The decentralized finance (DeFi) landscape is constantly evolving, with new Layer-1 blockchains vying for market share. These platforms promise enhanced scalability, security, and user experience. Sui, a permissionless blockchain, emerged as a promising entrant. Launched in May 2023 by Mysten Labs, founded by former Meta engineers, Sui quickly carved out a significant niche. It leverages a unique object-centric data model and the Move programming language. This positions Sui as a formidable player in the DeFi space.

This article delves into Sui’s rapid ecosystem growth. Specifically, it explores its expansion within Decentralized Finance (DeFi), gaming, and Non-Fungible Tokens (NFTs). This growth is evidenced by significant Total Value Locked (TVL) and expanding user adoption. Furthermore, the network’s strategic positioning is solidified by key partnerships with institutional players and a clear roadmap for future development.

Sui – A Flourishing DeFi Ecosystem

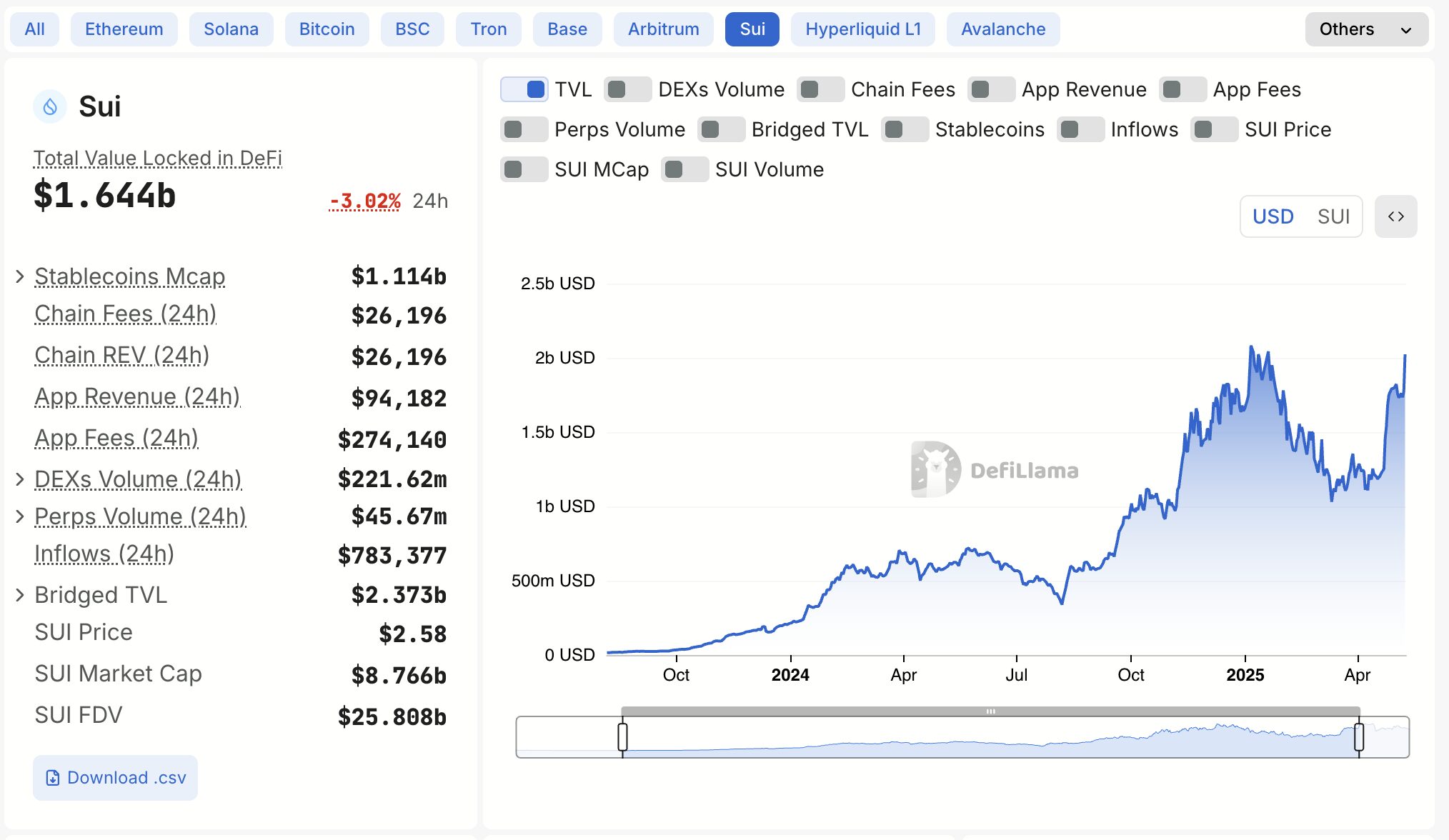

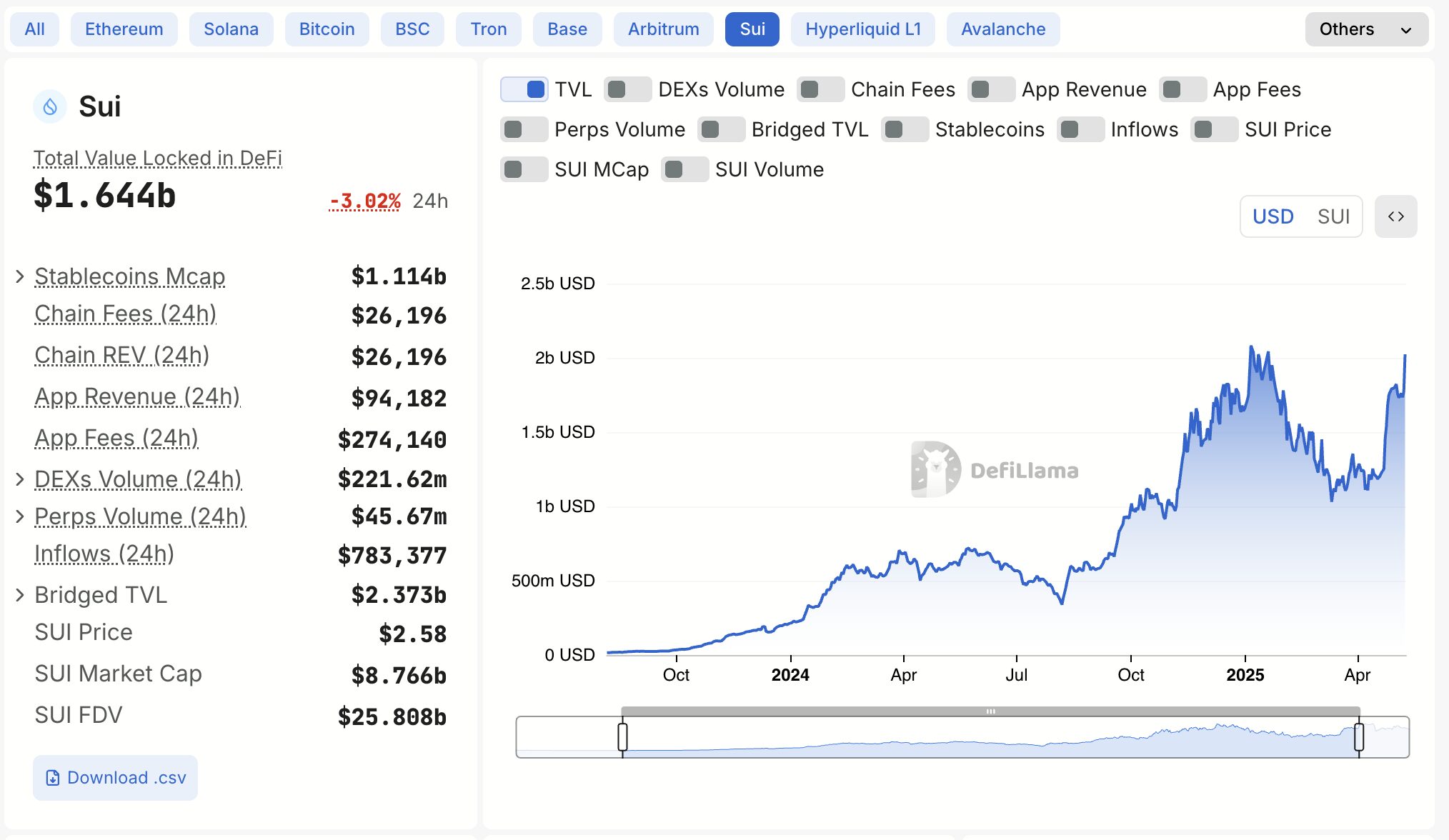

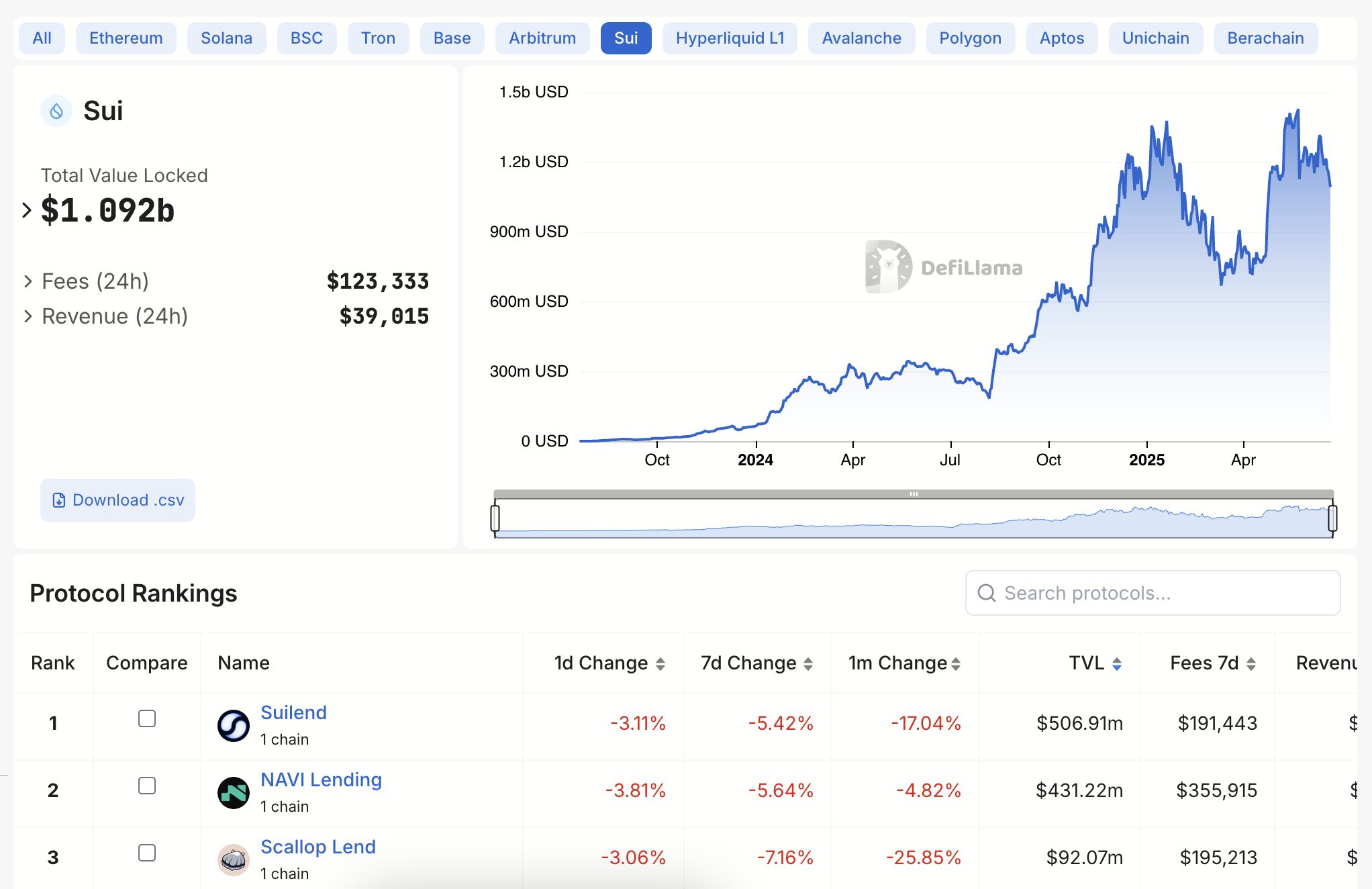

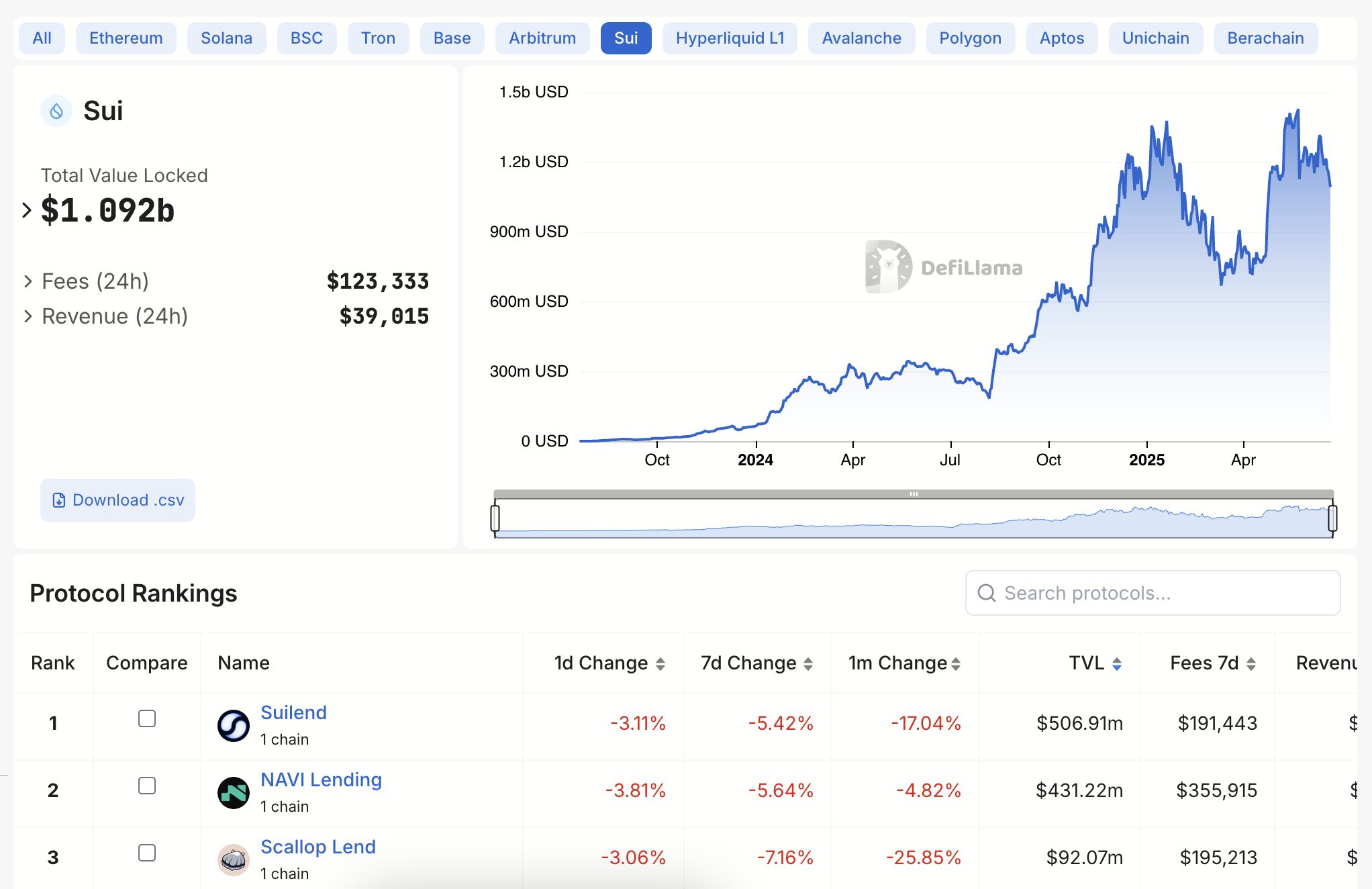

Sui‘s architecture enables high-speed lending, trading, and staking platforms. The network has demonstrated significant growth in its DeFi sector, with Total Value Locked (TVL) surging from approximately $25 million at launch to over $2 billion by May 2025, positioning Sui as the third-largest non-EVM chain by TVL.

Source: DefiLlama

By June 2025, its DeFi TVL exceeded $1.7 billion, surpassing more historical projects like Avalanche or Polygon. Stablecoin volume on Sui has also seen explosive growth, jumping from $400 million in January to nearly $1.2 billion by May 2025, with monthly stablecoin transfer volume exceeding $70 billion.

The cumulative total DEX volume on Sui has surpassed $110 billion, with an average 24-hour DEX volume of approximately $250 million, indicating substantial trading activity.

Sui’s DeFi sector is robust, characterized by high-speed transactions and capital efficiency, making it ideal for various financial activities.

For more: Sui Deep Dive: A Comprehensive Analysis

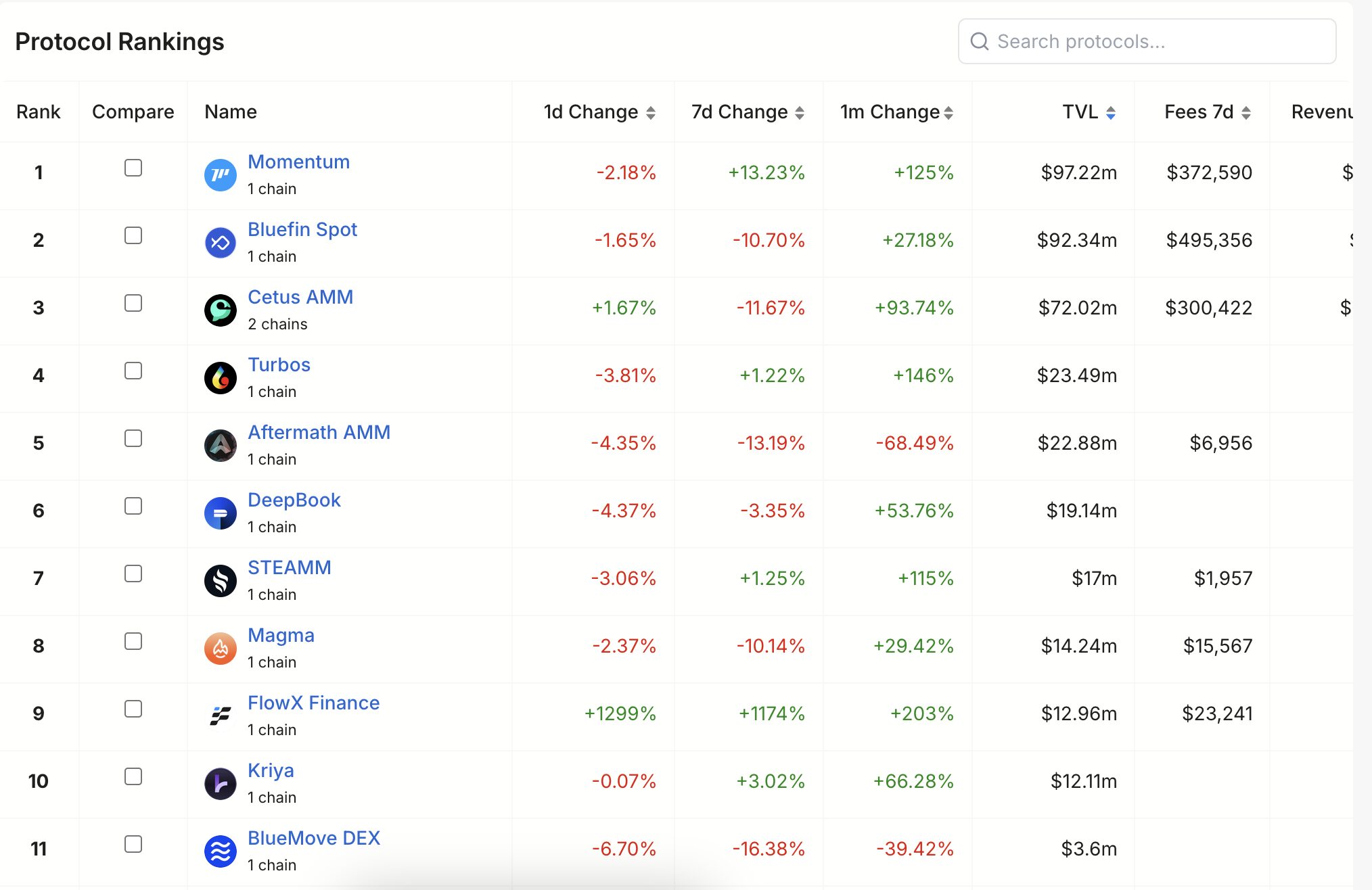

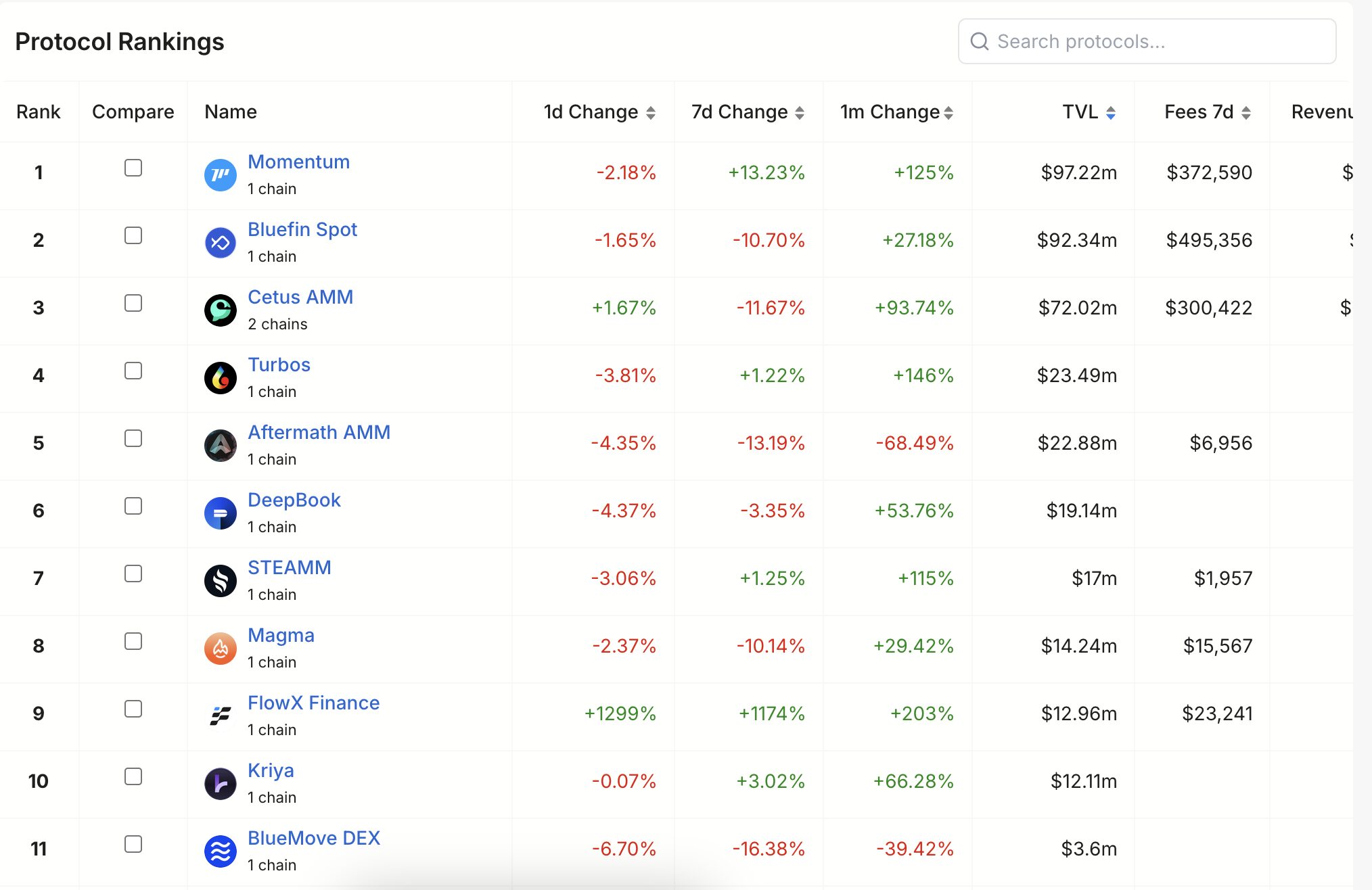

Source: DefiLlama

Decentralized Exchanges (DEXs)

Cetus Protocol (CETUS)

A leading DEX on Sui (and Aptos) utilizing a Concentrated Liquidity Market Maker (CLMM) model, similar to Uniswap V3. This allows liquidity providers to allocate assets within specific price ranges, significantly enhancing capital efficiency and reducing slippage for traders. Cetus also features a “Super Aggregator” to source the best prices across the Sui network and offers a developer SDK for easy integration.

Turbos Finance (TURBOS)

A prominent DEX known for its robust growth and strong support for meme tokens within the Sui ecosystem. Turbos emphasizes innovative trading mechanisms and comprehensive listings, positioning itself as a key liquidity provider and a catalyst for the meme coin market on Sui. It was notably unaffected by the Cetus exploit due to its independent and secure codebase.

Aftermath Finance (AF)

A decentralized trading and DeFi platform aiming to provide a CEX-like user experience fully on-chain. Aftermath offers multi-asset liquidity pools, a smart-order router for efficient trading, and liquid staking derivatives (afSUI). It integrates various DeFi products like a DEX aggregator, yield farming, and even a cross-chain bridge, striving to be a “one-stop-shop” for Sui DeFi.

Momentum DEX (MMT)

The first ve(3,3) decentralized exchange combined with a token launch platform on Sui. Momentum’s ve(3,3) tokenomics model aims to align incentives perfectly among liquidity providers, traders, and protocols, with 100% of emissions, trading fees, and rewards flowing directly to users. It also plays a key role in minting stablecoins on Sui, positioning itself as a critical infrastructure player.

KriyaDEX (KDX)

A comprehensive DeFi protocol offering a range of functionalities including AMM, limit orders, leveraged perpetual contracts, and strategy Vaults. Kriya focuses on providing fast, efficient, and low-cost transaction services, supporting professional traders with features like up to 20x leverage on perpetuals and on-chain dollar-cost averaging (DCA).

Source: DefiLlama

Lending & Borrowing Protocols

Suilend (SEND)

Suilend offers a unified platform integrating various essential DeFi services, making it a “one-stop-shop” for users. This includes:

- Lending & Borrowing: Users can deposit supported crypto assets to earn interest or borrow against their holdings with collateral, all powered by Sui’s high-speed, low-fee blockchain.

- Liquid Staking (SpringSui): This is a key feature where users can stake their SUI tokens and receive sSUI, a yield-bearing liquid staking token. sSUI can then be used in other DeFi activities, and SpringSui is particularly notable for offering instant unstaking, providing significant liquidity and safety.

- Token Swapping (STEAMM): Suilend features its own Superfluid AMM called STEAMM, allowing users to efficiently swap tokens directly within the platform. This integrated swap functionality helps reduce transaction fees and simplifies the user experience.

- Cross-Chain Bridging: Powered by Wormhole, Suilend facilitates the seamless transfer of assets across major blockchains like Ethereum, Solana, and Polygon, enabling users to bring assets into the Sui ecosystem for use within the platform.

NAVI Protocol (NAVX)

The first native liquidity protocol in the Sui ecosystem, offering a one-stop solution for lending, borrowing, and leveraged yield farming. NAVI supports various mainstream assets (WBTC, WETH, SUI) and aims to be a user-friendly decentralized bank on Sui, known for its capital-efficient and dynamic lending interest modes.

Scallop (SCA)

A leading decentralized finance (DeFi) protocol designed for peer-to-peer lending and borrowing. Scallop offers a comprehensive money market with high-interest lending and low-fee borrowing. It was the first DeFi protocol to receive an official grant from the Sui Foundation, underscoring its institutional-grade quality and security. Scallop prioritizes institutional-grade security and regulatory compliance.

Source: DefiLlama

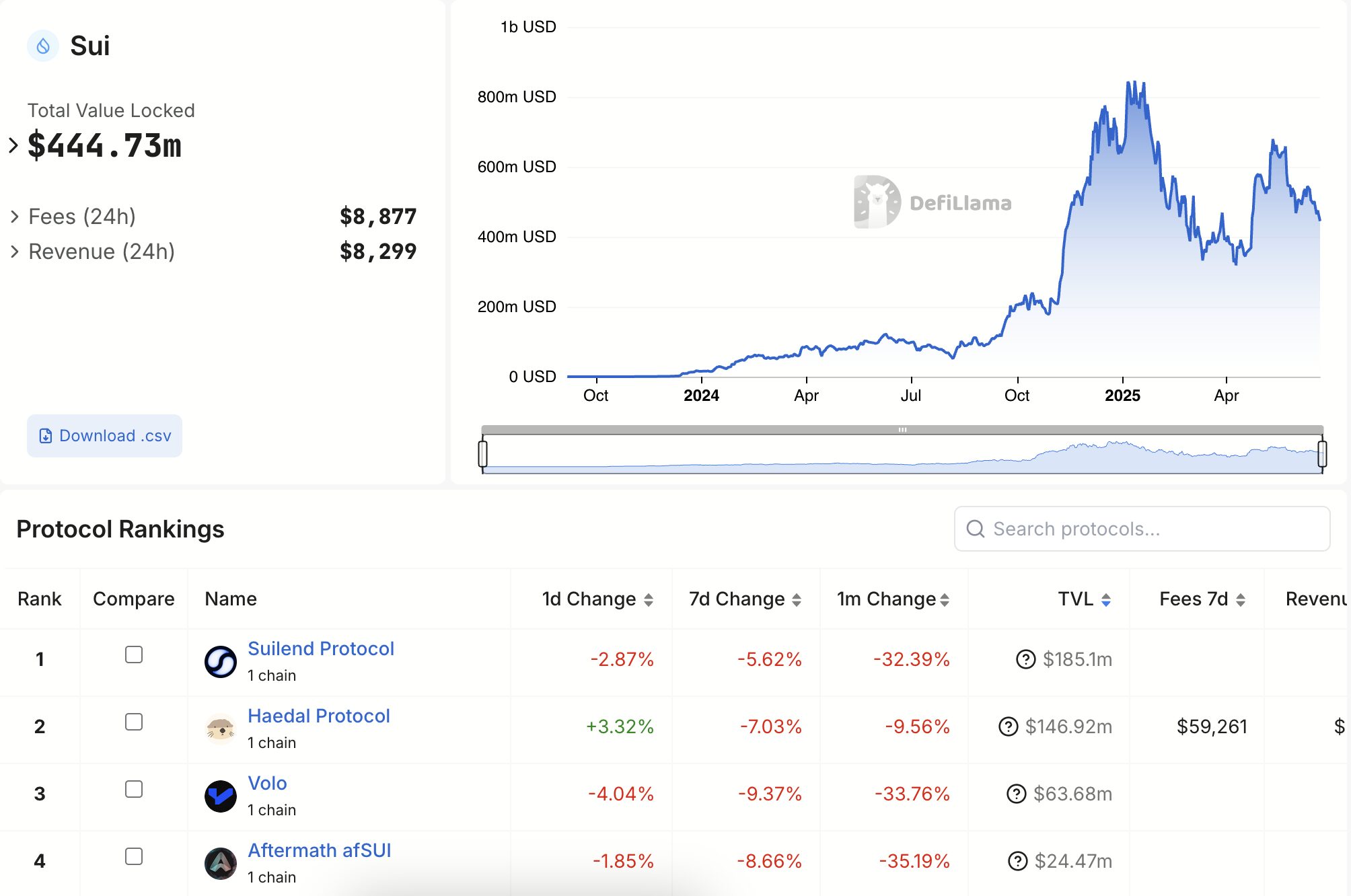

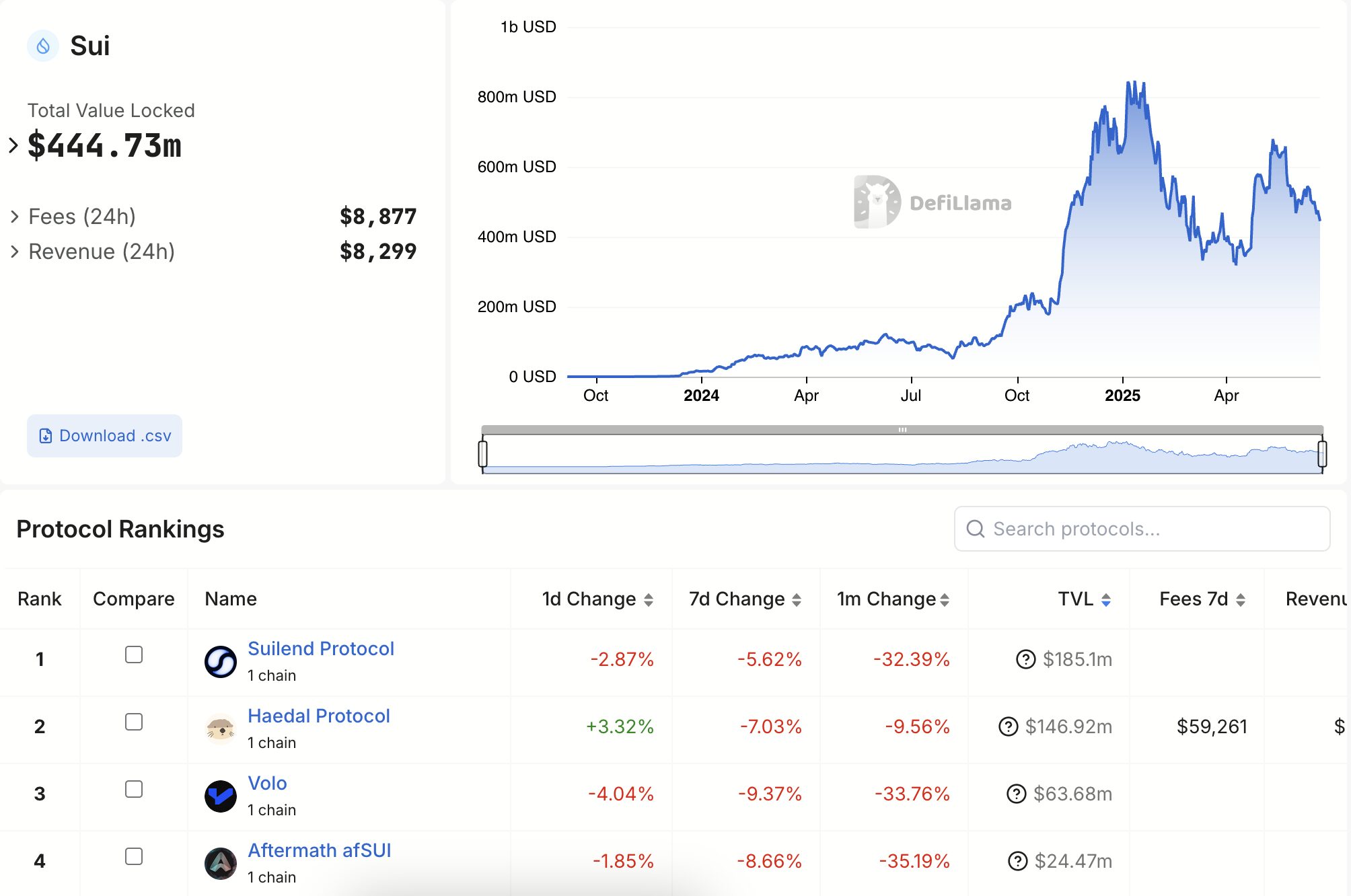

Liquid Staking Derivatives (LSDs)

Several protocols are facilitating liquid staking on Sui:

- SpringSui (by Suilend): Offers sSUI, notable for its instant unstaking feature, providing significant liquidity and safety by reducing depegging risk.

- Aftermath Finance: Provides afSUI and integrates liquid staking into its broader DeFi platform.

- Volo: Offers vSUI as its liquid staking derivative.

- Haedal Protocol: The first liquid staking solution built on Sui, providing haSUI and actively expanding its integration across major exchanges and DeFi platforms.

Source: DefiLlama

Stablecoin Integration

Sui has a diverse and growing portfolio of stablecoins, including native USDC, USDY (yield-bearing), AUSD, and FDUSD, which collectively represent a significant portion of the network’s stablecoin market cap. This diversity enhances liquidity for DeFi and supports in-game economies.

Other Applications and Infrastructure

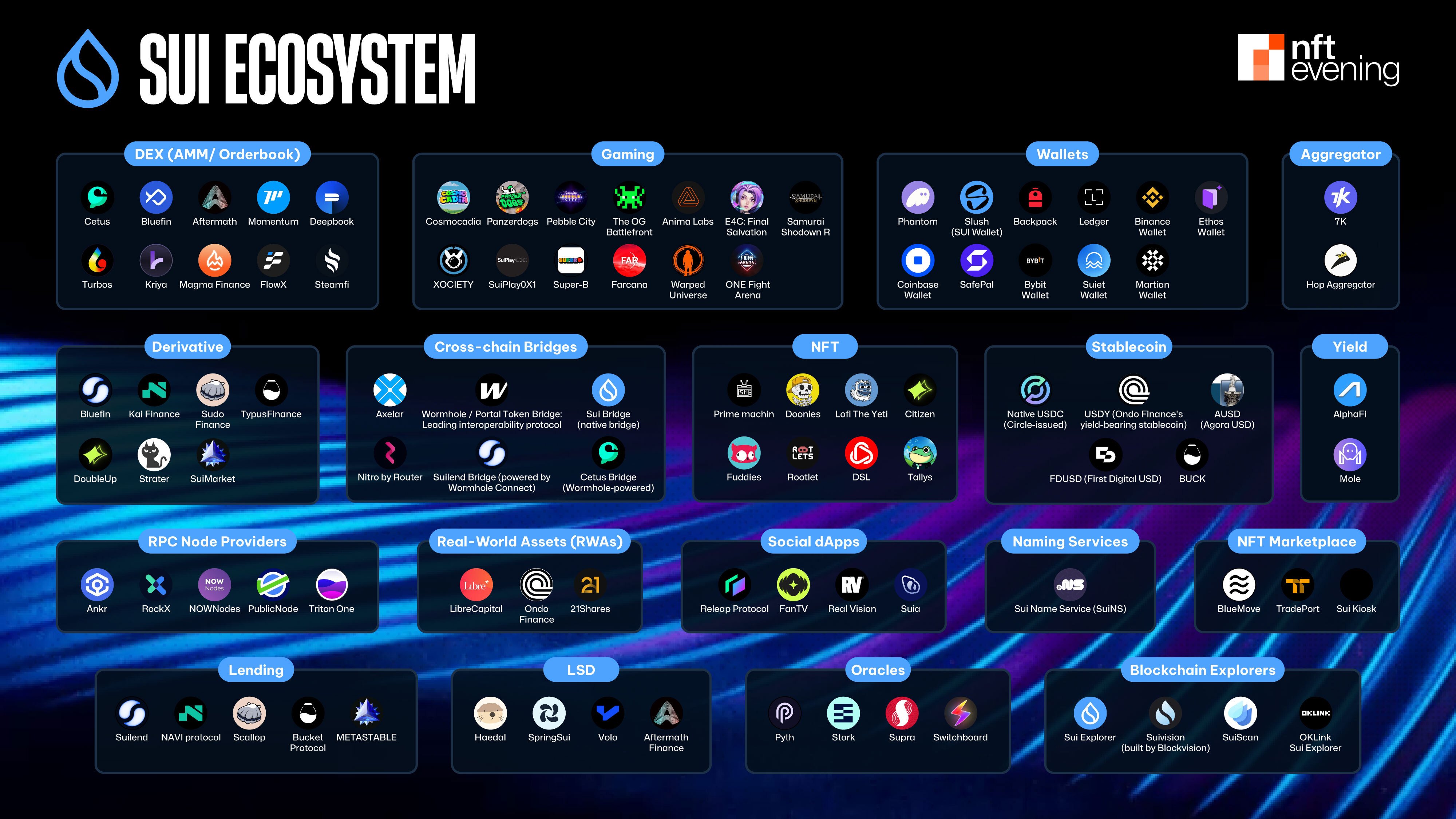

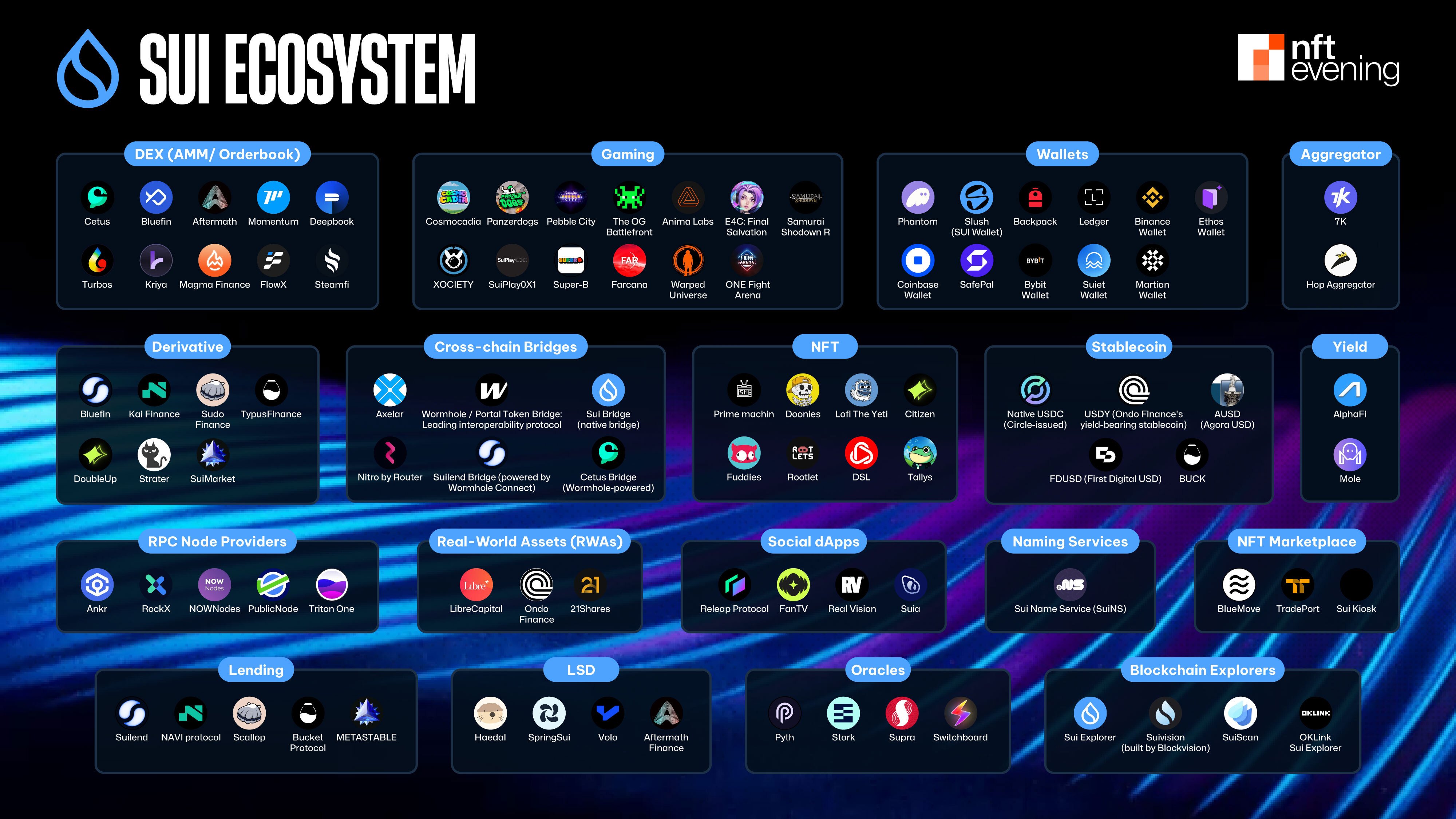

Sui’s versatile architecture supports a wide array of applications beyond DeFi and gaming:

- Social dApps: Projects like Releap Protocol (a fully decentralized social graph), FanTV, and Real Vision (integrating Sui for tokenized user rewards to foster interactive community engagement) exemplifies Sui’s reach into social applications.

- Wallets: A variety of wallets support the Sui ecosystem, including Phantom, Slush (SUI Wallet), Backpack, Ledger, Binance Wallet, Coinbase Wallet, SafePal, Bybit Wallet, Suiet Wallet, Martian Wallet, and Ethos Wallet.

- Cross-chain Bridges: Critical for interoperability, Sui integrates with Axelar and Wormhole, a leading interoperability protocol facilitating value and information transfer across numerous blockchains, including Ethereum and Solana.

- Oracles: Services connecting on-chain smart contracts with off-chain data, such as Pyth, Stork, Supra, and Switchboard, are available for the Sui network.

- RPC Node Providers: Infrastructure providers like Ankr, RockX, NOWNodes, PublicNode, and Triton One offer RPC services for Sui, crucial for dApp development and operation.

- Developer Tools and SDKs: Sui provides a comprehensive developer-friendly environment, including the Sui CLI, Sui VSCode extension, Sui JS (TypeScript SDK), extensive documentation, guides, tutorials, sample code, a developer forum, weekly office hours, and a Telegram channel for support.

- Blockchain Explorers: Tools like Sui Explorer and Suivision (built by Blockvision) allow users to view network activity, track assets, and debug smart contracts.

- Sui Name Service (SuiNS): This decentralized naming protocol allows users to register human-readable names (e.g., yourname.sui) that map to complex wallet addresses and smart contracts.

Strategic Growth: Partnerships, UX, and Future Vision

Sui’s commitment to broad adoption and long-term sustainability is evident in its strategic approach to partnerships, user experience, and a clear future roadmap.

Strategic Partnerships and Institutional Integration

Sui’s growth is significantly fueled by strategic partnerships and institutional integrations, signaling strong confidence and a path for large-scale capital. These collaborations are crucial for embedding Sui within traditional finance (TradFi) and mainstream Web3 infrastructure.

- Institutional Custody & Access: Collaborations with Fireblocks enhance institutional-grade custody and DeFi access.

- RWA Tokenization: Partnerships like 21Shares (a leading crypto ETP provider) aim to develop financial products, accelerate Real-World Asset (RWA) tokenization, and provide institutional and retail access.

- Cross-Chain Liquidity: Integrations with Wormhole and OKX Wallet are critical for boosting cross-chain liquidity and user engagement.

- Secure Self-Custody: Ledger integration provides secure self-custody and staking options for SUI.

- TradFi Bridges: Projects like Ondo Finance are launching tokenized U.S. Treasuries on Sui, while ATHEX Exchange explores on-chain fundraising via Sui, demonstrating a concerted effort to bridge TradFi with Web3. Notably, a recent partnership with Microsoft also positions Sui for deeper blockchain integration within enterprise applications.

This focus on established players and interoperability de-risks the platform, attracting capital and legitimizing Sui’s position in the global digital asset landscape.

User Experience (UX) and Developer Enablement

Sui’s core design philosophy prioritizes a seamless user experience (UX) and a developer-friendly environment to drive adoption beyond crypto natives.

- Simplified Onboarding: Initiatives like ZK Login allow users to access dApps with familiar web credentials, significantly lowering the barrier to entry for mainstream audiences.

- Robust Developer Support: Sui offers comprehensive tools, libraries, tailored SDKs, and strong community support (office hours, forums, Telegram, hackathons like Sui Overflow, and developer grants). The “Move Accelerator” program further supports developers in mastering the Move programming language.

This commitment reduces friction for both users and developers, fostering a “virtuous cycle of growth” essential for mass adoption and positioning Sui as a platform for everyday applications.

Source: Sui Ecosystem

Future Roadmap and Development Plans

Sui’s future roadmap emphasizes continuous ecosystem expansion and refinement. This is guided by several strategic priorities.

First, deepening DeFi is a key focus. Plans include exploring synthetics, Real-World Assets (RWAs), and stable yield opportunities. The Sui Foundation’s multi-million dollar DeFi Ecosystem Growth Fund aims to support builders. Moreover, it seeks to enhance liquidity and drive long-term protocol adoption.

Second, scaling GameFi and creator platforms remains crucial. The anticipated launch of the SuiPlay 0X1 gaming device is expected as a major catalyst. Consequently, it will create demand for new play-to-earn games. This could also attract adaptations of popular blockchain games to Sui.

For more: The Growth Potential of Sui?

Furthermore, technical enhancements are underway. Plans include Layer 2 enhancements leveraging Zero-Knowledge (ZK) technology. This aims to enable faster and cheaper transactions. Alongside this, ongoing improvements to the core network, like Mysticeti v2, are planned.

Finally, community and institutional focus continues. Efforts persist to attract institutional capital and enterprise solutions. Indeed, active community engagement through hackathons, educational programs, and community hubs supports this.

Analysts generally anticipate SUI price increases by 2029-2030. Some forecasts place it between $6 and $12, driven by its speed, scalability, and low fees. Overall, the long-term outlook remains bullish. This positions Sui as a potential leader in emerging AI-related niches. It could also challenge established Layer-1s by the decade’s end.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Hyperliquid

Hyperliquid  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  Uniswap

Uniswap  PayPal USD

PayPal USD  Canton

Canton  Mantle

Mantle  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Aave

Aave  Rain

Rain  Bitget Token

Bitget Token  MemeCore

MemeCore