On Tuesday, popular YouTuber KSI returned to crypto after almost two years. After his return, a crypto investigator discussed some of the YouTuber’s alleged shady practices from 2021 and 2022.

KSI’s Second Coming To The Crypto Kingdom

British YouTuber and boxer Olajide Olayinka Williams Olatunji, professionally known as KSI, came back to the crypto community after almost two years away. The content creator revived his crypto-related X account on February 13, asking, “Does this still work?”

The internet celebrity rose to fame at the beginning of the last decade thanks to the vlogging and gaming content posted on his YouTube channel. Since then, KSI has amassed a large following, with over 24 million subscribers. His crypto-related X account, created in March 2021, has over 372,000 followers.

Inb4 he starts sharing garbage again.

Dumping your tokens on Logan Paul’s lapdog is permitted and encouraged.

— ZachXBT (@zachxbt) February 13, 2024

Shortly after KSI’s return, crypto investigator ZachXBT called out the YouTuber for allegedly engaging in shady practices during the last bull run. According to the investigator, KSI was “shilling a couple of the scammy Polkastarter IDOs that went to zero way before the bull market ended last run.”

The crypto detective then revealed that KSI had allegedly manipulated the market on at least three occasions. According to the investigator, on March 27, 2022, the YouTuber posted that he was part of XCAD’s “#HodlGang” before selling approximately $850,000 worth of the token in the following days.

On March 20, 2021, KSI announced two NFT coins he seemingly was bullish on: SUPER and ERN. In the following hours, the content creator proceeded to sell around $349,000 worth of the ERN token, as the data shown by the crypto detective reveals.

Remember when KSI posted

“All of a sudden, my $XCAD bag is looking juicy again. #HodlGang”

Then proceeded to dump $850,000 worth of XCAD over the following days from his wallet address. https://t.co/qAEIRYGTMd pic.twitter.com/Gn6LMybQia

— ZachXBT (@zachxbt) February 13, 2024

Lastly, on May 5, 2021, the crypto sleuth found another post of the YouTuber hyping a token before dumping his remaining tokens in the next hour for a $25,000 profit.

According to the detective, he previously confirmed that the analyzed wallet address belonged to KSI by using his OpenSea username, an honorary NFT, and a Mutant Ape NFT, which he had previously claimed as his.

Pumping-And-Dumping Or Bad At Crypto?

Due to the nature of the accusations, Stephen Findeisen, the popular internet scam detective known as Coffeezilla, reached out to the YouTuber for comments. KSI replied, and his answers were featured in a Coffeezilla YouTube video.

According to KSI, he never left the crypto space because it’s “hard to leave when you invested years into it.” Instead, he claims to have been watching industry developments from the shadows since he last posted on his crypto-dedicated account in November 2022.

The replies to the investigator’s questions show that, at first, KSI didn’t outright deny the pump-and-dump allegations. The YouTuber claimed he still holds some of his XCAD bag and fully believes in the project.

He also argued that the reason behind selling after hyping the token was “to put into Luna thinking I would profit more to buy back more Xcad.” This ultimately resulted in KSI “taking a major L.”

Screenshot of KSI's response. Source: Coffeezilla on Youtube

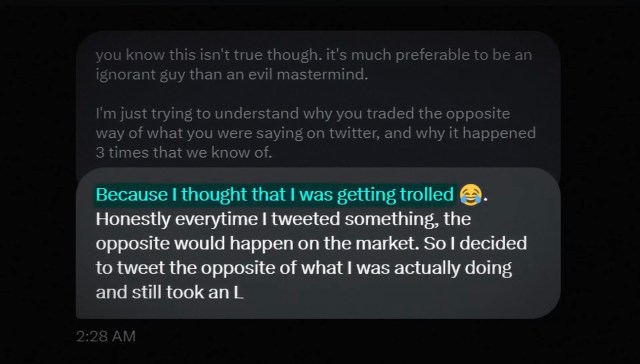

After further questioning, KSI assured that he didn’t intend to scam his followers maliciously. According to his replies, his private actions opposed his public claims because his track record showed that he was “bad at crypto,” making him feel like the market was against him.

Many community members were uncomfortable with the YouTuber’s replies, stating that being “bad at crypto” doesn’t cancel the “pump-and-dump” schemes he allegedly pulled. Some X users compared these findings to one of YouTuber Logan Paul’s allegations that surged years ago.

Bitcoin is trading at $52,278.6 in the hourly chart. Source: BTCUSDT on TradingView.com

Featured image from Unsplash.com, Chart from Tradingview.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  Canton

Canton  Uniswap

Uniswap  PayPal USD

PayPal USD  Mantle

Mantle  Cronos

Cronos  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Aave

Aave  Rain

Rain  Bitget Token

Bitget Token  MemeCore

MemeCore