Crypto exchanges are online platforms that help you buy and sell digital assets, including cryptocurrencies and decentralized finance (DeFi) tokens. They function like traditional stock exchanges or security brokers, providing users with various tools to execute crypto trades.

In this article, we’ll run you through the concept of cryptocurrency exchanges, their types, and how they operate. We’ll also cover the prominent exchanges and the factors to consider when choosing a digital asset trading platform.

What Is a Crypto Exchange?

A crypto exchange is a digital platform that facilitates the buying and selling of virtual currencies powered by blockchain technology. It is hosted by entities or companies that help users trade multiple cryptocurrencies from a single platform. You can also trade other assets such as non-fungible tokens (NFTs) and fiat currencies through crypto exchanges.

Additionally, certain exchanges offer DeFi services like staking, lending, and liquidity mining to help crypto investors generate passive income.

Moreover, many exchanges support different types of crypto trading. These include spot, margin, peer-to-peer (P2P), over-the-counter (OTC), and derivatives (futures and options) trading. They also provide advanced tools, market reports, live prices, and learning resources to help users make the right investment decisions.

Some cryptocurrency exchanges also facilitate copy trading. This feature helps users, especially beginners, emulate the trading strategies of experts to garner profits.

However, most platforms strictly require participants to trade digital currencies in pairs. Only specific exchanges like Binance allow users to buy (on-ramping) and sell (off-ramping) digital assets using multiple fiat currencies.

How Do Cryptocurrency Exchanges Work?

While crypto exchanges are tailored to digital currencies like Bitcoin and Ethereum, they operate like traditional stock and commodities exchanges.

Typically, cryptocurrency exchanges facilitate transactions by matching buyers and sellers. They maintain an order book, which lists and sorts buy and sell orders by intended purchase and sale prices.

When you place a buy order, the platform’s matching engine looks for a competing sell order from another user. It searches based on the required lot size and the best executable price.

Once matched, the transaction is performed. You transfer funds into the seller’s crypto wallet in fiat currency or cryptocurrency, based on the trading pair. Conversely, the seller transfers the purchased digital asset into your digital wallet. The exchange follows the same process for sell orders.

Types of Cryptocurrency Exchanges

Centralized Exchanges (CEXs)

Centralized exchanges are online trading platforms that are owned and managed by a particular firm or central authority. They are similar to traditional stock exchanges, where central authorities maintain complete control over all user accounts. They also serve as intermediaries between buyers and sellers. Moreover, all transactions must be approved by the centralized exchange. Hence, users need to fully trust the exchange operator.

Advantages

- Deep liquidity: Centralized exchanges have greater liquidity, protecting traders from market manipulations.

- Easy account retrieval: With CEXs, it is easier to recover access to digital assets in case you forget or misplace login credentials.

- Faster transactions: CEXs have a higher average transaction speed of 10 milliseconds, making them conducive for high-frequency trading.

- Advanced features: Centralized exchanges offer sophisticated charting tools and customizable trading interfaces. They also allow users to leverage their cryptocurrency investments with borrowed funds to boost potential profits.

Disadvantages

- Security risks: CEXs facilitate billions of trades daily and store user data on centralized servers. Thus, they are hot targets for malicious actors. In 2014, Mt. Gox, a leading exchange of that time, lost 740,000+ Bitcoins to hackers, leading to its closure.

- Market manipulation: Some centralized exchanges have been accused of manipulating trading volumes and prices or engaging in insider trading.

- Geographical restrictions: CEXs are usually exclusive to users within certain jurisdictions. Users based in other locations can’t access the exchanges without virtual private networks (VPNs).

- Less anonymity: Centralized exchanges require users to complete anti-money laundering (AML) and know-your-customer (KYC) formalities.

Decentralized Exchanges (DEXs)

Decentralized exchanges are autonomous dApps that are built on public blockchain networks. Unlike centralized exchanges, DEXs are not operated by a central authority and don’t store user data on centralized servers.

Moreover, decentralized exchanges conform to the core principles of blockchain technology. They are governed by decentralized autonomous organizations and are classified into the following types:

- On-chain order books (e.g., Dexalot)

- Off-chain order books (e.g., dYdX)

- Automated Market Makers (e.g., Uniswap).

Advantages

- Higher security: Decentralized exchanges run on open-source distributed ledger infrastructure. This distributed hosting makes them less vulnerable to cyberattacks.

- Self-custody: “Not your keys, not your crypto” is a popular adage in the crypto industry. It implies that the one who has the private keys to the account holding the cryptocurrencies is the true owner. As DEXs don’t possess private keys, users control their digital assets, data, and keys. Therefore, users’ assets are likely to remain safe even if the exchange enters bankruptcy or is hacked.

- More anonymity: Since DEXs foster P2P transactions in a trustless environment, you don’t need to fill up know-your-customer (KYC) forms. They are censorship-resistant and offer greater anonymity and privacy for users.

Disadvantages

- Less user-friendly: DEXs have a complex user interface (UI) and are more suitable for seasoned cryptocurrency traders.

- Low liquidity: Centralized exchanges enable 99% of crypto transactions. Thus, they are accountable for a significant proportion of the trading volumes. Consequently, DEXs struggle with liquidity for many token pairs, making them susceptible to market manipulations.

- No blockchain interoperability: DEX users cannot trade digital assets that exist on different distributed ledgers without using additional networks or software.

- Smart contract risks: Poorly coded intelligent contracts with bugs can be exploited, leading to losses and unintended outcomes.

Hybrid Exchanges

Hybrid exchanges offer the best of both worlds by merging the strengths of centralized and decentralized exchanges. On one hand, hybrid exchanges facilitate centralized order matching. On the other hand, they enable decentralized storage of cryptocurrencies. The exchange neither controls users’ digital assets nor stops them from withdrawing funds into their crypto wallets.

Advantages

- Closed ecosystems: As hybrid exchanges function as closed ecosystems, organizations can harness blockchain technology without compromising data privacy.

- Better privacy: Hybrid crypto exchanges safeguard an organization’s privacy when it is interacting with the public or stakeholders. Therefore, companies need not use private blockchains for privacy-focused use cases.

Disadvantages

- Poor liquidity: Hybrid cryptocurrency exchanges are in the fledgling stages of development. Thus, they lack adequate liquidity and trading volumes, leaving them exposed to price manipulations. Consequently, you cannot buy and sell digital assets on these exchanges swiftly and may fall prey to malpractices like spoofing.

How to Choose the Right Crypto Exchange?

1. Reputation

Visit aggregator websites like CoinGecko or CoinMarketCap to find an updated list of cryptocurrency exchanges. These sites rank exchanges based on trading volumes, liquidity, trustworthiness, and traffic. Select higher-ranked crypto exchanges as they are likely to be reputable, highly liquid, and reliable.

2. Regulatory compliance

The chosen exchange must comply with local and international laws, such as Know Your Customer. It should also possess the required licenses to operate in every jurisdiction in which it renders services. Information on its founders and licenses fosters trust, especially among potential customers.

To know whether a CEX is legally compliant, check the Financial Crimes Enforcement Network or equivalent systems in your country. When choosing decentralized exchanges, you must solely rely on reviews and other information sources.

3. Security

Since the security of your digital assets is paramount, you should only opt for crypto exchanges with potent safety features. The chosen exchange should have security measures like two-factor authentication(2FA), insurance coverage, and cold storage. It should perform penetration testing, run bug bounty programs, and undergo third-party audits regularly. Additionally, it must maintain proof-of-reserves (PoR). This indicates that the exchange has funds and cryptocurrency reserves to cover all user assets 1:1.

4. Fees

Transaction fees are a critical determinant of profits. They constitute a percentage of your trade value that must be paid to exchanges. For makers (those who provide liquidity), the fees are usually lower than those for takers (those who remove liquidity). Similarly, transaction fees for spot trades are lower than those for derivative trades.

Additionally, check the fees for withdrawing funds into your crypto wallet. Evaluate if the exchange collects deposit fees or hidden charges (e.g., inactivity costs).

5. User experience

Select exchanges with responsive desktop and mobile apps that are easy to navigate. Their trading interfaces should also be intuitive and suitable for both newcomers and experts.

6. Offerings

You should opt for cryptocurrency exchanges that offer numerous token pairs along with a wide range of products and services. It should support the digital assets you prefer to trade and provide features that align with your requirements.

7. Liquidity

The deeper an exchange’s liquidity, the faster trades execute at favorable prices. Thus, you should choose platforms with higher trading volumes and order book depths.

8. Global coverage

Crypto exchanges that operate in multiple locations worldwide offer broader market access and deeper liquidity. They also help users trade across countries and time zones seamlessly. Hence, you should select a legally compliant global cryptocurrency exchange that operates in your jurisdiction. Additionally, check if it supports your local fiat currency for deposits and withdrawals.

Best Cryptocurrency Exchanges

1. Binance

Binance is a leading centralized exchange for trading digital assets. It is also the world’s largest crypto exchange by trading volumes. It was launched by Chengpeng Zhao, an experienced developer who previously built trading systems for the Tokyo Stock Exchange. As of July 2025, Binance serves over 250 million customers across 180+ countries.

Binance enables cryptocurrency investors to transact in 1400+ spot pairs. It also facilitates margin, futures, and options trading. Moreover, its P2P marketplace supports 800+ payment options, while the Binance Wallet serves as your on-platform custodial digital wallet.

For newcomers, the exchange offers a one-click copy trading functionality. You can also automate crypto transactions using the platform’s pre-programmed bots, such as spot grid, futures TWAP, etc.

If you want to earn passive income on your crypto holdings, you can explore Binance Earn’s offerings. They include staking, smart arbitrage, on-chain yields, and dual investment.

In terms of security, Binance has implemented robust measures like two-factor authentication(2FA), anti-phishing codes, and withdrawal whitelists. It also maintains a PoR ratio greater than or equal to 100%.

Regarding trading fees, the maker and taker charges for regular users start from 0.1% on Binance. Moreover, BNB holders are eligible for fee discounts.

Lastly, all exchanges on our list, including Binance, follow a volume-based or tiered fee structure. Therefore, the higher your 30-day trading volumes, the higher your VIP tier, and the lower your transaction fees.

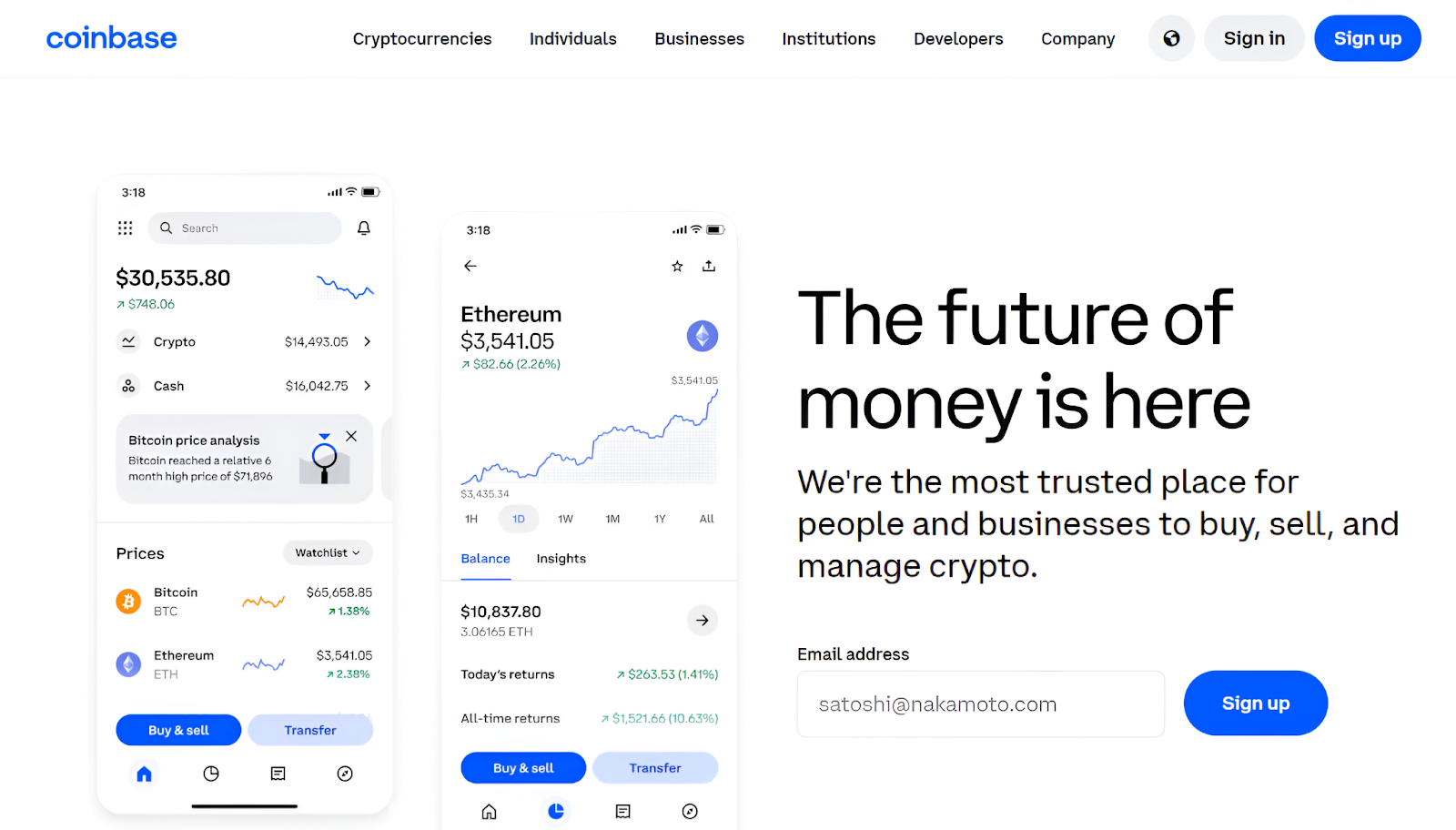

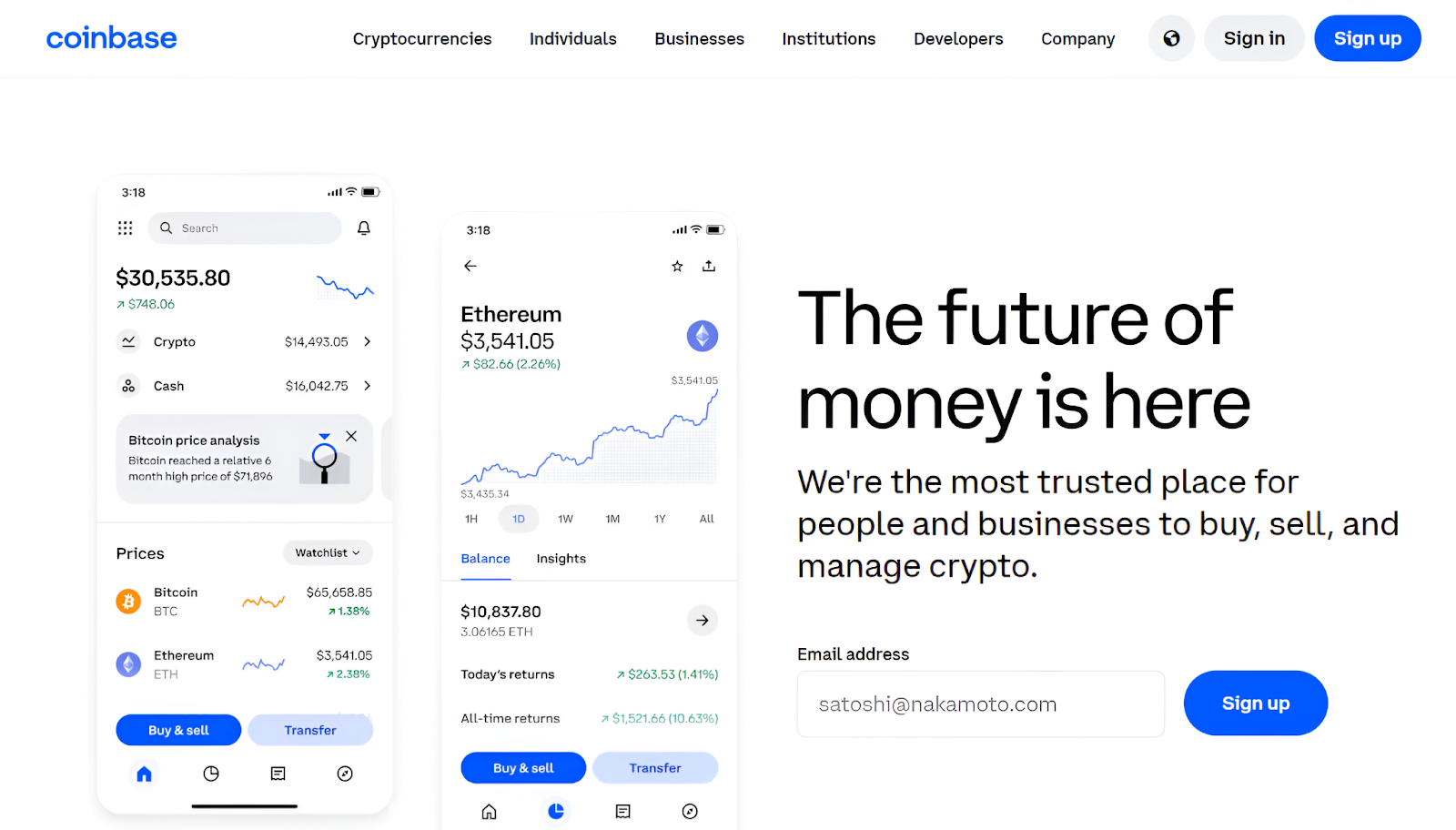

2. Coinbase

Coinbase is a top cryptocurrency exchange, especially in the United States of America (USA). It is also the biggest Bitcoin custodian. Founded in 2012 by crypto evangelists Brian Armstrong and Fred Ehrsam, Coinbase aims to promote economic freedom and operates in 100+ countries.

Coinbase Wallet is also one of the best self-custody crypto wallets. It helps you store cryptocurrencies, NFTs, and private keys in one place.

On Coinbase Advanced, you can trade 550+ spot pairs using advanced tools powered by TradingView. You can also customize the trading interface and leverage multiple technical indicators to identify profitable opportunities.

For derivative traders, Coinbase offers expiry futures and perpetual contracts. It provides access to increased leverage and has built contracts tailored to varying risk appetites.

Its security features include bug bounty programs, 2FA, PoR, industry-leading encryptions, allowlists, mobile biometrics, and multi-approval withdrawals.

Coinbase’s transaction fees are relatively higher. For users with 30-day volumes below $10,000, the maker and taker fees are 0.4% and 0.6%, respectively.

3. KuCoin

KuCoin is a popular crypto exchange, with 900+ listed tokens and 40 million users across 200+ countries. Established in 2013 by technology enthusiasts Michael and Eric, Kucoin aims to foster inclusion by making cryptocurrencies accessible to all.

You can access 1280+ token pairs on Kucoin. The exchange supports spot, margin, perpetual futures, and options trading. It also allows crypto purchases via 70+ payment methods, including fiat currency deposits.

Moreover, Kucoin has designed industry-leading security features to safeguard user data and assets. These include multi-factor authentication, device integrity checks, AI-powered anti-fraud detection, data leak prevention, and PoR. It also separates hot, warm, and cold crypto wallets, with a majority of user assets stored in offline wallets.

Kucoin’s fee structure is relatively more complex. It levies transaction fees based on 30-day volumes as well as the asset category. Standard users must pay a 0.1% maker or taker fee for spot trading of class A assets. For class B and class C assets, the fee increases to 0.2% and 0.3%, respectively.

4. OKX

OKX is one of the best digital asset exchanges for crypto-to-crypto conversions and DeFi services. With a large user base across 100+ countries, OKX is a highly liquid digital platform for trading cryptocurrencies. It supports spot, derivatives, and OTC trading, with nominal fees starting at 0.08% for makers and 0.1% for takers.

A standout aspect of OKX is that it allows you to swap cryptocurrencies with zero trading fees and no slippage. You can also buy or sell crypto in its P2P marketplace using 100+ payment options without incurring transaction fees.

If you’re interested in trading automations, OKX has a comparatively higher number of smart pre-built bots. Furthermore, the exchange helps users trade 300+ assets and 490+ active cryptocurrency markets on OKX directly from the TradingView platform.

To protect user assets, OKX maintains PoR and has engineered a potent security system. Multiple authorizations, air-gapped cold storage, address whitelisting, risk control checks, and dynamic transaction limits are its core features. Additionally, its hot crypto wallets store private keys in volatile memory.

5. Bybit

Bybit is a top cryptocurrency exchange with over 70 million users across 195+ countries. It was launched in 2018 as a crypto ark and a gateway to the Web3 ecosystem. It provides deep liquidity and a variety of cutting-edge features for novice and advanced traders alike.

It supports spot trading in 660+ pairs and offers up to 10x leverage for margin trading. If you want to invest in derivatives, you can consider Bybit’s perpetual futures and options contracts.

Bybit’s trading interface is also clean and user-friendly, with TradingView integration and advanced charting tools. Other functionalities offered by Bybit are copy trading, automated bots, and TradeGPT (AI-powered transactions).

For crypto investors who want to earn passive rewards, Bybit facilitates on-chain staking that yields high annual percentage returns. It also provides AMM-based liquidity mining pools.

Bybit’s trading fees are competitive. For non-VIP users, the exchange levies a 0.1% fee for both makers and takers.

Lastly, Bybit has implemented powerful security measures like 2FA, Yubikey authentication, anti-phishing code, authenticity check, and FIDO passkeys.

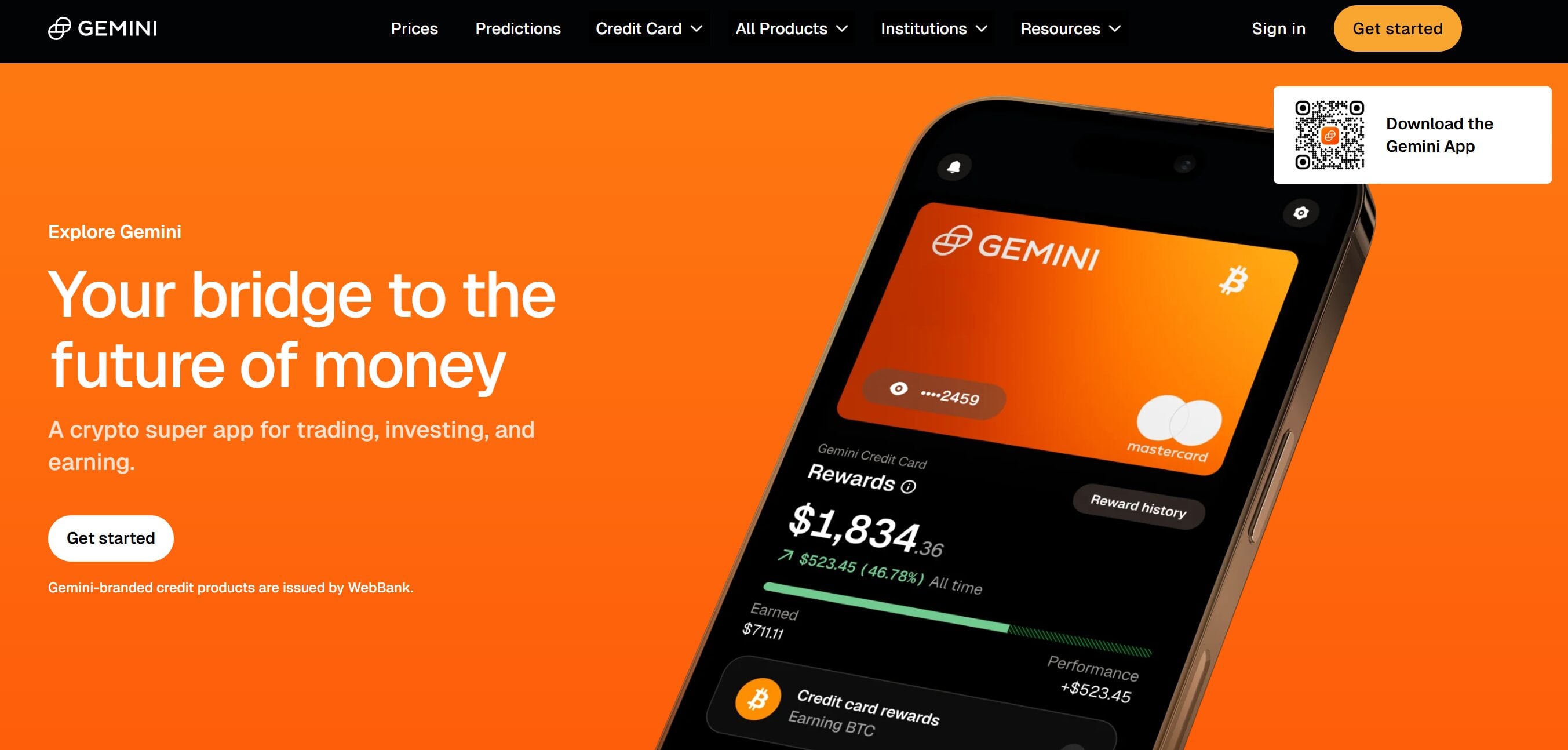

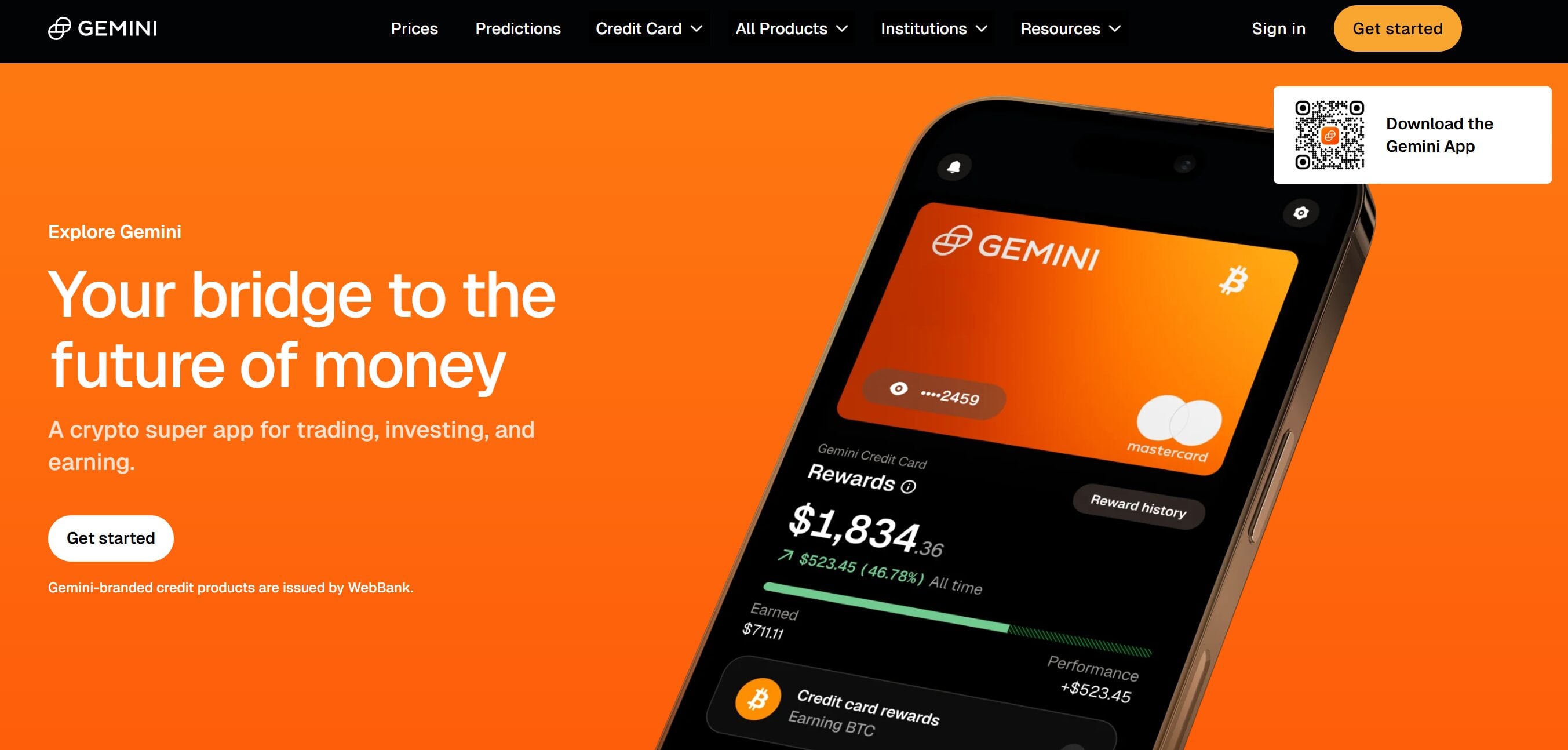

6. Gemini

If you’re seeking a trading platform that helps you invest in tokenized stocks along with cryptocurrencies, Gemini is the best. It allows you to trade in 100+ pairs across 70+ crypto and adds 20+ new stocks weekly. The exchange even has its own US Dollar-backed stablecoin, the Gemini Dollar (GUSD).

Gemini is also the top exchange for security and compliance. It is the world’s first exchange to obtain Systems and Organization Controls (SOC) certifications. It is also certified by the International Organization for Standardization (ISO-27001). Its security measures include 2FA, Yubikey, address allowlisting, and multi-signature cold storage.

For professional traders, Gemini provides a high-performance trading interface, ActiveTrader. Equipped with advanced technical indicators and combined order books (USD and GUSD), ActiveTrader executes crypto transactions in milliseconds. Other key offerings of Gemini include staking, OTC trading, and institutional-grade custodial services.

Lastly, Gemini’s transaction fees are quite high. It imposes a 0.2% maker and 0.4% taker fees on regular users with 30-day volumes below $10,000.

Crypto Exchange Vs. Crypto Wallet – Key Differences

| Crypto exchange | Crypto wallet |

| Crypto exchanges are digital platforms that enable the buying and selling of virtual currencies. | Crypto wallets are digital applications (software) or physical devices (hardware) that store public and private keys. They help you send, receive, and store cryptocurrencies. |

| They can be centralized exchanges, decentralized exchanges, or hybrid exchanges. | They can be hardware wallets, software wallets, paper wallets, or web wallets. |

| The exchange operator controls your private keys. | They are self-custody crypto wallets. You have complete control over your digital assets and private keys. |

| Account recovery and access to customer support are easier. However, withdrawals may be restricted, denied, or delayed. | Nobody can censor or confiscate your funds, as all transactions need your signature. However, retrieving passwords or accessing customer support may be challenging. |

| As exchanges store user funds and assets in custodial crypto wallets, they are more vulnerable to hacks. Access to funds may be blocked due to regulatory freezes or exchange outages. | Storing private keys or seed phrases in online wallets increases the risk of losing assets to hackers. Preserving keys and recovery phrases in offline or hardware wallets is safer. |

| Examples of cryptocurrency exchanges include Binance, Pancakeswap, and Qurrex. | Examples of cryptocurrency wallets include Metamask, Phantom, and Zengo. The top hardware wallet providers are Trezor and Ledger. |

Conclusion

The above cryptocurrency exchanges offer 24/7 customer support and early access to new tokens and airdrops. They also offer comprehensive learning libraries to enhance your crypto knowledge. Besides, you can earn commissions through referral programs.

Though centralized and decentralized exchanges have significant differences, you can use both for better flexibility, convenience, and profitability. However, no matter where you trade, safeguarding offline and online wallets’ private keys is imperative to prevent asset losses.

FAQs

Crypto trading platforms are centralized, decentralized, or hybrid exchanges that enable users to buy, sell, and trade cryptocurrencies. They may also offer additional products and services like staking, margin trading, crypto loans, dual investment, and NFT marketplaces.

Crypto exchanges predominantly make money through transaction fees. They also earn from deposit fees, withdrawal charges, new token listing fees, and leveraged trading interest. Some exchanges generate revenue or commissions from paid premium services, institutional services, subscription-based trading tools, and custodial services.

The best places to trade crypto are reputable centralized and decentralized exchanges. If you want a beginner-friendly platform for buying, selling, and storing Bitcoin, you can consider Cash App. You can quickly send and receive BTC on the Lightning network using Cash app.

Binance and Coinbase are examples of centralized crypto exchanges, while Orca and Pancakeswap are examples of decentralized cryptocurrency exchanges. Qurrex and Unodex are examples of hybrid exchanges.

Most exchanges, especially CEXs, have robust security features like 2FA, cold storage, multi-signature wallets, and anti-phishing codes. In contrast, DEXs ensure user security by deploying battle-tested smart contracts. Some even use decentralized oracles to feed external price data into these contracts. Overall, DEXs are more hack-proof than CEXs due to their autonomous nature.

Among the above exchanges, Gemini is the safest. It is the first cryptocurrency exchange with SOC1 Type 2 and SOC2 Type 2 certifications. It is also ISO-27001 and PCI-DSS-certified. Other key features of its compliance program include regular third-party security audits and annual penetration testing. It has also implemented security measures like 2FA, hardware security keys, cold storage, and address allowlisting.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Canton

Canton  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Dai

Dai  sUSDS

sUSDS  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  USD1

USD1  Polkadot

Polkadot  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor