Quick Take

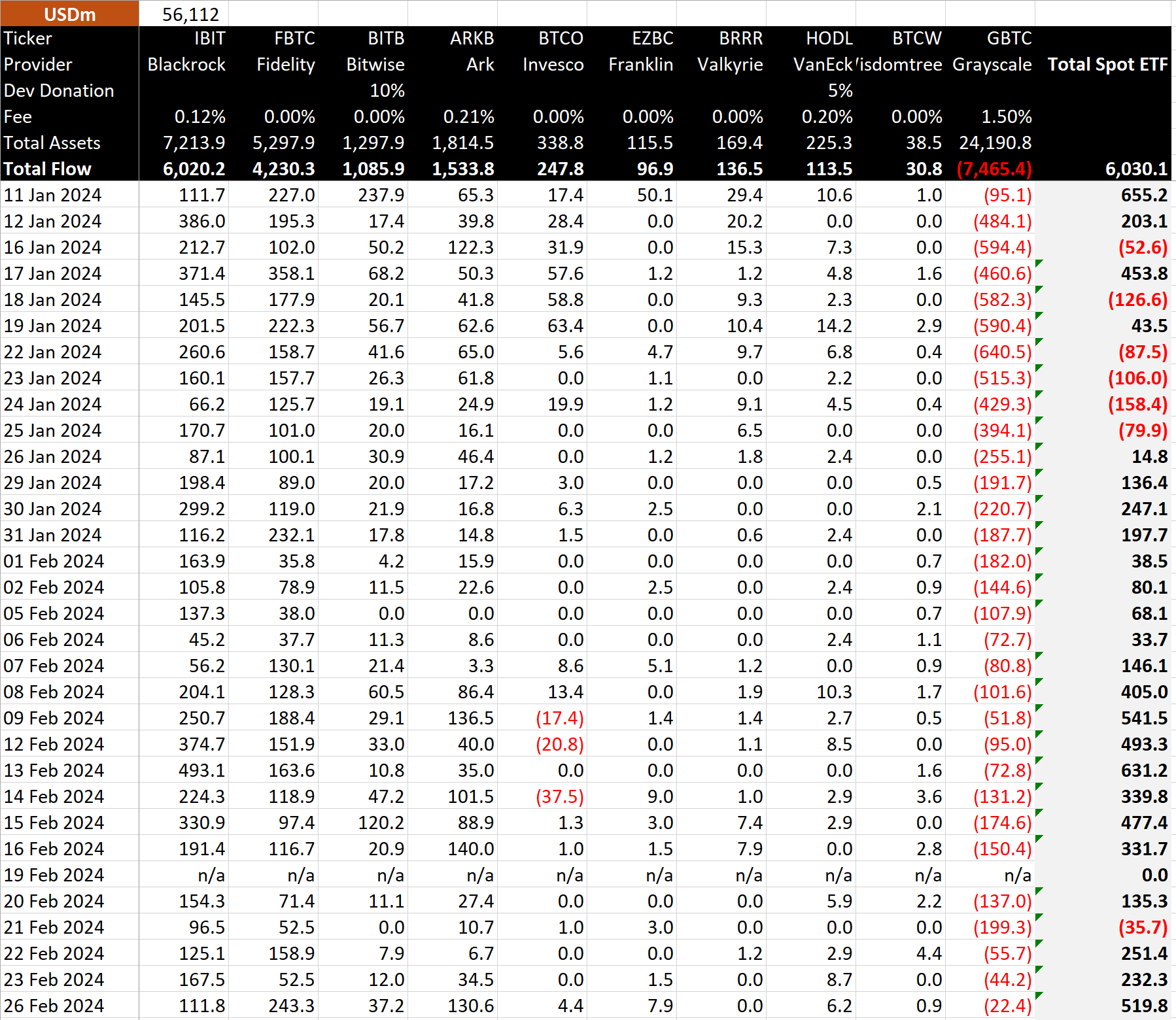

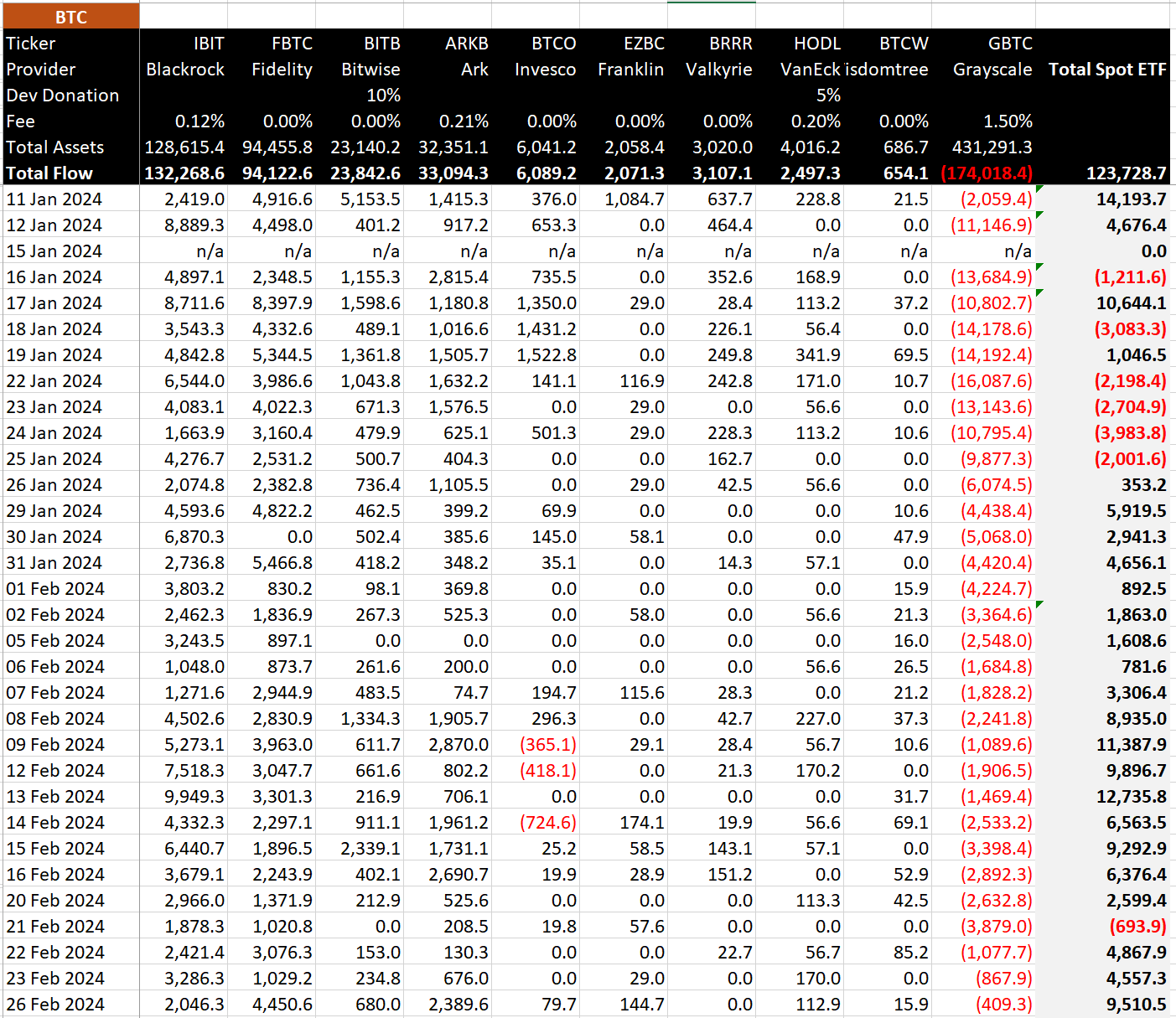

There is a notable surge in capital inflows into Bitcoin ETFs, a trend clearly highlighted by recent capital movements. BitMEX data shows that ETFs saw a massive net inflow of $520 million, or the equivalent of 9,510 BTC, on Feb. 26.

GBTC, once a favored choice among investors, continues to experience outflows with a record of $7.5 billion in total outflows. Interestingly, the outflow trend has been steadily dwindling over three consecutive trading days, dropping from $56 million to $22 million, according to BitMEX.

BitMEX data shows that Fidelity’s FBTC is experiencing a formidable upsurge, with a massive $243 million inflow on a single day, propelling their total net flows to an impressive $4.2 billion. Similarly, Ark Invest ARKB and BlackRock IBIT enjoyed strong inflow days, adding $131 million and $112 million, respectively, to their coffers.

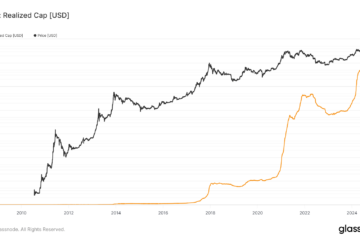

This trend represents an aggregate net inflow of over $6 billion for all spot US ETFs or the equivalent amount of 123,729 BTC, according to Bitmex.

The post Fidelity leads Bitcoin ETFs 4th best day since launch reaching $6 billion total net inflows appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  Canton

Canton  Uniswap

Uniswap  PayPal USD

PayPal USD  Mantle

Mantle  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Aave

Aave  Rain

Rain  Bitget Token

Bitget Token  MemeCore

MemeCore