Solana trading platform is any decentralized exchange (DEX), centralized exchange (CEX), broker, or peer-to-peer (P2P) platform that helps users buy and sell SOL, the native cryptocurrency of the Solana blockchain, and other Solana-based digital assets. Due to Solana’s energy efficiency, low transaction costs, scalability, and high speed, it has become increasingly popular in the crypto realm for building decentralized applications (DApps), Web3 infrastructure, blockchain games, metaverses, and non-fungible token (NFT) marketplaces. As a result, the demand for SOL has soared.

In this comprehensive guide, we have reviewed the best platforms for Solana trading. We shall also walk you through the types of Solana trading platforms, how to buy and trade SOL, and associated fees.

Comparison of Top Solana Exchanges

| Solana Exchange | Supported Coins | Trading Fees (Maker/Taker) | Solana Staking | Maximum leverage | Payment methods |

| Binance | 491 | 0.01%/0.03% | Yes | Up to 125x | Bank transfer, credit/debit card, Google Pay, Apple Pay, and 100+ local and global payment methods. |

| Bitget | 755 | 0.02%/0.06% | Yes | Up to 125x | Bank transfer, credit/debit card, and third-party gateways like Simplex, Banxa, etc. |

| Bybit | 719 | 0.1%/0.1% | Yes | Up to 200x | Bank transfer, credit/debit card, and multiple third-party gateways. |

| Coinbase | 297 | 0.4%/0.6% | Yes | Up to 20x | Bank transfer, debit card, Paypal |

| Gemini | 82 | 0.20%/ 0.40% | Yes | Up to 100x | Bank transfer, debit card, Apple Pay, and Google Pay |

| Kraken | 507 | 0.25%/0.40% | Yes | Up to 5x | FedWire, SEPA, and SWIFT Transfers, ACH transfer in the US, credit/debit card |

| Kucoin | 944 | 0.1%/0.1% | Yes | Up to 125x | Credit/debit card, Simplex, Banxa, and 70+ payment options |

| MEXC | 2267 | 0.00%/ 0.05% | Yes | Up to 500x | Credit/Debit cards, and third-party payment providers like Moonpay, Banxa, and Mercuryo. |

| OKX | 350 | 0.08%/0.1% | Yes | Up to 125x | Bank transfers, credit/debit card, and e-wallets like Skrill and Revolut. |

Best Platforms for Trading Solana: Detailed Review

1. Binance

Binance is the largest cryptocurrency exchange based on trading volumes, liquidity, and online traffic. It operates in over 100 countries and supports more than 600 cryptocurrencies, including Solana.

Apart from spot trading of cryptos, Binance facilitates trading in United States Dollar Coin (USDC)-M futures and Coin-M futures. The former is settled in USDC and USD Tether (USDT), while the latter is settled in cryptocurrencies. The centralized exchange also offers USDT options with limited downside risks.

With its robust security features such as two-factor authentication (2FA), stringent data privacy controls, cold storage, and Secure Asset Fund for Users (SAFU), Binance has emerged as a trustworthy platform for trading cryptocurrencies.

If you want to grow your crypto wealth through passive income, Binance Smart Earn offers a wide range of innovative products, such as dual investment, on-chain yields, smart arbitrage, and principal-protected instruments.

Additionally, Solana holders can unlock liquidity through SOL staking, a user-friendly offering with lower barriers and minimum requirements. When you stake Solana, you get BNSOL. It is a tokenized, tradable, and transferable representation of your staked SOL plus rewards earned.

With BNSOL, you can sell, transfer, and utilize your staked position, instead of locking your digital assets and incurring opportunity costs. Users can even move BNSOL into their personal wallets and use it in other products, DeFi applications, or outside Binance while continuing to accumulate rewards.

Other notable features of Binance include comprehensive learning resources for both novice and professional crypto traders, customized taxation reports, low transaction costs, and lightning-fast speed.

Key Features

- Supports numerous digital assets, including altcoins, stablecoins, meme coins, and tokens.

- Facilitates contactless and borderless transactions using secure payment technologies.

- Offers gift cards or prepaid vouchers that can be used to send, receive, deposit, withdraw, and transfer cryptocurrencies.

- Enables users to earn up to 40% commission through its referral program.

- Provides investors with overcollateralized flexible loans for spot, margin, and futures trading.

- 24/7 customer support via live chat.

2. Bitget

Bitget is another leading exchange that offers advanced trading features and a user-friendly interface. It has 120 million registered users across 150 countries and supports 140+ fiat currencies, 550+ cryptocurrencies, and 100+ blockchains. It is also the top-ranked platform for copy trading – a strategy where users emulate the trades of experts.

With state-of-the-art security measures comprising proof-of-reserves (PoR), a protection fund of over $672 million, and multi-signature cold storage wallets, Bitget is conducive for buying, selling, and storing Solana and other digital assets.

For USDT-M futures trading, the exchange allows traders to use SOL holdings or assets other than Tether as margin. The margined asset’s valuation is adjusted based on the haircut rate, which is the difference between the asset’s actual worth and its perceived value as collateral.

If you want to engage in leveraged trading of Solana, Bitget helps optimize your risks by automatically closing the position once your maintenance margin rate (MMR) crosses a pre-defined stop-loss threshold.

Lastly, Bitget’s efficient matching engine, cross-chain swapping functionality, and a safe multi-chain Web3 wallet enhance users’ trading experiences.

Key Features

- Lends customized premier loans of up to $10 million with flexible terms and accepts 300+ coins as collateral for borrowings.

- Offers capital-guaranteed structured wealth products like Shark Fin that combine fixed-income instruments with financial derivatives to generate a high annual percentage rate (APR) of up to 9%.

- Helps users maximize earnings using a plethora of intelligent bots such as spot grid, spot martingale, futures grid, and futures martingale.

- Imposes low fees for Solana futures trading.

- Prevents auto-liquidation of open positions by helping users set stop-loss orders.

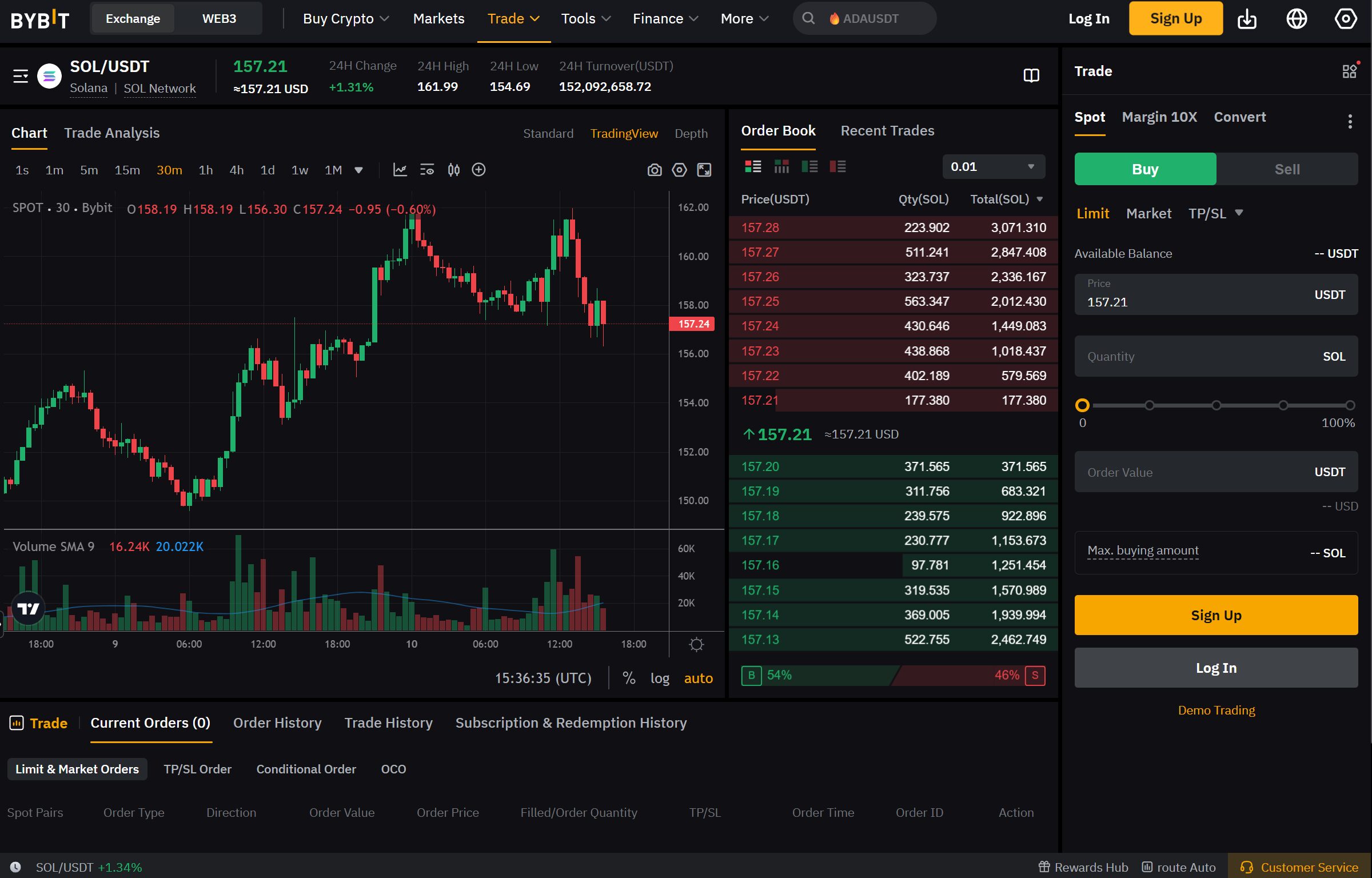

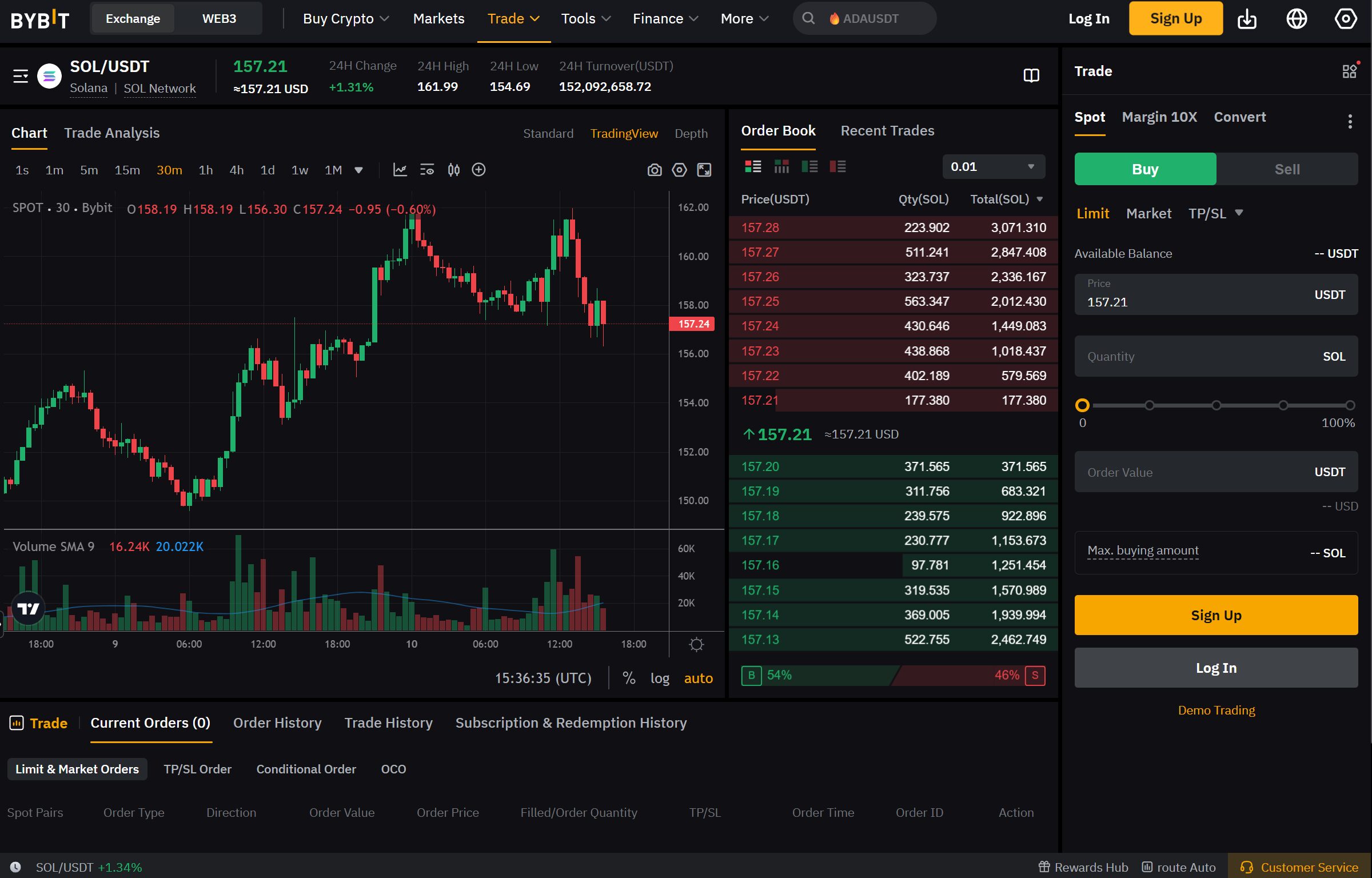

3. Bybit

Bybit is the second-largest crypto exchange with average trading volumes of $36 billion and a user base of over 60 million across 190+ nations. It has steadily emerged as a Crypto Ark, a bridge between real-world and digital assets, built on the three pillars of trading and investments, web3, and technology.

Users looking to buy and sell sizeable amounts of SOL can use Bybit’s peer-to-peer (P2P) platform. It supports large transactions, offers a competitive exchange rate for 65+ fiat currencies and 100+ cryptocurrencies, and levies zero trading fees. For customizable P2P trades, Bybit provides secure escrow accounts and conducts a risk-control review of suspicious transactions before processing them.

Overall, the Bybit ecosystem has robust security features such as PoR and whitelisting to prevent users’ assets from being withdrawn into unwhitelisted accounts. The platform also gives you an option to use third-party custodian partners for off-exchange settlements.

If you want to schedule regular purchases of SOL using dollar cost averaging (DCA), optimize fund allocation, customize recurring buy plans, and generate long-term returns on Solana holdings, you can use Bybit’s auto-invest functionality.

Bybit also offers margin-staked SOL, enabling traders to maximize Solana earnings with margined borrowings. The platform distributes staked and borrowed SOL across multiple validators to enhance network security. In return, you get bbSOL – Bybit’s liquid staking token that can be redeemed for more SOL. As Sanctum’s smart contract automatically allocates staked assets to various nodes, your bbSOL steadily grows in value.

For institutional Solana traders, Bybit offers custodial trading, enabling them to entrust their funds to the exchange’s team for asset management. It also allows them to use well-known trading strategies via 200+ Application Programming Interface (API) brokers.

Key Features:

- Provides 600+ payment options for buying cryptocurrencies.

- Offers 24/7 multi-lingual customer support.

- Supports 600+ cryptocurrencies and 900+ trading pairs.

- Handles gas fees and interest distribution for institutional investors opting for on-chain staking.

- Calculates portfolio risk using stress testing by enabling the portfolio margin mode in the unified trading account.

- Helps users earn up to 8% APR on idle funds, 2%-10% cashback on each spend, and withdraw up to $100 for free, using the Bybit card.

4. Coinbase

Coinbase is a reputable platform, offering users a seamless trading experience and powerful infrastructure for on-chain transactions. With assets worth $130 billion, a $393 billion quarterly trading volume, presence in 100+ countries, and over 105 million registered users, Coinbase is the largest public crypto company based in the United States.

It allows institutional and retail traders to buy and sell 70+ cryptocurrencies and invest in myriad digital assets through Coinbase Prime. For experienced traders, Coinbase offers advanced trading tools, deep liquidity, and real-time order books. Under Coinbase Advanced, trading experts can avail of additional benefits such as 0.00% maker and taker fees, up to 12% USDC rewards on perpetual futures portfolio, access to 550+ spot trading pairs (230+ USDC pairs and 22 stable pairs), and a TradingView-powered advanced charting tool.

Additionally, Coinbase has implemented ultra-modern security measures like 2FA, mobile metrics, PoR, allowlist, and Yubikey support. It also safeguards digital assets at scale with powerful encryption, multi-factor controls, air-gapped cold storage, and multi-party computation (MPC). By distributing the key shares across multiple secure environments, the exchange ensures keys are not idle, in use, or assembled.

Another outstanding feature of Coinbase is its self-custody wallet, enabling crypto traders to take control of their data, assets, and keys. It helps you safe-keep Solana and other cryptos, NFTs, and on-chain DeFi positions in one place. It also allows you to buy, sell, trade, send, and stake cryptocurrencies effortlessly.

Through the Coinbase mobile application, Solana lovers can stake SOL to earn an average APY of up to 5.54%. It saves time in running a node on your hardware, synchronizing it with the Solana blockchain, and funding the node to meet minimum thresholds.

You can also avail of the Coinbase One membership to reap exclusive benefits such as priority support, zero trading fees, pre-filled tax forms, boosted staking rewards, etc.

Lastly, Coinbase’s compliance program combines best practices from traditional finance with advanced technologies to create robust frameworks that help serve clients across multiple jurisdictions seamlessly.

Key Features

- Enables crypto transactions using bank accounts, debit and credit cards, and multiple local and digital payment methods.

- Helps users earn USDC rewards on the Coinbase wallet and simplifies backups with passkeys.

- Protects assets with Coinbase vault storage that combines cold storage with physical security, stringent process controls, and consensus computations.

- Helps businesses access verified liquidity pools that adhere to institutional Know Your Customer (KYC) and Anti-Money Laundering (AML) norms.

- Provides non-custodial access to multiple assets across Solana, Ethereum, Base, and EVM networks.

- 24/7/365 operation and scale.

- Comprehensive learning library.

- Supports 40+ blockchains.

5. Gemini

Gemini is the best exchange for SOL traders who prefer trading or swapping a limited number of crypto assets. Gemini’s ActiveTrader is a high-performance, customizable platform with advanced trading features and integrated charting tools. It offers high speed and stability along with multiple order types and execution options.

For providing high liquidity, Gemini combines USD and GUSD, a regulated stablecoin issued by the exchange and pegged 1:1 to the US Dollar. It also maintains central limit order books based on the price-time priority model.

Additionally, Gemini provides a streamlined trading view through a consolidated, user-friendly interface. Users can set recurring buys or dynamic price alerts, and download account statements and transaction histories. The platform also ensures that withdrawals go to approved addresses only.

If you want to earn more rewards on your staked SOL, you can opt for Gemini Staking Pro. Unlike regular staking, where rewards are shared proportionally among network participants, under Staking Pro, rewards are stored in a segregated address and not shared with anyone. You also get access to information on dedicated validators and reward payments.

In terms of user security, Gemini is the pioneer crypto-native platform to achieve both Systems and Organization Controls (SOC) Type 1 and Type 2 certifications. It is also ISO 27001-certified and conducts penetration testing annually to ensure transparency, safety, compliance, and integrity in the Gemini ecosystem.

For Solana buffs interested in derivatives trading, Gemini’s SOL/GUSD perpetual contracts are an attractive option. They help traders gain a custody-free exposure to Solana’s price. These contracts have no expiration dates and possess high average execution times.

If you want to reduce your exposure to a single crypto, you can even invest in Gemini’s index perpetuals, a basket of crypto assets. These contracts have Kaiko indices as the underlying asset.

With a cross-collateral enabled account, you can pledge USDT, Bitcoin(BTC), or Ethereum(ETH) as collateral to trade derivatives. If cross-collateralization is not enabled, you can directly transfer Singapore Dollar(SGD), USD, or USDC into the derivatives account, which will be auto-converted into GUSD.

Key Features

- Supports 70+ cryptocurrencies and 100+ trading pairs.

- Equipped with an auto-liquidate feature that automatically closes users’ positions if the risk is high compared to the fund balances in their accounts.

- Facilitates cross-collateralization of digital assets to improve capital efficiency and flexibility.

- Provides a pre-built price converter tool that helps users see the value of their Solana holdings in another cryptocurrency beforehand.

- Provides up to 100x leverage for perpetual contracts.

6. KuCoin

Kucoin is the top-ranked exchange in terms of globalization, as it operates in 200+ countries. It aims to leverage the power of blockchain technology to stimulate a free flow of digital value globally. It supports 48+ fiat currencies, 750+ assets, and 900+ coins.

The exchange offers advanced trading tools and facilitates a seamless conversion of base currencies like USDT into other cryptocurrencies like Solana. With Kucoin, you can discover the best exchange rates, incur no hidden trading costs, and enjoy faster settlements. You can also borrow, repay, trade, and leverage your crypto holdings with margin trading.

Through Kucoin’s P2P platform, users can buy Solana directly from merchants and other customers with as little as 1 USDT. Each P2P transaction is protected by escrow services. Buying SOL on Kucoin is also more convenient as the platform supports 70+ versatile payment methods, including Visa, Mastercard, fiat deposits, and SEPA (Single Euro Payments Area).

Kucoin also lays a strong emphasis on security with advanced features like encrypted asset storage, quick detection of cyber attacks, potent account safety, and PoR, which confirms that Kucoin has enough funds to cover all the user assets recorded in its books. Moreover, Kucoin’s Insurance Fund protects every futures transaction and provides high liquidity for perpetual cum delivery contracts.

You can also enable the futures cross-margin mode for hedging and maximizing the usage of account funds with no risk limits, frequent transfers, or manual positional adjustments.

If you are a newbie, Kucoin’s automated trading bots are helpful. Futures grid bots automate the execution of long and short trading strategies to make profits from market fluctuations. Spot Martingale reduces volatility by buying in stages but selling at once. Smart rebalance helps build a risk-optimized portfolio, while dollar-cost averaging (DCA) helps make gains from regular investments. Spot grids manage market vagaries by buying low and selling high. For experienced traders interested in Solana derivative trading, you can choose to invest in USDT and USDC-settled linear margined contracts or coin-settled inverse contracts.

Key Features

- 24/7 customer support in 20+ languages.

- 412+ tradeable futures contracts.

- Feature-rich order management and trading systems to optimize risks.

- Sophisticated order-matching engine for high-performance needs.

- Allows users to buy leverage tokens without loans or liquidation.

- Offers structured products like dual investments for Solana.

7. Kraken

Kraken is the leading crypto exchange in Europe, with a 35% market share and a 9 million client base across 190+ countries. It is best-suited for Solana enthusiasts looking for margin trading, as Kraken has high margin allowance limits, minimal fees, and nominal rollover charges.

With Kraken’s integrated margin trading tool, users can trade with 5x equity leverage. It tracks risks in real time and aids in advanced portfolio management. It also provides profound liquidity and matches margin trades with tight spreads and nominal slippage.

Additionally, Kraken offers flexibility, as investors can go long or short to capitalize on cryptocurrency market movements. It has a transparent fee structure and offers up to 5x leverage in 150+ margin-enabled markets. The exchange helps traders boost their buying and selling power through capital-efficient futures trading. Its cutting-edge advanced analytics tools help users make informed trading decisions by monitoring historical performances and balances.

Through Kraken, you can access 350+ USD perpetual linear futures, hedge price moves, and automatically convert profits into a cryptocurrency of your choice.

For institutional traders and high-net-worth individuals wanting to place large orders of Solana, Kraken offers personalized over-the-counter (OTC) trading services. Clients also get deeper liquidity, tighter spreads, and more secure settlements. Its full suite of OTC capabilities includes automated OTC trading, OTC spot with minimal slippage, and all-around-the-clock settlement. Its OTC derivative offerings comprise options trading and structured products tailored to investors’ objectives.

With Kraken’s Auto Earn, retail traders can earn up to 17% returns annually by staking eligible cryptos like Solana. They can also unstake anytime without incurring penalties.

Kraken Pro is specially designed for experienced traders. It has an all-in-one advanced and user-friendly interface, offering users multiple layouts and 25+ data widgets for customizing the trading experience. Users can also seamlessly switch between spot, margin, and derivative trading. With live cryptocurrency market feeds into the responsive user interface (UI), traders can track performance in real-time.

If you want to make payments directly to a Kraken client, you can choose from 300+ fiat and cryptocurrencies on Kraken Pay.

Lastly, Kraken offers industry-leading security, assisted by a team of cryptography experts who conduct safety checks and run bug bounty programs regularly. It also has 24/7 surveillance systems to safeguard its crypto infrastructure, PoR, and hot and cold wallet solutions to prevent asset losses and improve trading experience.

Key Features

- Request for quote (RFQ) function provides instant access to 150+ asset pairs.

- Allows users to settle transactions through the Kraken account, bank, or external software or hardware wallets.

- Provides all-inclusive bid and offer prices for OTC trades, eliminating additional trading charges.

- Enables traders to buy 421+ cryptocurrencies.

- Helps users set up recurring buys to accumulate cryptos in small increments at periodic intervals.

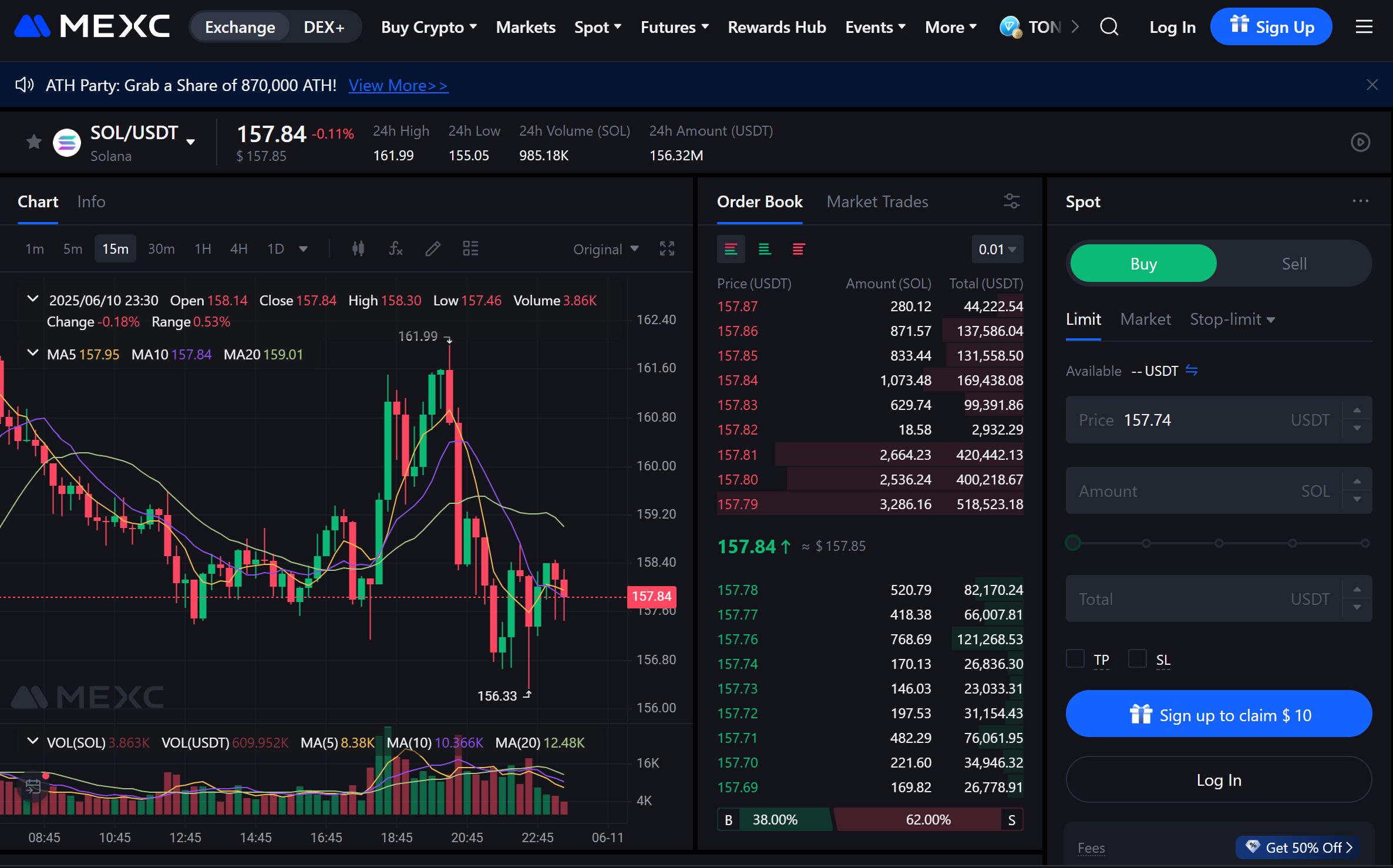

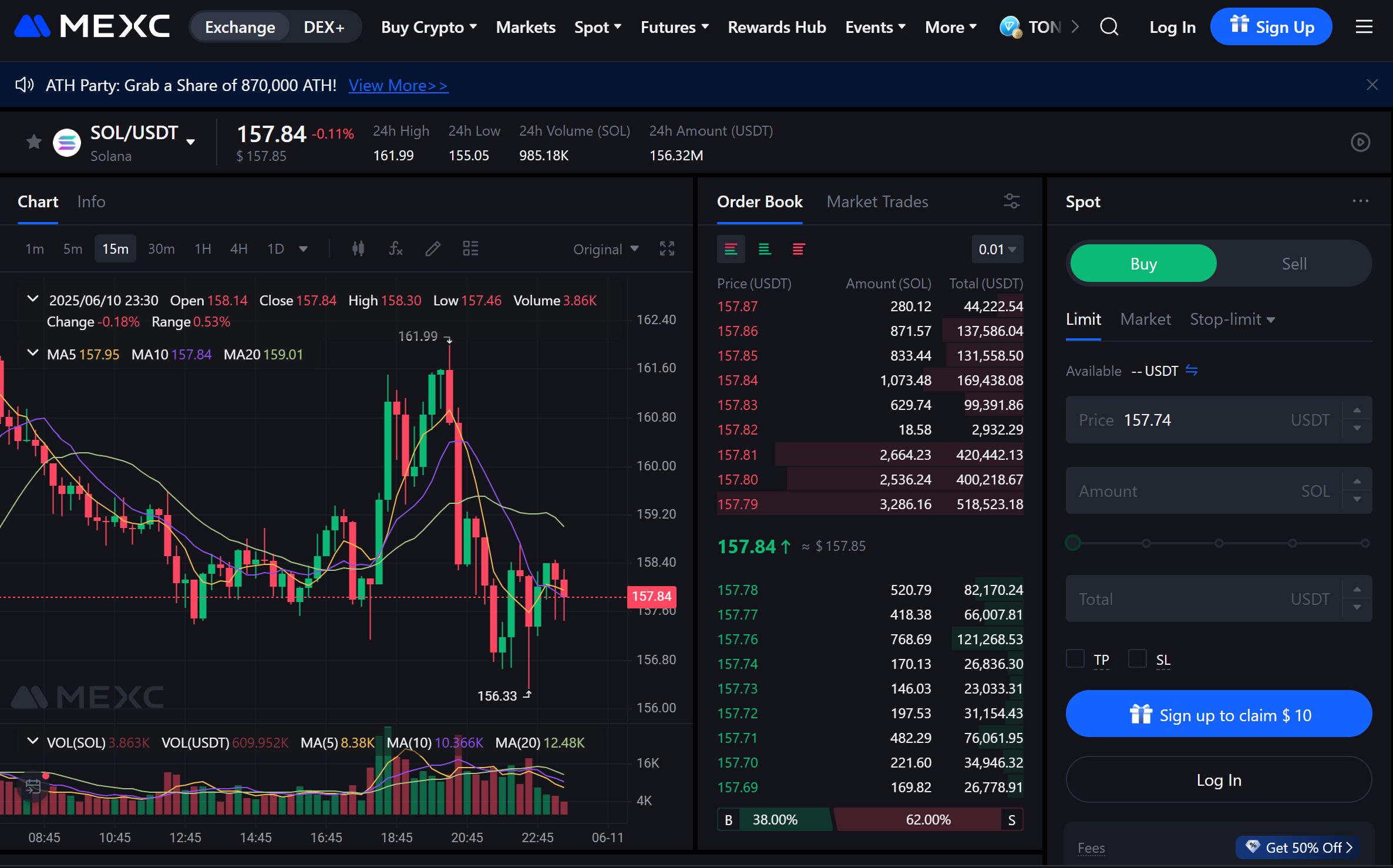

8. MEXC

MEXC is a pioneer in blockchain technology and financial services. It aims to simplify crypto trading and make it accessible to millions worldwide by offering a wide selection of tokens, trading pairs, and futures contracts. It has more than 30 million registered users and operates in 170+ countries.

A unique feature of MEXC is its multi-tier multi-cluster architecture for enhanced security, scalability, and accessibility. Its reserve rates exceed 100%, and it has a futures insurance fund to compensate traders for losses from margin trading. By combining cold storage and hot wallet strategies, MEXC provides an additional safety layer to users’ assets. Plus, the exchange maintains hot wallets with backup private keys to handle emergencies, off-site backups to diversify risks, and an automated risk management system. It also constantly monitors asset risks and immediately compensates traders for losses caused by the platform.

As MEXC supports 50+ fiat currencies and 99+ tokens, you can trade Solana quickly without relying on the order book for matching. The platform charges no fees for crypto swaps and minimizes slippages during the conversion process. The platform also offers holder fee discounts of up to 50% to users who have held a minimum of 500MX in their accounts for at least 24 hours and up to 20% fee deductions on spot and futures trades. Each user gets the higher of the two discounts, not both.

MEXC’s copy trading feature is also commendable. Once you set the copy trade parameters, the system continuously monitors the chosen trader in real-time, enabling you to mirror their trading strategies. Positions are opened and closed automatically.

With MEXC Flexible Savings and MEXC Fixed Savings, you can earn interest on your subscribed or locked assets. For the former, interest is distributed daily, and for the latter, interest may be paid every day or at maturity. Lastly, MEXC loans allow you to pledge one cryptocurrency to secure another for various purposes, such as withdrawals, investing for higher returns, trading, etc.

Key Features:

- Daily airdrops, low fees, and high liquidity.

- Multilingual customer support in 48+ languages.

- Superfast trading engine that processes 1.4 million transactions per second.

- Follows the highest standards of regulatory compliance.

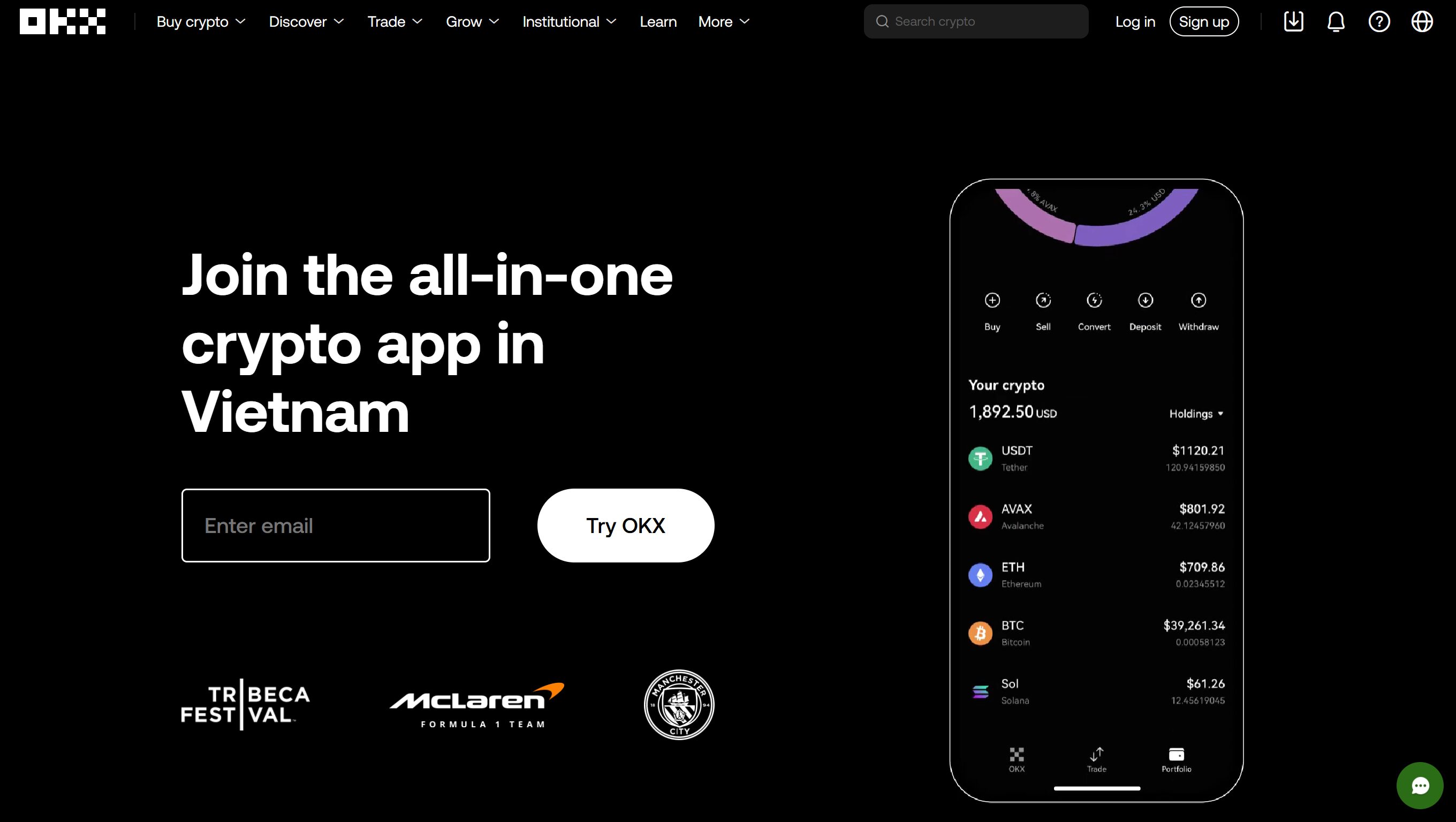

9. OKX

OKX is a crypto exchange known for its low fees, powerful APIs, swift transactions, and advanced financial offerings. It provides crypto earning and trading services to more than 60 million institutional and retail traders based in 180+ countries. It also enables you to trade a diverse range of tokens and trading pairs.

OKX helps traders buy BTC, USDT, SOL, and other altcoins using USD, GBP, EUR, or local currencies instantly. It also supports various payment methods such as Visa, Apple Pay, and Mastercard credit cards.

For trading Solana directly, OKX provides users with a world-class TradingView interface with integrated advanced charting tools. It also enables automated signal trading and helps users research a crypto based on various parameters using the Crypto Screener.

You can also easily convert any crypto asset supported by OKX into SOL or another crypto. The readymade converter displays a competitive rate as soon as you enter the cryptos you intend to swap. You need not worry about price slippages either, as the converter automatically chooses the best exchange rate for the selected cryptos and enables you to complete the swap instantly.

If you’re looking to earn passive income on your SOL holdings, OKX offers many attractive options, including fixed and flexible staking, on-chain decentralized finance (DeFi) staking, and structured products like dual investment and snowball.

Lastly, OKX has progressive security features. It leverages hot and cold wallet systems with multiple backups and approvals. It adopts a multi-signature mechanism to ensure multiple parties verify and sign a transaction. Such intricate checks minimize the risks of insider threat and a single point of compromise. Each transaction also undergoes multiple layers of risk audits to spot suspicious transactions in real-time. Dynamic transaction limits coupled with the authentication of whitelisted addresses bolsters the exchange’s security measures, making it less susceptible to cyberattacks.

Key Features:

- Allows trading in 700+ cryptos and fiat trading pairs in spots, options, and futures markets.

- 99.99% uptime record.

- Offers custodial solutions to store, manage, and protect users’ assets.

- Highly liquid marketplace with RFQ automation and multi-leg strategies

- TradingView integration helps users backtest trading strategies and access technical analysis tools to stay informed on market performance in real-time.

- Maintains a 1:1 reserve ratio, indicating users’ assets are backed 1:1 by real virtual assets.

How to Choose the Best Solana Exchange

Trading Fees

Each exchange levies maker and taker fees for crypto transactions. Some platforms also collect deposit and withdrawal fees. The higher the trading costs, the lower your profitability. Thus, it is imperative to compare the costs across platforms and choose the one with nominal fees, especially if you trade frequently.

All the exchanges mentioned above follow a tier-based fee structure. The higher your trading volume, the higher your tier, and the lower your trading fees. Simply put, fees decrease as you move up the tiers by trading actively.

Liquidity

High liquidity is essential for processing transactions faster, reducing slippages, and maintaining price stability. Deep liquidity also makes it easier for traders to enter and exit positions quickly.

Security Measures

Since security is critical in crypto trading, you must choose platforms that offer robust features such as 2FA, data encryption, cold storage, account whitelisting, PoR, and insurance for user assets.

User Interface

Traders, especially amateurs, require a user-friendly and intuitive interface for trading, enabling them to navigate smoothly. Apart from a responsive UI, traders will also require advanced charting tools, customizable dashboards, and high speed to execute trades faster. Moreover, a complex UI design can cause interruptions and errors in the trading process.

Payment Methods

You should select an exchange that supports multiple global and local payment options, such as fiat or crypto deposits, credit or debit cards, and Automated Clearing House (ACH) transfers. Multiple payment methods ensure flexibility, accessibility, and convenience when funding accounts, withdrawing assets, or transacting across borders.

Accessibility

As most crypto exchanges have limited geographical penetration, it is important to choose a platform that operates in your country. Plus, the platform should be device-agnostic, meaning it should work on desktops, laptops, mobile phones, and tablets efficiently.

Customer Support

As you may face hiccups anytime while trading, you should choose platforms that offer 24/7/365 multilingual customer support via chat, e-mail, or a ticketing system. Additionally, you must assess the support quality, response time, and query-handling process before making a final choice.

Regulation

Crypto exchanges that adhere to local and international laws, as well as KYC or AML standards, foster user trust and enhance the transparency of the trading process. Thus, you must choose legally compliant platforms for trading.

Types of Solana Trading Platforms

Decentralized Exchanges (DEXs)

Decentralized exchanges are P2P marketplaces where crypto traders transact with each other directly. They are an indispensable part of the decentralized finance (DeFI) ecosystem as they foster censorship resistance. Simply put, they do not require a broker, intermediary, or central authority to officiate trades or transactions between two parties. Examples of DEXs that help users trade Solana include Raydium, Orca, and Jupiter.

Centralized Exchanges (CEXs)

Centralized exchanges are platforms or regulated businesses owned and run by private companies. They enable investors to buy, sell, swap, trade, deposit, and withdraw cryptocurrencies.

While some CEXs offer custodial crypto wallets, others provide self-custody wallets, giving you the flexibility to choose based on your preferences.

Unlike DEXs, which allow only crypto-to-crypto conversions, CEXs enable both fiat-to-crypto and crypto-to-crypto swaps. Binance, Coinbase, and Kraken are well-known exchanges that help users trade SOL seamlessly.

Brokerage Platforms

Crypto brokers are platforms that help users buy and sell cryptocurrency CFDs. With crypto CFDs, traders can go long and short on a digital currency. Traders can also take a leveraged position to amplify their exposure to a crypto asset and improve capital efficiency even if the market changes rapidly.

FP Markets, a leading forex broker, enables cryptocurrency CFD trading in Solana for positions against the US Dollar. If you want to trade Solana CFDs without incurring commission costs, Fusion Markets is better.

P2P Exchanges

Peer-to-peer exchanges are decentralized environments where users can buy or sell cryptocurrencies directly from other traders. These platforms serve as intermediaries that match buyer with sellers, but do not secure their funds or digital assets. Many exchanges such as Kucoin, Binance, and Kraken facilitate P2P trading.

How to Buy and Trade Solana?

- Choose a crypto exchange: You can select any crypto exchange, such as Bybit, Kucoin, Kraken, etc., for buying or trading Solana. Binance is the best exchange due to its cutting-edge security features and staggering Solana trading volumes. If you are buying from the United States, Coinbase is better.

- Create an account: Visit the chosen exchange’s official website or download its mobile app. Sign up on the platform by entering basic details such as name, phone number, e-mail, etc., and set up a strong password for your account.

- Complete KYC formalities: Once you register successfully, finish the KYC procedure by uploading a government-issued identity proof such as a passport, national ID card, or driver’s license. For address proof, furnish a utility bill. Completing this step is critical as it helps you stay legally compliant and provides access to a wider range of offerings.

- Choose a payment method to buy Solana: Check the payment options offered by the chosen exchange in your location. Select “SOL” and the suitable payment method before clicking the “Buy Crypto” button.

- Assess the payment details and fees: Confirm the order within a minute, else the exchange will recalculate the order based on the current market price.

- Trade Solana: After buying, you can trade SOL for fiat or other cryptos, based on the platform you have chosen.

How to buy Solana (SOL) through a DEX?

- Select a DEX that supports Solana, like Orca or Raydium.

- Connect a Solana wallet like Phantom or Solflare.

- Click the “Swap” section and enter which currency you want to trade for Solana. Select the chosen currency in the “from” field and SOL in the “To” field.

- Verify and confirm the transaction in your wallet.

Types of Fees When Buying and Selling SOL

- Maker fees: It is the fee traders must pay to the market makers, who provide liquidity to the order book. It is computed as a percentage of the maker’s coin price.

- Taker fees: It is a fee charged by exchanges to traders who place orders that reduce the cryptocurrency market’s liquidity. When a trade is executed at the current market price, some liquidity is removed from the order book. Taker fees is also calculated as a percentage of the coin price, but is slightly higher than the maker fee.

- Withdrawal fees: It is typically a flat fee that traders pay to exchanges to cover the transaction costs of moving a crypto asset out of their registered accounts. In other words, exchanges impose withdrawal fees when you transfer digital assets from the exchange to an external wallet.

- Deposit fees: Most exchanges do not levy deposit fees for topping up your account with cryptocurrencies. However, depending on the payment method you choose, you may have to incur a small fee for fiat deposits.

Conclusion

The Solana network’s unique value proposition lies in its Proof-of-History consensus mechanism, which works in tandem with the Proof-of-Stake system. As a result, the Solana can process thousands of transactions per second at minimal fees, compared to other blockchains, making it a hot choice among traders and developers alike.

You can also trade SOL and potentially profit from the Solana network’s high growth potential. While the above exchanges facilitate smooth SOL trading, it is advisable to check their reputation with the Solana community for valuable insights. Last but not least, trying demo trading with virtual funds in a simulated environment on these platforms can help you determine which exchange best suits your needs.

FAQs

Does Solana have a trading platform?

The Solana network supports smart contracts (executable programs) and decentralized applications, including crypto trading platforms. In the recent past, many platforms like Orca, Raydium, Jupiter, Lifinity, and Drift Protocol have been built on Solana. They help users exchange or trade Solana in a decentralized environment.

Where can I buy Solana (SOL)?

You can buy Solana on CEXs such as Kraken, Kucoin, and OKX, and DEXs like Raydium and Orca. If you want to buy Solana CFDs, you can explore brokerage platforms such as Axi, BlackBull Markets, and ActivTrades. Most platforms, such as Binance and Coinbase, also facilitate P2P trading of Solana.

What is the safest Solana exchange?

Binance is one of the safest Solana exchanges with state-of-the-art security features such as 2FA, SAFU, real-time detection of suspicious transactions, API access controls, cold storage, withdrawal whitelisting, and data encryption. Coinbase also places a strong emphasis on security with features like PoR, 2FA, Yubikey support, multi-factor controls, and offline cold storages.

What is the best Solana trading bot?

GMGN is the best Solana trading bot with AI-powered algorithms for optimized entries and exits in a volatile market, real-time liquidity monitoring, powerful analytics, efficient snipers, and copy trading. It executes trades as per preset parameters and spots 100+ trading opportunities daily, of which 70% yield more than 120% returns.

If you want multi-chain compatibility, hyper-vision to conduct quick audits, limit orders, multi-account trading, or meme coin tracking, BullX is better.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Chainlink

Chainlink  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Hyperliquid

Hyperliquid  Stellar

Stellar  Monero

Monero  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Mantle

Mantle  PayPal USD

PayPal USD  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Polkadot

Polkadot  Aave

Aave  Bittensor

Bittensor  USD1

USD1  Canton

Canton  Rain

Rain