As Sui’s DeFi ecosystem expands, Cetus is poised to remain at its center, continually evolving via community governance. With ongoing innovations (intent-based trading, automated vaults, multichain swaps) and a “liquidity as a service” ethos, Cetus is helping shape Sui into a vibrant, interconnected DeFi landscape.

About Cetus Protocol

Cetus Protocol is a pioneering decentralized exchange (DEX) and concentrated liquidity AMM built on the Sui network (and also deployed on Aptos). Launched as one of the first DEXs in Sui’s DeFi landscape, Cetus serves as a crucial liquidity hub and infrastructure component for the network. Its mission is to provide a powerful, flexible liquidity network that makes on-chain trading efficient for all users and assets.

In practice, Cetus offers a hub of DeFi tools – from high-capacity swap pools with concentrated liquidity to a built-in aggregator and launchpad – all designed to maximize liquidity utilization and enhance user experience.

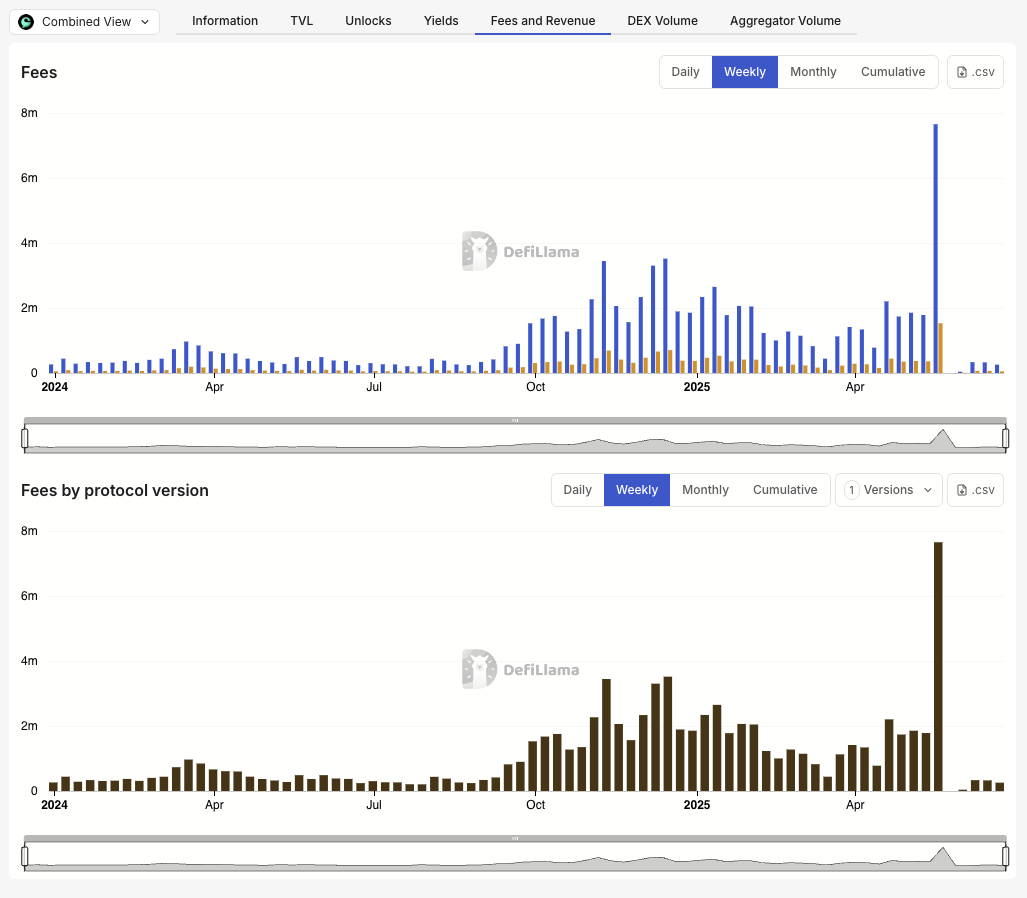

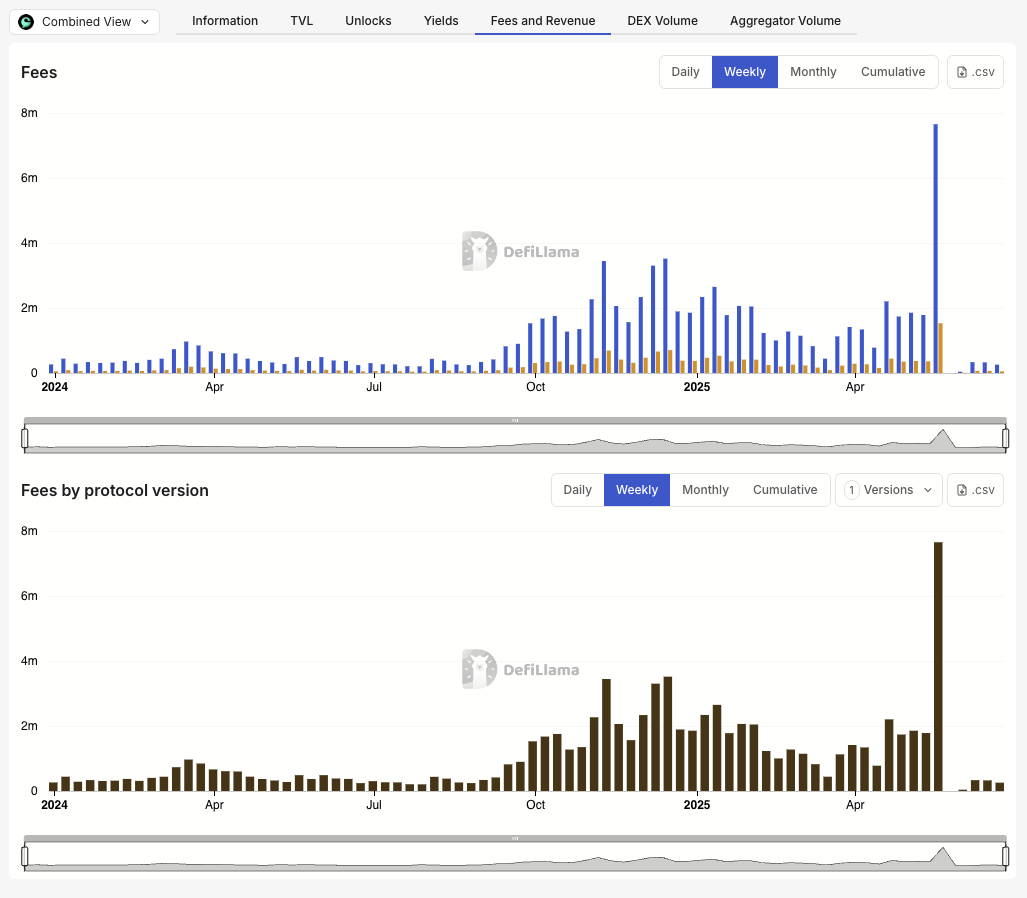

Source: DefiLlama

As the leading DEX on Sui, Cetus plays a pivotal role in the ecosystem. It enables deep liquidity for native tokens on the Sui ecosystem, allowing traders to swap with low slippage and enabling new projects to bootstrap liquidity via its pools and Asset Launch launchpad. In essence, Cetus has become a background DeFi protocol on Sui, simplifying on-chain trading and attracting a growing user base with its innovative features.

Notably, Cetus is more than a single DEX – it’s a suite of interoperable modules within Sui’s DeFi. For example, its “Super Aggregator” feature sources liquidity from all major Sui venues to ensure users get the best prices.

Its Intent Trading module enables advanced order types such as on-chain limit orders and automated dollar-cost averaging (DCA) directly through smart contracts. This extensible, “Liquidity as a Service” approach means other developers and dApps can easily integrate Cetus’s liquidity and even build on top of it via SDKs.

Overall, Cetus’s comprehensive toolkit and deep liquidity have made it an indispensable component of Sui’s emerging DeFi ecosystem.

Adoption and Growth Metrics

Since launch, Cetus Protocol has gained significant traction on Sui, underpinning its importance in the network’s growth. As of mid-2025, Cetus has amassed over $236 million in total value locked (TVL) (mostly on Sui network), making it the largest DeFi protocol on the chain.

Stage 2: Back to the Top 5 DEX Aggregator list of all chains by daily volume. 💥#Cetus 🐳 pic.twitter.com/ROvzYGG0AY

— Cetus🐳 (@CetusProtocol) June 25, 2025

Daily trading volumes often reach hundreds of millions of dollars (e.g. ~$295M in 24h volume), reflecting high usage and liquidity depth. Cumulatively, Cetus has facilitated more than $57 billion in trading volume across 144 million trades – an impressive scale for a relatively new blockchain. The platform has also engaged a broad user base, with over 15 million on-chain accounts interacting with Cetus’s pools or swaps.

These data underscore Cetus’s dominance on Sui. Even after a challenging security incident in May 2025, Cetus demonstrated resilience by quickly relaunching and restoring liquidity with community and Sui Foundation support.

Within weeks, over 50% of the lost TVL was restored (~$120M) and Cetus regained its position as the top DEX on Sui. The Sui community even approved an on-chain upgrade to freeze and recover the stolen funds, highlighting the ecosystem’s commitment to Cetus’s stability.

Source: Sui

By mid-2025, TVL of Cetus climbed back above pre-exploit levels, reflecting strong user trust and sustained growth. In summary, Cetus Protocol has become the de facto liquidity base for Sui’s DeFi, with robust usage statistics and a roadmap aimed at further expanding the Sui-Aptos Move-based DeFi universe.

Within just 48 hours, the Sui community united to pass a critical on-chain vote — marking a pivotal moment for the entire ecosystem. Cetus extends our deepest gratitude to the >90% of validators and stakers who voted in favor. Regardless of your stance, your participation… https://t.co/UN2DrlDRTw

— Cetus🐳 (@CetusProtocol) May 29, 2025

Technical Analysis of Cetus Protocol

Smart Contract Architecture on Sui (Move-Based Design)

Cetus Protocol is built on a set of autonomous smart contracts deployed on the Sui network (also on Aptos), implementing an Automated Market Maker (AMM) optimized for Sui’s object-centric model. Unlike Ethereum’s account-based system, Sui treats assets and contract states as objects, enabling parallel execution and granular control.

Cetus leverages this by minting each liquidity position as a unique NFT (called Position NFT), recording details like token pair, tick range, and liquidity amount. These NFTs act as proof of ownership and can be transferred or staked in other contracts, enhancing composability.

Inspired by Uniswap v3 architecture, this design is made safer on Sui thanks to Move’s strict resource control, which prevents duplication or loss. Cetus also uses a factory-contract architecture where a central Factory deploys Pool contracts for each token pair and fee tier. Each Pool operates independently, allowing multiple trades and liquidity actions to be processed simultaneously—boosting throughput and lowering latency.

Move’s safety features help with reliable accounting of tokens and predictable behavior, even under complex interactions. By fully embracing Sui’s unique architecture, Cetus delivers a secure, high-performance AMM framework that supports scalable, efficient DeFi infrastructure on-chain.

Concentrated Liquidity AMM Design (CLMM Mechanics)

Cetus Protocol uses a Concentrated Liquidity Market Maker (CLMM) model to maximize capital efficiency. Unlike traditional AMMs that spread liquidity across an infinite price range, Cetus allows LPs to focus liquidity within a specific range, making their capital more effective and earning higher fees. For example, in a USDC/USDT pool, an LP can target a tight range like 0.995–1.005, ensuring most trades use their liquidity.

As the market price moves outside this range, the position becomes inactive but remains intact until re-entered. LPs can open multiple positions across a variety of ranges to implement custom strategies. Cetus uses a tick-based system for price granularity, with pools offering six fee tiers (0.01% to 2%). Each tier corresponds to a separate pool, letting the market self-select between low-slippage swaps or higher rewards for volatile assets.

A key feature is range orders, which function as on-chain limit orders. LPs can provide liquidity on one side of the price (e.g., only token A) and effectively “sell high” or “buy low” while earning swap fees. This combines automated trading with capital efficiency. Overall, Cetus offers a CEX-like experience in a fully decentralized setup, enabling deep liquidity, efficient swaps, and advanced strategies.

Source: Cetus

Cetus Fee Structure and Optimization Mechanisms

Every swap on Cetus incurs a fee based on the pool’s tier (e.g., 0.05%), with 80% going to active LPs and 20% to the protocol treasury. Fees are distributed only to LPs whose ranges include the current price, rewarding those providing real liquidity. LPs can choose from six fee tiers ranging from 0.01% to 2%, allowing pools to self-regulate: low-fee tiers attract volume for stable pairs, while higher tiers compensate for riskier assets.

Unlike typical DEXs that reward liquidity size, Cetus uses a fee-based liquidity mining model. The CETUS tokens are fairly distributed based on the actual fees a position generates. This discourages idle capital and ensures incentives go to productive LPs, improving capital efficiency and reducing unnecessary emissions.

Source: DefiLlama

To simplify liquidity management, Cetus provides Vaults that automate rebalancing and fee compounding. Its Intent Trading module enables automated strategies like DCA or limit orders, executed fully on-chain. Sui’s low-cost, high-speed infrastructure makes these advanced features feasible.

Lastly, Cetus includes a Swap Aggregator, sourcing liquidity from all Sui DEXs to ensure best execution. This allows users to trade seamlessly across the Sui ecosystem with minimal slippage, reinforcing Cetus’s position as the leading trading venue on Sui.

Oracle Functionality and Cross-Chain Integration

Cetus Protocol extends beyond being a DEX by offering built-in oracle and cross-chain features. Its concentrated liquidity pools serve as on-chain price oracles, recording swap-based price data and enabling time-weighted average price (TWAP) queries.

Developers can access this data source directly from pool contracts to derive reliable, manipulation-resistant price feeds—ideal for use in lending protocols or automated strategies on Sui. This removes reliance on external oracles, lowering integration costs and risks.

Source: Cetus

Cetus is also inherently multi-chain, supporting asset transfers between Sui, Aptos, and 20+ networks via the Wormhole bridge. Though Cetus doesn’t custody bridged assets, it provides an interface for users to move tokens such as USDC and CETUS across chains. While bridge-related risks exist, integrations with Wormhole and Axelar highlight Cetus’s commitment to multichain liquidity.

Its architecture also aligns closely with Sui’s parallel execution and object-centric model. Projects can reference Cetus pool objects or integrate directly via SDKs, making Cetus a foundational liquidity layer. Developers can offer token incentives/rewards to customized pools, creating composable DeFi use cases. Altogether, Cetus combines high-performance AMM design with oracle tools, multichain access, and developer-friendly integrations—positioning it as a core infrastructure protocol on Sui.

CETUS Tokenomics and Incentives

A deep dive into the Cetus Protocol would be incomplete without examining its tokenomics. The project provides a dual-token model:

These tokens are central to the protocol’s incentive structure, governance mechanism, and long-term sustainability strategy.

Source: Cetus

CETUS Token Utility and Governance Role

CETUS token is designed to facilitate and incentivize participation in the Cetus DeFi ecosystem, rather than act as a general-purpose currency. Holding CETUS does not confer ownership or revenue rights in a legal sense, but it does entitle holders to partake in protocol governance and benefit from the protocol’s growth through utility features.

It’s worth emphasizing that CETUS is not a revenue share token in a direct sense – protocol fees collected do not automatically flow to CETUS holders. However, the protocol’s model uses those fees for sustaining rewards (e.g. buyback or funding incentives) and insurance, which indirectly benefits the community and can support the token’s value.

The economic logic is that CETUS incentivizes user participation (liquidity, volume, etc.), which grows the platform, generates fees, then used to further reward users and enhance the platform, creating a positive feedback loop.

Source: Coingecko

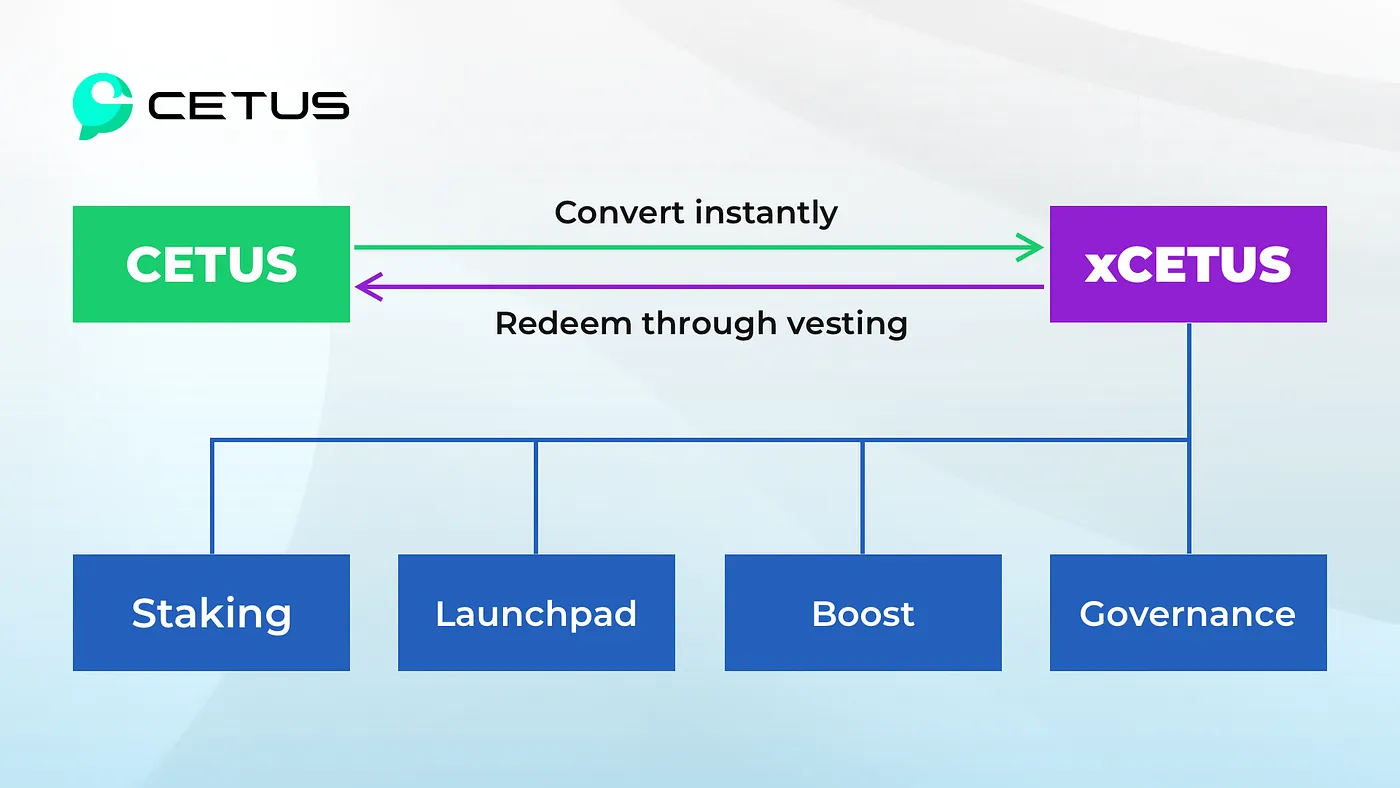

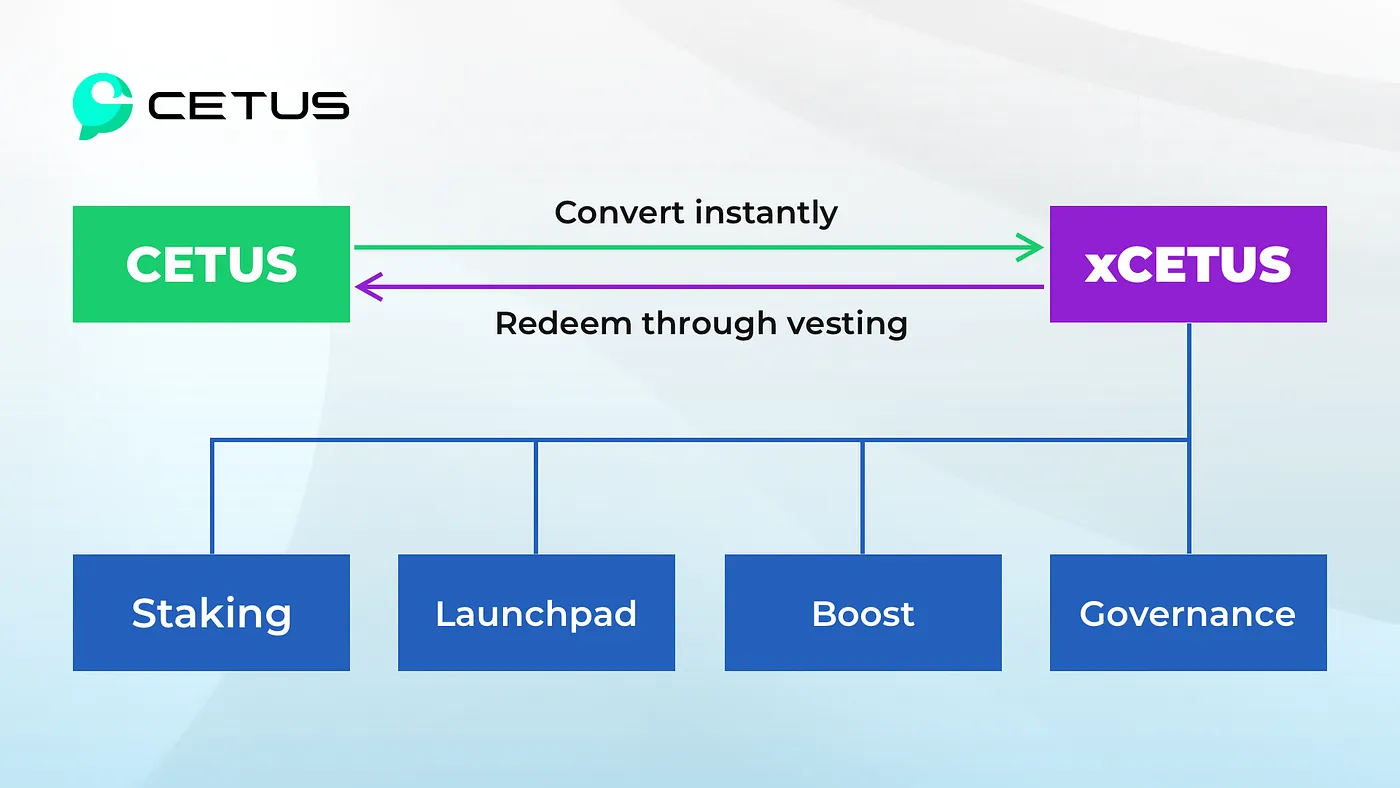

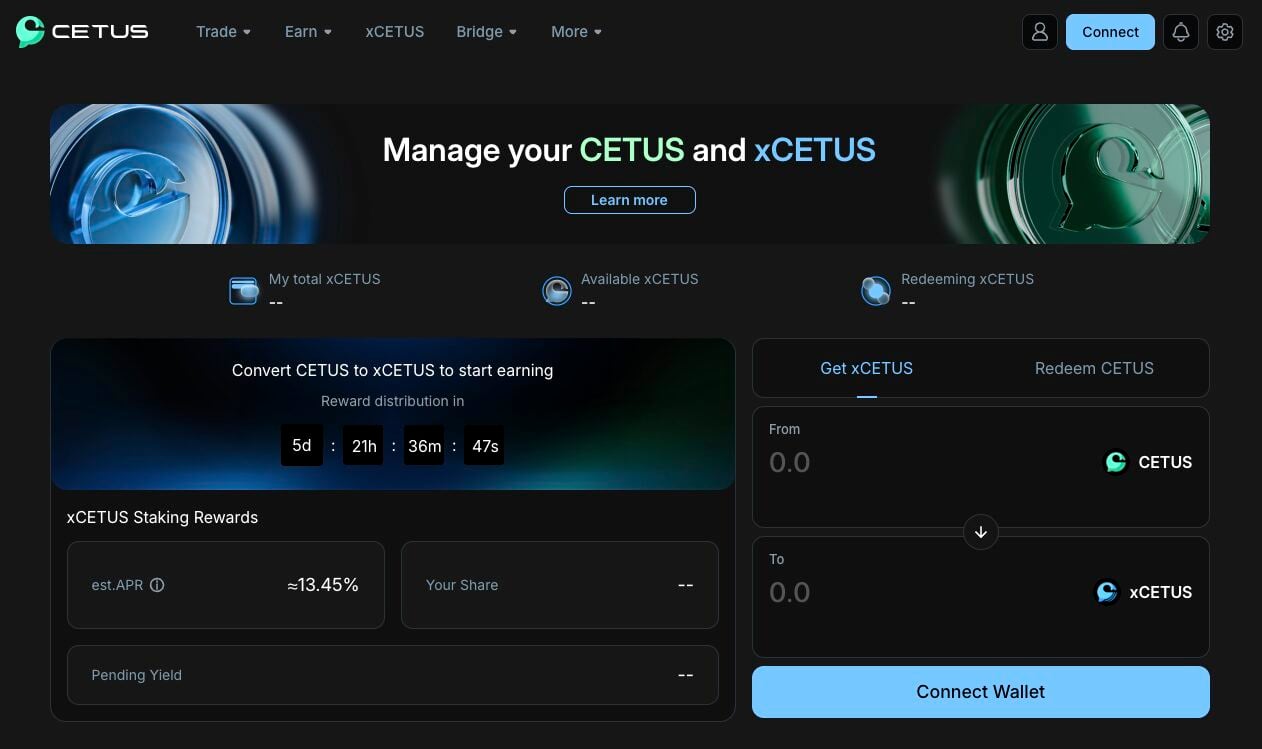

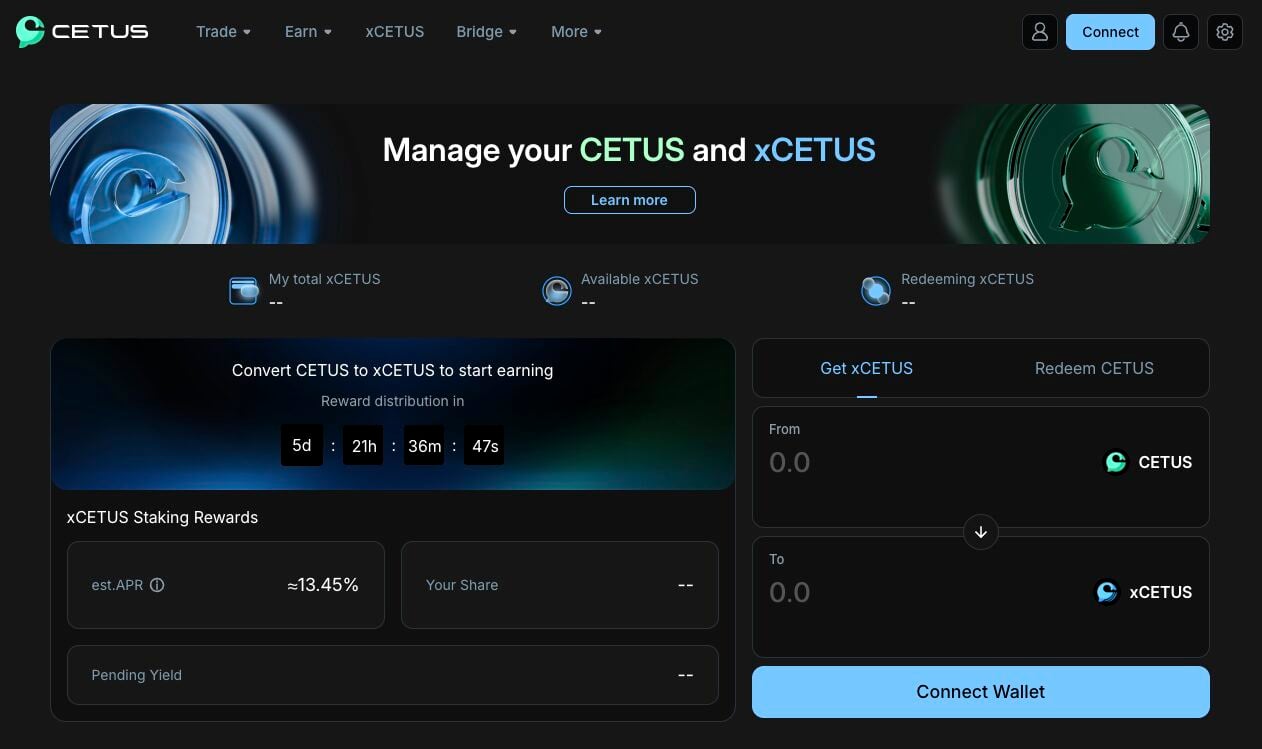

xCETUS: Staked Escrowed Token and Governance

To promote long-term alignment and decentralized governance, Cetus uses an escrowed token model: xCETUS. When users stake (lock) their CETUS, they receive a non-transferable xCETUS token at a 1:1 rate initially.

xCETUS represents voting power and loyalty status within the protocol. The design is similar to vote-escrow models (like Curve’s veToken concept) but with a flexible twist: users can choose how long to vest if they want to convert back to CETUS.

Key aspects of xCETUS:

- Instant Conversion: Users stake CETUS anytime to receive xCETUS at a 1:1 rate with no lock-in. While staked, users retain full governance rights and access to loyalty benefits.

- Governance Power: Only actively held xCETUS counts for voting. If xCETUS is in redemption, it loses voting power—preventing governance manipulation by existing users.

- Redemption Mechanics: Users choose a vesting period (15 to 180 days).

- Cancel Anytime: Pending redemptions can be canceled before completion to regain xCETUS.

- Loyalty Utility: xCETUS levels up user tiers, unlocking perks like better Launchpad allocations or fee benefits.

- Ecosystem Role: xCETUS governs mining rewards, fee settings, and treasury use. Holding it may also boost access to exclusive token sales.

Source: Cetus

The xCETUS model is powerful. It aligns with long-term participation, allowing immediate governance participation but delaying full value until exit. This model is more flexible than a fixed multi-year lock. Users choose their lock time when exiting, trading time for value. Those who remain staked support the protocol’s stability and avoid token loss. Any collected penalties strengthen Cetus’s financial situation.

From a governance perspective, xCETUS holders will vote on proposals once Cetus DAO is fully on-chain. Additionally, xCETUS links to Launchpad participation. When new projects launch tokens via Cetus’s Asset Launch, xCETUS amounts determine users’ whitelist eligibility or allocation size. This adds a direct economic benefit to holding xCETUS, potentially providing access to lucrative token sales for emerging Sui projects.

Source: Cetus

Overall, the CETUS/xCETUS tokenomics are geared towards sustainable, long-term growth: CETUS incentivizes user activity and liquidity provision; xCETUS encourages holding and aligned governance; the dual model rewards genuine contributors and disincentivizes mercenary capital.

For more: Sui Deep Dive: A Comprehensive Analysis

Cetus in the Sui Ecosystem

Cetus Protocol plays a pivotal role in the Sui ecosystem as its primary liquidity engine and DeFi infrastructure layer. As the first and most dominant DEX on Sui, Cetus enables deep, efficient, and flexible trading through its concentrated liquidity AMM model, which drastically improves capital efficiency and reduces slippage for users.

This design makes Cetus the default venue for token swaps, liquidity provisioning, and price discovery across the network. More than just a DEX, Cetus acts as a modular building block for Sui-based applications. In short, Cetus is the liquidity backbone, oracle layer, and governance gateway of the Sui blockchain.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  Canton

Canton  Uniswap

Uniswap  PayPal USD

PayPal USD  Mantle

Mantle  Cronos

Cronos  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Aave

Aave  Rain

Rain  Bitget Token

Bitget Token