On May 9, 2025, the crypto market saw a strong rally, with Bitcoin (BTC) breaking above $103,000 for the first time since January. Ethereum (ETH) and many altcoins also posted significant gains, pushing the total global crypto market capitalization above $3.22 trillion.

The Fear & Greed Index jumped from 48 (neutral) to 63 (greed) in just three days. According to Santiment, the number of retail wallets buying BTC and ETH has increased sharply since the beginning of the week.

So, what’s driving this impressive recovery?

Rise in Rate Cuts Sentiment

U.S. jobless claims data released on May 8 showed a slight decline to 228,000 filings, down from 241,000 the previous week. The earlier spike was largely attributed to seasonal factors in New York State and not indicative of a broader trend in layoffs.

Learn more: Bitcoin Price Surpasses $100k amid Trade Optimism

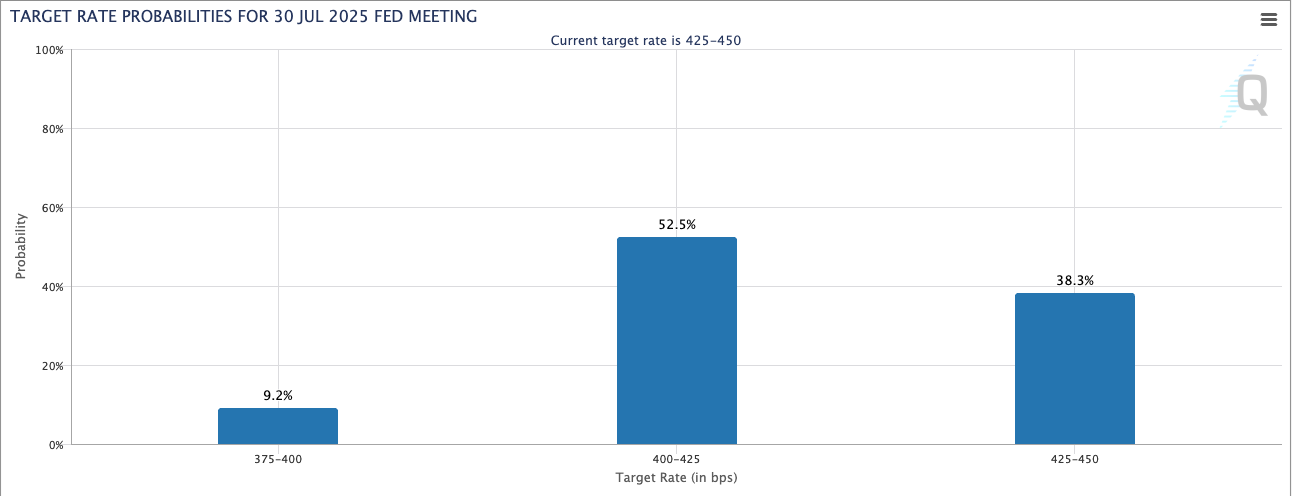

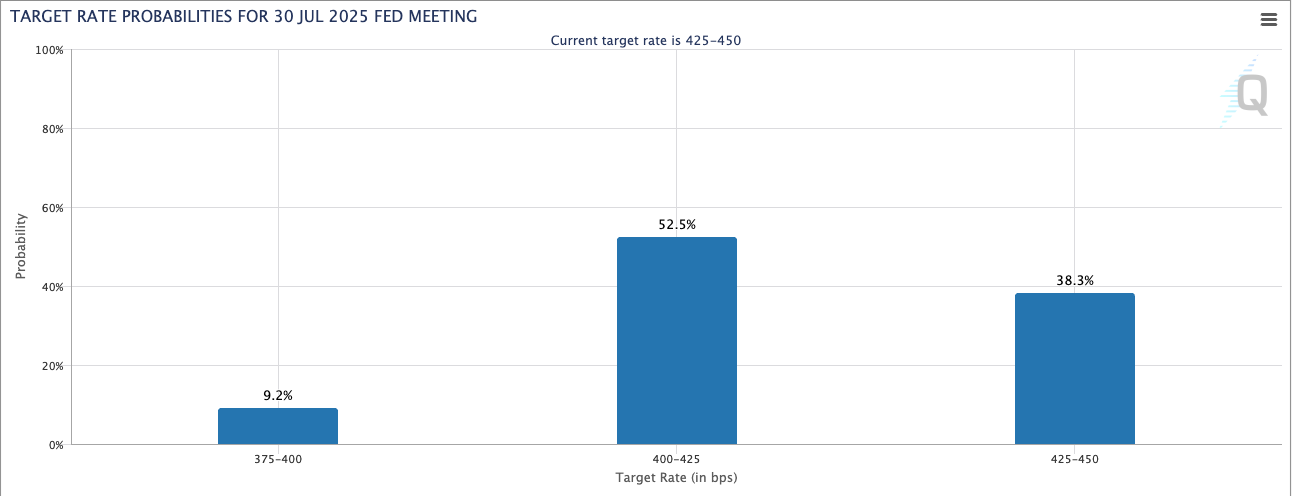

Still, investors remain concerned about the health of the U.S. economy, interpreting the Fed’s decision to keep rates steady at 4.25%–4.50% as a sign that recession risks are being weighed. As a result, expectations of rate cuts in Q3 2025 continue to support risk assets, including cryptocurrencies.

Source: CME Groups

The 10-year U.S. Treasury yield fell to 4.38%, while the DXY index (which measures the strength of the U.S. dollar) dropped to a three-week low, signaling a shift in capital toward speculative assets.

Another key factor is growing concern over stagflation – a scenario in which economic growth slows while inflation remains high, prompting investors to seek store-of-value assets like Bitcoin.

With the Fed holding rates steady and offering no clear guidance on cuts in June, markets are increasingly pricing in a more dovish monetary stance in the quarters ahead.

In this environment, Bitcoin, often referred to as “digital gold,” has emerged as a compelling hedge, particularly as the dollar weakens and macro uncertainty rises.

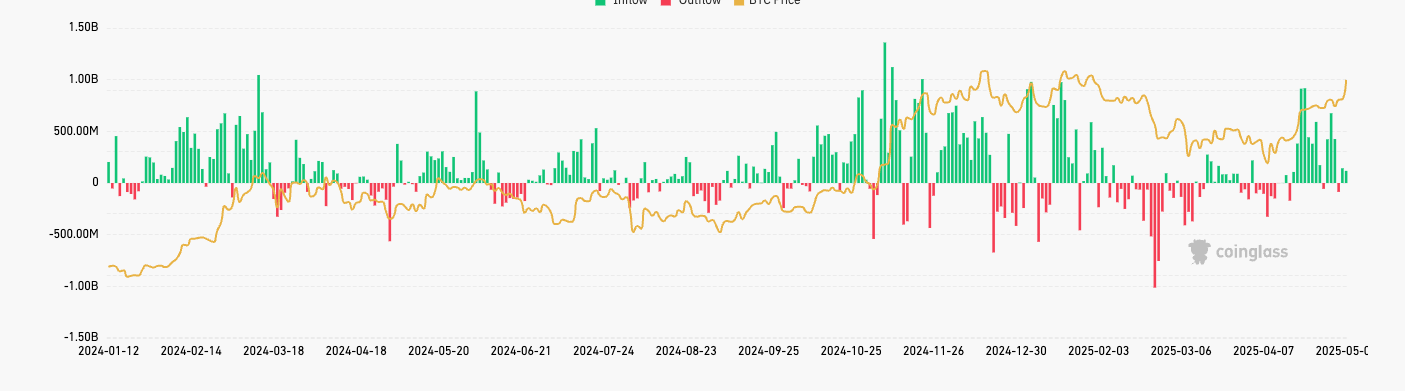

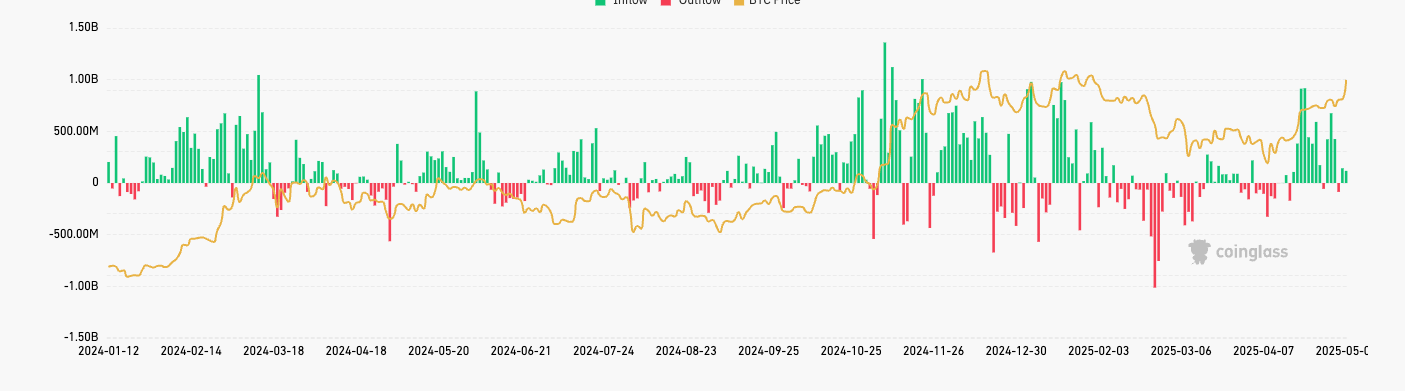

Strong Inflows into Bitcoin ETFs: A Key Catalyst Behind the Market Rally

In the first week of May 2025, U.S.-listed Bitcoin ETFs witnessed robust inflows, highlighting growing institutional interest in digital assets.

On May 8, 2025, alone, total inflows into Bitcoin ETFs reached $117.4 million, with:

- BlackRock’s iShares Bitcoin Trust (IBIT) leading the pack at $69 million,

- Followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC) with $35.3 million,

- And the ARK 21Shares Bitcoin ETF (ARKB) at $13.1 million.

Over the past three weeks, Bitcoin ETFs have attracted more than $5.3 billion in cumulative inflows, underscoring a surge in demand from traditional investors.

Notably, since the start of 2025, IBIT has surpassed the SPDR Gold Shares (GLD) in net inflows, with over $6.96 billion, signaling a shift from gold to Bitcoin as a preferred store of value asset.

Source: CoinGlass

Ethereum Boosted by ETF Hopes and the Pectra Upgrade

Ethereum has rallied nearly 20% over the past 7 days, driven primarily by two key catalysts. The successful rollout of the Pectra upgrade on May 7, which improves network performance and streamlines staking, and speculation that the SEC may approve one or more spot Ethereum ETFs ahead of the May 23 deadline.

The Pectra upgrade not only enhances transaction experience and scalability but also revises staking parameters, making it easier for retail investors to participate in ETH staking – a factor that could drive long-term holding demand.

Learn more: ETH Price Prediction after Pectra Upgrade in May

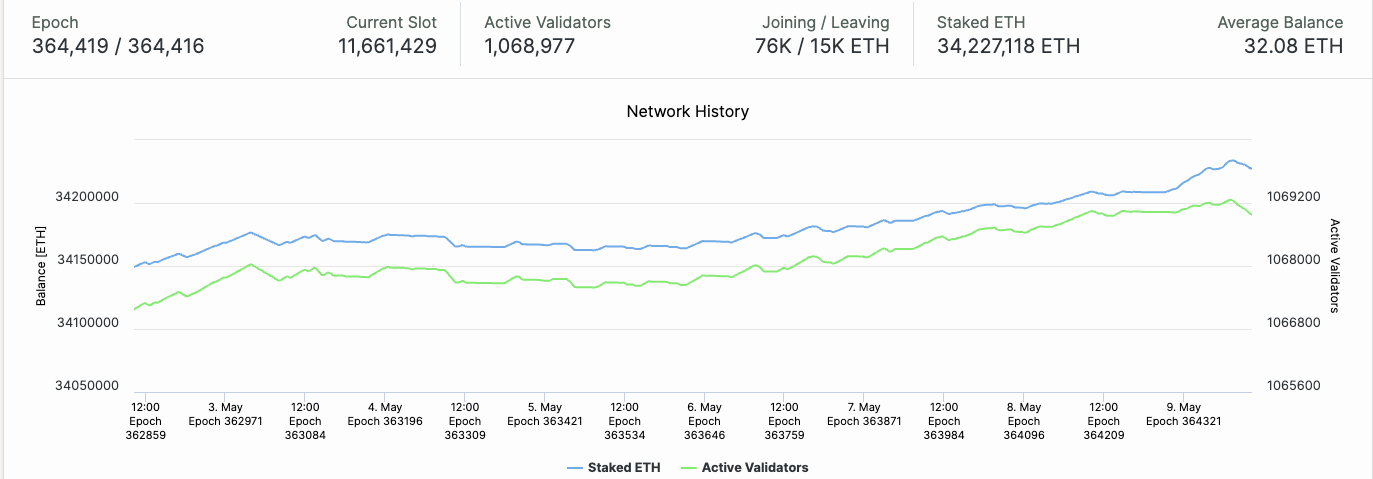

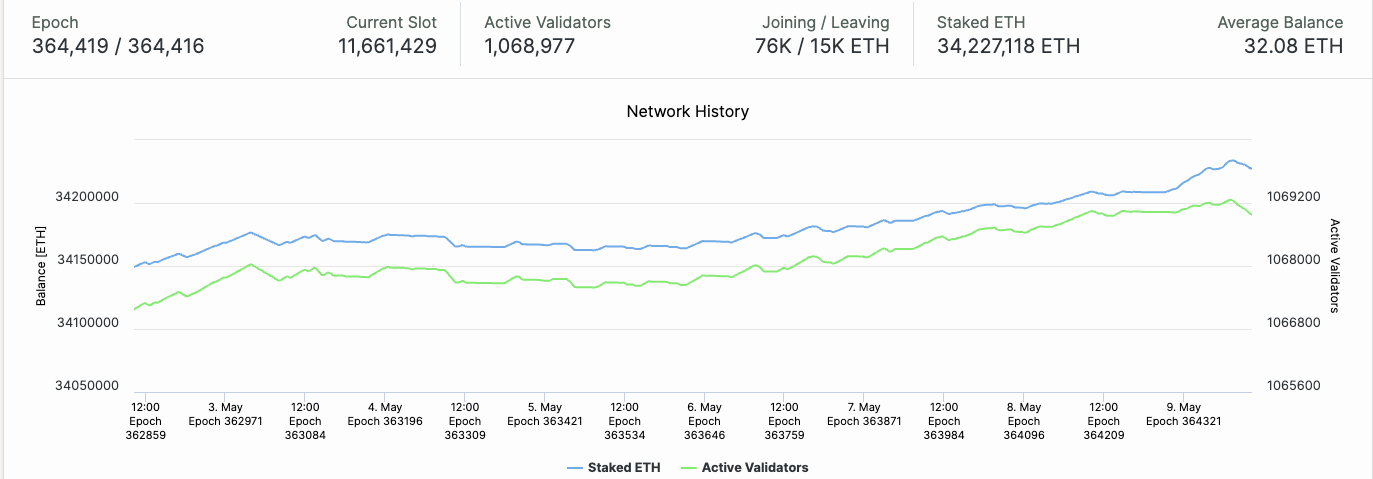

According to BeaconScan, over 400,000 ETH have been added to staking in the three days following the upgrade, marking the largest spike since January 2024.

Number of Ethereum validator after Pectra – Source: Beaconcha

Additionally, Bloomberg reports that the SEC held several closed-door meetings with ETF issuers last week, sparking speculation of a potentially favorable surprise decision – much like the approval of spot Bitcoin ETFs earlier this year.

U.S.–U.K. Trade Deal Hopes Boost Risk Sentiment

Amid ongoing global geopolitical uncertainty, a new statement from U.S. President Donald Trump has helped lift market sentiment. Trump announced that the U.S. is preparing to unveil a major trade deal with a “very respected” country, widely interpreted by analysts to mean the United Kingdom.

Markets quickly took this as a signal that the U.S. may be softening its trade stance, potentially easing tensions with key partners after a prolonged period of tariffs and protectionist policies.

🇺🇸 JUST IN: President Trump announces a “major trade deal” news conference scheduled for tomorrow at 10:00 AM in the Oval Office with “a big, and highly respected country.” pic.twitter.com/irsood0JRZ

— Cointelegraph (@Cointelegraph) May 8, 2025

The positive mood spilled over into risk assets such as equities and cryptocurrencies. The U.S. dollar weakened, while stocks and Bitcoin surged, reflecting a return of speculative capital amid growing optimism for a more stable global trade environment.

Technical Analysis Confirms Bullish Momentum

The total crypto market capitalization (TOTAL) has rebounded strongly from the $2.4 trillion support zone and is now holding steady above $3.2 trillion. This recovery coincides with the RSI breaking out of oversold territory and approaching 70, indicating strong bullish momentum.

Moreover, the move above the 200-day moving average further confirms that a short-term uptrend has been firmly established.

This rally is not isolated to crypto alone – traditional financial markets are also trending higher:

- The Nasdaq index rose 1.8%

- Gold prices surpassed $2,380/oz

These moves reflect a growing appetite for both safe-haven and speculative assets. In this context, crypto appears to be benefiting from broader global market dynamics, rather than rallying in isolation.

Source: TradingView

Conclusion

The strong rally on May 9 was the result of multiple converging factors: expectations of a Fed rate cut, continued institutional inflows into Bitcoin ETFs, the successful Ethereum upgrade, and a rapid improvement in investor sentiment.

However, for the rally to become sustainable, the market still needs further confirmation. Two upcoming events will be critical:

- The Fed’s monetary policy decision in June

- And the SEC’s ruling on spot Ethereum ETFs, expected by late May

These will serve as key turning points that could shape the crypto market’s short-term trajectory.

Read more: Will Bitcoin Price Reaching $100k Trigger Another Sell-Off?

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  Monero

Monero  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  LEO Token

LEO Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  WETH

WETH  Ethena USDe

Ethena USDe  Zcash

Zcash  Sui

Sui  Canton

Canton  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Litecoin

Litecoin  World Liberty Financial

World Liberty Financial  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  USD1

USD1  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  PayPal USD

PayPal USD  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore  Tether Gold

Tether Gold