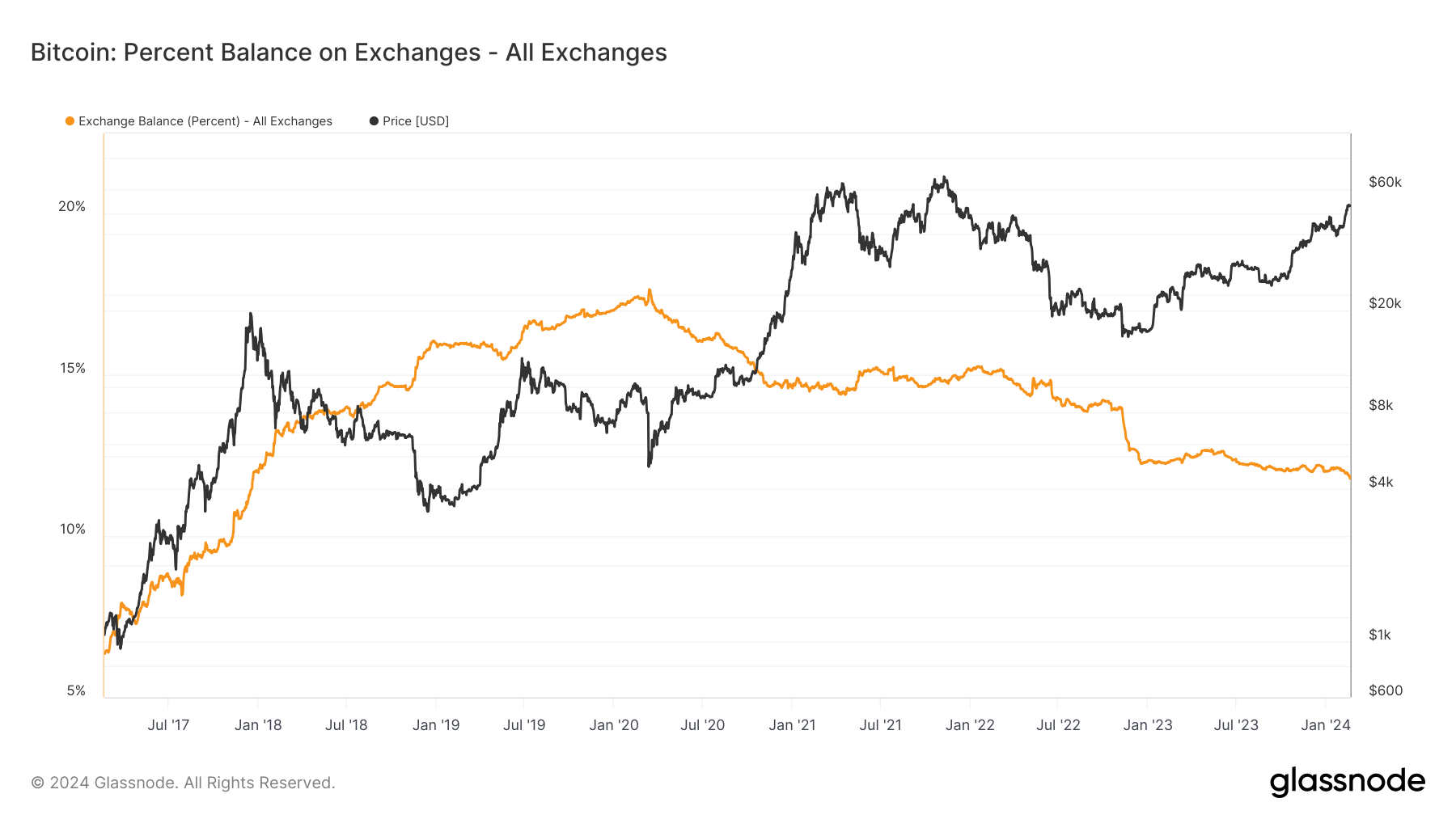

Since mid-March 2020, there has been a notable decline in the volume of Bitcoin stored in exchange wallets, marking a significant shift in investor behavior.

At the time, over 17% of Bitcoin’s total supply was housed on exchanges, a record high. This trend of declining exchange balances has continued unabated, even through Bitcoin’s 2021 bull run, which saw its price peak at $69,000 in November of that year.

This trajectory has extended into 2024, with CryptoSlate’s analysis of Glassnode data revealing a persistent decrease in Bitcoin holdings on exchanges.

From Jan. 1 to Feb. 19, the amount of Bitcoin in exchange wallets fell from 2.356 million BTC to 2.314 million, the lowest since April 2018. Meanwhile, the percentage of Bitcoin’s supply in exchange wallets decreased from 12.03% to 11.79%.

The diminishing presence of Bitcoin on exchanges suggests a growing preference among holders to transfer their assets away from these platforms. This movement may indicate a broader strategy shift towards long-term holding or a reaction to prevailing market conditions.

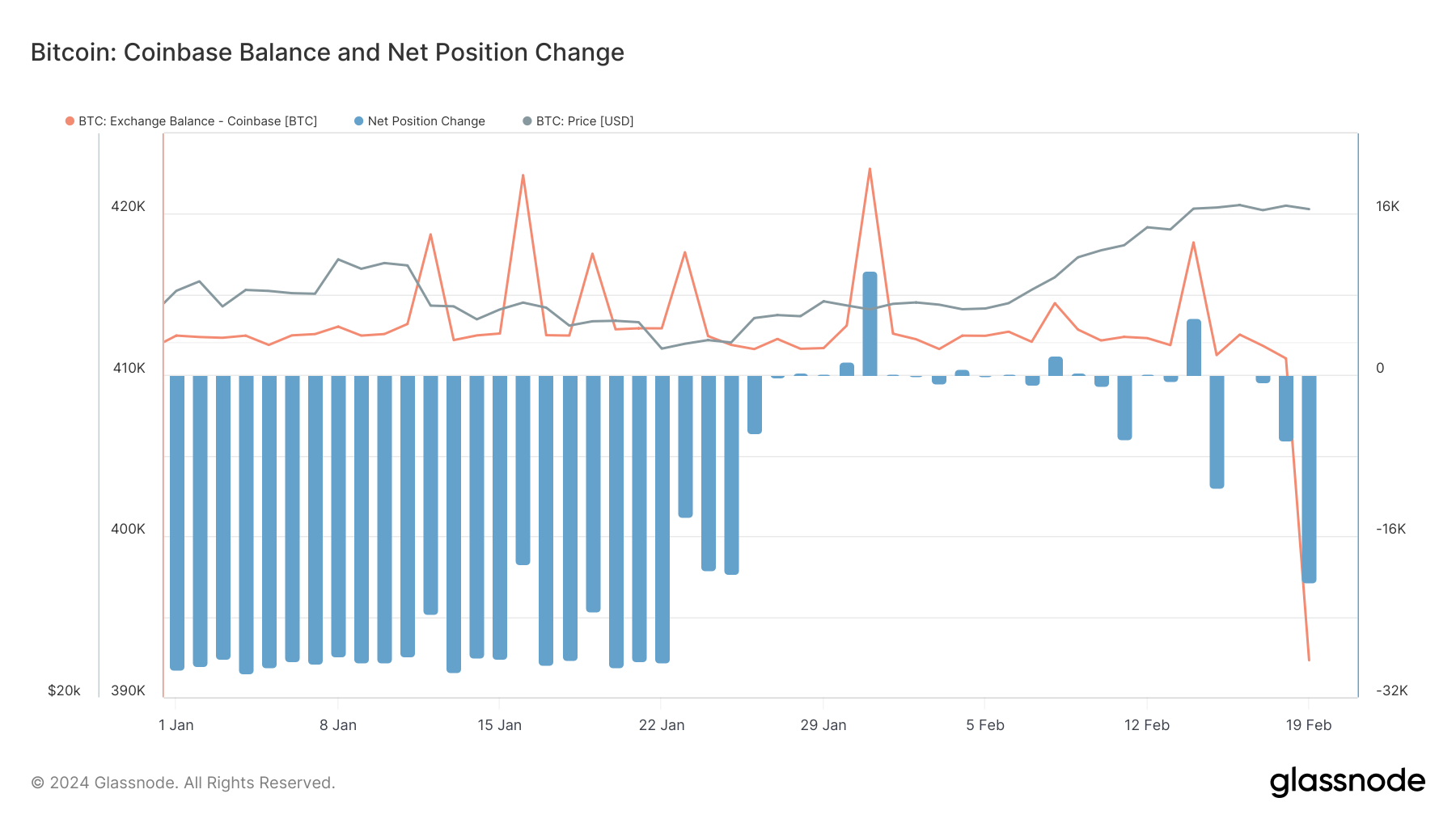

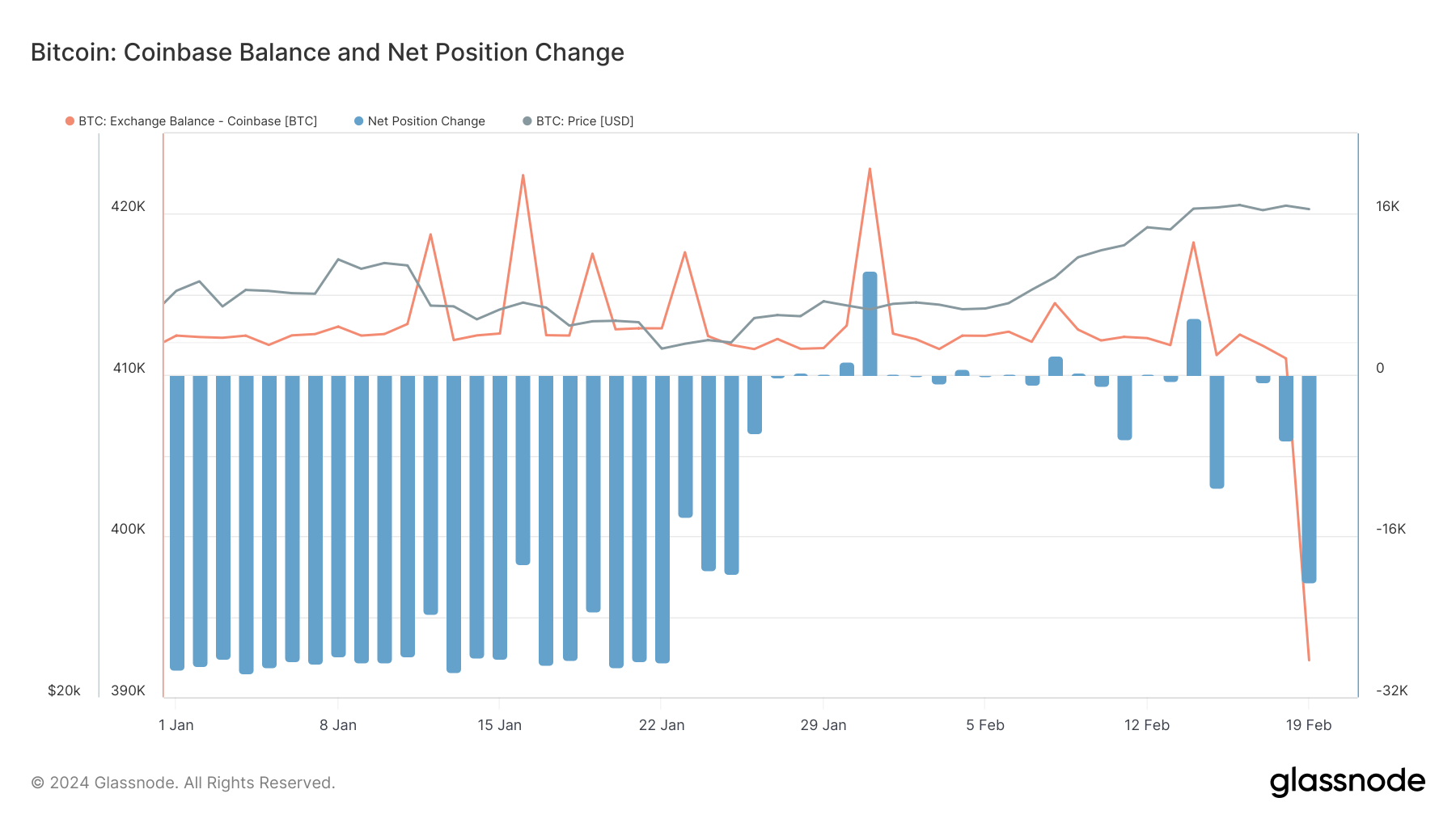

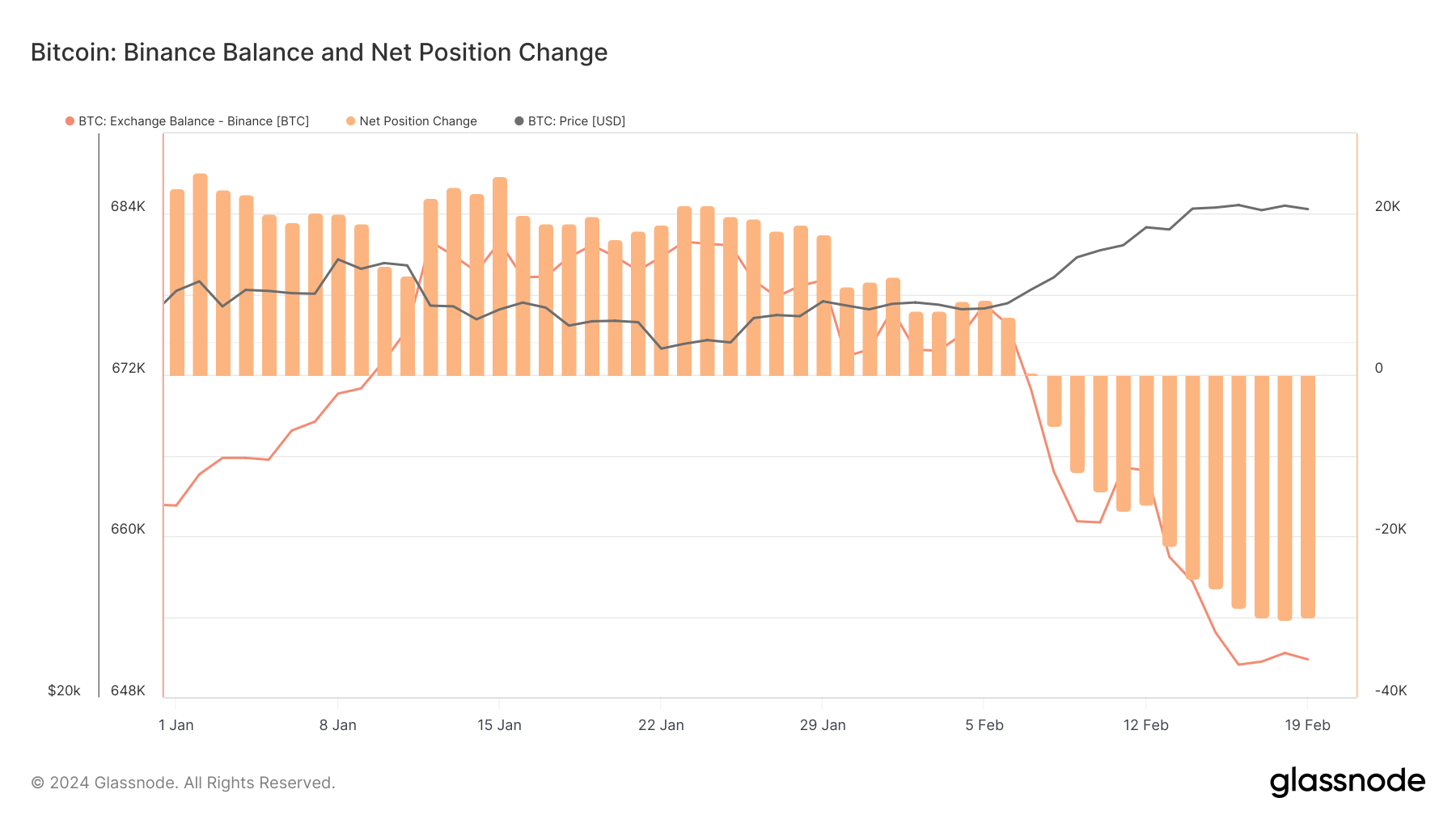

Examining specific exchanges reveals nuanced trends and exceptions within this broader pattern.

Coinbase experienced a marked reduction in its Bitcoin balance, shedding over 20,000 BTC from Jan.1 to Feb. 19, with consistent net outflows since the end of January.

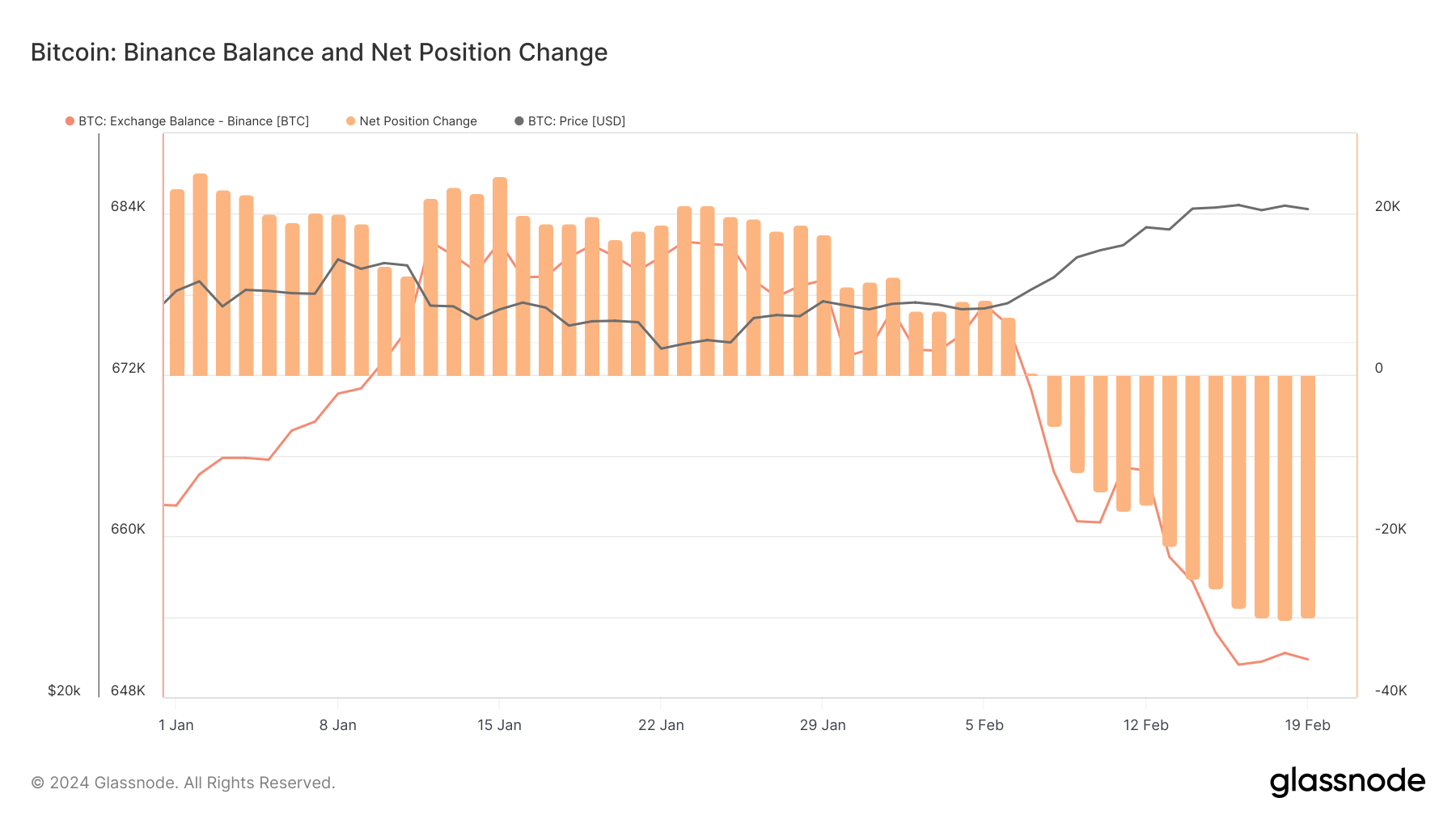

Binance also saw a notable reduction in its Bitcoin balance this year. The exchange’s balance initially increased until Jan. 26, when it began declining, with net outflows starting on Feb. 8.

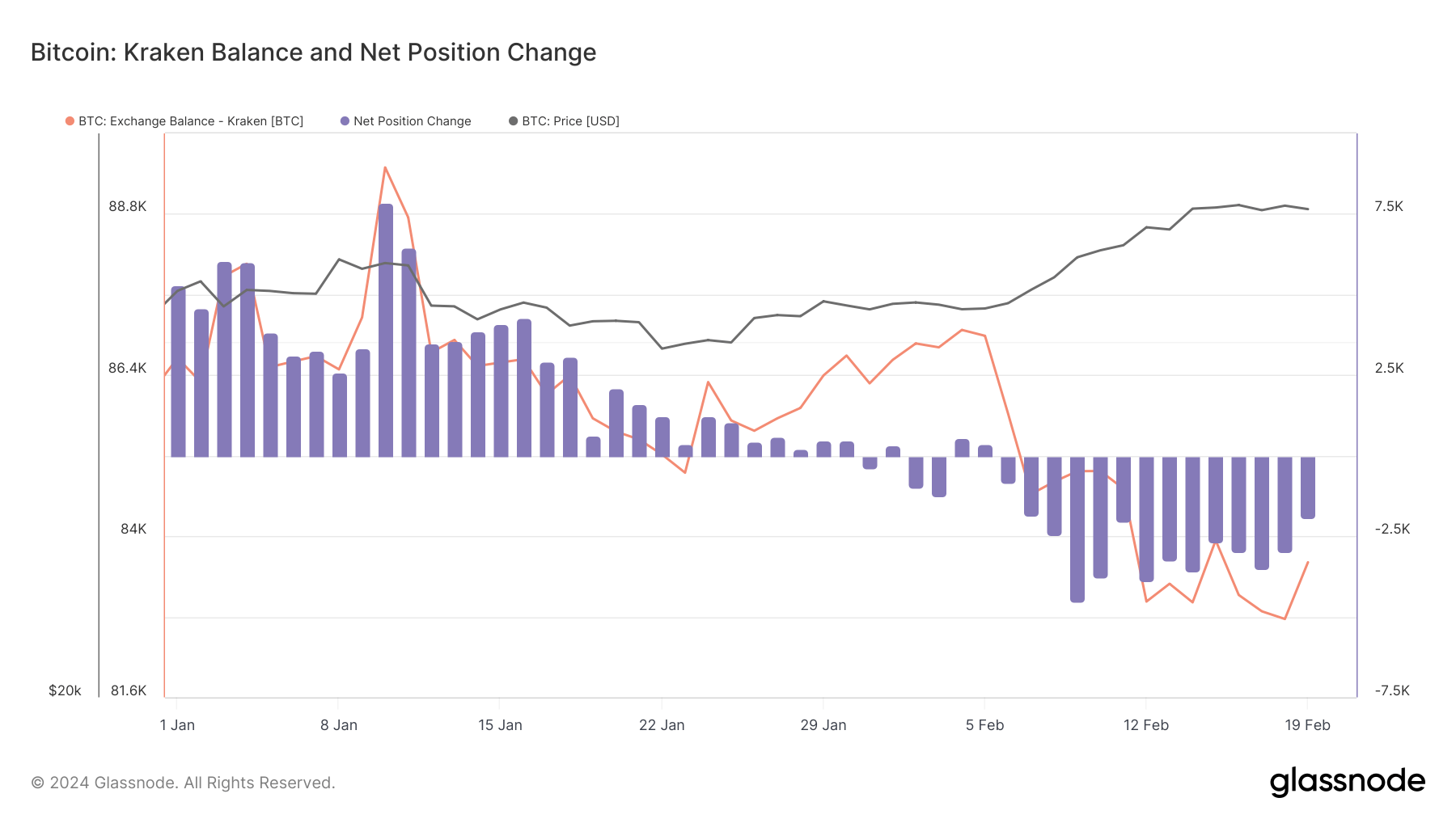

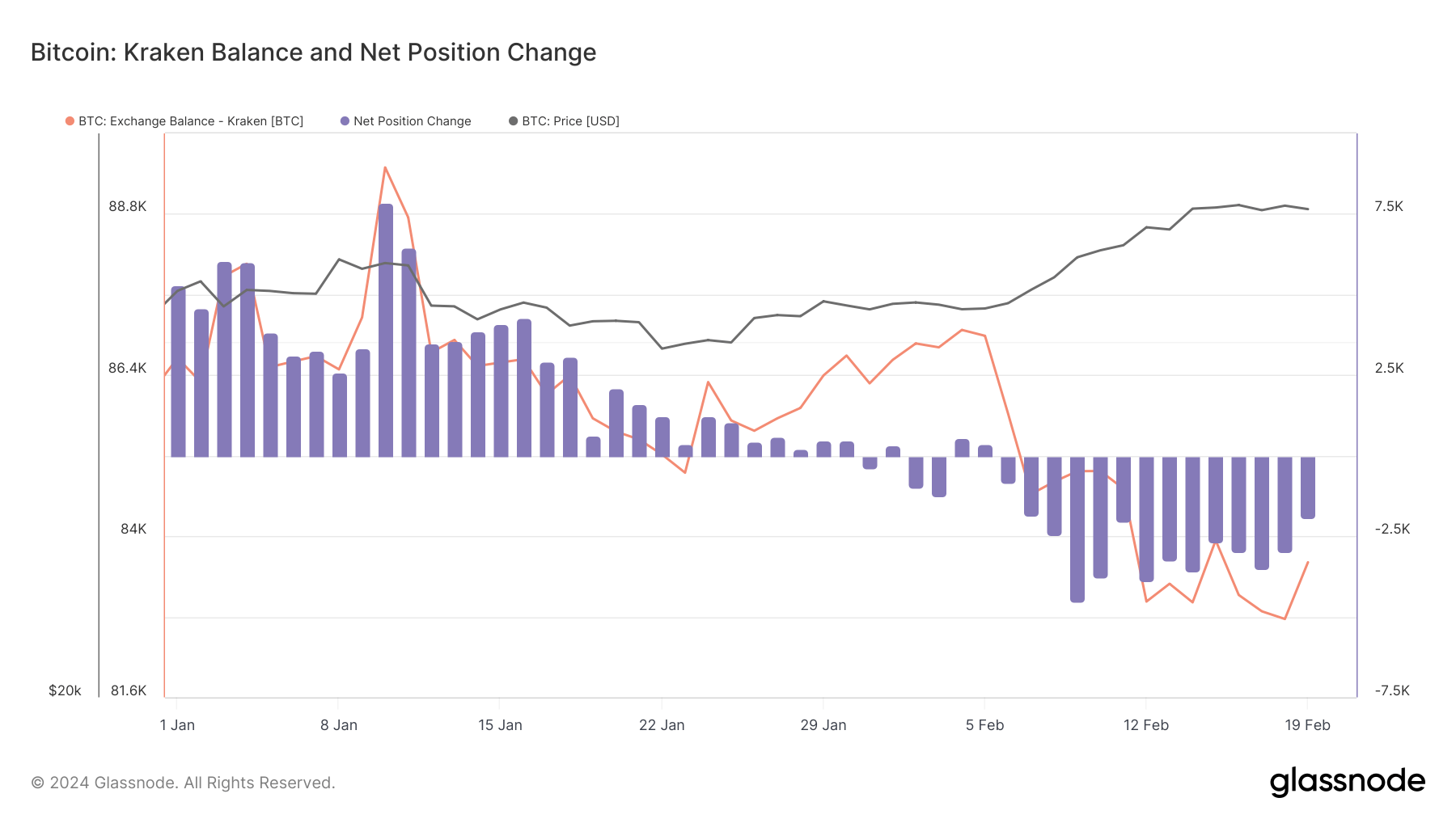

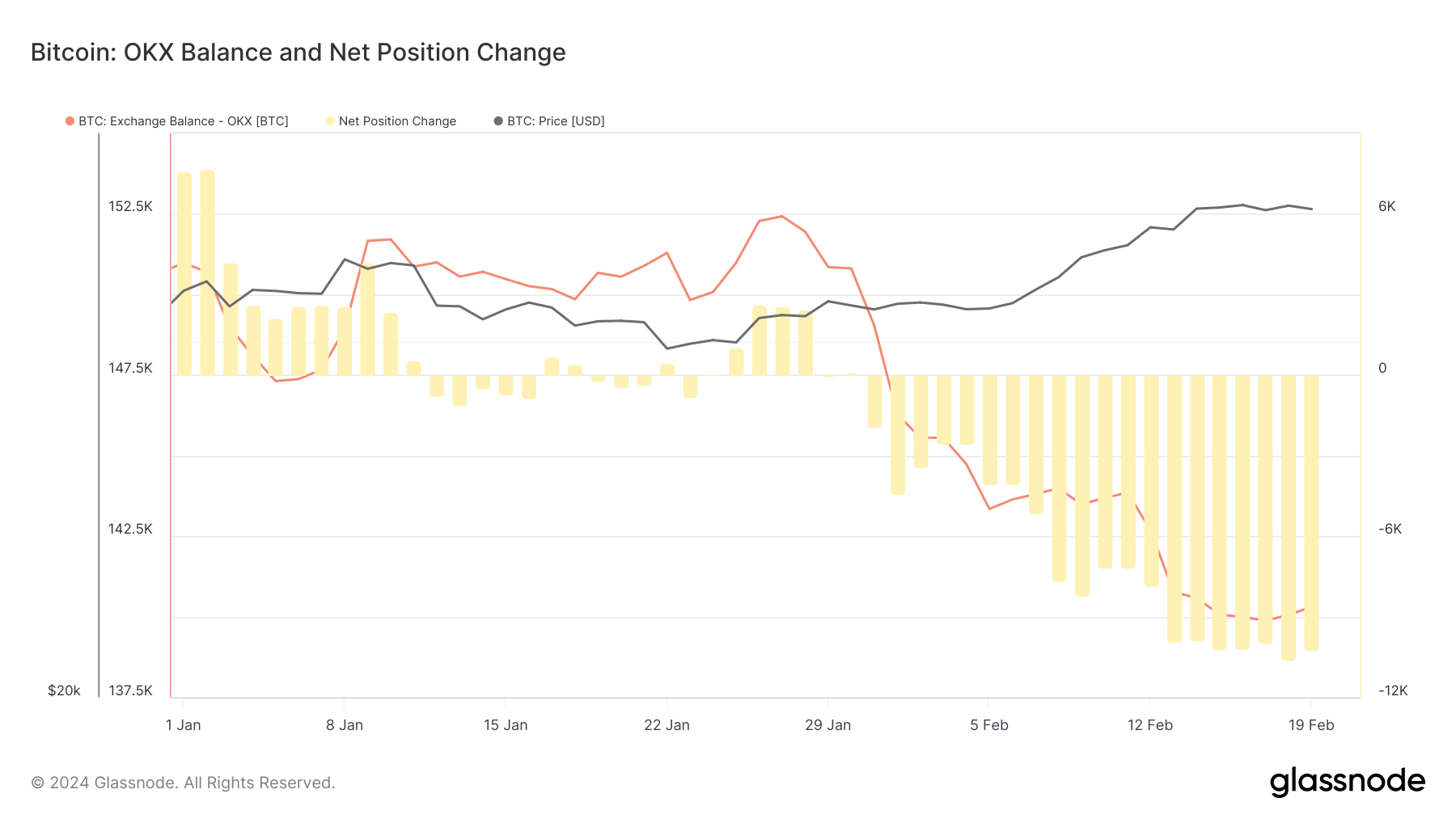

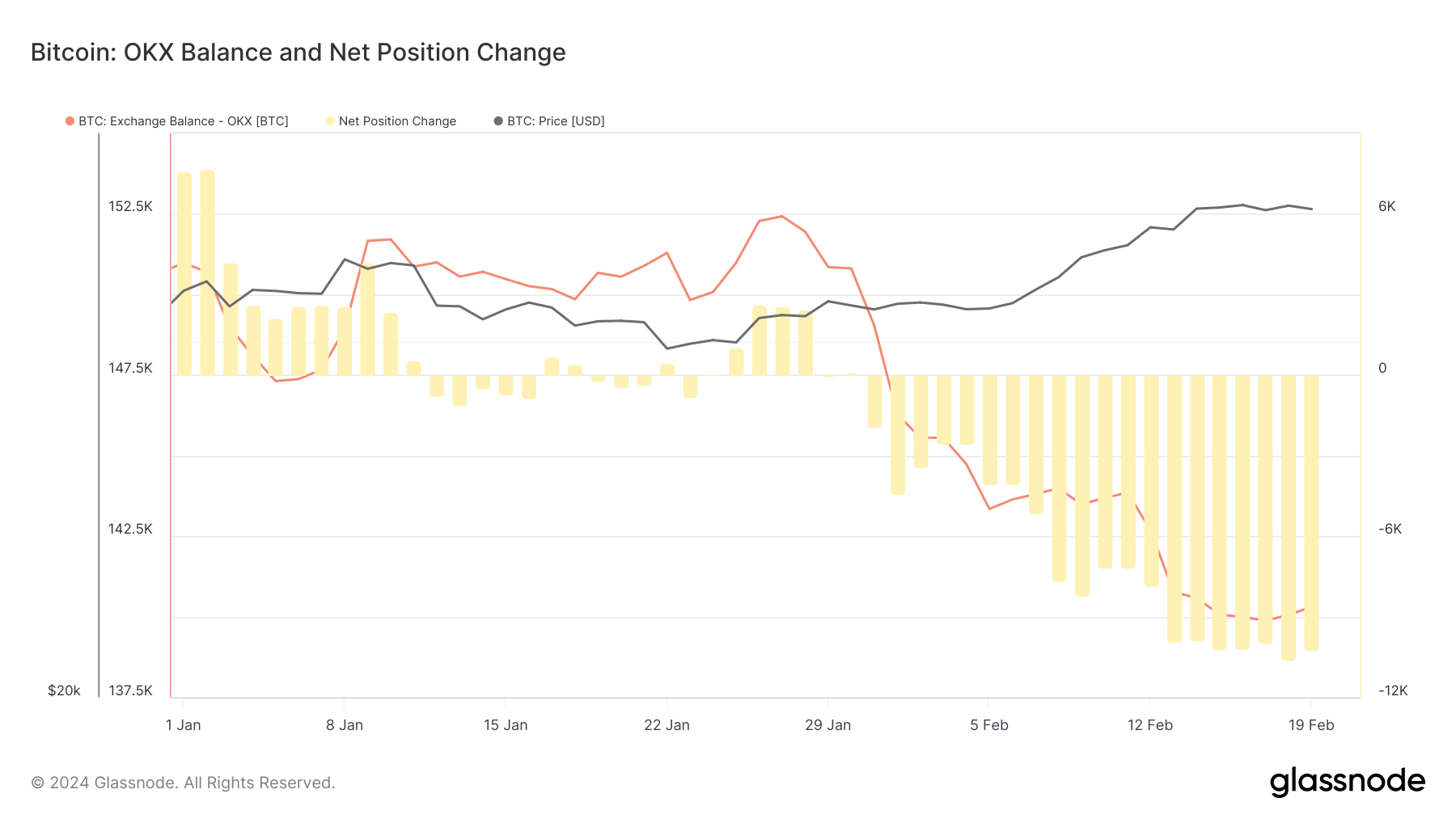

Kraken and OKX aligned with this trend, recording net outflows and a significant decrease in their Bitcoin balances.

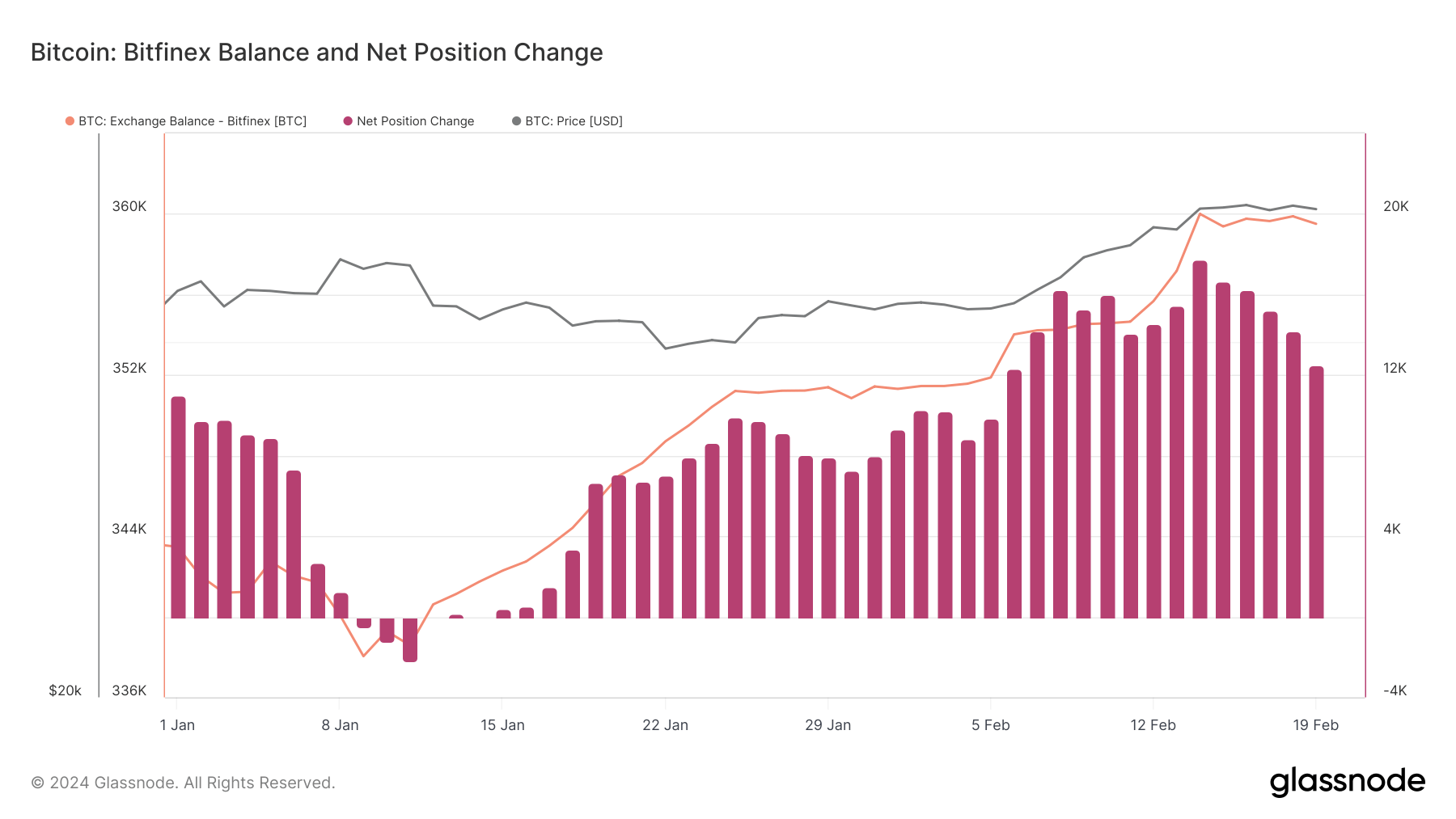

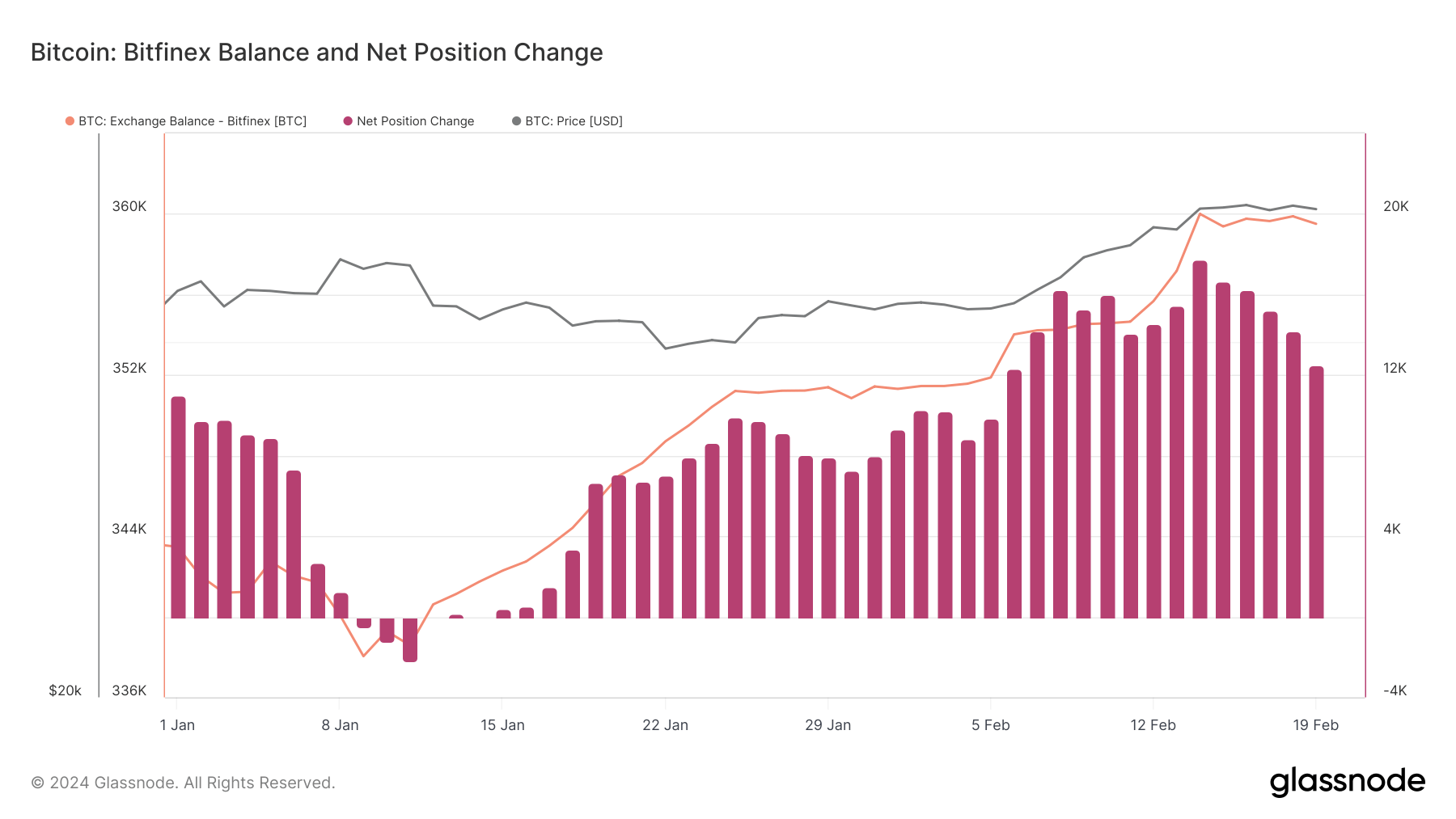

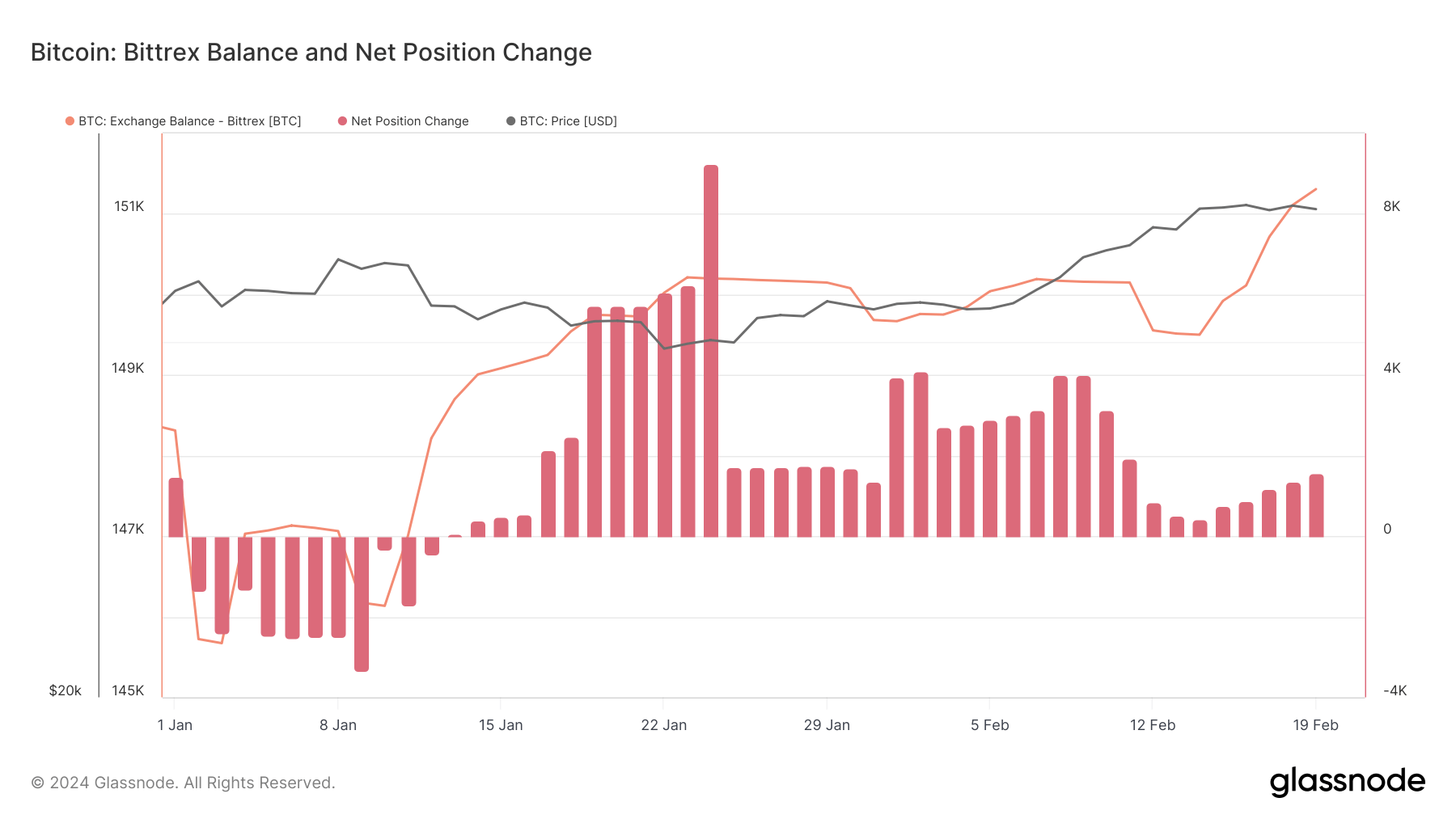

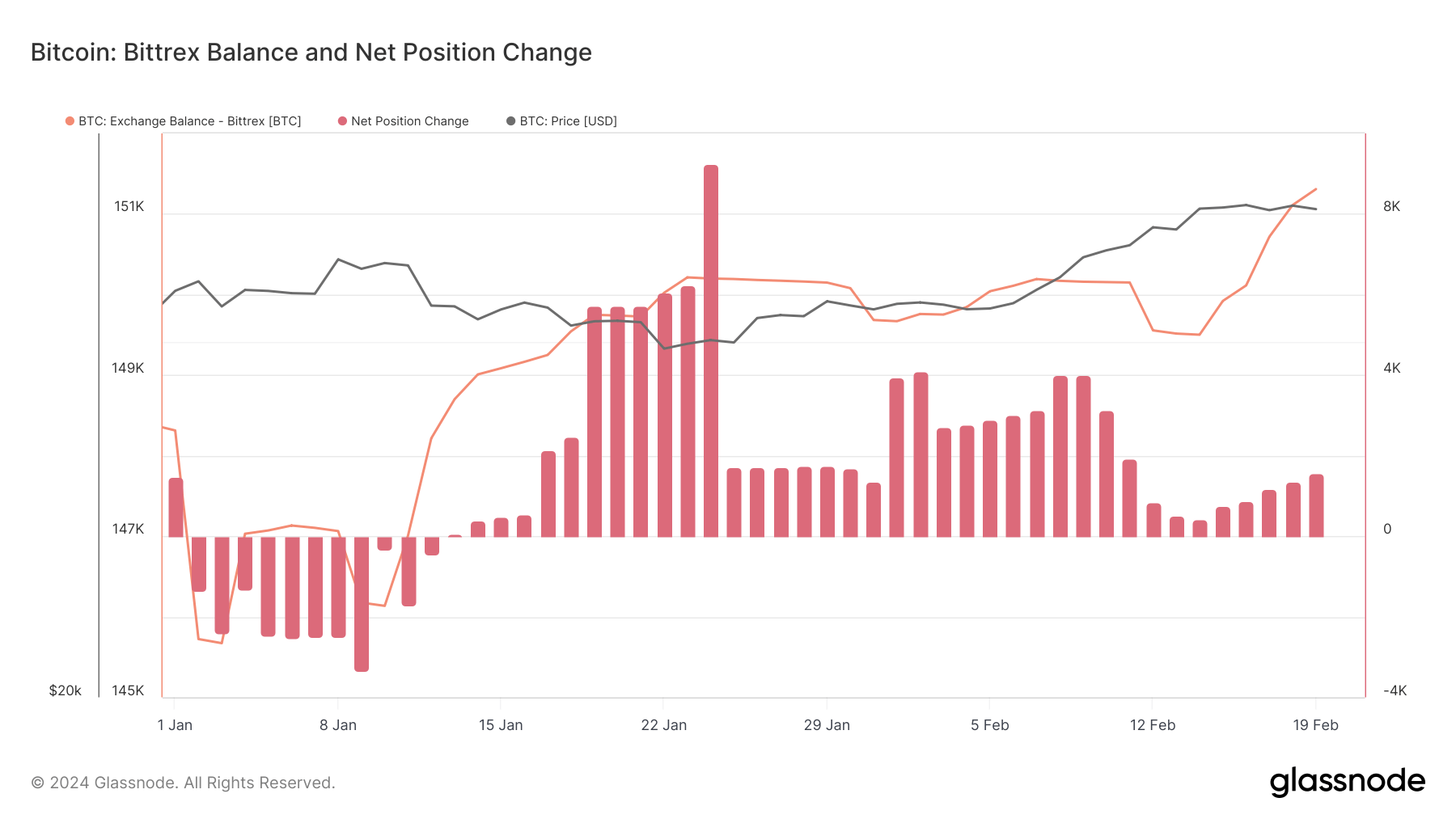

Contrary to the general trend, Bitfinex and Bittrex have seen net inflows since mid-January.

Bitfinex saw over 16,000 BTC added to its Bitcoin balance since the beginning of the year, helped by consistent net inflows since Jan. 15.

Bittrex also saw a spike in its balance, but this time by a modest 3,000 BTC since Jan. 1. The exchange also witnessed consistent net inflows since Jan. 14.

The general decrease in Bitcoin balances on exchanges correlates with a bullish sentiment in the market. Investors withdrawing Bitcoin to personal wallets for long-term holding reduces the selling pressure on exchanges. This strategy is underscored by Bitcoin’s price surge from $44,152 on Jan. 1 to $52,000 by Feb. 19, despite experiencing a dip in mid-January.

The launch of Spot Bitcoin ETFs in the US has likely influenced these trends, but other significant factors have also played pivotal roles. The anticipation and introduction of these ETFs might have bolstered market sentiment, contributing to Bitcoin’s price rebound and further rise in February.

Additionally, the migration of Bitcoin away from exchanges could be attributed to growing optimism among investors, who foresee further price gains driven by broader acceptance and investment in Bitcoin.

However, the collapse of FTX and Celsius and Binance’s legal challenges have been significant catalysts, prompting users to withdraw funds from exchanges due to security and regulatory compliance concerns.

These events have heightened awareness around the risks associated with keeping assets on exchanges, leading to a shift towards personal wallets for enhanced control and safety.

As Bitcoin is removed from exchanges, the resulting liquidity reduction could increase price volatility. Yet, this movement also shows a firm conviction in holding among investors, setting the stage for potentially more sustained price growth as the available supply becomes increasingly constrained.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  Canton

Canton  Uniswap

Uniswap  PayPal USD

PayPal USD  Mantle

Mantle  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Aave

Aave  Rain

Rain  Bitget Token

Bitget Token  MemeCore

MemeCore