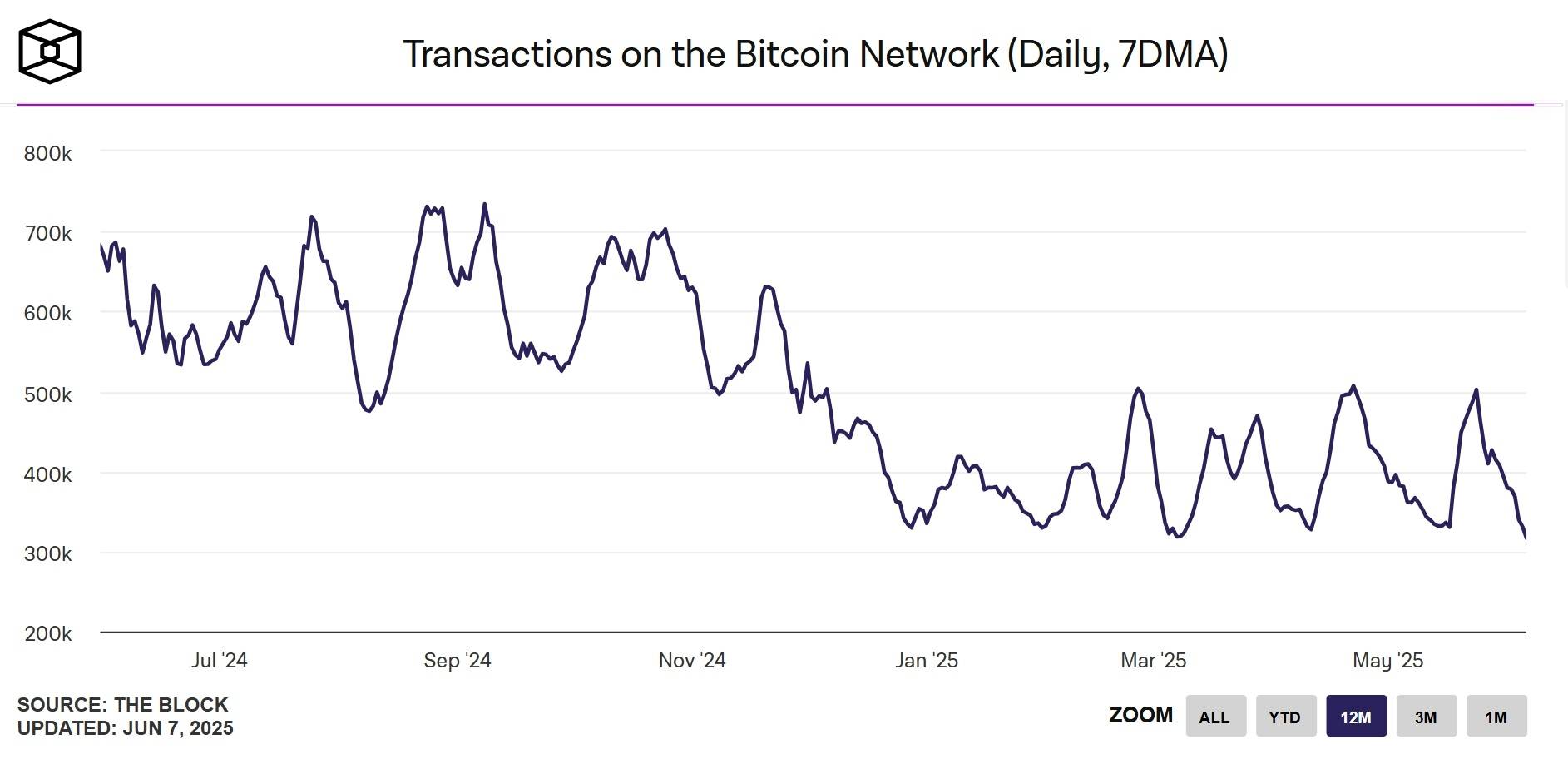

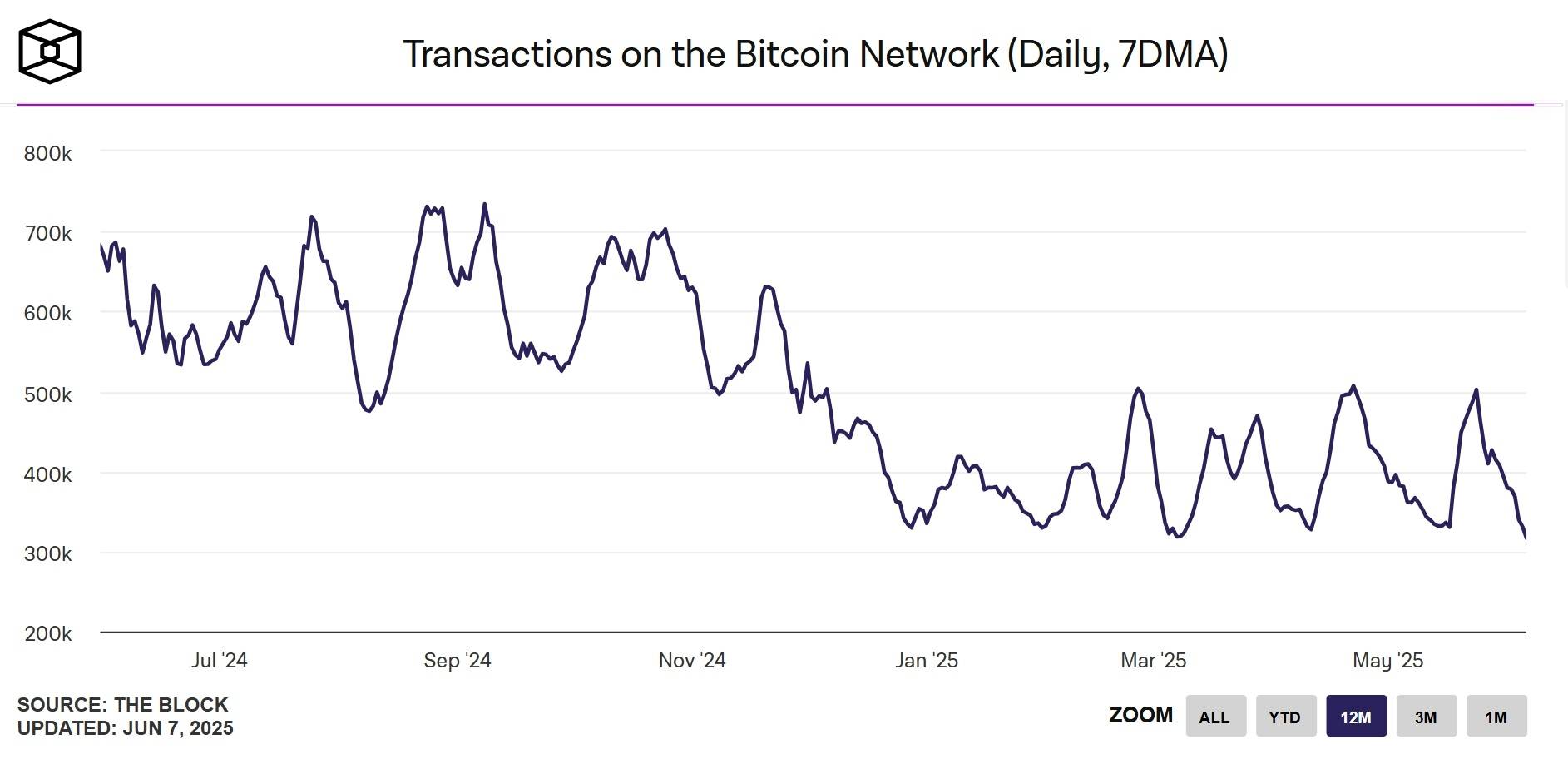

According to memepool space, key indicators including the number of active addresses and daily transactions have fallen sharply, suggesting waning user engagement and possibly a temporary retreat in market confidence.

Recent Glassnode data indicates that the number of active Bitcoin addresses has dropped to just 566,000 per day, a level not seen since the bear market of late 2023. Similarly, the number of daily transactions has slipped below 275,000—a figure that reflects a near-30% decline from the monthly average in April 2025.

Ordinals and Inscriptions Cool Off

Part of the decline in network activity is attributed to the fading hype around Bitcoin Ordinals and inscriptions. These NFT-like digital artifacts, once a major source of congestion and gas fee spikes on the Bitcoin blockchain, have seen diminished interest in recent months.

Dune Analytics data shows that the number of daily Ordinals inscriptions has plummeted to under 3,000, compared to highs of over 400,000 in late 2023 and early 2024. This trend has not only eased pressure on transaction fees but also reflects a broader cooling in speculative behavior.

Bitcoin miners are among the hardest hit by the decline in network activity. As transaction volumes drop and fees fall, mining revenue—particularly from fees rather than block rewards—has also taken a hit. Fee-based income now accounts for less than 2% of total miner revenue, down significantly from the 10–15% levels seen during the inscription boom.

Source: The Block

According to Blockchain.com, daily miner revenue has slipped below $30 million, putting pressure on smaller mining operations and potentially accelerating industry consolidation.

Market Interpretation and Outlook

Analysts suggest that the current slowdown may not be entirely bearish. Some view it as a phase of market consolidation, where speculative excesses are flushed out before a healthier growth cycle resumes. Others note that despite the drop in activity, Bitcoin’s core fundamentals remain intact, with hash rate still hovering near all-time highs and institutional interest—albeit subdued—remaining steady.

Still, the short-term outlook remains cautious. The decline in transaction volumes, user activity, and fee incentives presents challenges for network sustainability, especially as the next Bitcoin halving in 2028 draws closer.

The latest data underscores a crucial inflection point for Bitcoin. While long-term holders and institutions may stay the course, the retail market appears to be in retreat—at least for now. Whether this period marks a brief lull or the beginning of a deeper structural shift in Bitcoin’s usage patterns will likely depend on broader macroeconomic developments and evolving user narratives.

Read more: Bitcoin Crushes Wall Street: Second Only to NVIDIA in a Decade of Gains

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Zcash

Zcash  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  Canton

Canton  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  MemeCore

MemeCore  Rain

Rain  Bittensor

Bittensor  Pepe

Pepe