Bitcoin Exchange Traded Funds (ETFs) have achieved a historic milestone, amassing over $41 billion in cumulative inflows as of May 14, 2025. This record-breaking achievement marks a significant turnaround for the funds, which faced outflows earlier amid global economic uncertainties, signaling robust investor confidence and growing mainstream adoption of Bitcoin.

After yesterdays inflows, the spot Bitcoin ETFs are now at a new high water market for lifetime flows. Currently at $40.33 billion according to Bloomberg data h/t @EricBalchunas pic.twitter.com/0GKPNlmprs

— James Seyffart (@JSeyff) May 9, 2025

A Historic Milestone for Bitcoin ETFs

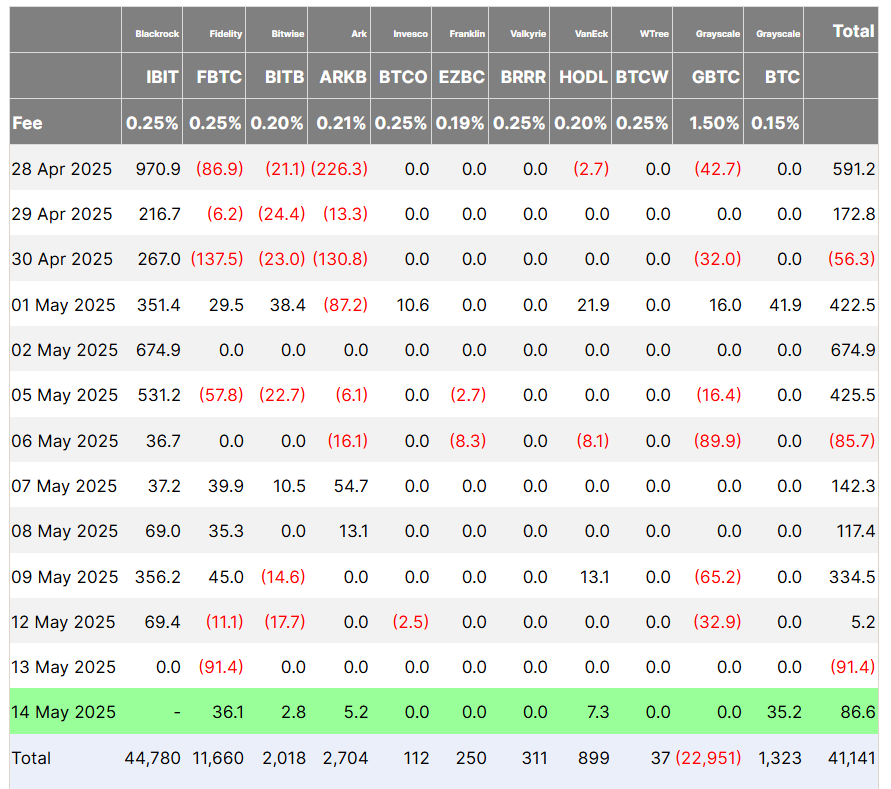

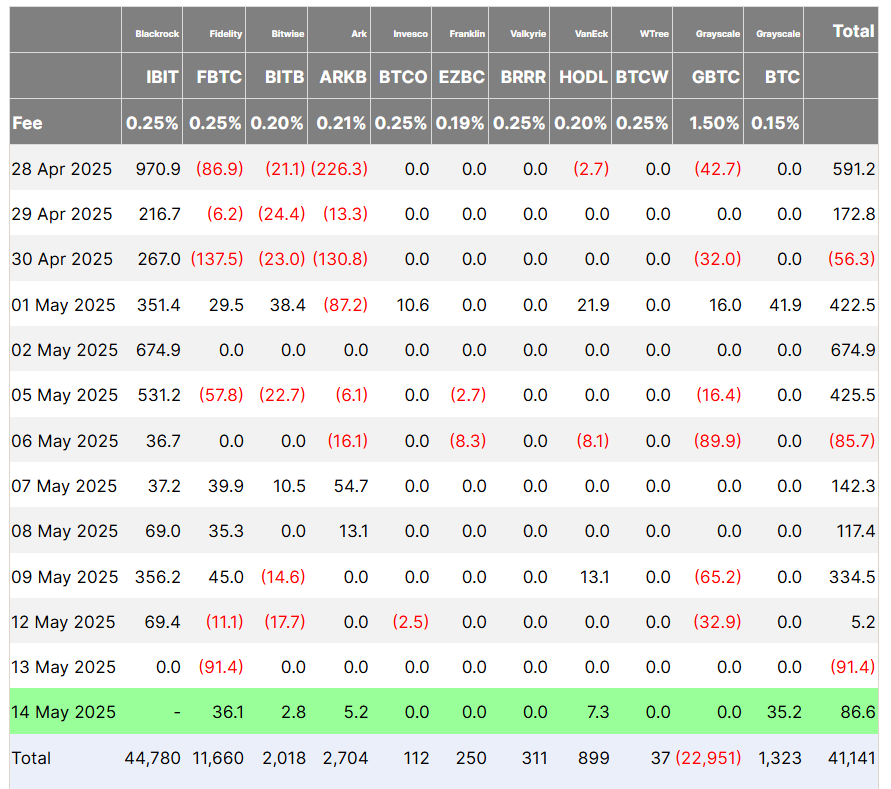

Bitcoin ETFs in the United States have reached an unprecedented peak, with cumulative inflows surpassing $41.1 billion as of May 14, 2025, according to data from Farside Investors.

Source: Farside Investors

This all-time high comes just over a year after the Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs in January 2024, following a decade of rejections and a successful lawsuit by ETF issuer Grayscale. The launch of these funds marked a pivotal moment for cryptocurrency, offering investors a regulated and accessible way to gain exposure to Bitcoin BTC without directly owning the asset.

The journey to this milestone has been remarkable. Initially met with skepticism by traditional finance, Bitcoin ETFs have defied expectations, with major asset management firms like BlackRock leading the charge. BlackRock’s Bitcoin ETF, for instance, became the fastest-growing ETF in U.S. history, a testament to the growing appetite for crypto-based financial products.

Read more: BlackRock Proposes Ethereum ETF Staking, Boosting ETH Price

The $41.1 billion in net inflows reflects a significant reversal of fortunes, as these funds had previously experienced rapid outflows amid an erratic global trade war and economic uncertainty. The ability to hit a new high-water mark so soon after such challenges underscores the resilience of Bitcoin as an asset class and the increasing trust investors place in regulated crypto products.

Bitcoin ETFs are the gateway to entering the crypto sphere

This surge in inflows also aligns with broader market trends. As of Q4 2024, institutional investors with over $100m under management hold $27.4 billion worth of Bitcoin ETFs, according to CoinShares.

Asset management giants like Millennium Management and Jane Street account for 20% of total Bitcoin ETF assets, further highlighting the institutional embrace of cryptocurrency. The record inflows signal that Bitcoin ETFs have become a cornerstone of crypto investment, bridging the gap between traditional finance and the digital asset space.

The success of ETF Bitcoin spot also underscores the increasing mainstream adoption of cryptocurrency. Since their launch, these funds have smashed expectations, offering exposure to Bitcoin’s price movements through both spot and futures-based products.

As Bitcoin ETFs continue to attract capital, they are likely to play a pivotal role in shaping the future of cryptocurrency investment, driving further integration into traditional financial systems.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  Canton

Canton  Uniswap

Uniswap  PayPal USD

PayPal USD  Mantle

Mantle  Cronos

Cronos  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Aave

Aave  Rain

Rain  Bitget Token

Bitget Token