Bitcoin’s price reacted swiftly after the approval of Bitcoin ETFs, surging to new all-time highs as billions in capital flooded into regulated ETF products. These ETFs introduced unprecedented buying pressure by continuously absorbing real Bitcoin from the open market. In this article, we explore how ETF inflows translated into price action, backed by hard data from July 2024 to July 2025. Through analyzing fund flows, institutional demand, and market metrics, we uncover how ETFs have fundamentally reshaped Bitcoin’s price dynamics and its perception as an asset class.

The Launch of Bitcoin ETFs and Early Market Reaction

On January 10, 2024, the approval of spot Bitcoin ETFs in the United States marked a milestone and a step forward for the cryptocurrency markets in general. For years, investors had speculated on whether the U.S. Securities and Exchange Commission (SEC) would ever greenlight a spot-based ETF. Their reluctance finally broke when products from financial giants like BlackRock (IBIT), Fidelity (FBTC), and Ark Invest (ARKB) were allowed to launch.

Unlike Bitcoin futures ETFs, which had been trading since October 2021, spot ETFs hold actual Bitcoin as the underlying asset. This gave traditional financial institutions, retirement funds, hedge funds, and retail investors a regulated and structured path to exposure to Bitcoin. According to Kiplinger and MarketWatch, the move legitimised Bitcoin and catalysed a flood of capital for these new vehicles.

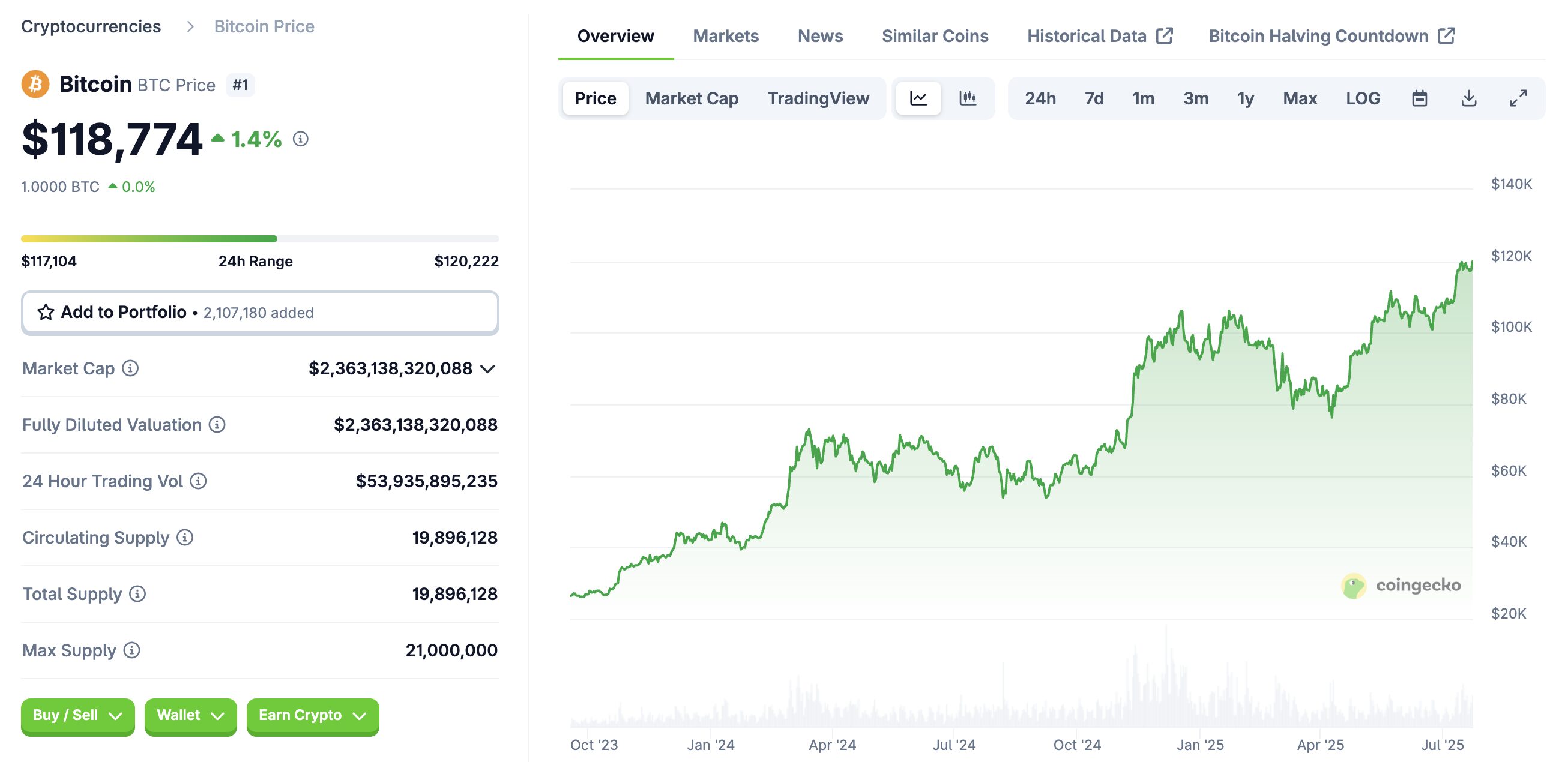

In the days and weeks following the ETF approval, BTC surged from $45,000 to over $73,000 by March 2024. The rally was driven largely by institutional capital flowing into spot ETFs. On-chain data and ETF flow trackers confirmed that ETFs became a dominant force in absorbing available BTC supply, especially during periods of strong demand.

For more: 8 Best Bitcoin ETFs to Buy Right Now

Source: Coingecko

Billions of ETF Inflows Surge and Bitcoin Price Acceleration

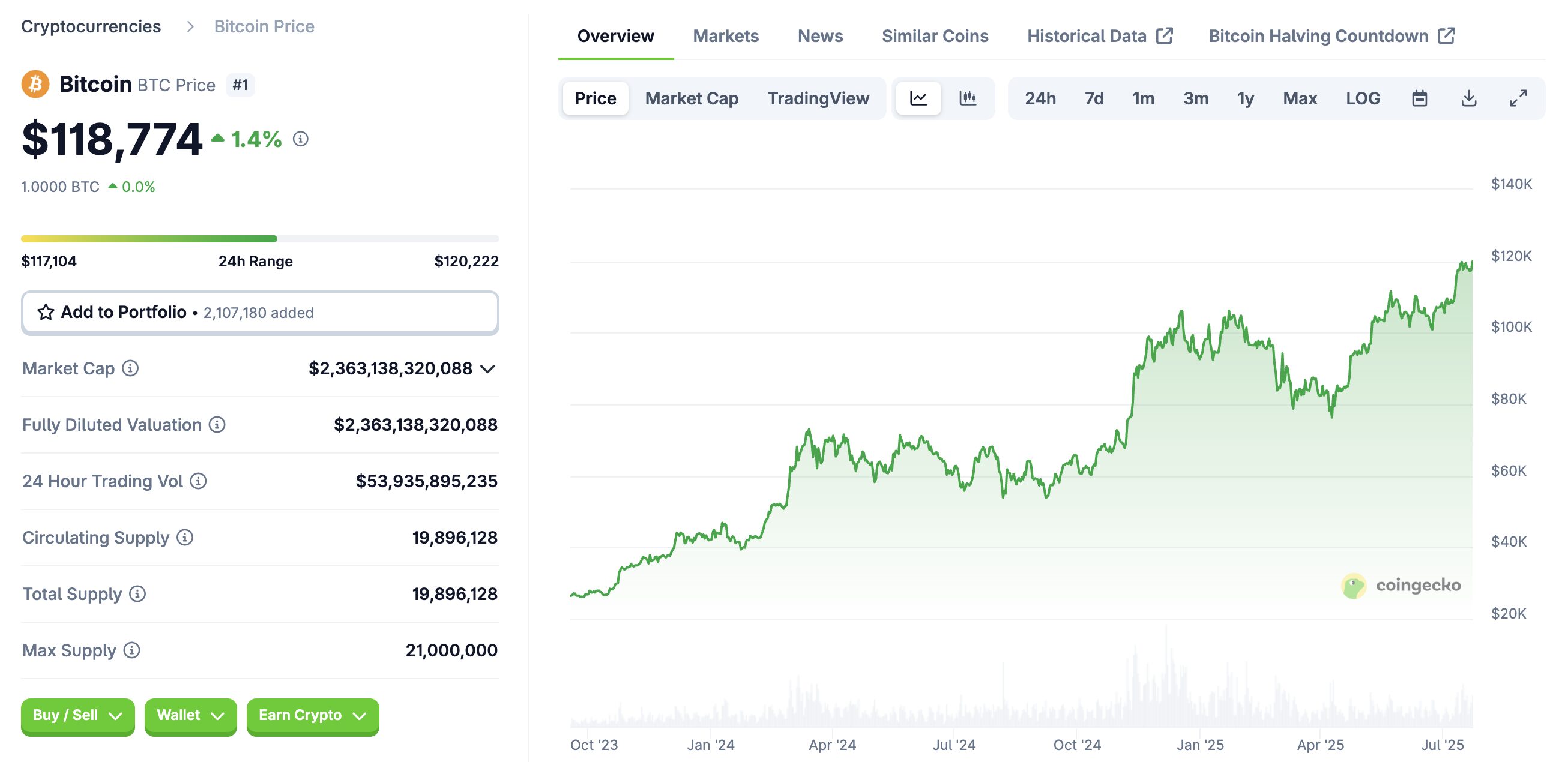

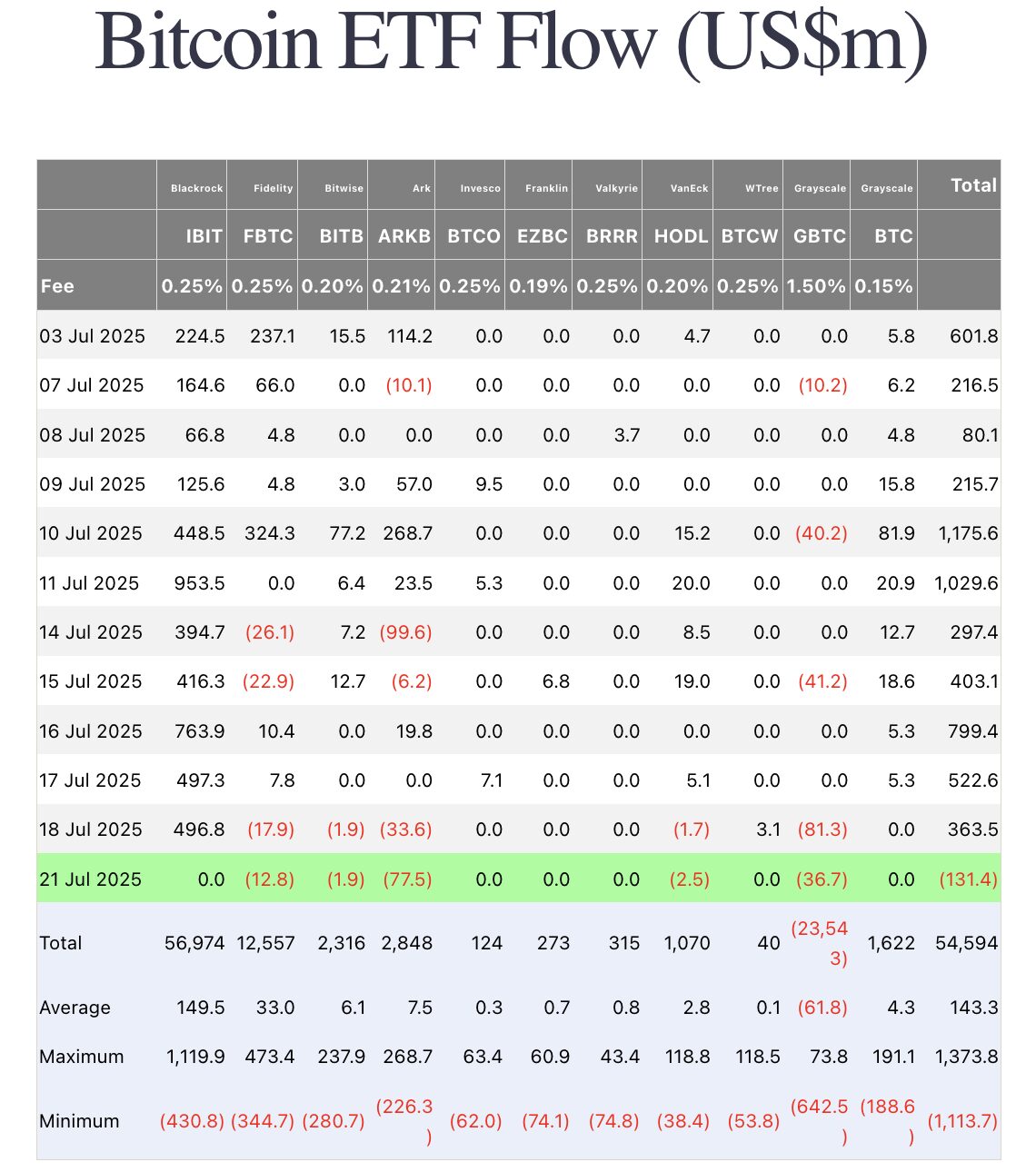

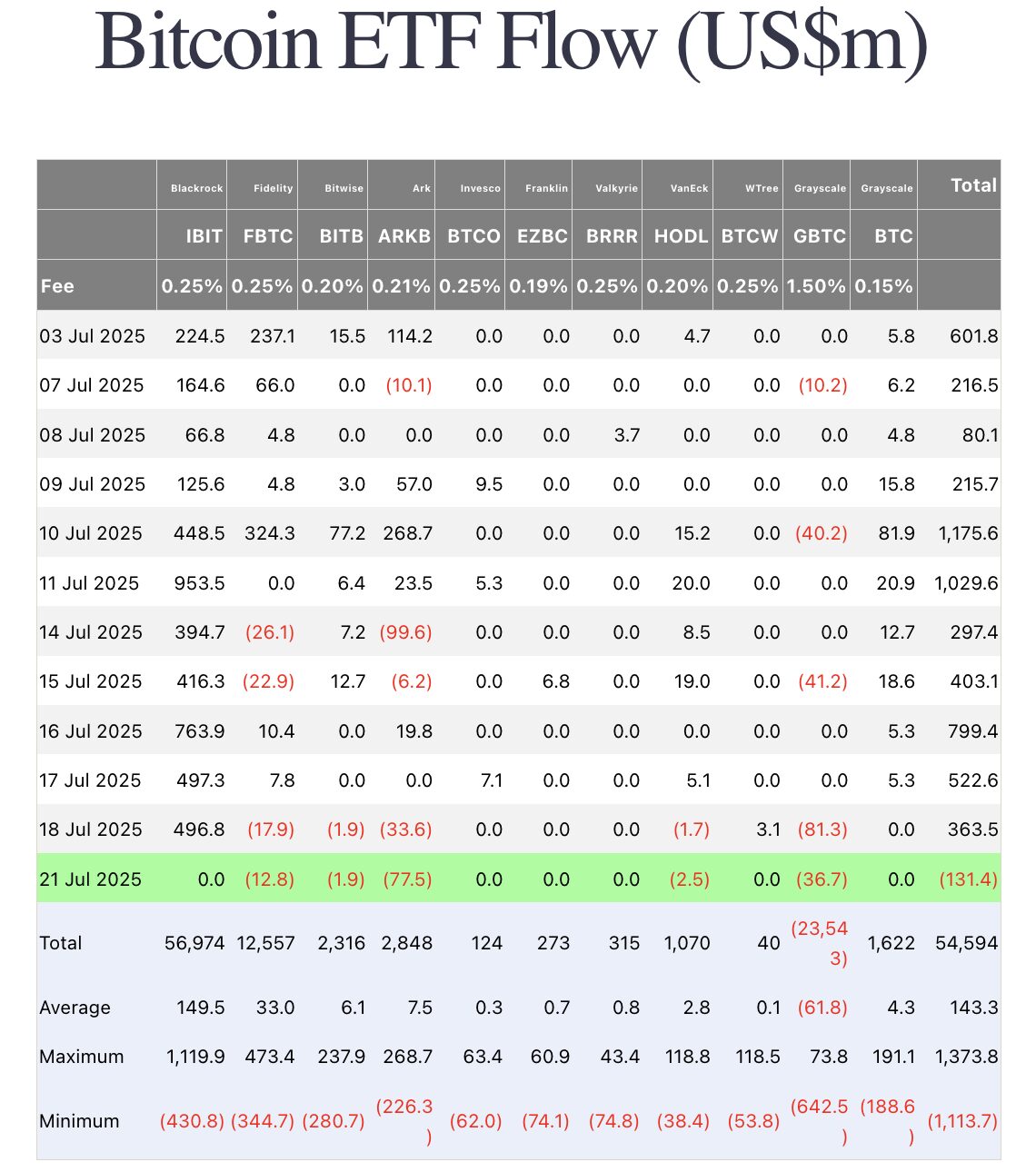

The real impact of Bitcoin ETFs becomes evident when we analyze the inflows and price performance across 2024 and 2025. According to Cointelegraph data, spot Bitcoin ETFs recorded total inflows of $6.62 billion during a 12-day streak in July 2025, which included two consecutive days with inflows exceeding $1 billion each. On July 10, ETFs brought in $1.18 billion, followed by $1.03 billion on July 11.

As of mid-July 2025, the total cumulative net inflow into all U.S.-listed spot Bitcoin ETFs had surpassed $54.75 billion. The total assets under management (AUM) of these ETFs reached approximately $152.4 billion, according to Cointelegraph. This number represents around 6.5% of Bitcoin’s total market capitalization at the time.

Source: Farside Investors

The largest ETF, BlackRock’s IBIT, saw its AUM grow from under $200 million at launch to over $80 billion in just over a year — the fastest growth of any ETF in financial history, as noted by AInvest and MarketWatch. Fidelity’s FBTC and Ark’s ARKB also surpassed $13.2 billion and $6.7 billion in AUM respectively.

This level of demand not only validates Bitcoin as a financial instrument but also introduces a supply-demand imbalance. An ETF’s issuer must purchase an equivalent amount of Bitcoin every time it records new inflows, thereby removing it from the circulating supply. This effect supports upward pressure on price, particularly when coupled with other macroeconomic or speculative catalysts.

For more: Tokenized Stocks vs ETFs: Which One Wins in the Long Run?

Price Performance: From $45K to Over $123K

The impact on Bitcoin’s price was dramatic. In March 2024, just some months after the ETF launch, Bitcoin surged to a new record of over $73,000. ETF inflows and growing institutional legitimacy directly contributed to this story. Bitcoin then crossed the $100,000 mark on December 5, 2024 — propelled by continued inflows and regulatory optimism tied to the incoming U.S. administration.

Perhaps even more significant is Bitcoin’s performance in 2025. By mid‑July, it had surpassed $123,000, marking an increase of nearly 65% since April of the same year. MarketWatch reported that ETF inflows reached $14.8 billion in 2025 alone, underscoring how institutional demand has outpaced retail-led cycles. In a striking daily example, Bitcoin surged above $118,000 when ETFs attracted $1.18 billion in inflows, triggering a short squeeze that accelerated price gains.

For more: How to Buy Bitcoin ETF in 2025: A Comprehensive Guide

Source: TradingView

This inflow-driven price action is further supported by data from The Block, which shows cumulative trade volume through spot Bitcoin ETFs exceeding $1 trillion since launch. The intensity of activity, measured by both volume and velocity, highlights the significant level of institutional involvement.

Another telling metric comes from Farside Investors, which tracked daily flows across ETF issuers. For instance, on July 10 and 11, 2025, combined daily inflows across issuers such as BlackRock’s IBIT, Fidelity’s FBTC, Bitwise’s BITB, and ARKB topped $1.18 billion and $1.03 billion, respectively. These days correspond exactly with Bitcoin’s near‑record price levels, indicating a tight correlation between capital inflows and price surges.

#BTC we’re back at $116K as planned. CPI drops in an hour. IMO we’ll either see a quick liquidity grab below or hold this level and push higher. pic.twitter.com/lSkgGcB2au

— Mind Over Market | by Llamito🎩 (@LlamitoCharts) July 15, 2025

What does such data imply? First, it affirms that ETFs function not only as conduits for institutional money but also as supply-demand catalysts. When large sums flow into ETFs, custodians must acquire Bitcoin, syphoning it from open exchanges and shrinking available supply — all while demand rises. It is this dynamic that underpins sustained upward pressure on price.

Source: CryptoQuant

Second, Bitcoin’s growing integration into traditional asset allocation strategies is evident by its correlations. Academic research has shown that Bitcoin’s correlation with major equity benchmarks rose as ETFs entered the fray, at times reaching 0.87 — a level previously unseen in crypto’s history. While some criticize the increase as a dilution of Bitcoin’s diversification profile, it also signals institutional acceptance and integration into portfolio frameworks.

🚨Crypto markets are making history:

The largest Bitcoin ETF, $IBIT, has crossed above $80 BILLION in total assets value for the first time in history.

It took 374 trading days to achieve this milestone, 5 TIMES FASTER than the previous record set by the S&P 500 ETF, $VOO. pic.twitter.com/1jgYgBQ5vI

— Global Markets Investor (@GlobalMktObserv) July 13, 2025

Third, in contrast to the FOMO-driven rallies of retail cycles, ETF‑led advances exhibit traits of structural robustness and regulatory grounding. The BlackRock-backed IBIT surpassed $80 billion in AUM in just 374 days, illustrating how mainstream financial infrastructure—brokering platforms, index inclusion, and custody services—now supports Bitcoin at scale. Better yet, ETF inflows often preceded price rallies, suggesting a possible leading indicator role for institutional flows.

From a market structure perspective, ETFs are now dominating spot trading volumes. The Block claims that by the middle of 2025, the total trading volume through U.S. spot Bitcoin ETFs had surpassed $1 trillion. This level of volume indicates not only market maturity but also the extent to which traditional finance has embraced Bitcoin.

Institutional Integration and Correlation with Traditional Assets

Another consequence of Bitcoin ETF adoption is how it reshapes the asset’s behavior in macro markets. As institutional adoption surged, Bitcoin’s correlation with traditional assets—particularly the S&P 500 and Nasdaq—increased significantly. A study published on arXiv.org in early 2025 found that correlation coefficients reached as high as 0.87 during ETF-driven rallies.

This shift reflects Bitcoin’s changing role in portfolios. No longer is it treated purely as a speculative asset; it is now integrated into multi-asset strategies, used for hedging against currency debasement, or as a growth lever. While some purists lament the loss of its uncorrelated status, others see the change as a sign of legitimacy and financial utility.

ETF accessibility has also accelerated corporate adoption. Firms like MicroStrategy, Tesla, and several insurance companies are known to allocate Bitcoin through ETF exposure, rather than self-custody wallets—highlighting the importance of regulatory compliance and institutional-grade custody.

Regulatory Tailwinds and Future Outlook

The U.S. regulatory environment has played a critical role in sustaining ETF momentum. In July 2025, Congress passed the GENIUS Act — a landmark piece of legislation that clarifies The topics of digital asset custody, tax treatment, and fund structuring are important considerations. This act, coupled with SEC guidance on staking and digital asset disclosures, has made it easier for ETF issuers to expand their product lineup.

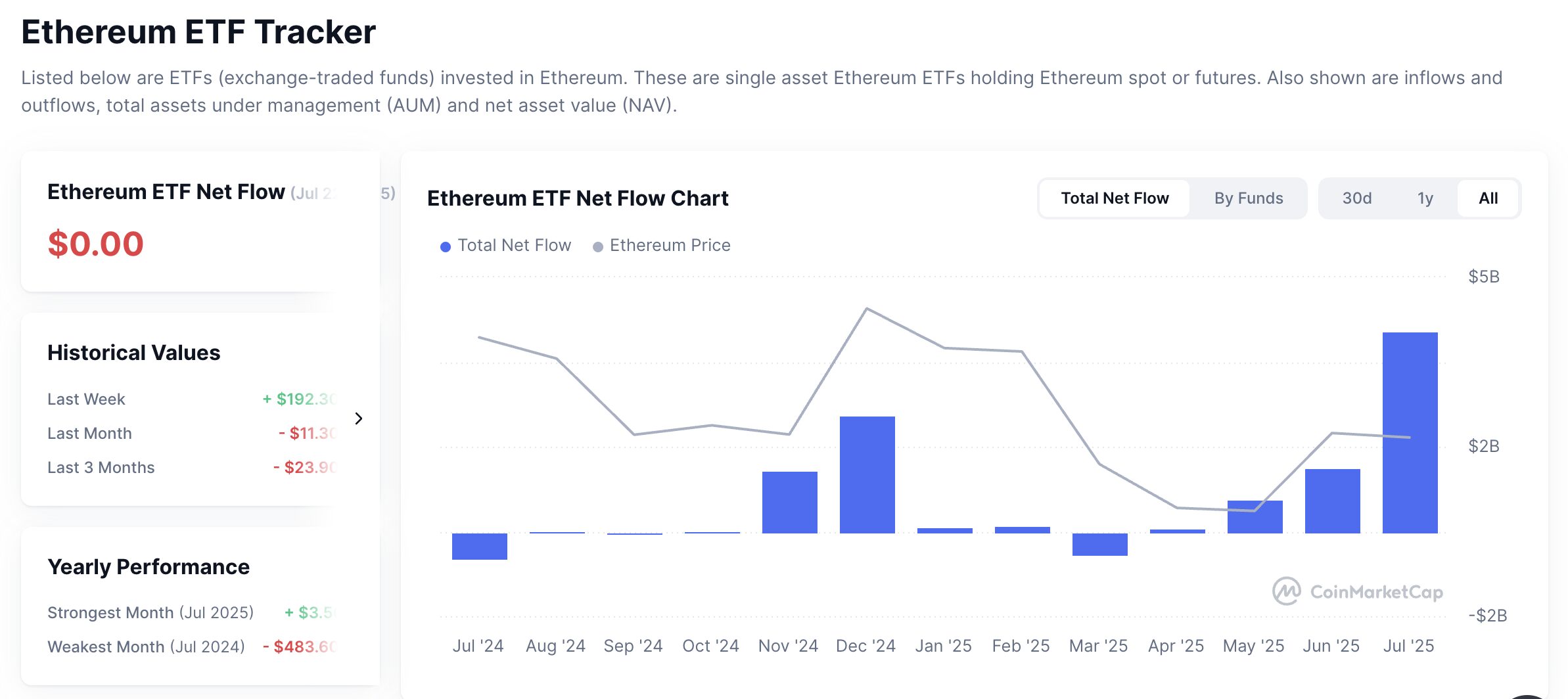

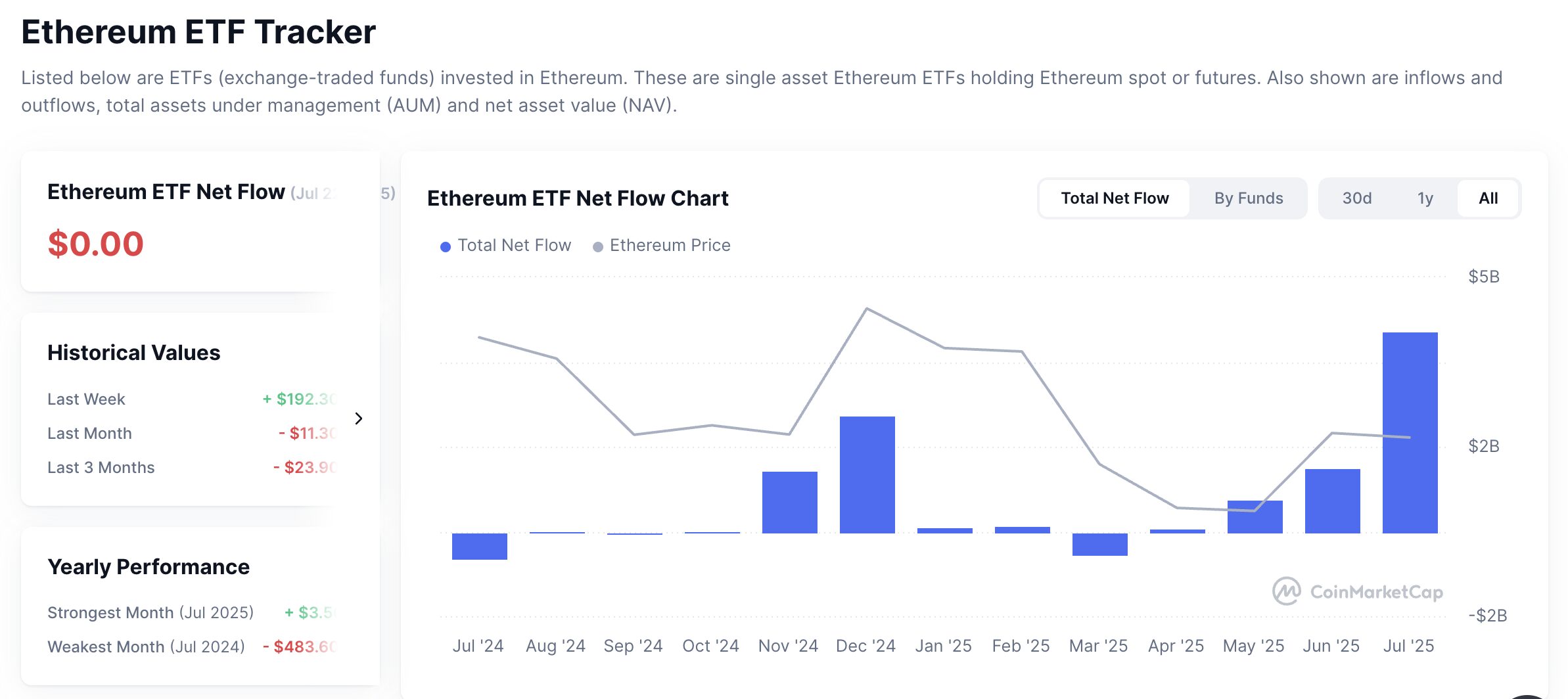

Source: CoinMarketCap

As of mid-2025, Ethereum spot ETFs have already attracted over $7 billion in net inflows, and new filings for Solana, XRP, and even “blue chip crypto” ETFs are under review by the SEC. The trend is clear: ETF-based crypto exposure is here to stay, and it is expanding beyond Bitcoin.

Looking forward, ETF activity is likely to become a key leading indicator of BTC price trends. Historically, ETF inflows have preceded major Bitcoin rallies by one to two weeks — a This pattern may remain valid as long as these funds continue to accumulate BTC at a rate faster than it is being mined. With only 21 million Bitcoin ever to exist and over 960,000 BTC already held by ETFs, supply pressure will only intensify.

For more: Altcoin ETFs After Solana – XRP, ADA, AVAX Next in Line

ETFs Reshape Bitcoin’s Market Narrative

In just 18 months, Bitcoin ETFs have transformed BTC from a speculative fringe asset into a cornerstone of institutional portfolio strategies. Backed by over $150 billion in assets, driving nearly daily inflows in the billions, and supported by an increasingly clear regulatory framework, ETFs are now a central pillar of Bitcoin’s price structure.

Real-world data — including AUM, trade volumes, and price action — confirm that ETFs are not only reacting to Bitcoin market cycles but actively defining them. For investors and traders, policymakers must understand the mechanics of ETF-driven demand to interpret Bitcoin’s future price potential effectively.

As more ETF products come online — including those for Ethereum, Solana, and potentially even DeFi or Layer 2 protocols — the asset class is poised for deeper integration with the global financial system. But for now, the story is clear: Bitcoin ETFs have reshaped price discovery, market structure, and investor behaviour — and they are likely to define the next era of crypto adoption.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Monero

Monero  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Zcash

Zcash  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Canton

Canton  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Aave

Aave