The Bitcoin price has had a rocky start to the new week after losing its footing above $52,000 on Tuesday. However, all hope is not lost, as indicators still point to a continuation of this trend. Crypto analyst Tony The Bull has identified an important trend in the Bitcoin chart which could trigger a continuation of the trend back above $52,000.

Bitcoin 1-Week Fisher Transform At Crucial Point

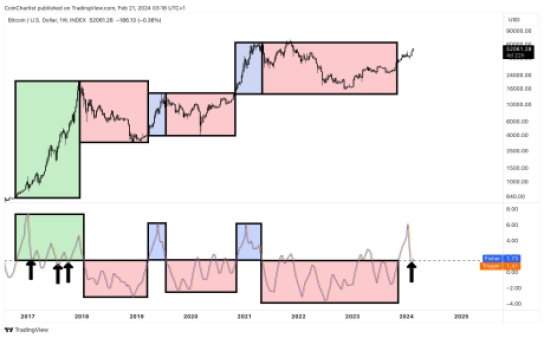

In an analysis posted on X (formerly Twitter), the crypto analyst shared a chart that showed the Bitcoin Fisher Transform in comparison to price. Most importantly, the chart showed the 1-week Fisher Transform and how it has moved since 2017.

The analysis shows some similarities between the current trend and the trends seen in 2017. A similar trend was also seen in 2019 and 2021, where the Fisher Transform rose rapidly before falling. But the importance of this trend lies in where the Fisher Transform heads next from here.

The current important level is the 1.5 Standard Deviation, which has been a crucial point whenever this trend has occurred. Now, if the Fisher Transform is able to stay above this level, it is bullish for the price. However if it falls below this standard deviation, it is very bearish for the price.

Source: Tony The Bull on X

“This is a pivotal area based on historical price action and its exhibiting 2017-like behavior not seen in 2019 or 2021,” the crypto analyst explains. “Below it tends to incite bearish trends, while holding above gives bulls extra vigor.”

BTC price at $51,100 | Source: BTCUSD on Tradingview.com

Bears And Bulls Vie For Control Over BTC Price

The interest in the next direction of the Bitcoin price has seen bulls and bears lock horns over which camp will reclaim control of BTC. This has seen the price of the digital asset fluctuate wildly over the last few days, going from $53,000 to below $51,000, before bouncing back up once again in the early hours of Wednesday.

This tug-of-war continues to hold the price of Bitcoin down, but investor sentiment seems to be climbing even through this. According to the Bitcoin Fear & Greed Index, investor sentiment has reached Extreme Greed for the first time in one year.

Historically, the index going into extreme greed has signaled the top of the market, with prices trending downward not too long after. However, Bitcoin is still seeing positive indicators, with its trading volume rising more than 40% in the last 24 hours alone.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Hedera

Hedera  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle