token launches.

Additionally, MegaETH raised funds via Echo, similar to how Usual and Initia did. Notably, both Usual and Initia secured Binance listings shortly after completing their Echo-based fundraising rounds. This strengthens the case that Binance is currently monitoring community-driven projects, especially those supported through the Echo launch framework.

Read more: MegaETH Airdrop Guide: Earn the Exclusive Airdrop Distribution

MegaETH was raised on Echo – Source: Echo

Deepbook (DEEP)

DeepBook is a decentralized on-chain orderbook built directly into the infrastructure of the Sui Network. Unlike traditional standalone DEXs, DeepBook functions as a shared liquidity layer for the entire DeFi ecosystem on Sui.

Several major exchanges – including Gate.io, Bybit, KuCoin, Bithumb, and MEXC—already list DEEP.

DeepBook serves as a core infrastructure component for Sui — much like Raydium and Serum did for Solana or dYdX for Cosmos. Binance has historically prioritized tokens that serve as “core liquidity infra.” Since DEEP anchors liquidity across most DeFi protocols on Sui, it is a natural candidate for Binance’s radar.

Second, usage metrics are highly positive. According to data from the Sui Foundation, over 85% of orderbook trading volume on Sui flows through DeepBook — particularly via DEXs like Cetus and Turbos. By integrating natively into the Sui consensus, DeepBook offers ultra-fast matching speeds without relying on standalone smart contracts like most other DEXs. This gives it a technical edge in scalability and security — two key listing factors for Binance.

DEEP also fits into Binance’s broader strategy to expand liquidity and list key Sui ecosystem tokens. Binance has already listed SUI, followed by CETUS. By ecosystem logic, DEEP is the most likely next candidate.

Moreover, DEEP’s token distribution is strongly community-driven, with the majority allocated to users and builders through airdrops, incentives, and liquidity mining – aligning closely with Binance’s preference for decentralized distribution models.

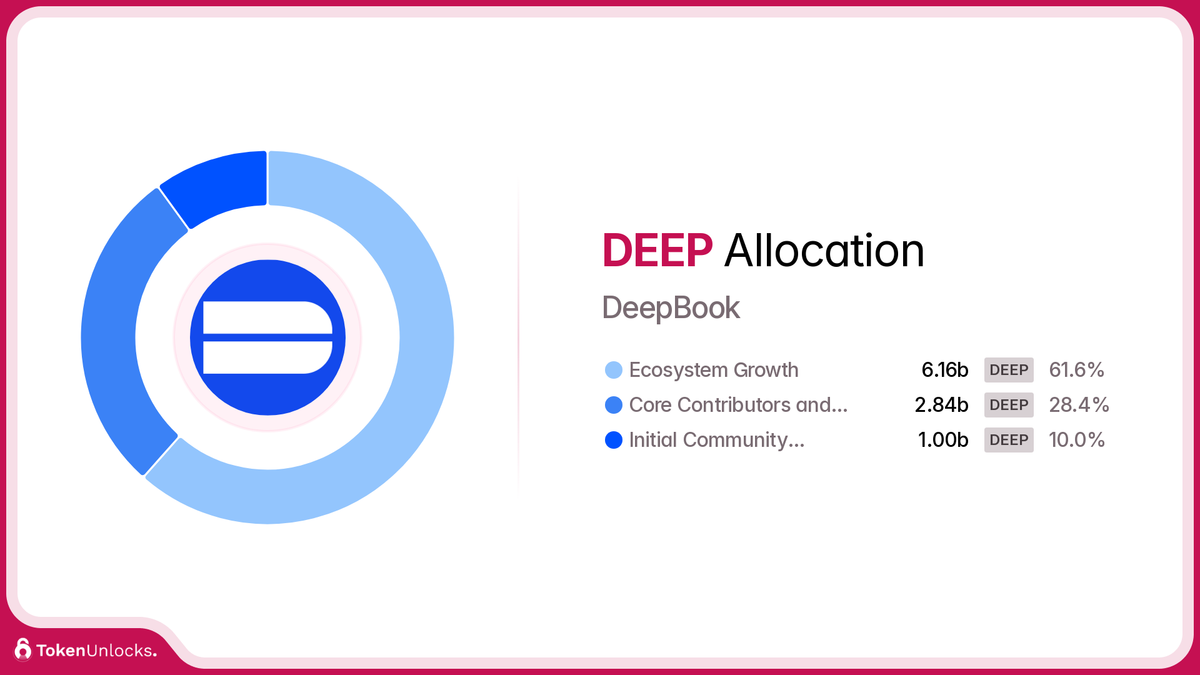

Token allocation breakdown:

- 61.57% to the community

- 10.93% to investors

- 10% to Mysten Labs

- 7.5% to early contributors

- 10% for the initial airdrop

DEEP Allocation – Source: TokenUnlocks

Hyperlane (HYPER)

Hyperlane (HYPER) is a cross-chain messaging protocol that enables blockchains to send and receive data securely and flexibly, similar to LayerZero.

The project plays a strategic role in the emerging modular blockchain wave, alongside projects like Celestia, Movement Labs, Eclipse, and Berachain. Binance has shown increasing interest in this trend, especially after listing modular-focused tokens like ZRO. If ZRO helps bridge capital across EVM chains, then HYPER could serve as the messaging backbone for modular and app-specific chains – a direction Binance is also pursuing through the modularization of BNB Smart Chain.

Like DEEP, HYPER features a decentralized token distribution, with 57% allocated to the community via incentives, grants, staking, and liquidity mining. Private allocations are subject to long-term lockups, aligning with Binance’s preference for decentralization.

Another notable advantage is HYPER’s investor profile, which includes funds with strong historical ties to Binance listings. Firms like CoinFund, Variant, and Galaxy Digital have previously backed projects that later launched on Binance. With a funding round totaling over $18 million, HYPER stands out as a strong listing candidate.

According to ICO Drops, CoinFund has backed 93 projects, with roughly 28.57% of them making it onto Binance – a relatively high success rate.

Read more: Check Your Hyperlane Airdrop: HYPER Claimer has Opened

Gomble (GM)

Gomble (GM) is one of the few Web3 gaming studios that prioritize “fun-first” gameplay, rather than focusing solely on the “play-to-earn” model. With its flagship title, RumbyStars, and a broader ecosystem of interconnected minigames built around a social graph, the project has attracted over 3.5 million users, including 2.8 million monthly active players—a rare milestone in the Web3 gaming space today.

Gomble secured direct investment from Binance Labs, and Binance Alpha Spotlight recently featured the project — a signal that often suggests a potential Launchpool inclusion or spot listing.

Additionally, Gomble has had early and meaningful integration with the Binance Wallet ecosystem, including community campaigns, staking trials, and official mentions on Binance’s social channels. This aligns with a familiar pattern observed in past Binance listings: media collaboration → user engagement campaign → exchange listing. Notable examples include Renzo and Fusionist.

Lastly, Gomble’s token distribution structure aligns closely with Binance’s emphasis on decentralized tokenomics – a key criterion for many of its recent listings.

Learn more: Binance Alpha Newly Launches DARK and GOMBLE

Gomble on Binance Alpha – Source: Binance

Aster

Aster, formerly known as Astherus, operates as a decentralized perpetuals exchange (perpetual DEX) that aims to rival leading platforms like dYdX, GMX, and Hyperliquid. The project aims to deliver high performance with a CEX-like user experience while also building out a native rewards points system and proprietary stablecoin to support long-term growth.

As of April 2025, Aster has surpassed $258 billion in cumulative trading volume, making it one of the most active perpetual DEXs yet to launch a token.

Aster participated in Binance Labs’ Seed funding round, joining the ranks of projects like Arkham (ARKM) and Ethena (ENA)—both of which later secured listings through Binance Launchpool or direct spot markets. Recently, nearly 50% of Binance Labs’ seed-stage portfolio has made it to Binance, a pattern that underscores the strength of internal support and ecosystem alignment.

You can join Aster airdrop and ave 10% discount at this link here

Beyond funding ties, Aster also has technical integration with Binance infrastructure. Specifically, the project has run staking incentive campaigns via Binance’s Keyless Wallet, showcasing real traction within the Binance ecosystem.

There are so many different versions of BNB rewards. asBNB, slisBNB, clisBNB… combine them? https://t.co/J5MLT44prt

— CZ 🔶 BNB (@cz_binance) April 18, 2025

The perp trading narrative is clearly resurging following the surge of next-gen perpetual DEX tokens like Hyperliquid and Aevo. As Binance looks to diversify liquidity and foster healthy competition with CEX alternatives, Aster stands out as a well-developed candidate for potential Launchpool inclusion or direct listing—much like Ethena (ENA) before it.

Conclusion

In the fierce competition for a Binance listing, few projects truly stand out, but these five bring unique strengths that give them a clear edge.

Each project aligns closely with Binance’s known listing patterns: strong narrative fit, active user base, strategic investor alignment, and—perhaps most importantly—credible involvement with Binance’s own infrastructure or venture arms. While nothing is ever guaranteed in crypto, Binance may soon turn its attention to these five promising projects.

Read more: Top 5 Best Airdrop Farming Projects on Solana (Part 1)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Avalanche

Avalanche  Sui

Sui  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  Dai

Dai  USDT0

USDT0  Canton

Canton  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  PayPal USD

PayPal USD  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  USD1

USD1  Polkadot

Polkadot  Rain

Rain  MemeCore

MemeCore  Bitget Token

Bitget Token