Spot Bitcoin ETFs and Ethereum ETFs are experiencing record inflows, reflecting growing institutional confidence in cryptocurrencies as Bitcoin surpasses $106,000 and Ethereum gains momentum, driven by global adoption and market dynamics.

Spot Bitcoin ETFs hit $109 billion AUM

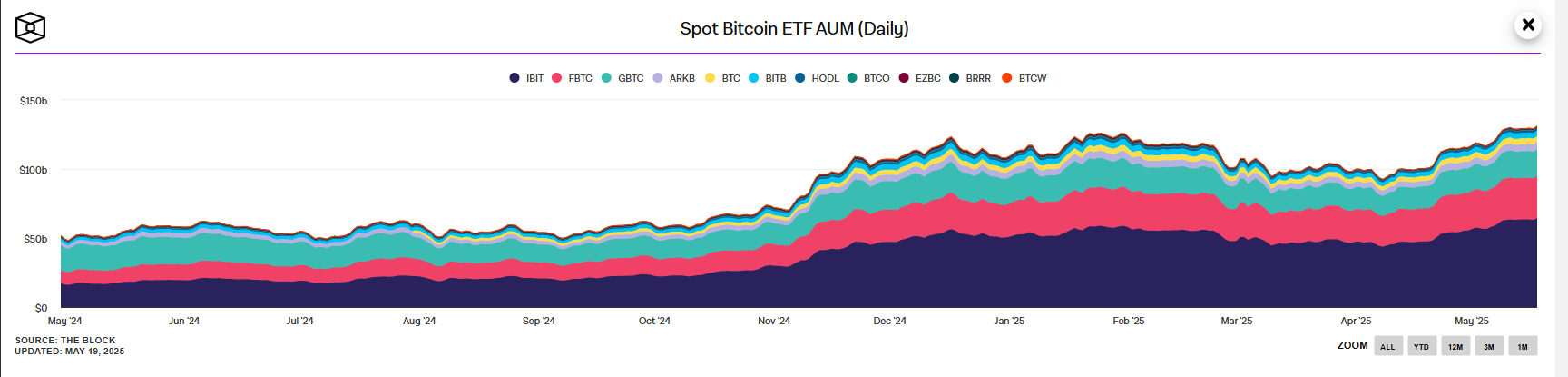

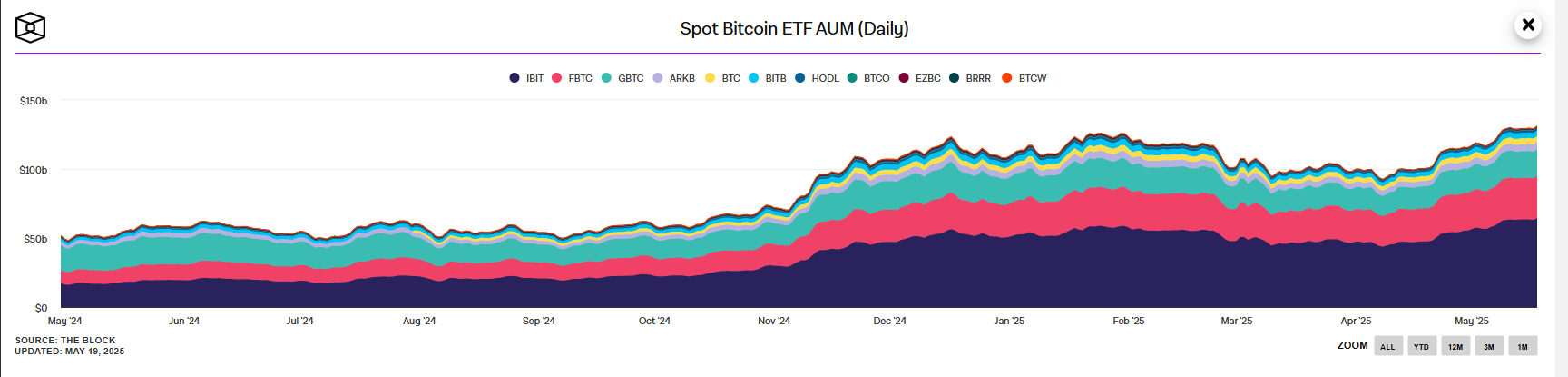

The cryptocurrency market is witnessing a historic surge in institutional investment, with U.S. spot Bitcoin exchange-traded funds (ETFs) reaching a remarkable $109 billion in assets under management (AUM) as of late April 2025.

Source: The Block

This milestone underscores the accelerating pace of institutional adoption globally, with Bitcoin ETFs reaching all-time high with over $41 billion in inflows since their launch in early 2024.

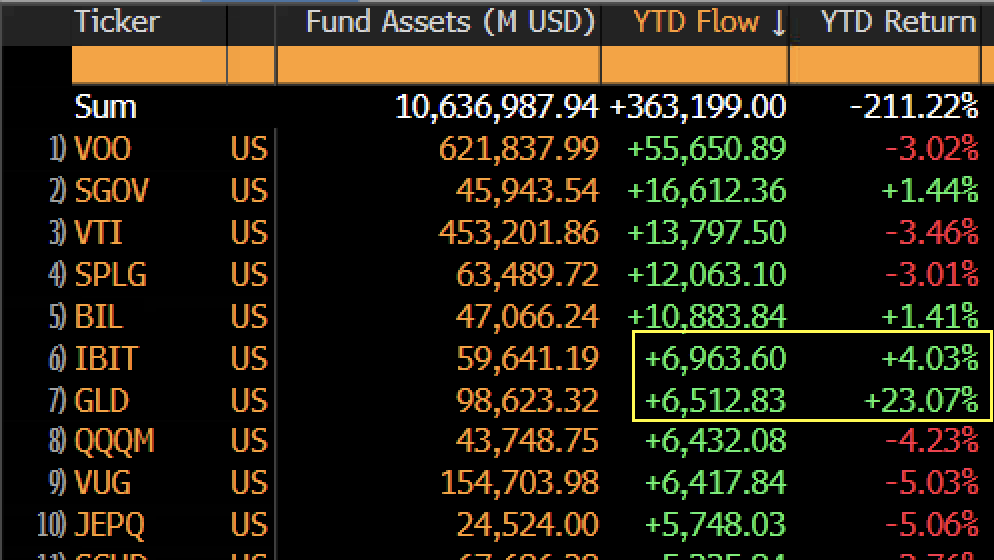

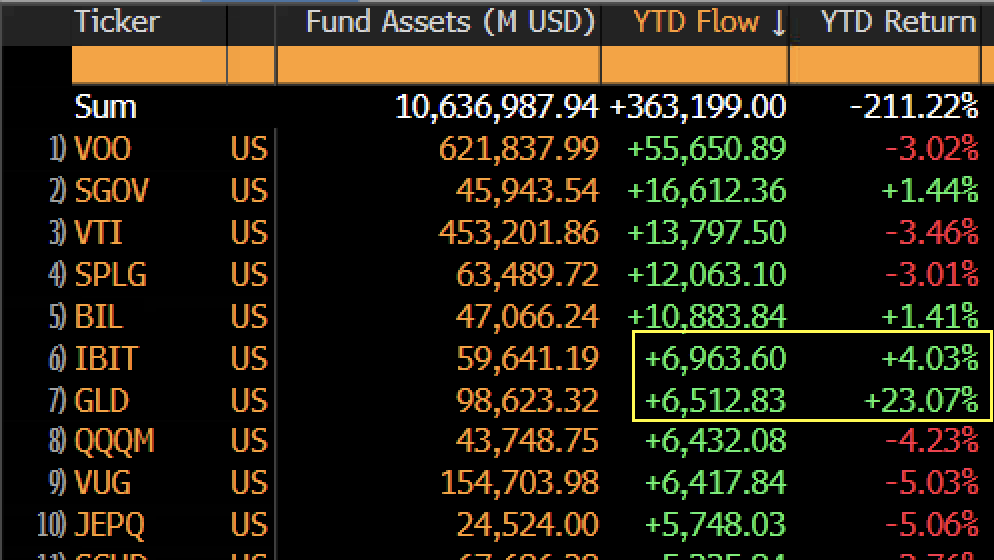

On May 8, 2025, investors poured new capital into these funds, pushing the total to this record-breaking figure. BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot Bitcoin ETF, alone has attracted $6.96 billion in year-to-date inflows, outpacing even the world’s largest gold ETF, SPDR Gold Trust (GLD), which recorded $6.5 billion.

Source: X

This outperformance highlights institutional investors’ growing confidence in Bitcoin BTC as a long-term store of value, despite its modest 3.8% price gain compared to gold’s 29% surge this year.

Long-term buying pressure from Bitcoin whales points to a potential continuation of the bullish trend.

Source: CryptoQuant

Ethereum ETFs Gain Momentum

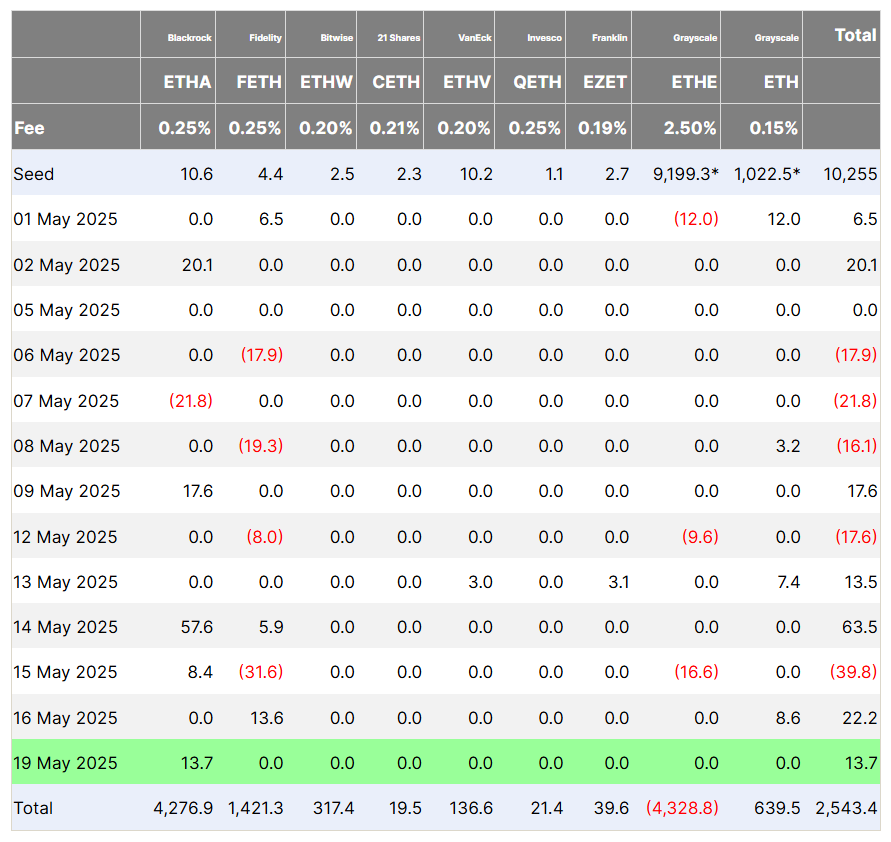

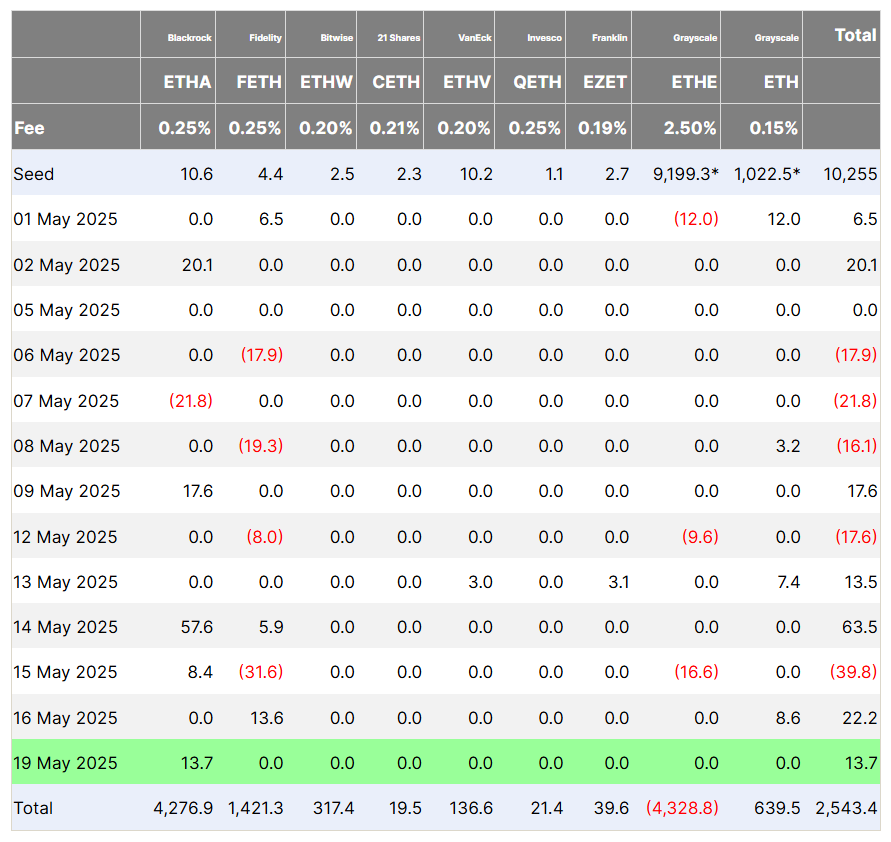

While Bitcoin ETFs continue to dominate headlines, spot Ethereum ETFs are steadily carving out their own success.

In early May 2025, Ethereum ETFs recorded significant net inflows, ending an eight-week streak of outflows, driven by a broader cryptocurrency market rally. This marked their first positive weekly inflows since February 2025, reflecting renewed investor confidence.

Source: Farside Investors

BlackRock’s Ethereum ETF (ETHA) has been a standout, attracting substantial capital and contributing to the fund’s growing AUM, which now reaches billions.

Despite earlier challenges, including notable outflows in March, the recent surge underscores Ethereum’s appeal as an institutional investment, fueled by its robust ecosystem and Pectra upgrades.

Analysts note that while Ethereum ETFs still trail Bitcoin in scale, their recent performance signals a shift, with institutions increasingly recognizing Ethereum’s potential as a cornerstone of the crypto market.

Rising Institutional Trust Powers ETF Inflows

While Bitcoin benefits from its established narrative as digital gold, Ethereum ETFs remain a “sidekick” to their Bitcoin counterparts, with inflows significantly lower.

The record inflows into both Bitcoin and Ethereum ETFs signal a structural shift in the financial landscape, with institutions increasingly viewing cryptocurrencies as viable portfolio assets. Analysts attribute this trend to macroeconomic factors, including persistent inflation, a weakening U.S. dollar, and expectations of renewed quantitative easing by the Federal Reserve.

Rachael Lucas from BTC Markets noted that these inflows reflect a “maturing role” for Bitcoin and Ethereum ETH in diversified portfolios. Additionally, global adoption is gaining traction, with countries like the UAE, Singapore, and Hong Kong launching their spot Bitcoin and Ethereum ETFs, further legitimizing cryptocurrencies as an asset class. Despite short-term volatility, such as Bitcoin’s 12% price drop in Q1 2025, the sustained inflows demonstrate unwavering institutional optimism.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Canton

Canton  Ethena USDe

Ethena USDe  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Hedera

Hedera  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Tether Gold

Tether Gold  Uniswap

Uniswap  Mantle

Mantle