On May 19, 2025, Bitcoin surged to $107,000 before dropping to $103,000 amid $620 million in market liquidations, while crypto whales opened high-leverage positions, signaling strong confidence that Bitcoin will break the ATH despite the volatility.

BTC, ETH, XRP Experience Sharp Volatility, Market Sees $620M in Liquidations

Bitcoin’s climb to $107,000 was propelled by multiple catalysts. Optimism around U.S.-China trade deal prospects and former President Trump’s pro-crypto stance, including a potential Bitcoin reserve. The Relative Strength Index (RSI) for BTC hit 73.51, signaling overbought conditions but strong bullish momentum.

However, the rally stalled as macroeconomic concerns emerged. Moody’s downgrade of the U.S. credit rating to Aa1, citing a $36 trillion national debt, triggered risk-off sentiment across markets.

Profit-taking ensued, right after Bitcoin BTC skyrocketed to $107k, the price dipped to $103k, finding support between $102k and $104k.

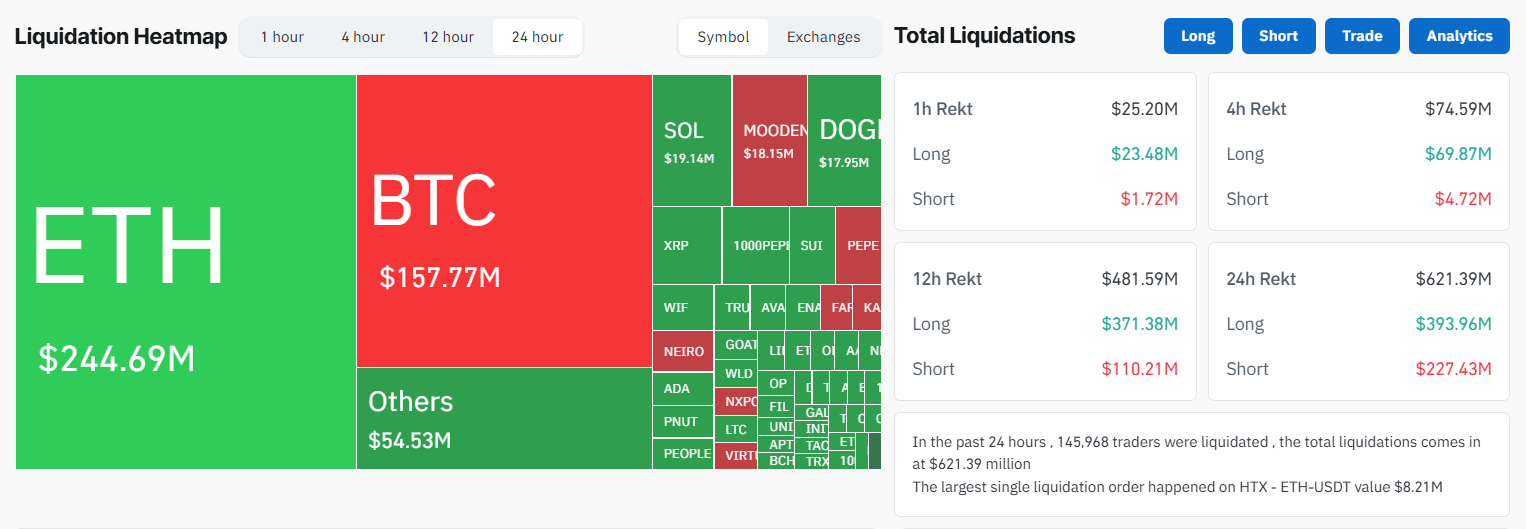

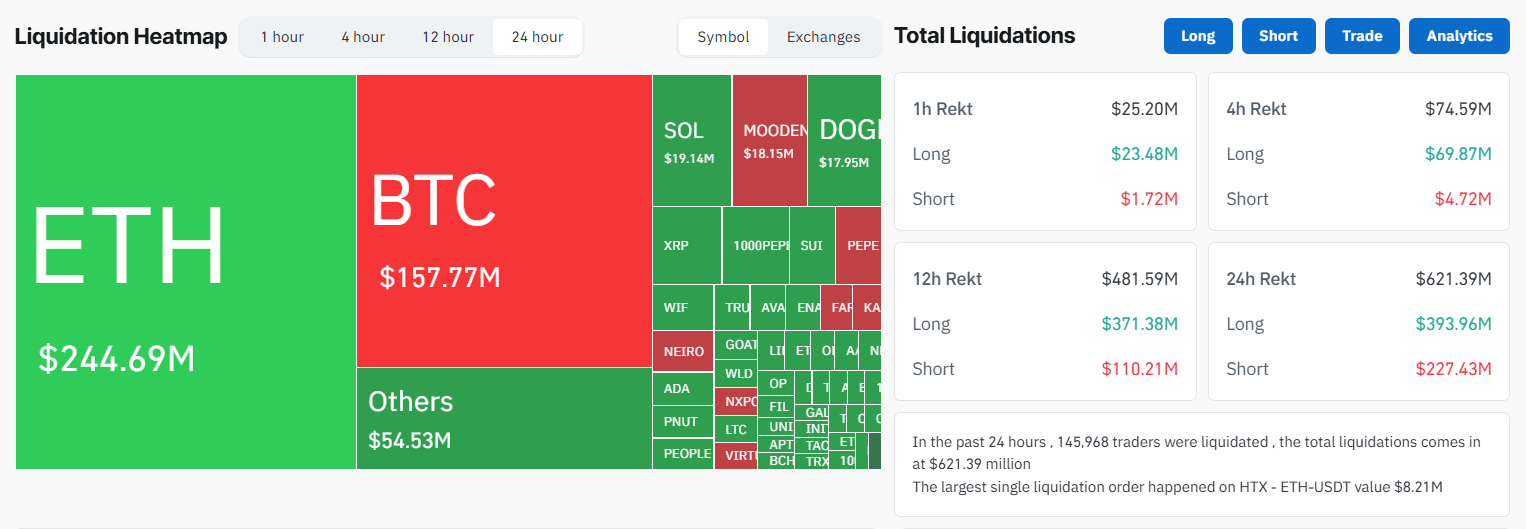

Liquidation data from CoinGlass revealed a total of $620M in liquidations, with long positions hit hardest at $390M across the market. This pullback, described as a “correction within a broader uptrend” by analysts, reflects the market’s sensitivity to global economic signals.

Source: CoinGlass

Altcoins followed Bitcoin’s lead, showcasing high volatility. Ethereum ETH surged toward $2,600 before sliding to $2,390, down 4% in 24 hours, driven by whale accumulation but tempered by $245M in liquidations.

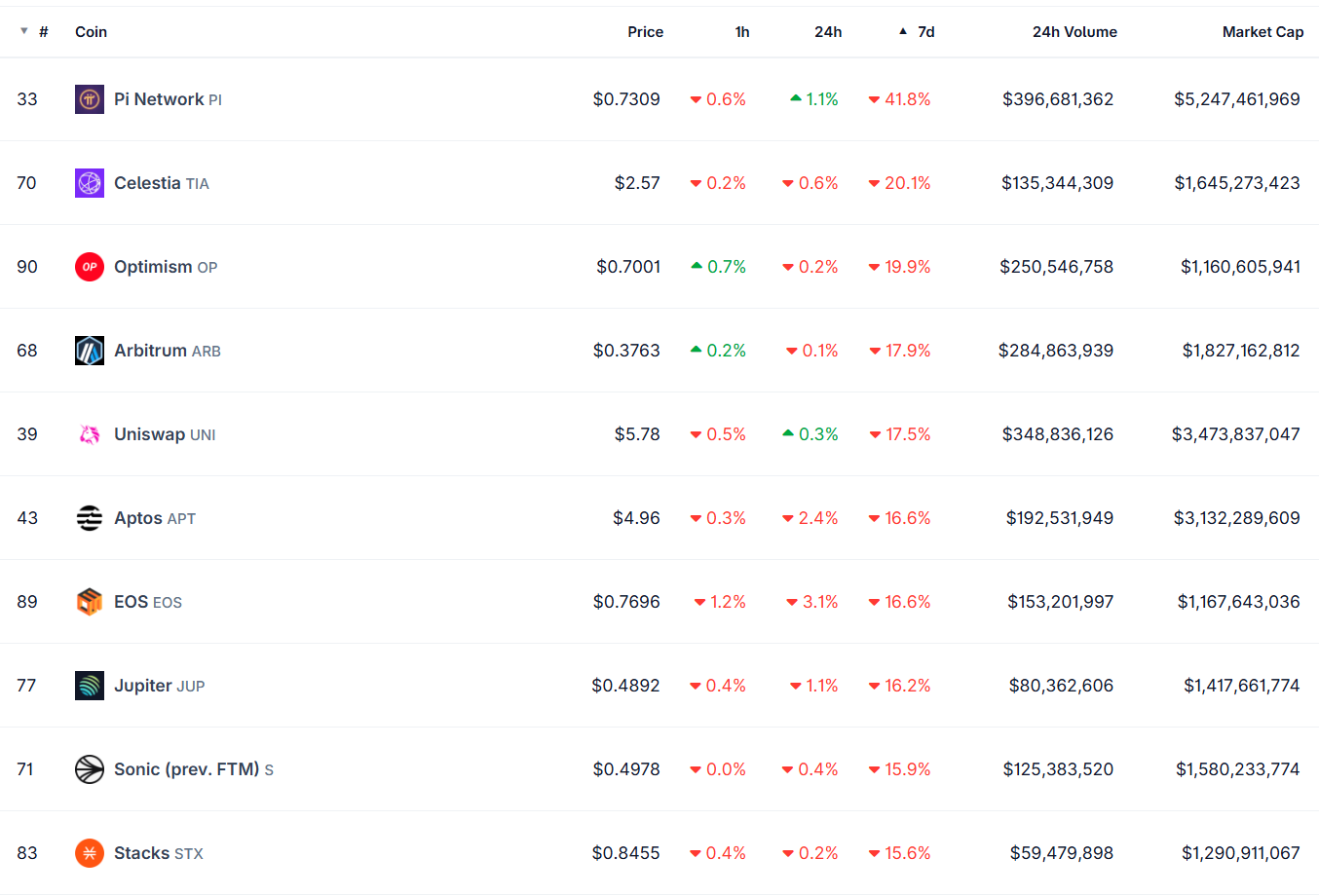

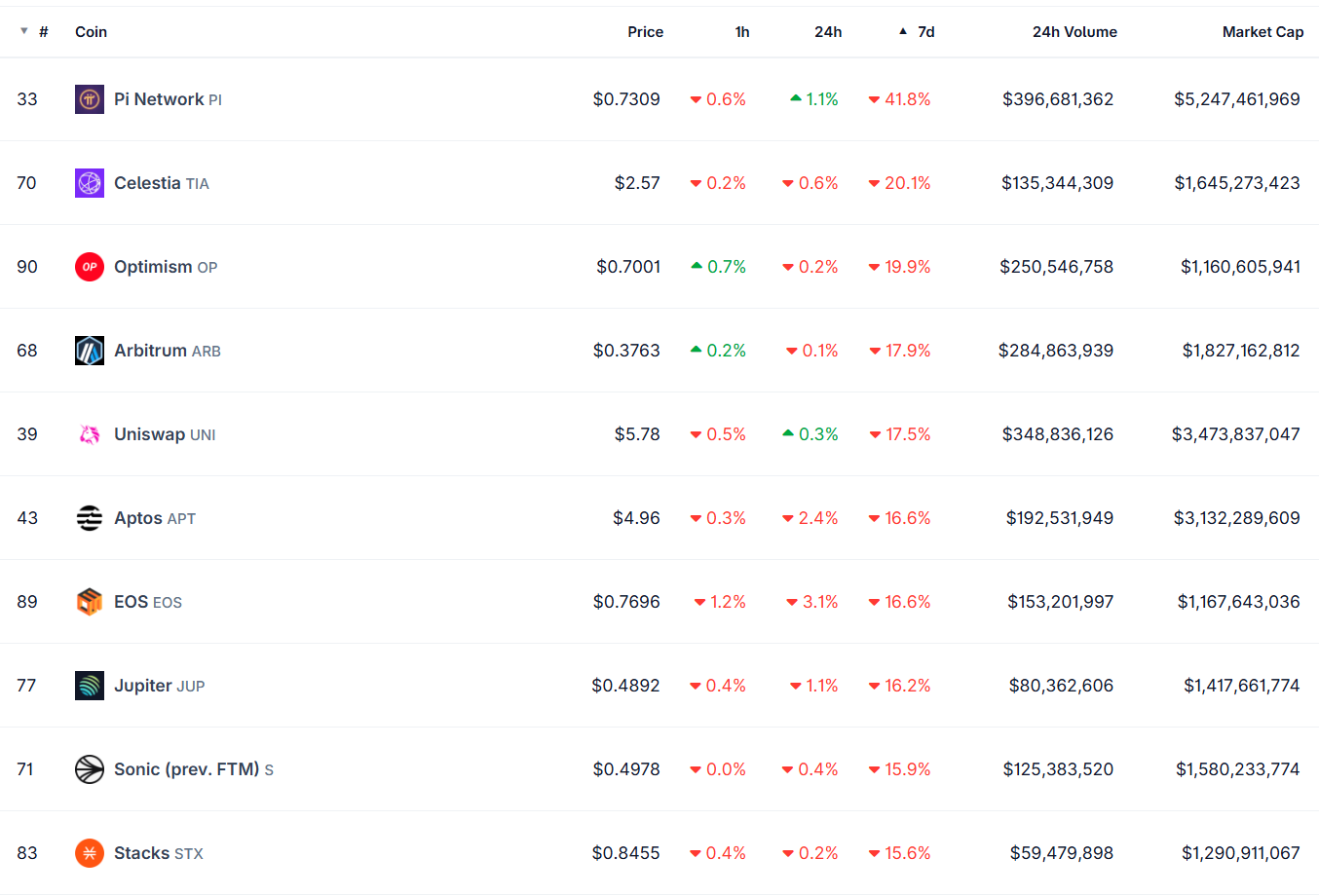

Solana SOL and XRP faced steeper declines, with SOL dropping 1% to around $165 and XRP falling 2% amid profit-taking. Meme coins like Dogecoin (DOGE) held steady at $0.22, while others, like PI, crashed 42% in the last 7 days.

Source: CoinGecko

Analysts Remain Optimistic, Predict Bitcoin Will Reach $200K

The crypto market experienced significant turbulence on May 19, 2025, with total capitalization dropping 2.5% to $3.38 trillion, driven by low trading volumes amplifying large trades and economic uncertainty from U.S.-China trade tensions.

Despite the market’s strong volatility, experts remain highly optimistic about Bitcoin’s future.

Read more: Hyperliquid Asserts Dominance, Set to Surpass Layer 1 Berachain

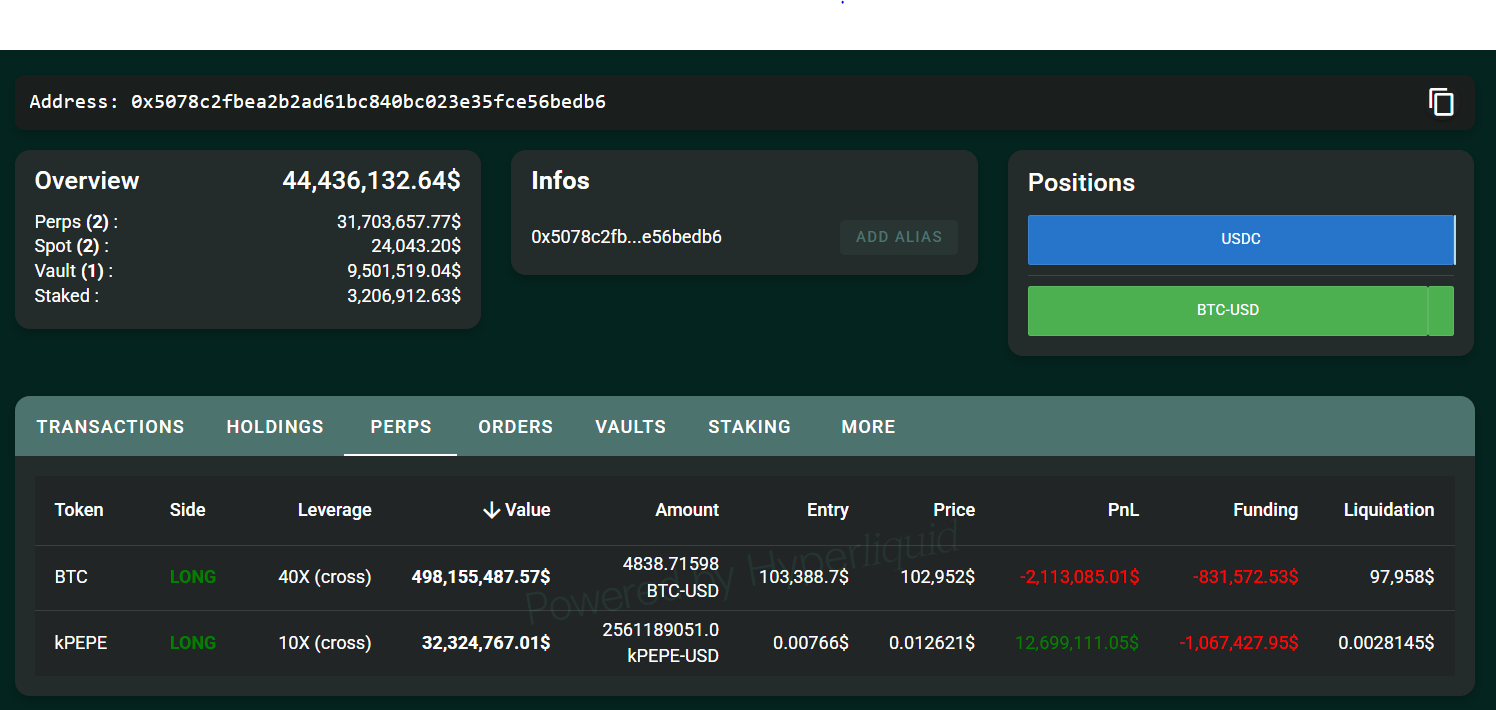

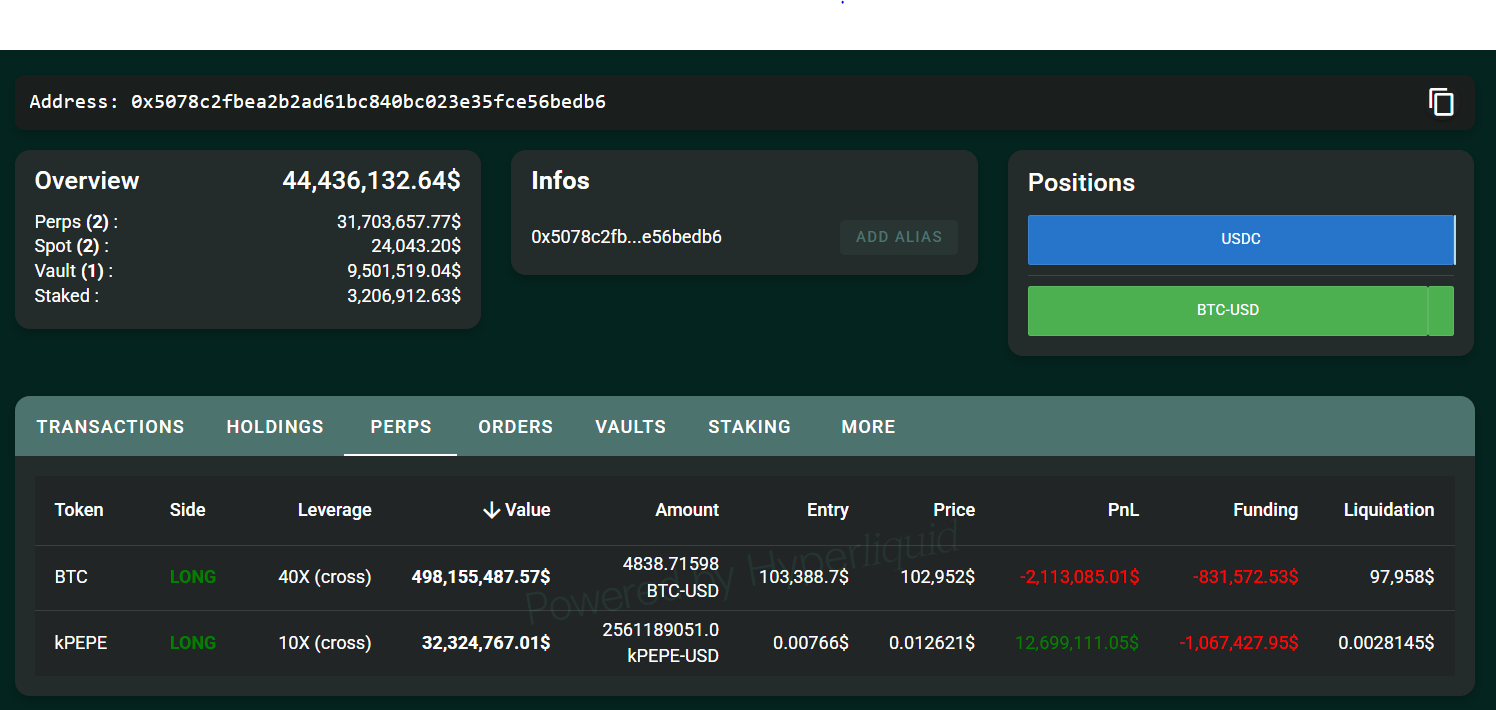

On May 19, 2025, analysis highlights a massive leveraged position taken by a whale on Bitcoin. The whale opened a 40x leveraged long position worth $488M on BTC-USD, entering at $103,389. The entry near $104,000 is “pretty high,” indicating a bold bet on Bitcoin breaking its all-time high.

This move suggests whales might be detecting market signals, such as potential institutional inflows or regulatory shifts, driving their confidence in taking such high-leverage risks. Their aggressive positioning could foreshadow a significant price movement, as whales often act on insights unavailable to retail traders.

Source: Hyperliquid

Additionally, BitMEX founder Arthur Hayes, in the latest Fortune Crypto interview, offered a bullish outlook, predicting Bitcoin could reach $200,000, driven by U.S. Treasury spending, while also holding gold as a hedge.

Read more: Bitcoin to $150,000: Mike Novogratz’s Bold Predictions

He also emphasized Ethereum’s undervaluation, arguing that its current “hated” status in the market presents a buying opportunity, especially as institutional interest in ETH grows.

Hayes’ perspective aligns with his broader strategy of holding gold as a hedge against inflation while advocating for a “degen” approach to investing in altcoins with strong fundamentals, such as DeSci tokens, to capitalize on the market’s next wave of growth.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor