Financing a new business used to mean pitching venture-capital firms or navigating a lengthy initial public offering that already required a certain level of establishment and success. Blockchain projects completely changed that, flipping the script in 2013 when the first initial coin offering let a new project generate capital raised directly from selling newly minted tokens.

Since then, ICOs have supported billion-dollar ventures alongside monumental flops, all on the main stage of crypto finance. They’ve helped raise money for everything from metaverse games to decentralized platforms like exchanges, while offering early contributors a stake in either future utility or governance.

If you’re curious about joining an ICO or launching your own, it’s crucial to understand how these token sales work, the risks they carry, and how they stack up against traditional fundraising. In this straightforward but detailed guide, we’ll take the mystery out of ICOs, look at previous ICO campaign events, and look at a checklist for evaluating opportunities on their own merits.

What Is an Initial Coin Offering (ICO)?

An initial coin offering, or ICO, is a method of crowdfunding a blockchain project. An ICO helps raise capital by selling tokens instead of issuing equity like a conventional startup. The dev team mints a set supply of crypto assets, typically from the utility or governance allotment, on a smart-contract platform such as Ethereum, BNB Chain, or Solana.

Early buyers can exchange established cryptocurrencies like ETH, BNB, and USDC for the new asset at a special new token price. These purchases fund development while acquiring an asset that may appreciate if the project ends up succeeding.

ICOs will usually happen before the project is fully built, so contributors can bet on future points of utility, like access to decentralized storage, discounted trading fees, governance votes, staking rewards, and more. This fundraising model has more or less become the standard since projects like Filecoin and Bancor raised millions in the blink of an eye.

Although regulatory scrutiny has since tightened, especially in the United States, where many tokens risk classification as unregistered securities, ICOs remain popular in jurisdictions that embrace innovation.

The key features of ICOs include increasing the total global reach of the project (since essentially anyone with internet access can participate), rapid settlement via existing smart contract networks, and funding transparency searchable on public blockchains.

That said, with minimal gatekeeping comes the increased risk of scams, overpromised roadmaps, and poorly audited code. Successful ICOs balance bold vision with verifiable progress, detailed tokenomics, and clear legal disclosures.

How Does an ICO Work?

In the simplest sense, an ICO follows a very simple sequence of events. First, the team publishes their white paper, deploys a smart-contract sale contract, and collects crypto in exchange for newly minted tokens.

Behind that quick process rundown, however, is a complex array of moving parts like legal vetting, ongoing marketing campaigns, community discussions and engagement, and large-scale liquidity planning. These are generally the components that will ultimately determine the fate of the project.

White Paper Release

The white paper is the beating heart of any ICO and serves multiple audiences at once: prospective investors, regulators, auditors, and future community members. An ideal document begins with an executive summary that explains the real-world problem and why blockchain is the optimal solution, written in language clear enough for non-technical readers. It then dives into a technical architecture section, laying out consensus mechanisms, data structures, and interoperability layers. Diagrams, sequence charts, and gas-usage benchmarks help developers verify feasibility.

Next comes tokenomics. Here, the dev team must specify total supply, initial circulating supply, vesting cliffs, inflation schedules, and burn mechanics. Transparent formulas show that the team has stress-tested incentives against edge cases like whale dominance or governance gridlock. Projects also outline fund allocation: what percentage of raised capital goes to R&D, marketing, audits, liquidity, or legal reserves, often accompanied by Gantt-style timelines and quarterly milestones.

A credible white paper includes a risk disclosure section, candidly addressing smart-contract exploits, regulatory shifts, and market volatility. Teams bolster trust by publishing code repositories and commissioning third-party security audits, linking hash-verified PDF reports directly in the document. Legal analysis is increasingly standard; reputable projects append memoranda explaining why the token is a utility token under Swiss FINMA or Singapore MAS guidelines, or how U.S. purchasers are geo-fenced to avoid securities violations.

Lastly, leading white papers will lay out a go-to-market strategy that details partnership pipelines, exchange listing plans, and community incentive programs. Clear KPIs like monthly active wallets or TVL targets help investors more easily track execution, post-ICO.

What it really comes down to is that a white paper isn’t just a marketing or publicity asset. A thorough white paper is a technical blueprint, financial prospectus, and legal affidavit rolled into one, providing the transparency necessary for informed participation.

ICOs vs. Traditional Fundraising Methods

Traditional fundraising routes, like angel rounds, venture capital, and IPOs, all require extensive due diligence, board approvals, and often months of negotiation. They also impose geographic and accreditation barriers, restricting access to institutional money and accredited investors.

ICOs flip that script by automating issuance and settlement through smart contracts, enabling projects to raise millions in days from a global contributor base. Fees are lower, and founders retain more equity because they issue tokens rather than shares.

On the flip side, ICO investors receive no ownership stake and limited legal protections, so if the project fails or founders disappear, recourse is minimal. Regulatory certainty is stronger for IPOs, where underwriters and the SEC enforce disclosure standards, while ICOs operate in a patchwork of global jurisdictions, increasing legal risk for both issuers and participants.

Who Can Launch an ICO?

Theoretically, any individual, startup, or DAO with a compelling or interesting enough idea and the technical expertise for execution can launch an ICO. Practically, the team needs smart-contract developers to write the token contract, legal counsel to navigate securities laws, marketing specialists to cultivate the community, and auditors to vet code.

This means paying attention to jurisdiction, since it matters the most for getting a token off the ground with an ICO. Switzerland, Singapore, and the Cayman Islands offer clearer token guidelines, whereas the United States and China impose stricter rules.

An ICO launch also requires a solid treasury capacity for treasury management. There needs to be multisig wallet setup, creation of vesting contracts, and deciding on liquidity strategies for post-sale trading.

How to Launch an ICO: Step-by-Step

If you’ve been itching to start a new cryptocurrency project, launching a public or private ICO is going to require a few steps. Let’s take a look at what you’ll need to think about and accomplish in order to launch an ICO.

- First is the concept validation. You need to start with a clear value proposition, where you can identify a genuine market gap and determine why a token is foundational to your solution. Do a competitor analysis, build out a rough prototype, and get feedback from experts in the space to be sure there’s enough demand for the solution before committing to legal and marketing spend.

- Now comes the jurisdictional decision and legal structuring. Engage experienced counsel to map regulatory risk. Choose a crypto-friendly headquarters where you can incorporate an entity to handle the token issuance. Draft your legal opinions surrounding token utility, KYC/AML policies, and any investor accreditation requirements.

- Here’s where you really get into the guts of how things are going to work. For your tokenomics, you need to design supply, distribution, and incentive mechanics that align long-term user growth with your overall treasury sustainability. Write and intensely test ERC-20 or other chain-specific contracts, and use them to integrate time-locked vesting, multisig admin controls, and upgradeability safeguards. Be sure you commission at least one independent audit and publish those findings to cultivate confidence with investors.

- With all the details mapped out, it’s time to create your white paper and official website. Here’s where you’ll have your roadmaps, team bios, audit links, and legal disclosures all available to the public, and where you’ll declare your official social channels. You should create a content calendar so you can maintain transparent communication.

- Next comes your private and pre-sale rounds. Here, you’re conducting a sale limited to strategic partners, VCs, angel investors, etc., usually with longer vesting to keep skin in the game. Well-structured pre-sales raise crucial capital for marketing, while also showing the demand potential.

- Public sale mechanics are going to matter, so think about whether you’ll be selling with fixed-price, Dutch auction, or dynamic cap. Integrate KYC gates if required, set contribution caps to mitigate whale accumulation, and configure smart-contract limits to pause the sale when hard-cap or time limits are met. Provide real-time dashboards for investors to track funds raised during the ICO.

- Always set aside a portion of funds and tokens for initial DEX liquidity pools or negotiate centralized-exchange listings. Announce listing timelines in advance to prevent misinformation and coordinate with market-making partners to stabilize early trading.

Key Differences Between ICO vs IPO

- Regulation: IPOs undergo a stringent review by bodies like the U.S. Securities and Exchange Commission (SEC), requiring audited financial statements and a detailed prospectus. ICOs survive in a patchwork of global jurisdictions and often rely on legal opinions rather than formal approval, leaving participants with fewer protections.

- Availability: ICOs are generally open worldwide to anyone with internet and crypto funds, while IPO shares are usually offered to accredited or institutional investors during book-building, with retail access only after listing.

- Time & Cost: IPOs can take 6–18 months and millions in underwriting, legal, and road-show expenses. On the other hand, ICOs can fully launch within weeks with lower costs.

- Transparency: ICO teams provide white papers and audits, but rarely face standardized accounting rules, making diligence variable and rather subjective. IPO firms, however, publish extensive audited financials, risk factors, and executive compensation.

Pros and Cons of ICOs

ICOs help to democratize a project’s fundraising by allowing entrepreneurs to tap a global pool of crypto-savvy backers. However, that same openness can end up exposing participants to higher levels of risk. Being clear about expectations on both sides of the fence can help backers decide whether to launch an ICO, and can help investors size their investment and portfolio positions appropriately.

Pros of ICOs

- Global, frictionless capital: Anyone with an internet connection and a crypto wallet can join, expanding the funding base far beyond Silicon Valley or Wall Street.

- Speed to market: Smart-contract sales close in days or weeks, giving teams immediate resources to build without lengthy VC negotiations.

- Early community engagement: Token holders become evangelists, testing products, providing liquidity, and driving network effects from day one.

- Founder equity preservation: Instead of selling company shares, founders issue utility tokens, retaining corporate ownership while still raising substantial capital.

- Programmable incentives: On-chain vesting, staking rewards, and burn mechanics can align long-term user behavior automatically, reducing reliance on legal contracts.

Cons of ICOs

- Regulatory uncertainty: In major markets such as the United States, tokens risk classification as unregistered securities, exposing issuers and buyers to enforcement actions.

- High scam frequency: Minimal gatekeeping attracts fraudulent teams that copy code, spoof audits, and disappear post-raise, leaving investors with worthless tokens.

- Information asymmetry: White papers are not standardized; missing financials and unaudited claims make due diligence difficult for retail participants.

- Extreme volatility: Tokens can list at 10× presale price and crash 90 % within days, driven by thin liquidity and short-term speculation.

- Reputational risk: Failed milestones or hacks quickly erode trust, depressing secondary-market value and hindering future partnerships or regulatory approvals.

Examples of Initial Coin Offerings

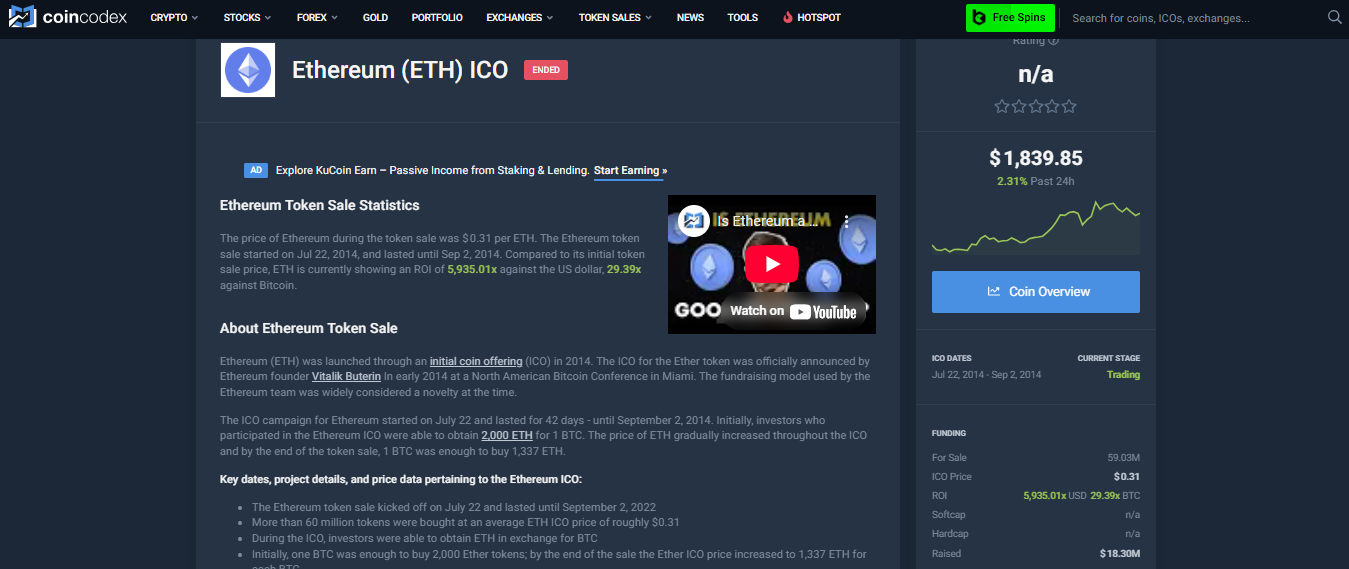

1. Ether (2014)

Source: Coincodex

Raised about $18 million in BTC by selling Ether at roughly $0.31. The ICO funded the launch of a programmable smart-contract platform that now underpins most DeFi and NFT activity. Early participants saw exponential returns when ETH later traded above $4,000.

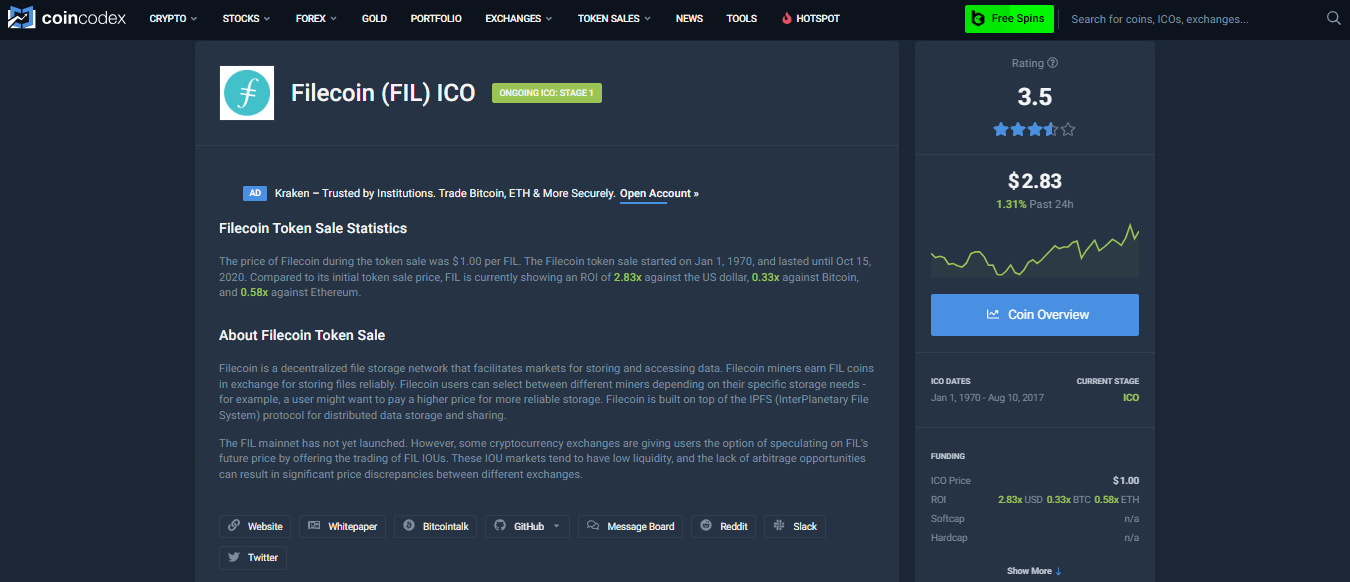

2. Filecoin (2017)

Source: Coincodex

Secured $257 million via SAFT (Simple Agreement for Future Tokens), promising decentralized storage. Despite launch delays, Filecoin shipped mainnet in 2020, and FIL reached a $10 billion market cap peak.

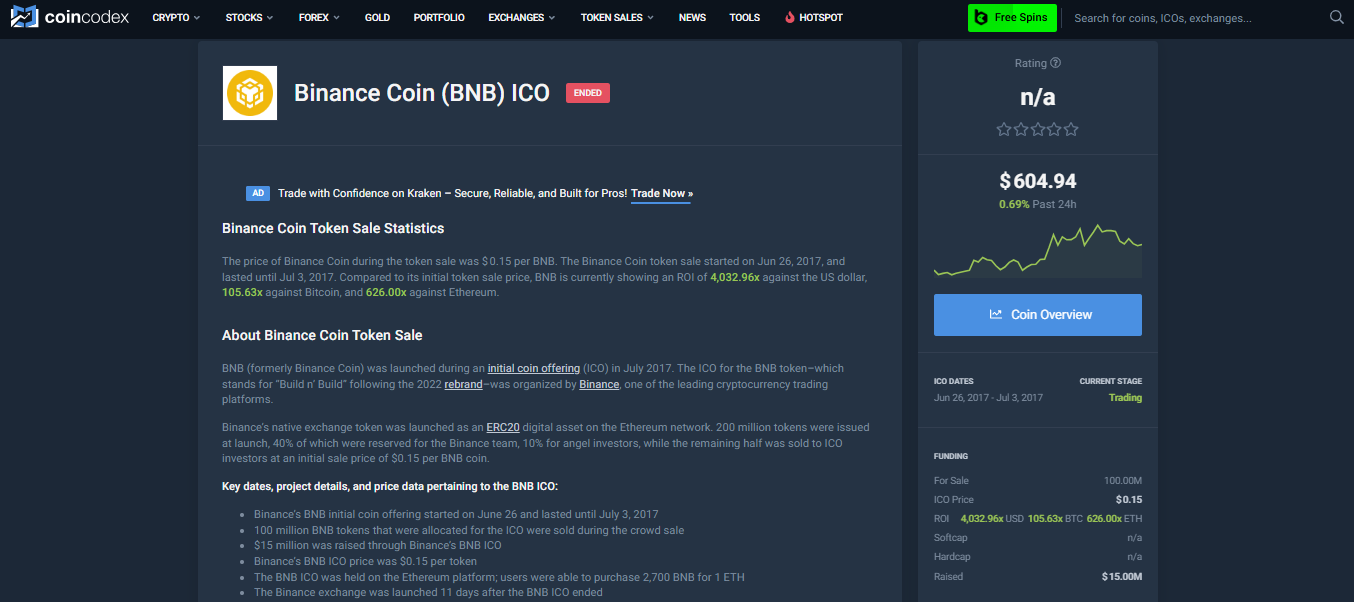

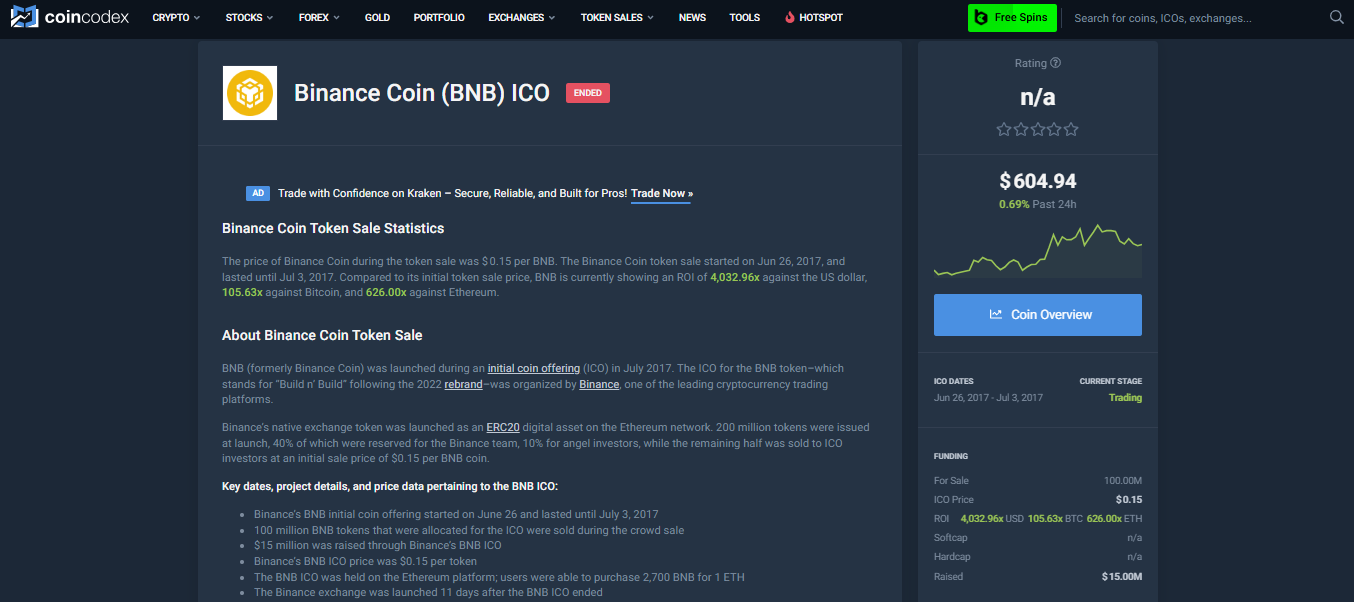

3. Binance Coin (2017)

Source: Coincodex

Binance raised $15 million, using BNB to offer trading-fee discounts and later to pay gas on BNB Smart Chain. BNB became a blue-chip utility token, climbing from $0.11 in the sale to over $600 during the 2021 bull run.

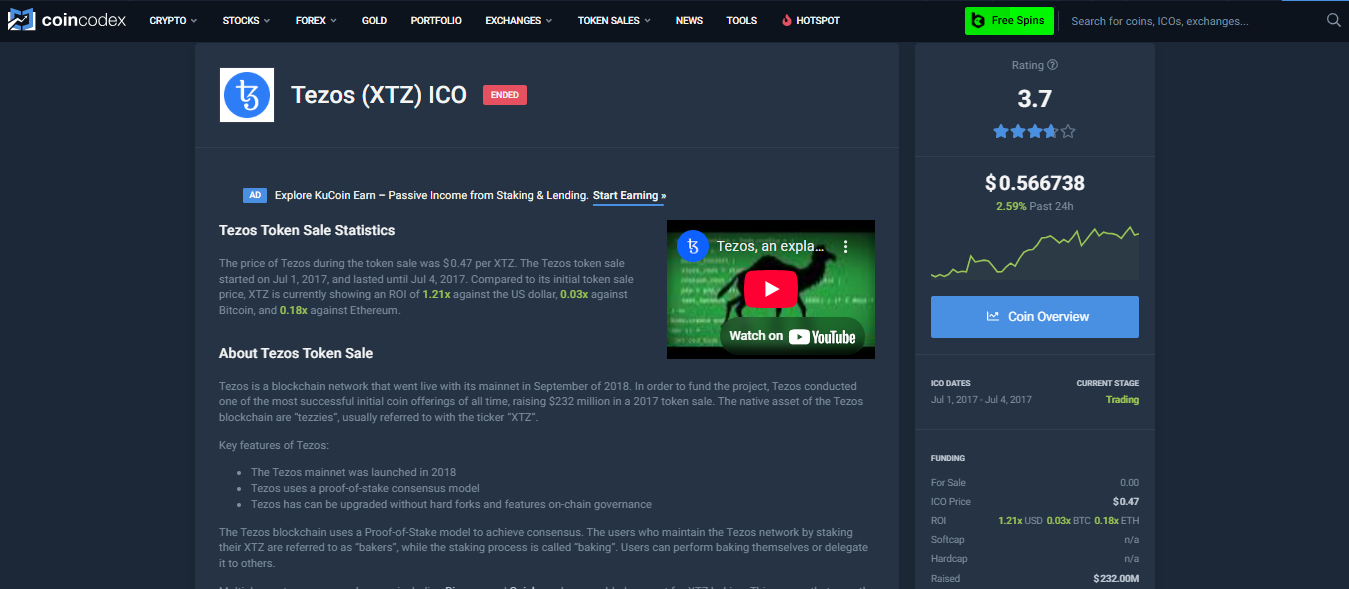

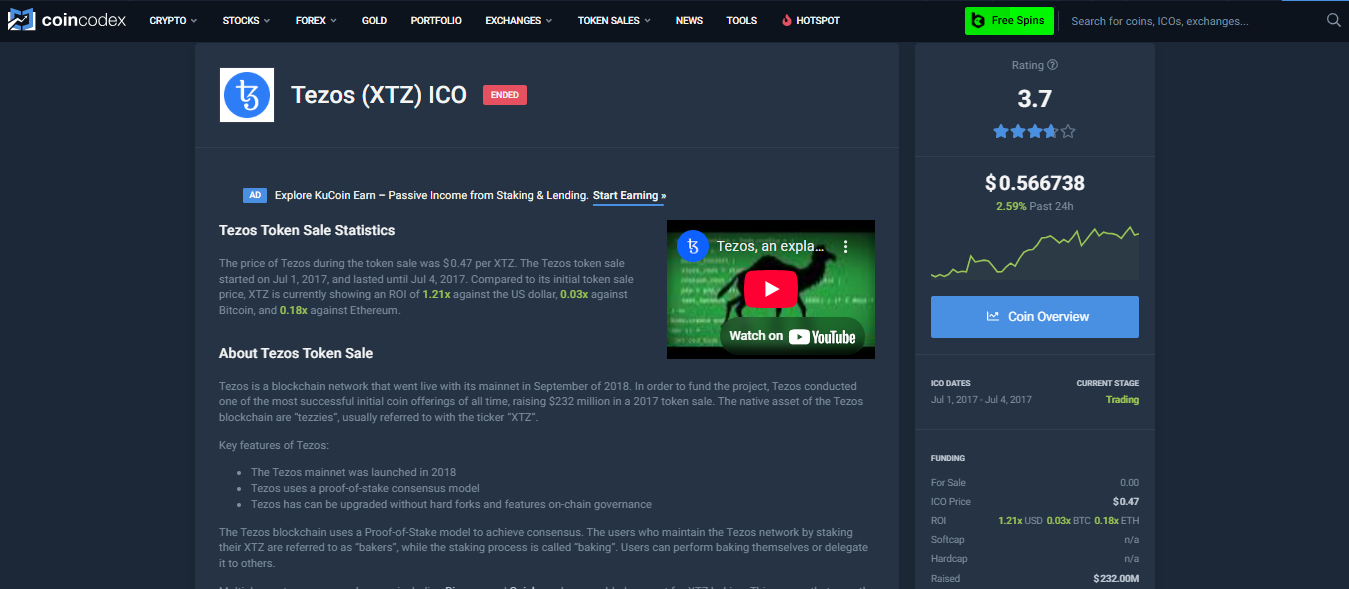

4. Tezos (2017)

Source: Coincodex

Tezos initially collected $232 million, but internal governance disputes delayed the mainnet launch for roughly a year. The result was Tezos DAO ultimately deciding to implement on-chain self-amendment, allowing XTZ to remain an active staking asset. Tezos also acts as an illustration of how larger governance challenges can be solved with transparency and community.

5. EOS (2018)

Source: Coincodex

EOS ran a rolling ICO that raised more than $4 billion. While EOS itself delivered high throughput, long-term adoption failed largely due to criticism over centralized governance and SEC fines.

How to start your own ICO

We’ve shown you step by step what it takes to get an ICO off the ground. It will takes more than a little programming and some ambition.

- You needs a cohesive business plan, solid compliance, and relentless community building. Always start with regulation mapping, and get legal opinions in at least one crypto-friendly country.

- Recruit a multidisciplinary core team that includes smart contract engineers, product managers, marketing teams, and auditors. You’re going to rely on them for accountability and competence. Publish a detailed white paper and open-source repositories so the community can inspect code and milestones in real time.

- Secure early momentum through a strategic seed round: allocate a modest token tranche to credible angels and crypto funds under strict vesting to align incentives. Simultaneously, cultivate community across social channels with dev chats, AMAs, and bounty programs. Always deploy a testnet before mainnet rollout.

- For the public sale, choose a transparent mechanism: fixed-price with per-wallet limits to avoid whale dominance, or a Dutch auction that lets price discover demand organically.

- Pre-plan post-ICO liquidity with seeded DEX pools, tier-one exchange listings, and create a six-month roadmap of shipping goals. Then be sure to meet those goals for sustained success.

FAQs

What is the meaning of ICO?

ICO stands for Initial Coin Offering. Initial coin offerings are crowdfunding campaigns where a blockchain project issues newly minted tokens to raise capital before its product is fully built. Contributors pay in established cryptocurrencies, and in return, they are given governance or utility tokens tied to the project’s future ecosystem.

How Can I invest in an ICO?

First, vet the project’s white paper, audits, and team credentials. Confirm legal eligibility, since many ICOs geo-block U.S. residents. Create a compatible wallet, complete any KYC, and fund it with the accepted currency. On the sale day, connect your wallet to the project’s smart-contract interface or launchpad, specify the contribution amount, and approve the transaction. Always use a fresh browser tab to avoid phishing sites.

Why is ICO not allowed in the US?

The U.S. Securities and Exchange Commission often classifies token sales as unregistered securities offerings under the Howey Test. Issuers would need to register or qualify for an exemption, which is a process that tends to be time-consuming and cost-prohibitive. To limit legal exposure, ICOs will typically exclude US customers and restrict American IPs from accessing the system.

What is an ICO crime?

ICO-related crimes include market manipulation, insider dumping of unlocked tokens, selling tokens that constitute unregistered securities, and fraud. Fraud covers a lot, including raising funds with no intention of building the promised product. Penalties range from investor lawsuits to SEC enforcement actions, criminal wire-fraud charges, asset freezes, and prison sentences for founders.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor