The successful debut of the REX-Osprey Solana ETF and the growing probability of a spot Solana ETF approval have intensified discussions about what comes next. As Solana climbs the institutional ladder, the spotlight turns to other altcoins that could follow its path into the ETF arena. XRP, Cardano (ADA), and Avalanche (AVAX) are among the top contenders.

The Ripple Effect: Why Solana Opens the Door

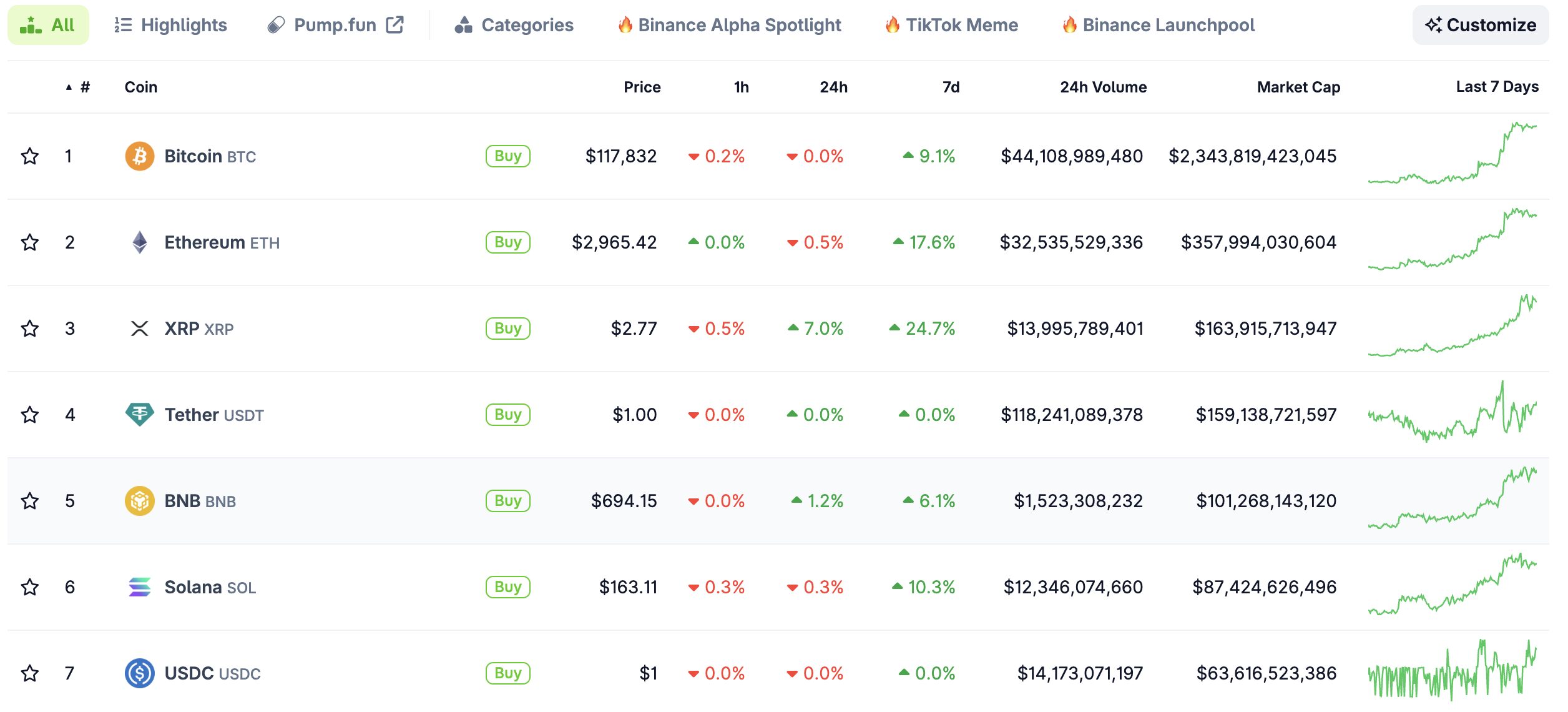

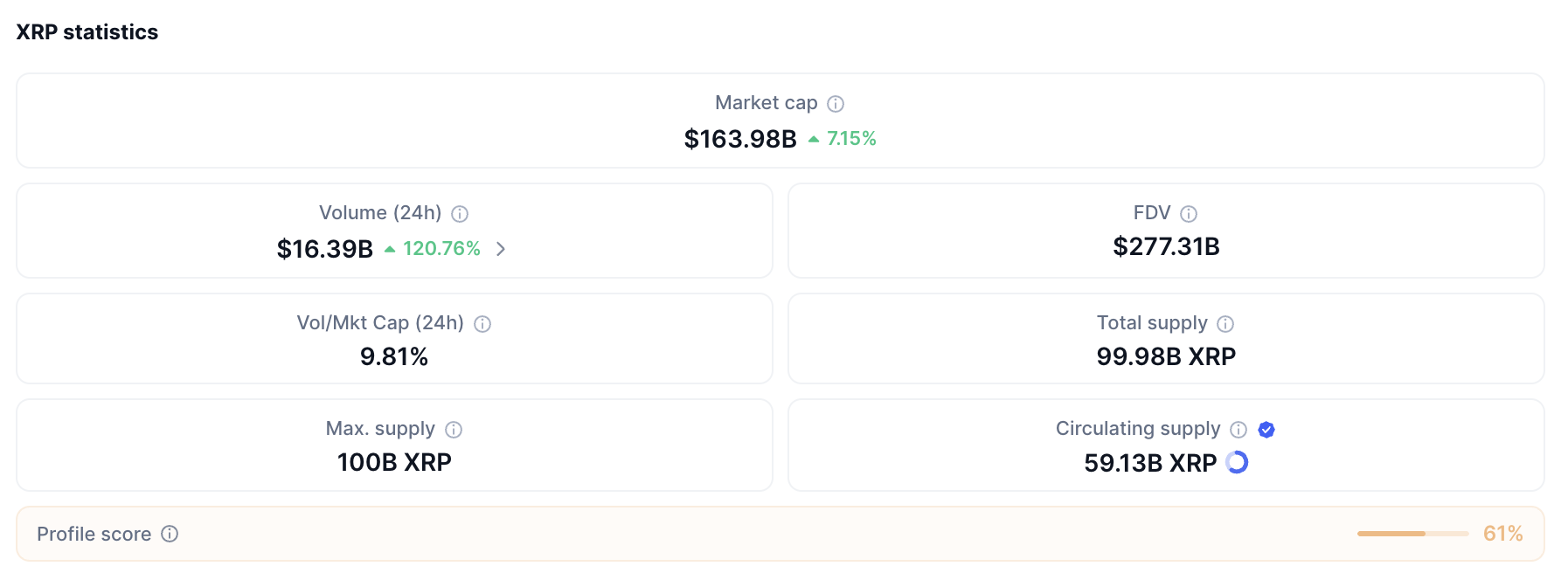

Solana’s ETF breakthrough is not just a win for its ecosystem — it sets a beginning step for other altcoins. After Bitcoin and Ethereum ETFs were approved based on their commodity-like status and deep liquidity, Solana became the first altcoin beyond the “Big Two” to meet the conversation threshold. As of July 2025, Solana ranks #6 by market cap at over $67 billion, with daily trading volumes averaging $2.5 billion across major exchanges.

Source: Coingecko

Moreover, with over 2,400 active validators and high throughput, at up to 65,000 TPS as announced, have made Solana a good consideration in the eyes of institutional investors. The SEC’s recent request for amended S-1 filings for spot Solana ETFs — with a soft deadline of July 31 — signals the regulatory door is opening wider, potentially establishing a framework that altcoins like XRP, ADA, and AVAX could follow.

For more: Solana ETF: VanEck, REX-Osprey & the Road Ahead

XRP: The Dark Horse with Legal Clarity

XRP could be seen as the most notable case when referring to altcoin ETFs. It is the most legally clarified asset in the altcoin ETF discussion. In July 2023, a U.S. federal court ruled that XRP sales on secondary markets do not constitute securities transactions, a partial victory that Ripple Labs capitalized on. While the ruling didn’t fully absolve Ripple from regulatory scrutiny, it effectively removed one of the biggest legal barriers to institutional products based on XRP.

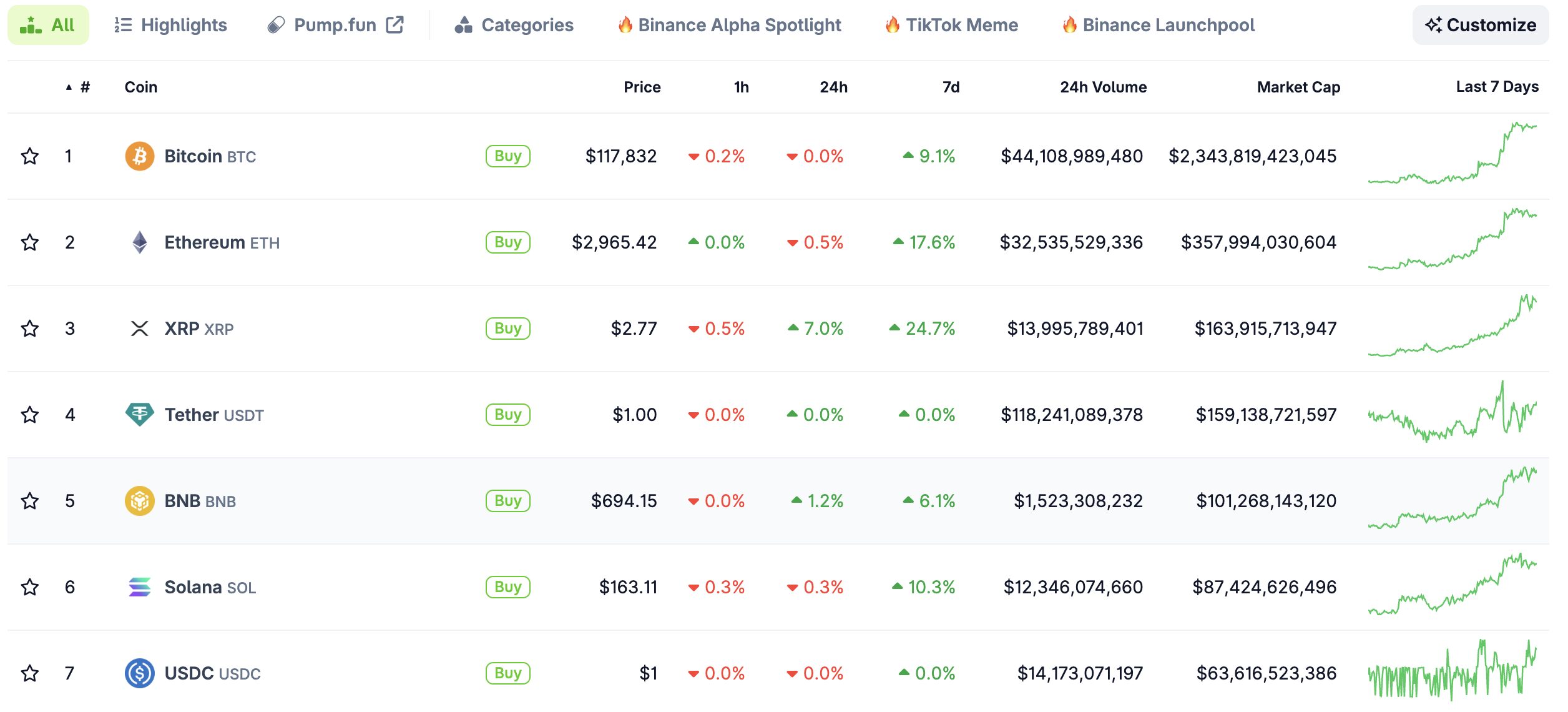

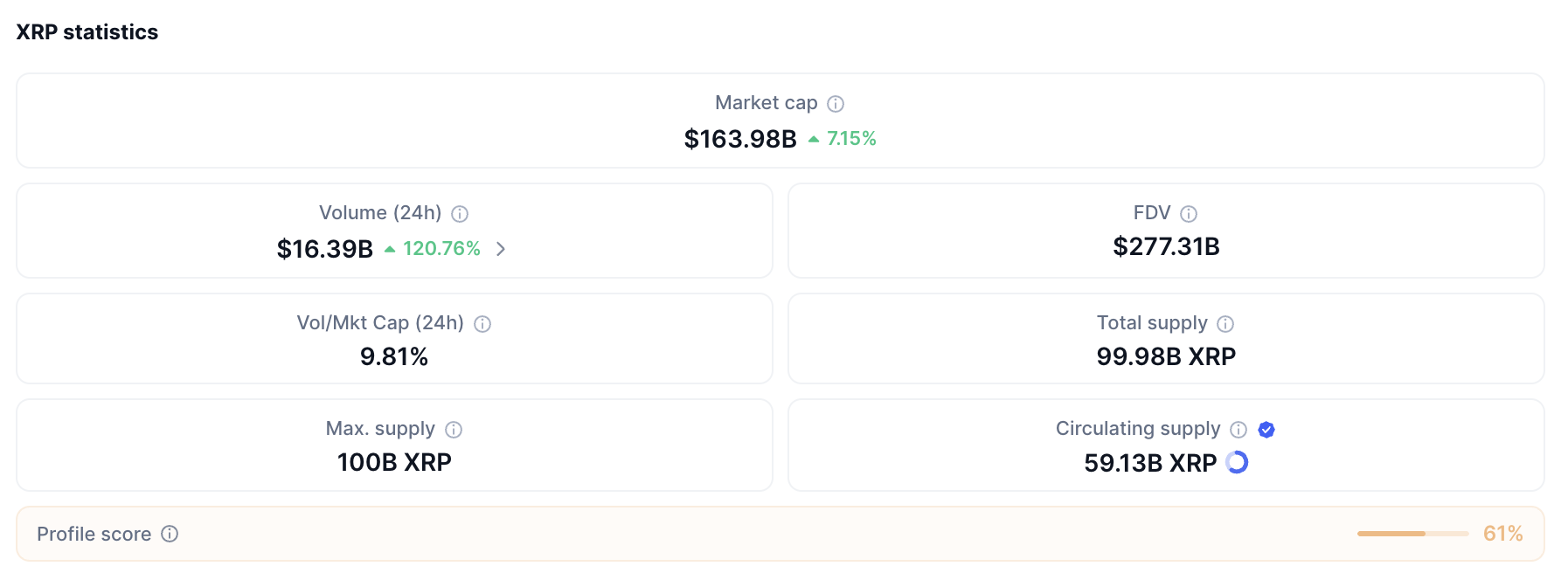

Source: CoinMarketcap

XRP’s liquidity metrics are strong. As of Q2 2025, XRP sees daily volumes exceeding $1.2 billion and is listed on over 100 exchanges globally. Its use case in cross-border payments continues to be validated, with RippleNet processing over $15 billion in remittance volume annually across regions like Asia and Latin America, according to the Ripple Transparency Report.

With its legal clarity, deep liquidity, and existing institutional footprint, XRP is arguably the most ETF-ready altcoin — pending a shift in SEC posture toward post-Solana altcoin products.

For more: XRP Deep Dive: A Comprehensive Analysis of Ripple Effect

Cardano (ADA): A Long-Term Bet on Fundamentals

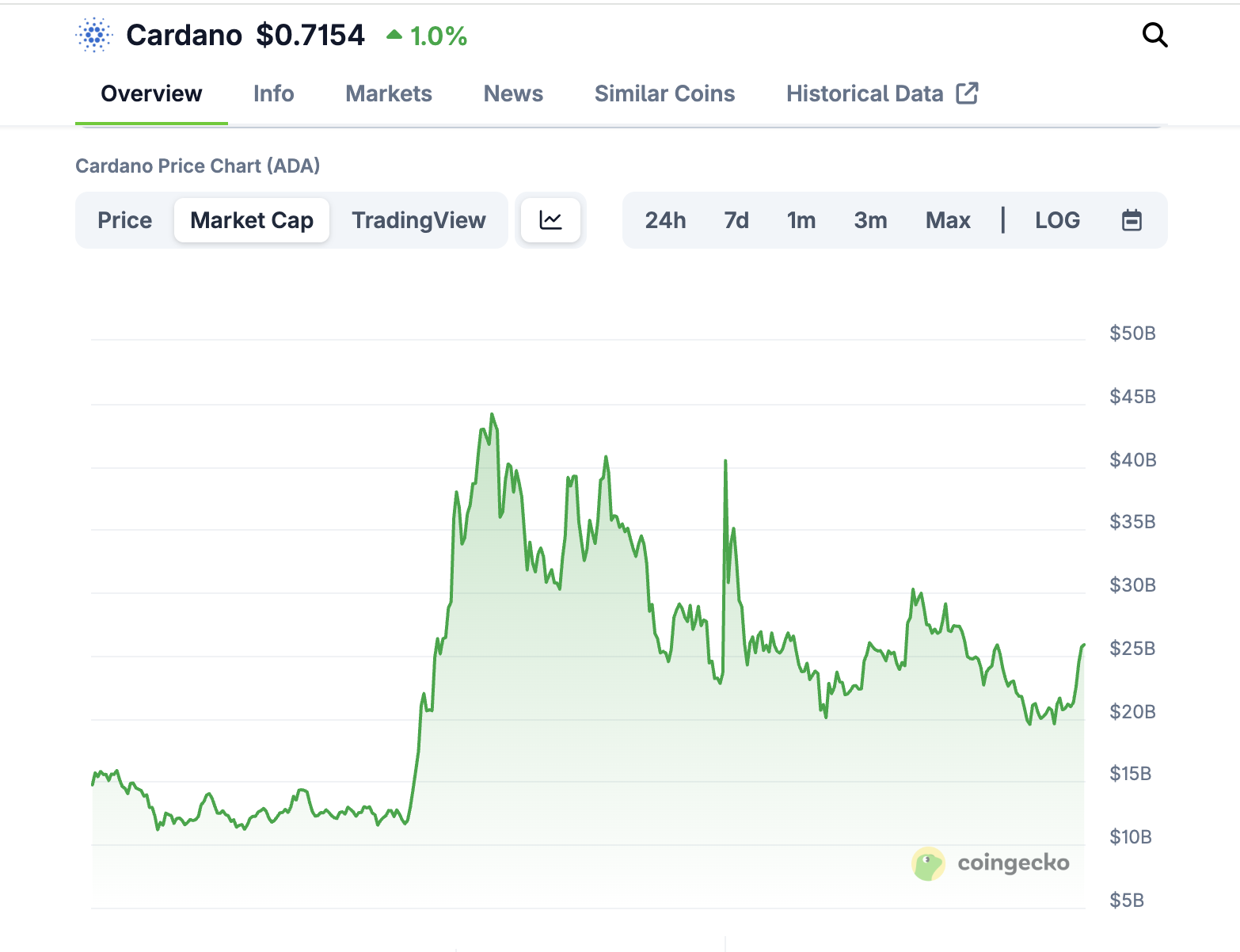

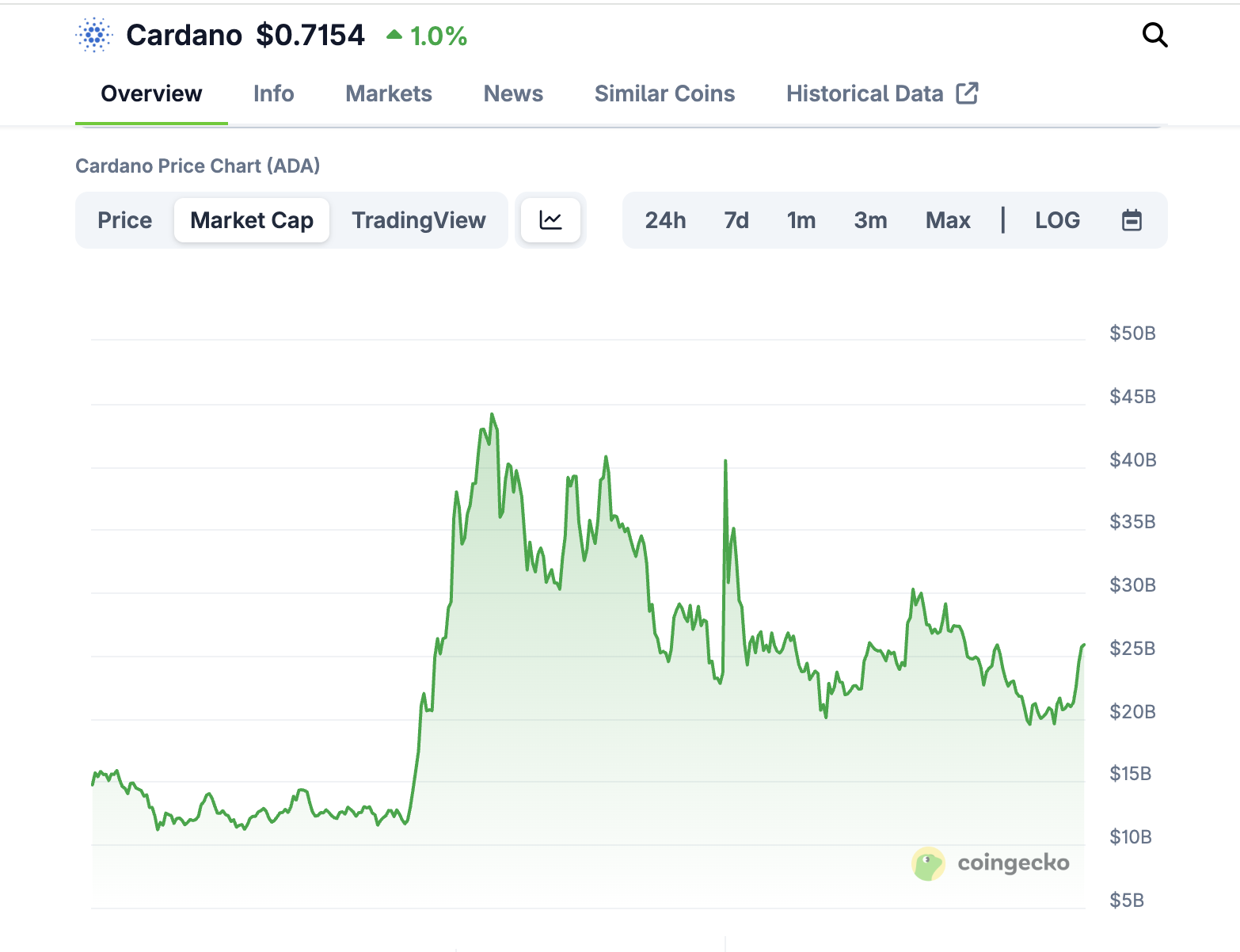

Cardano is a strong name in this list. It is seen as the “slow and steady” contender. Its research-first philosophy, rooted in peer-reviewed academic papers and formal verification, makes it appealing to institutional investors looking for technical rigor. With a current market cap of $25 billion, ADA ranks among the top 20 cryptocurrencies, and its staking ecosystem includes over 3,200 stake pools, highlighting strong decentralization.

Spurce: Coingecko

However, Cardano’s on-chain activity lags behind Solana and Ethereum. According to Coingecko metrics, daily transaction volume for ADA in June 2025 was approximately $2.6 billion, approximately to Solana’s $2.5 billion. Its DeFi TVL remains modest at just over $400 million, limiting its case for financial utility compared to faster-growing chains.

Source: DefiLlama

Yet, in the eyes of conservative allocators, ADA’s long-term vision for governance, scalability (via Hydra), and interoperability could serve as a foundation for ETF viability — particularly as broader altcoin regulations mature.

Avalanche (AVAX): The Enterprise-Friendly Contender

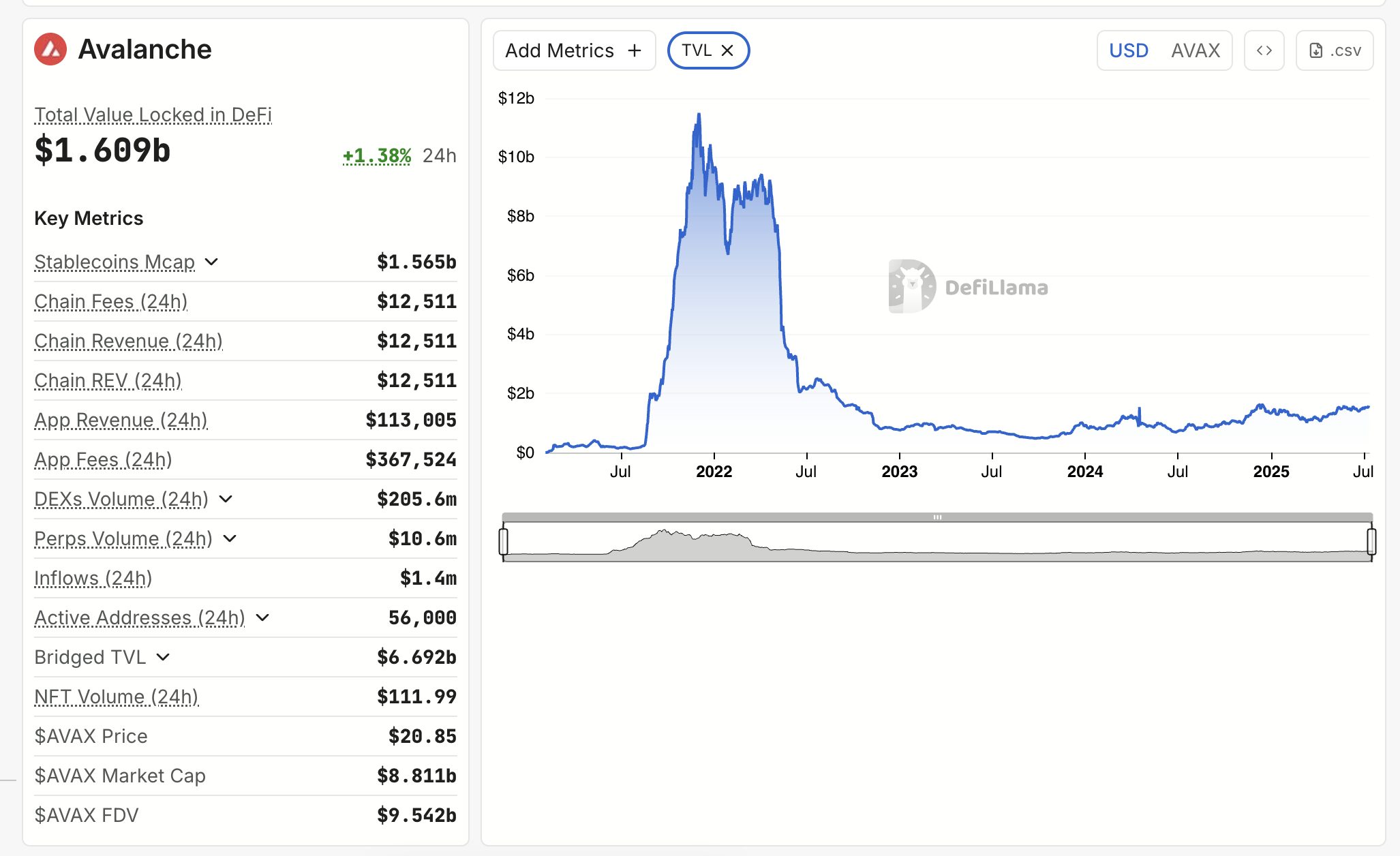

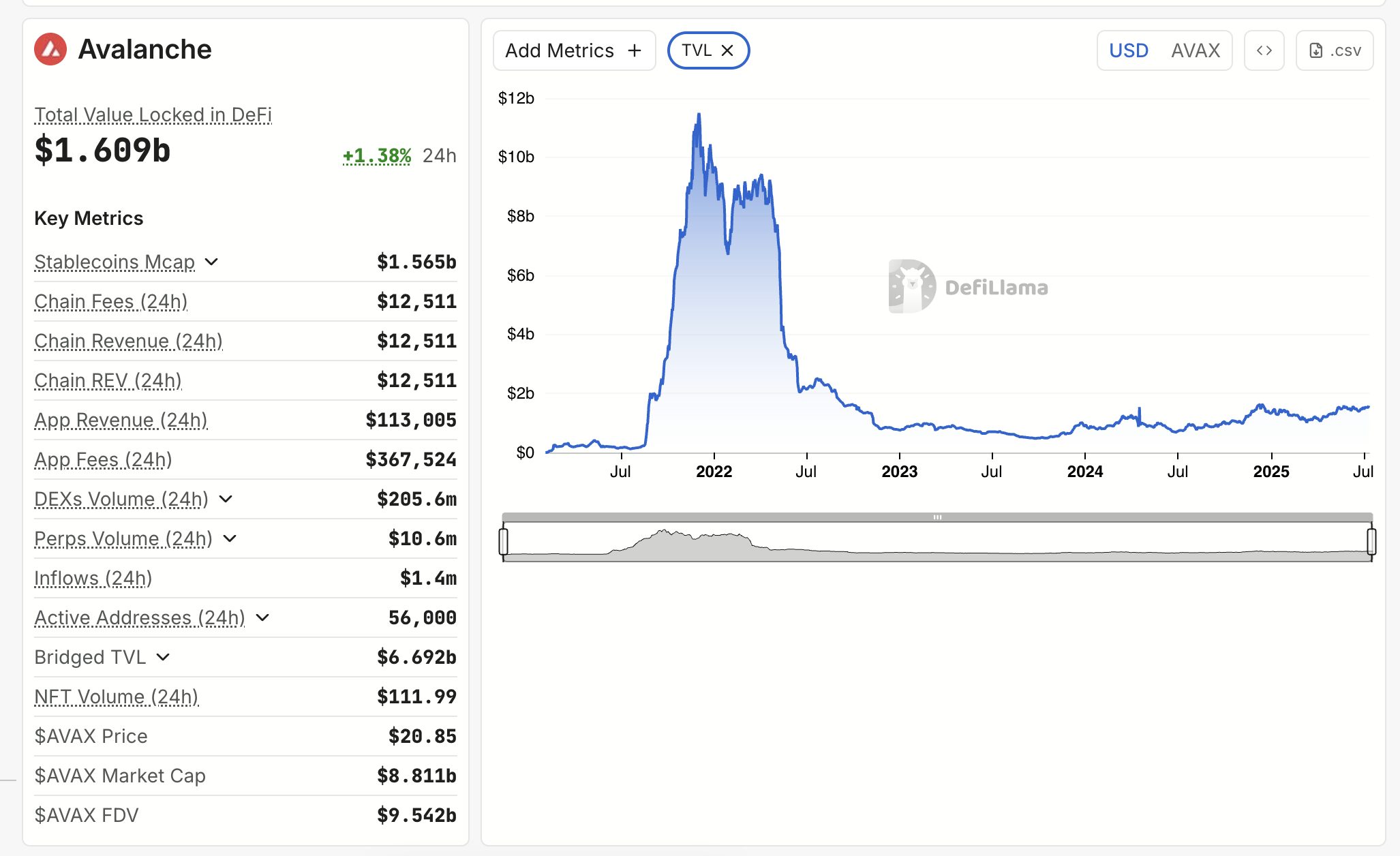

Final in the list, Avalanche stands out for its modular design and enterprise appeal. With its unique subnet architecture, AVAX enables institutions to create custom, permissioned chains — a key differentiator in discussions around compliance-ready blockchain infrastructure. As of July 2025, Avalanche supports over 120 subnets and has partnered with firms like Amazon Web Services and JPMorgan on blockchain pilots.

Source: DefiLlama

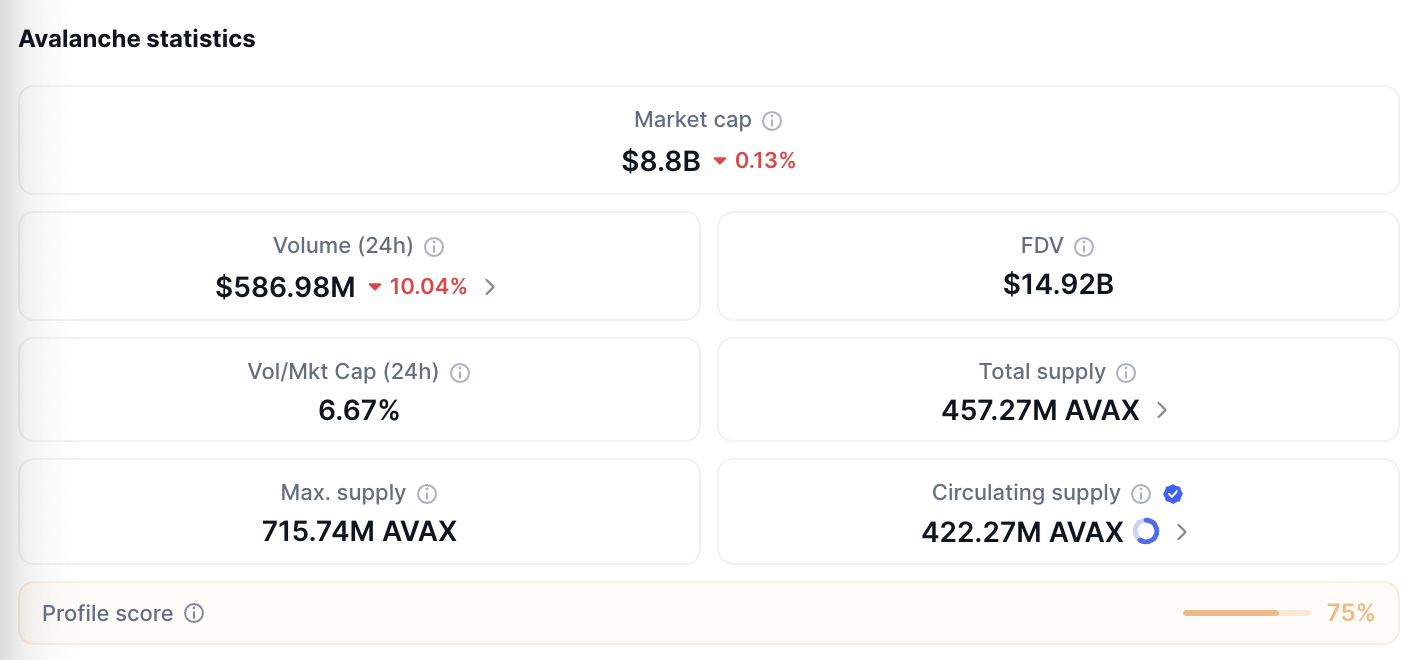

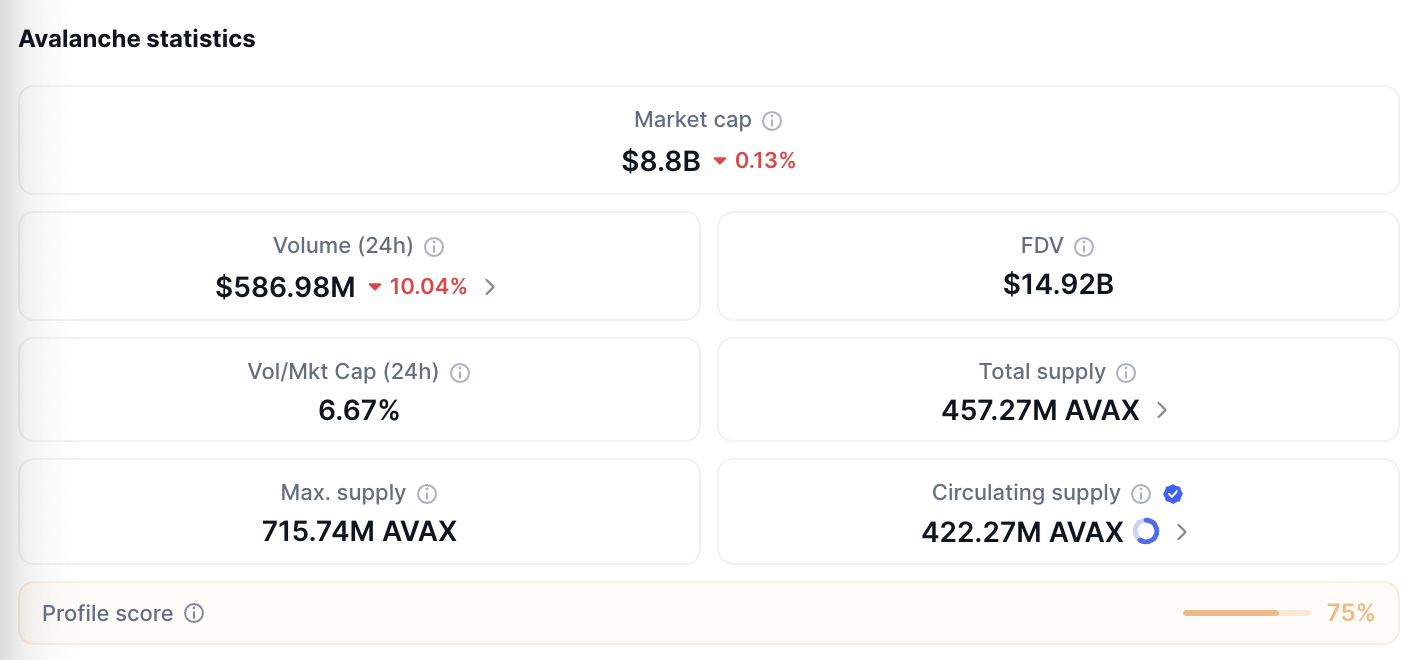

In terms of metrics, AVAX commands a market cap of $8.8 billion, with a DeFi TVL of $1.6 billion, ranking it within the top 6 in the DeFi space. Daily transaction volume across Avalanche’s C-Chain averages $600 million. Its focus on real-world asset tokenization — such as the initiative with Intain and JPM — places it in a prime position for institutional traction.

Source: CoinMarketcap

While AVAX doesn’t yet have the legal clarity of XRP or the retail cult status of Solana, its enterprise-first narrative could fit well into multi-asset ETF products or bespoke institutional vehicles in regulated markets.

What the SEC Looks For

The SEC’s approach to ETF approvals has historically centered on market maturity, investor protection, and surveillance sharing agreements. For altcoins to qualify, they must meet several unwritten criteria:

- Sufficient trading volume on regulated U.S. exchanges

- Demonstrable decentralization and security

- Clarity on token classification (i.e., not a security)

- Potential for price discovery and arbitrage across venues

Currently, none of the altcoins mentioned have CFTC-regulated futures markets, which was a pivotal factor in the approval of Bitcoin and Ethereum ETFs. This remains the biggest hurdle. However, a successful Solana ETF could recalibrate the SEC’s benchmarks, particularly if it includes staking, on-chain rewards, or DeFi interactions.

Would love to hear directly from Atkins, but all good chance of happening. Here’s our latest odds of approval for all the dif spot ETFs via @JSeyff https://t.co/nLhYJJmO9U pic.twitter.com/4AcJVwhics

— Eric Balchunas (@EricBalchunas) April 30, 2025

According to Bloomberg Intelligence, the odds of a Solana ETF approval by the end of 2025 are above 90%. If that approval materializes, it would almost certainly trigger a reassessment of XRP, ADA, and AVAX ETF proposals by both issuers and regulators.

The Role of Multi-Asset Crypto ETFs

Another likely development post-Solana is the approval of diversified crypto ETFs that include multiple altcoins. These may offer exposure to a basket of digital assets, weighted by market cap or ecosystem strength. Firms like Fidelity and Bitwise have explored such concepts, proposing index-style ETFs that reduce single-asset risk while complying with SEC requirements.

This structure could be a workaround for altcoins that are individually not ready for standalone ETFs. It also reflects growing investor interest in broad-based crypto exposure without the complexity of managing multiple wallets and exchanges.

For more: Tokenized Stocks: The Future of Equities on the Blockchain

Final ranking for ETF potential (as of mid-2025)

Based on available data and regulatory considerations, XRP currently appears to have the strongest chance of receiving ETF approval following Solana. The partial court ruling in 2023 established that XRP, when traded on secondary markets, is not considered a security—granting it a level of legal clarity that most other altcoins lack. XRP also benefits from deep liquidity, consistent exchange support, and a well-established use case in cross-border payments.

Avalanche (AVAX) is another strong contender, offering modular architecture, high developer activity, and growing adoption among enterprise users. Although AVAX lacks the same legal clarity as XRP, its real-world integrations and robust ecosystem make it attractive for diversified or thematic ETF products.

Cardano (ADA), while highly decentralized and academically rigorous, faces challenges in daily transaction volume, DeFi activity, and network usage, which are metrics often scrutinized by regulators. As a result, ADA may be viewed as a longer-term candidate. In summary, XRP leads on legal clarity and infrastructure, AVAX stands out in innovation and enterprise readiness, while ADA remains strong on fundamentals but may require further market maturity before ETF consideration.

Final ranking for ETF potential (as of mid-2025):

| Rank | Altcoin | ETF Viability | Primary Strength | Main Obstacle |

| 1 | XRP | High | Legal clarity & liquidity | Historical regulatory baggage |

| 2 | AVAX | Medium | Enterprise adoption & TVL | No legal clarity or futures |

| 3 | ADA | Low–Medium | Decentralization & governance | Low activity & TVL |

Conclusion

Solana’s breakthrough into the ETF space has created a ripple effect across the altcoin market. XRP, ADA, and AVAX each offer compelling—yet distinct—cases for becoming the next ETF-approved asset. While regulatory and structural hurdles remain, momentum is clearly building. Whether through single-asset vehicles or multi-asset crypto ETFs, the post-Solana era may finally unlock a new phase of altcoin accessibility for institutional and retail investors alike.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Dai

Dai  USDT0

USDT0  Shiba Inu

Shiba Inu  sUSDS

sUSDS  Hedera

Hedera  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle  MemeCore

MemeCore