Plasma (XPL) has emerged as one of the most closely watched blockchain projects in 2025, drawing significant attention from both retail and institutional investors.

What is Plasma?

Plasma XPL is a purpose-built, EVM-compatible Layer 1 blockchain engineered specifically for stablecoin payments. Its design goal is to let users move stablecoins (e.g. USDT) quickly, with low latency, and in many cases with zero fee for basic transfers. The network is secured via a variant of Byzantine Fault Tolerant consensus (PlasmaBFT), and it draws legitimacy and stability from backing by major organizations in the crypto space.

At launch, Plasma claimed throughput exceeding 1,000 transactions per second and block times under 1 second, placing it in the high-performance class of blockchain systems. It is also backed by prominent names in industry and finance, such as Tether/USDT, Bitfinex, Founders Fund, and others.

Recently, Plasma has quickly become a focus of market FOMO thanks to several notable signals. At launch, the network attracted more than $2 billion in stablecoin liquidity, and within just two days the stablecoin supply on Plasma exceeded $7 billion, reflecting unprecedented capital inflows. Trading volume surged by over 300,000% in 24 hours, driving the price up by 50–85% within a single day.

In just 2 days, stablecoin supply on Plasma has surpassed $7 billion.

The future is bright. pic.twitter.com/uD3Dgs6e9i

— Plasma (@Plasma) September 27, 2025

Only 1.8 billion XPL, were circulating at launch, creating scarcity that fueled speculation. Large investors reportedly committed tens of millions in USDT during early sales, reinforcing the narrative of strong whale interest. Binance listed XPL immediately, distributing 75 million tokens through a HODLer airdrop and reserving an additional 200 million tokens for future marketing campaigns. Together, these factors positioned Plasma as a prime “gem hunting” target, though they also highlight the risks of hype-driven volatility and upcoming token unlocks.

What Does Plasma Solve?

First, fee friction: On networks such as Ethereum or BNB Chain, users need to have a small amount of gas tokens in their wallets to pay for gas fees. In some cases, it causes inconvenience for new users. Plasma addresses this issue through a paymaster mechanism. This design allows basic USDT transfers to be executed with no direct fee for the end user, thereby removing the dependency on holding native tokens and making stablecoin payments more efficient.

Second, latency and finality: many existing chains have trade-offs between throughput and finality (time to irreversible confirmation). Plasma’s consensus (PlasmaBFT) is designed to allow fast finality in seconds.

Third, user experience and onboarding: users unfamiliar with crypto don’t want to manage multiple tokens just to send stablecoins. By allowing custom gas token support (users may pay gas in stablecoins or other approved ERC-20s), Plasma reduces cognitive overhead.

Source: Plasma

Fourth, scaling payment flows: stablecoin use cases (remittances, point-of-sale, micropayments) require high throughput and predictable cost structures. Plasma is optimized for high-volume payments, not only general DeFi or NFT workloads.

Finally, security trust: to reassure financial institutions and stablecoin issuers, Plasma designs strong security measures, including anchoring and rigorous consensus, to reduce the risk of reorgs or censorship.

Hence, Plasma sits between the extremes of specialized payment rails (e.g., Visa, SWIFT) and general-purpose blockchains, offering a “money-native” Layer 1 for dollar-denominated digital value.

How Does Plasma Work?

From an architectural perspective, Plasma layers its protocol into multiple cooperating components: an execution layer, a consensus/sequencing layer, and mechanisms for gas abstraction, paymaster logic, and bridging.

One of Plasma’s standout features is zero-fee USDT transfers: for simple send/receive USDT operations, the protocol’s built-in paymaster covers gas, meaning end users don’t need to possess XPL to move stablecoins.

Another key feature is custom gas token support: developers can register ERC-20 tokens (including stablecoins) so that gas fees for smart contract interactions may be paid in those tokens rather than forcing users to hold XPL for gas. This improves usability and flexibility.

Plasma also offers EVM compatibility via Reth as its execution layer: developers can deploy contracts by using standard Solidity with minimum changes.

Source: Plasma

On consensus, Plasma employs PlasmaBFT, a variant of HotStuff (Fast HotStuff) consensus mechanism. Plasma parallelizes many things in its pipelines such as proposal, voting, committing processes, to ensure the blocks work well with high throughputs.

Moreover, Plasma is developing or planning confidential payments: a module to allow privacy of amounts or sender/recipient while maintaining compatibility with smart contracts. As of late 2025, this feature is under research but not fully launched.

The protocol supports a Bitcoin bridge / trust-minimized BTC usage so that Bitcoin can be used natively within smart contracts via a wrapped variant (pBTC). In effect, it blends the security and ubiquity of Bitcoin with programmable logic.

Plasma mainnet beta will go live with $2B+ in liquidity, making us the 8th largest chain by stablecoin supply.

The future is bright, on Plasma. pic.twitter.com/KPALwq1AJq

— Plasma (@Plasma) September 23, 2025

At launch, the network began with over $2 billion in stablecoin deposits/TVL, putting it immediately in the top-tier blockchains by TVL for a new network. The mainnet beta also launched with multiple DeFi integrations (Aave, Ethena, Fluid, and Euler) from day one.

And finally, institutional-grade security and integration with stablecoin issuers is baked into its design. Plasma markets itself not purely as a blockchain for crypto natives but as infrastructure for digital dollars, aiming to bridge legacy finance with on-chain rails.

Plasma’s working logic is to combine fast consensus, gas abstraction, and stablecoin-native support into a unified system that treats USD-equivalent value as a first-class asset.

XPL Tokenomics

XPL Token Metrics

The XPL token has:

- Token Name: Plasma

- Ticker: XPL

- Total Supply (Fixed): 10,000,000,000

- Circulating supply: approximately 1,800,000,000 XPL (18 %)

- Market capitalization at listing: reported over $2.4 billion as XPL debuted on exchanges.

XPL Token Allocation

The XPL token allocation is structured as follows:

- Public Sale: 10 % (1,000,000,000 XPL)

- Ecosystem & Growth: 40 % (4,000,000,000 XPL)

- Team (and future service providers): 25 % (2,500,000,000 XPL)

- Investors / strategic backers: 25 % (2,500,000,000 XPL)

XPL Allocation

XPL Token Vesting Schedule

The XPL token vesting schedule is as follows:

Public Sale

- Allocation: 1.00 billion XPL

- Unlock: 100% vested at TGE (1.00 billion XPL released immediately)

Team

- Allocation: 2.50 billion XPL

- Unlock: 0% at TGE

- Vesting: Cliff + linear release over 24 months

Investors

- Allocation: 2.50 billion XPL

- Unlock: 0% at TGE

- Vesting: Cliff + linear release over 24 months

Ecosystem & Growth

- Allocation: 4.00 billion XPL

- Unlock: 20% at TGE (0.80 billion XPL), remainder vested over time

Token Vesting Schedule

XPL Token Utility

The XPL token is at the heart of the Plasma ecosystem. With utilities as follows:

- Gas and Transaction Fees

- Staking and Network Security

- Validator Rewards and Incentives

- Ecosystem Growth and Incentive Funding

- Governance and Protocol Upgrades

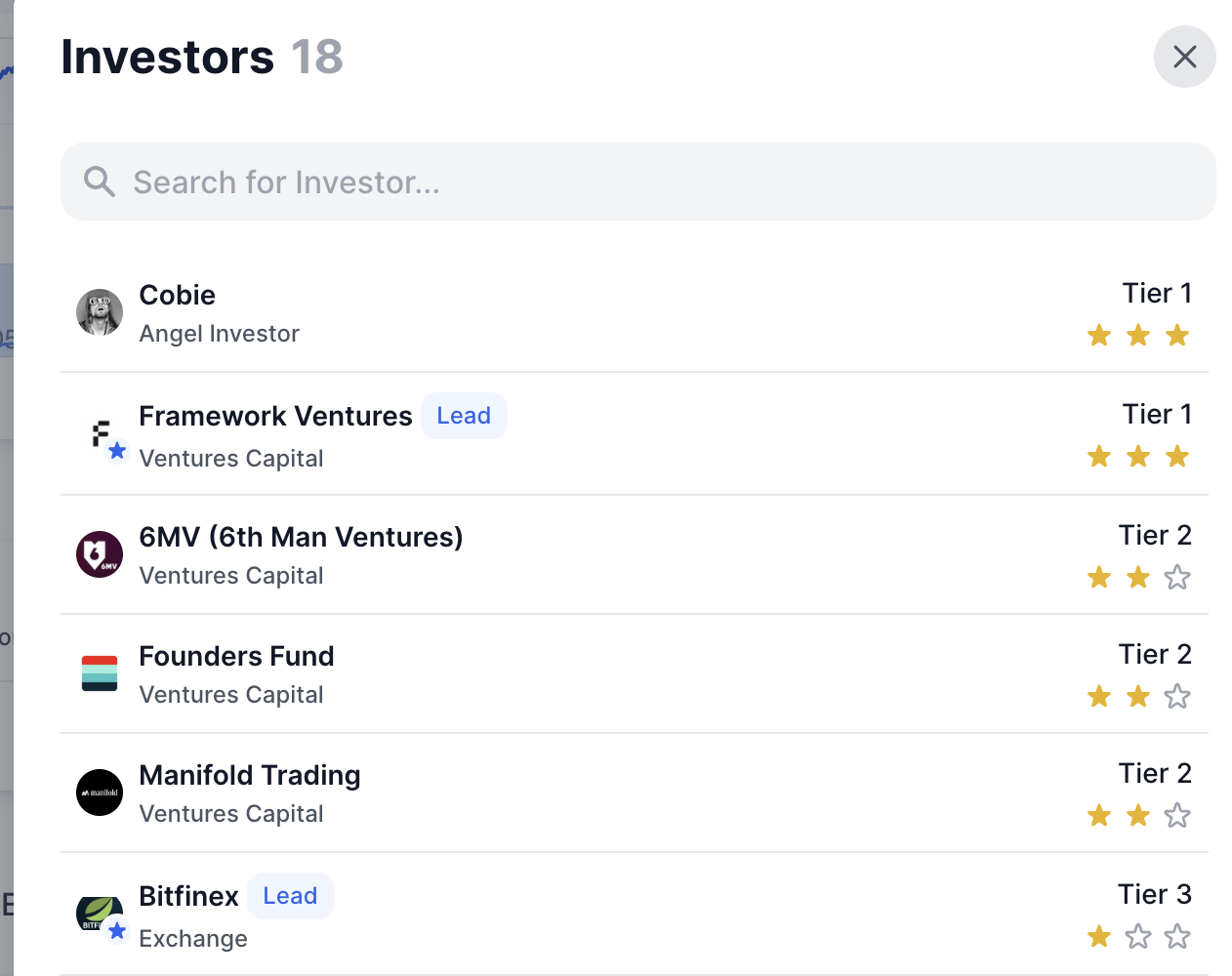

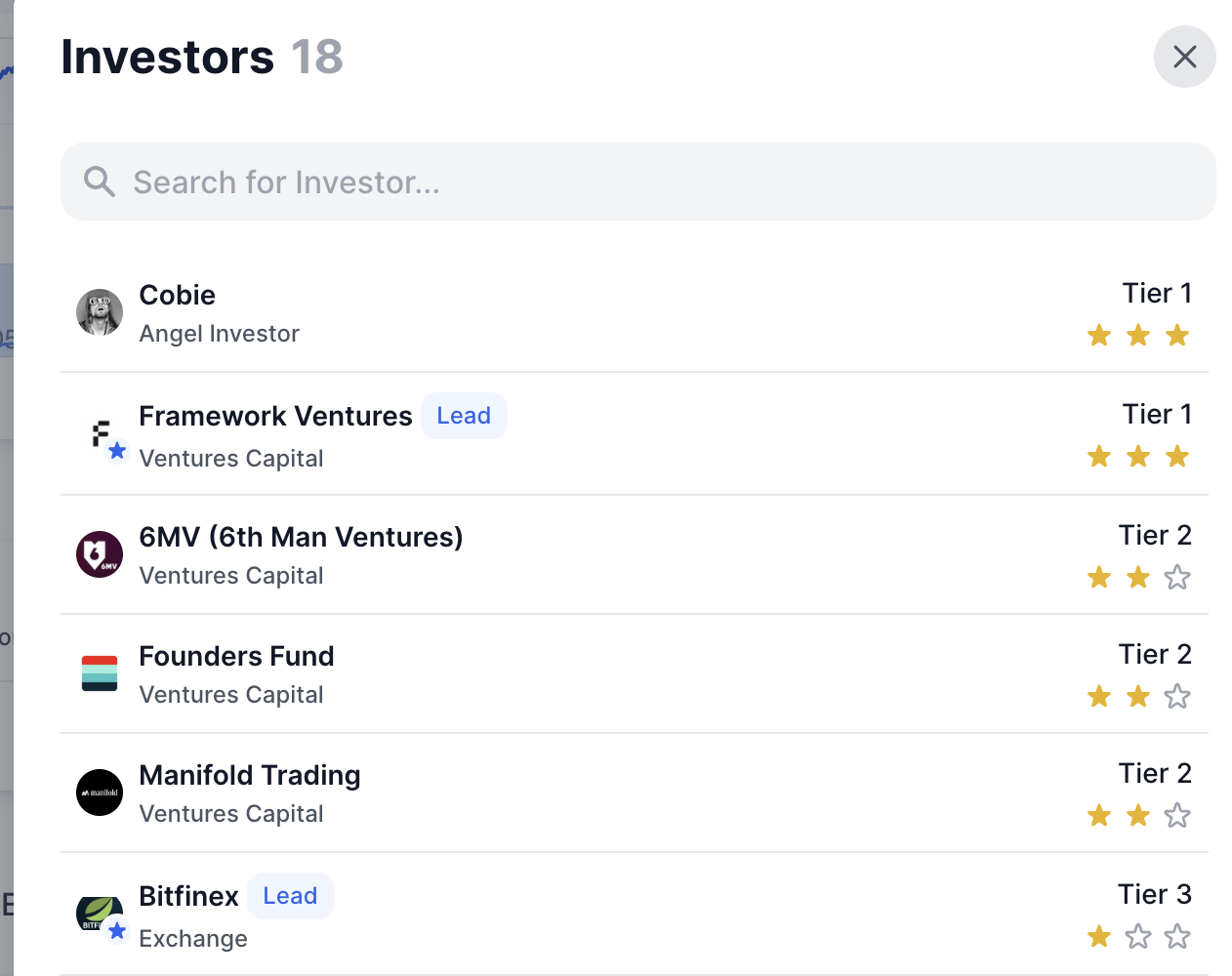

Plasma Investors

Plasma has attracted backing from several well-known names in crypto and venture capital:

-

Cobie – Angel investor, recognized figure in the crypto community.

-

Framework Ventures (Lead) – Tier 1 crypto VC, early backer of leading DeFi projects.

-

6MV (6th Man Ventures) – Tier 2 VC with focus on Web3 startups.

-

Founders Fund – Tier 2 venture capital firm with global presence.

-

Manifold Trading – Tier 2 quantitative trading and venture firm.

-

Bitfinex (Lead) – Tier 3 exchange, closely linked to Tether ecosystem.

Plasma Investors

FAQ

What is Plasma?

Plasma is a Layer 1 blockchain designed for stablecoin payments.

Do I Need XPL To Send USDT?

No. USDT transfers on the Plasma do not require gas. Only complex actions will need gas.

How Is Plasma Secured?

The Plasma uses PlasmaBFT to secure the network. The consensus enhances fast finality and periodic anchoring of the chain to Bitcoin for additional assurance.

How Is Plasma Different From Tron Or Stellar?

Plasma is built specifically for stablecoin payments. It combines zero-fee transfers, the option to use custom gas tokens, and full EVM compatibility. Tron and Stellar, by contrast, are general-purpose payment networks without full smart contract flexibility.

What Are XPL’s Main Utilities?

XPL is used for staking, validator rewards, ecosystem funding, governance, and as gas for advanced transactions that go beyond simple transfers.

Can XPL Be Used In DeFi?

Yes. The XPL token can be used as collateral.

What Risks Should I Consider?

As with many other blockchain networks, the risks could include validator centralization if some top holders account for more than 51% of the network. Besides, they could also bear a selling pressure from token unlocks. The protocol with smart contract vulnerabilities, etc.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Chainlink

Chainlink  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  WETH

WETH  Wrapped eETH

Wrapped eETH  Monero

Monero  Zcash

Zcash  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Hedera

Hedera  Avalanche

Avalanche  Sui

Sui  Shiba Inu

Shiba Inu  Dai

Dai  World Liberty Financial

World Liberty Financial  Cronos

Cronos  sUSDS

sUSDS  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  PayPal USD

PayPal USD  Polkadot

Polkadot  Mantle

Mantle  USDT0

USDT0  Canton

Canton  Bittensor

Bittensor  Aave

Aave  USD1

USD1  Bitget Token

Bitget Token