Cryptocurrency adoption may be gaining momentum, but getting crypto-friendly banks isn’t a walk in the park. Many users find that locating a friendly financial institution is filled with hurdles, and giving up on the search is easy. Moreover, it’s easy to define crypto-friendliness because regions have varied digital asset regulatory and acceptance levels.

While banking rules and regulations regarding crypto range from indifferent to supportive to restrictive, some banks allow users to buy crypto directly using their banking apps, others prohibit the practice altogether.

So, how do you, as a crypto enthusiast, know the best crypto bank?

Our guide examines the fundamentals of finding the best crypto banks worldwide and their level of support for cryptocurrencies. Welcome on board!

What Is a Crypto-Friendly Bank?

The question of what banks are crypto-friendly is a common one within crypto communities, and users, both new and experienced, seek answers. We, therefore, define crypto-friendly banks as institutions that offer a blend of traditional and innovative crypto-based financial services. Such banks become a one-stop-shop for companies or individuals offering cryptocurrency management, trading platforms, wallet services, and crypto-backed loans.

Crypto-friendly banks enable digital asset users to buy, sell, and safeguard their cryptocurrencies easily and securely. These banks also go beyond just offering services by facilitating benefits exceeding your traditional cryptocurrency wallet, including prepaid debit cards and federally insured accounts. Using state-of-the-art technology, crypto banks are making it possible for people to engage with cryptocurrencies efficiently.

Besides offering the services mentioned, these banks guarantee user funds’ security by adhering to stringent KYC and AML procedures within the cryptocurrency industry. By acting as a bridge between the traditional banking and crypto worlds, they enhance cost-effectiveness in transitioning between fiat and cryptocurrencies.

How to Choose the Right Crypto-Friendly Bank

Choosing banks that support crypto requires carefully assessing several features and your individual needs. You want to locate a bank offering a wide range of services that integrate crypto and fiat currencies since having both types of currencies under one roof is a game changer. As you start researching and trying to locate banks that offer crypto-friendly services, create a shortlist of potential candidates based on the following factors to increase your chances of succeeding.

1. Regulatory Compliance and Risk Management

Since cryptocurrencies operate outside the regulatory controls that govern traditional banking systems, looking for a bank that complies with the available regulatory standards is necessary. Confirm that the bank has regulatory authority to handle digital assets. This will safeguard your funds as you can be sure that the institution adheres to know-your-customer (KYC) and anti-money-laundering (AML) regulations. Check also whether the bank insures your fiat deposits with a reputable government agency.

Dealing with a non-compliant bank could expose you to serious risks, such as limited access to services, frozen accounts, and several other transactional delays. Moreover, there could be legal complications associated with regulated jurisdictions, all of which you can avoid by checking on compliance issues.

2. Services, Fees, and Accessibility

There are diverse transaction fees associated with cryptocurrency transactions, and every bank has its fee structure for withdrawals, deposits, and transfers or other fees associated with using crypto wallets. Carry out a careful evaluation by comparing the free schedules of the banks in your shortlist. Choose a bank that offers transparent and competitive fees to ensure your transactions will not cost you an arm and a leg.

Since you cannot plan and budget unless you understand the bank’s fee structure, some critical questions to ask include whether there are monthly account maintenance fees, exchange rates, limits on crypto-related accounts, whether the pricing model is transparent, or if there are hidden costs or excessive bank charges for crypto.

Additionally, identify the number and type of cryptocurrencies the bank supports since not all banks support the same digital assets. Other essential features to consider include:

- Fiat and Crypto Support: Find out if the bank allows you to manage fiat and cryptocurrencies in the same account.

- Crypto Cards: A bank that issues crypto cards will enable you to spend your cryptocurrencies easily and conveniently.

- Integration with Exchanges and Wallets: Confirm whether the bank seamlessly integrates with digital wallets and crypto exchanges to facilitate a seamless transfer of funds. Verify that the bank seamlessly integrates with popular cryptocurrency exchanges and digital wallets to facilitate easy transfers of funds.

- Crypto-Powered Banking Features: Some banks offer specialty services like yield farming, crypto-backed loans, and other services that could benefit you.

Since a user-friendly experience will enhance your crypto investment journey, look for a bank that provides mobile apps or an easy-to-use interface, portfolio tracking, and integration with other relevant platforms.

3. Security Features

Fund security is an essential factor when dealing with cryptocurrencies. Prioritize a bank that offers high-grade security measures, including encryption, multi-factor authentication (MFA), biometric logins, insurance coverage, a transparent incident response policy, cold storage for custody, and insurance against hacking incidents or thefts. Choose a bank with a proven track record for safeguarding its clients’ crypto assets.

Top Global Crypto-Friendly Banks

If you’re asking yourself what banks are crypto-friendly globally, the following is a list of the top five crypto-friendly banks you can consider for your investment.

1. Revolut

Revolut is a renowned crypto bank operating from the UK. The firm facilitates fiat currency custody, transfers, and exchanges in addition to crypto trading on the 30+ supported cryptocurrencies. The bank also offers numerous crypto storage vaults, enabling passive income from idle assets. Revolut facilitates buying and selling crypto, trading, and fiat withdrawals across the UK, USA, Singapore, Australia, Switzerland, and Japan, with over 30 million registered users. The bank includes a secure integrated cryptocurrency exchange, and clients can use business and personal debit cards.

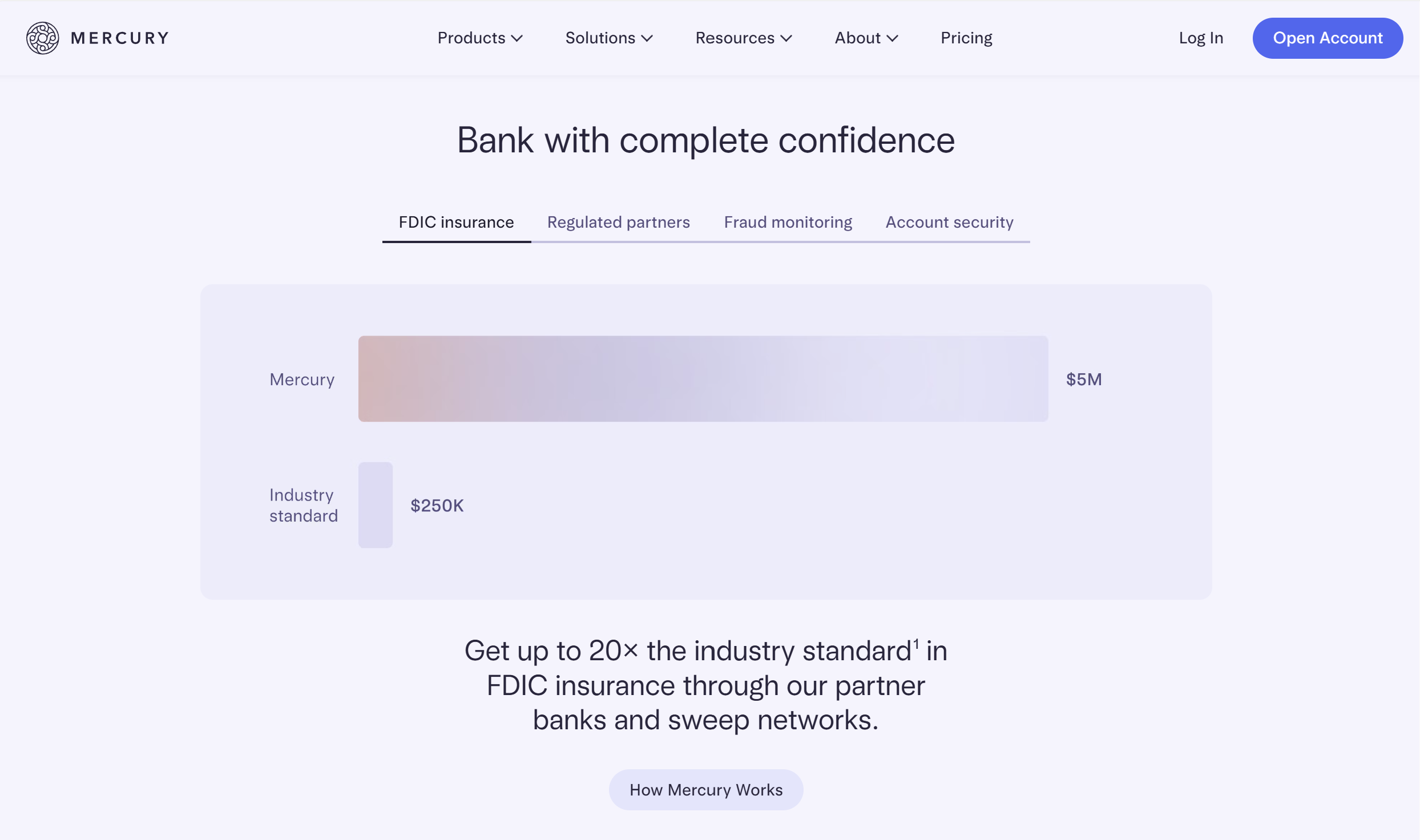

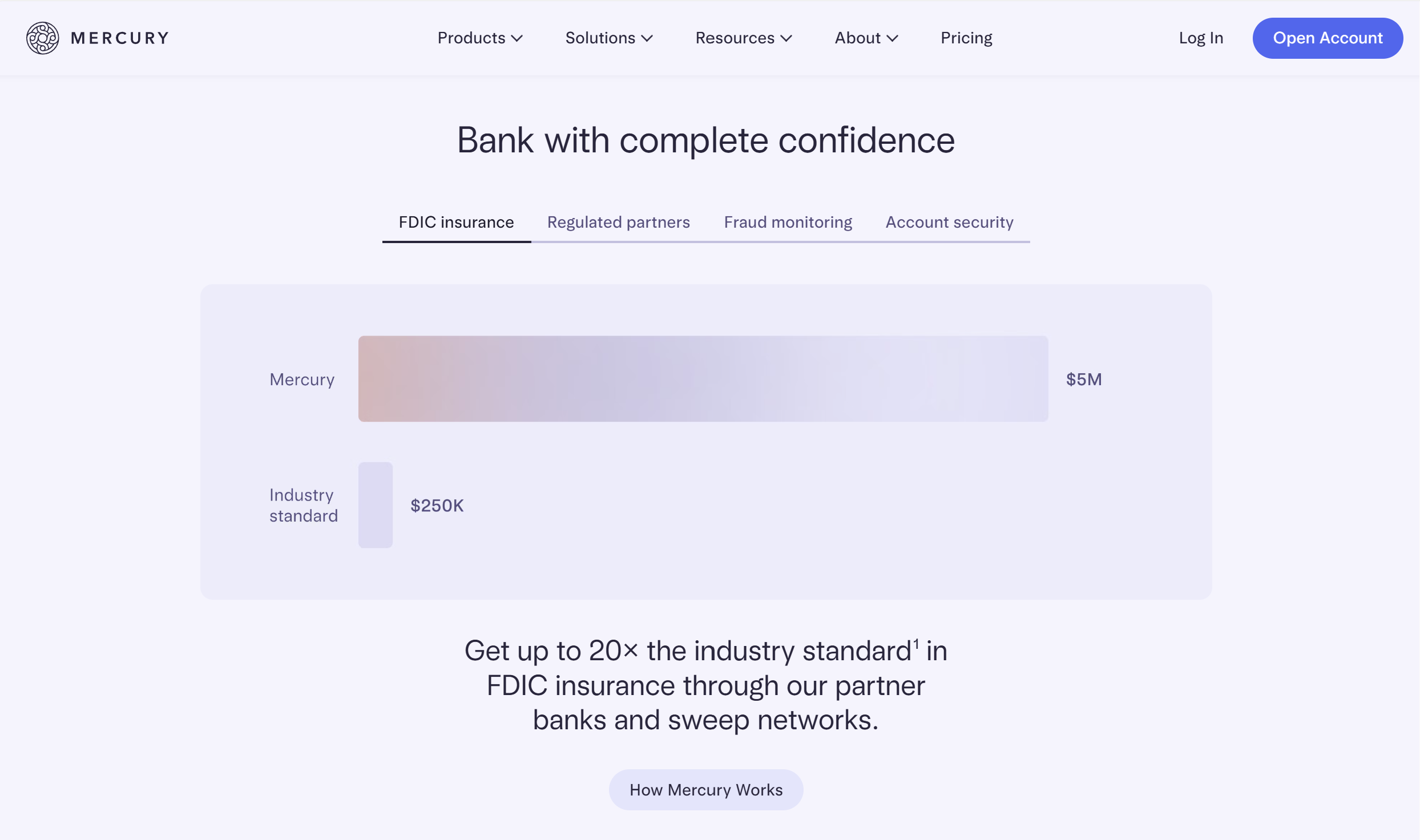

2. Mercury

Mercury is a well-known US-based crypto-friendly bank. The Federal Deposit Insurance Corporation (FDIC) fully regulates the institution; ensuring users’ funds are fully secured and insured. Services are charged with a minimum annual cost of $500, but no minimum account balance requirements exist. The firm covers a wide geographical area apart from a few African countries. The best features of Mercury include crypto trading and custody services, crypto payments for institutions, digital asset lending, API connectivity, and sub-accounts for virtual IBANs, and a crypto-to-fiat exchange. The bank adheres to all security and regulatory requirements and has a dedicated crypto trading platform for institutions and insurance coverage of up to $250,000.

3. Wirex

While it may not technically be a crypto bank, Wirex offers a wide range of crypto and fiat currency services, including deposits and buying crypto to Wirex accounts for use in payments via Mastercard-supported debit cards. Wirex’s services are available globally, with a 5 million user base in at least 130 countries. Services offered primarily include crypto transactions, ATM withdrawals, Wirex debit cards, and currency exchange. For true crypto enthusiasts, note that Wirex has a native cryptocurrency, WXT, that can be used for DeFi activities. Users can participate in crypto staking and yield farming and enjoy free fiat currency withdrawals at partnering ATMs.

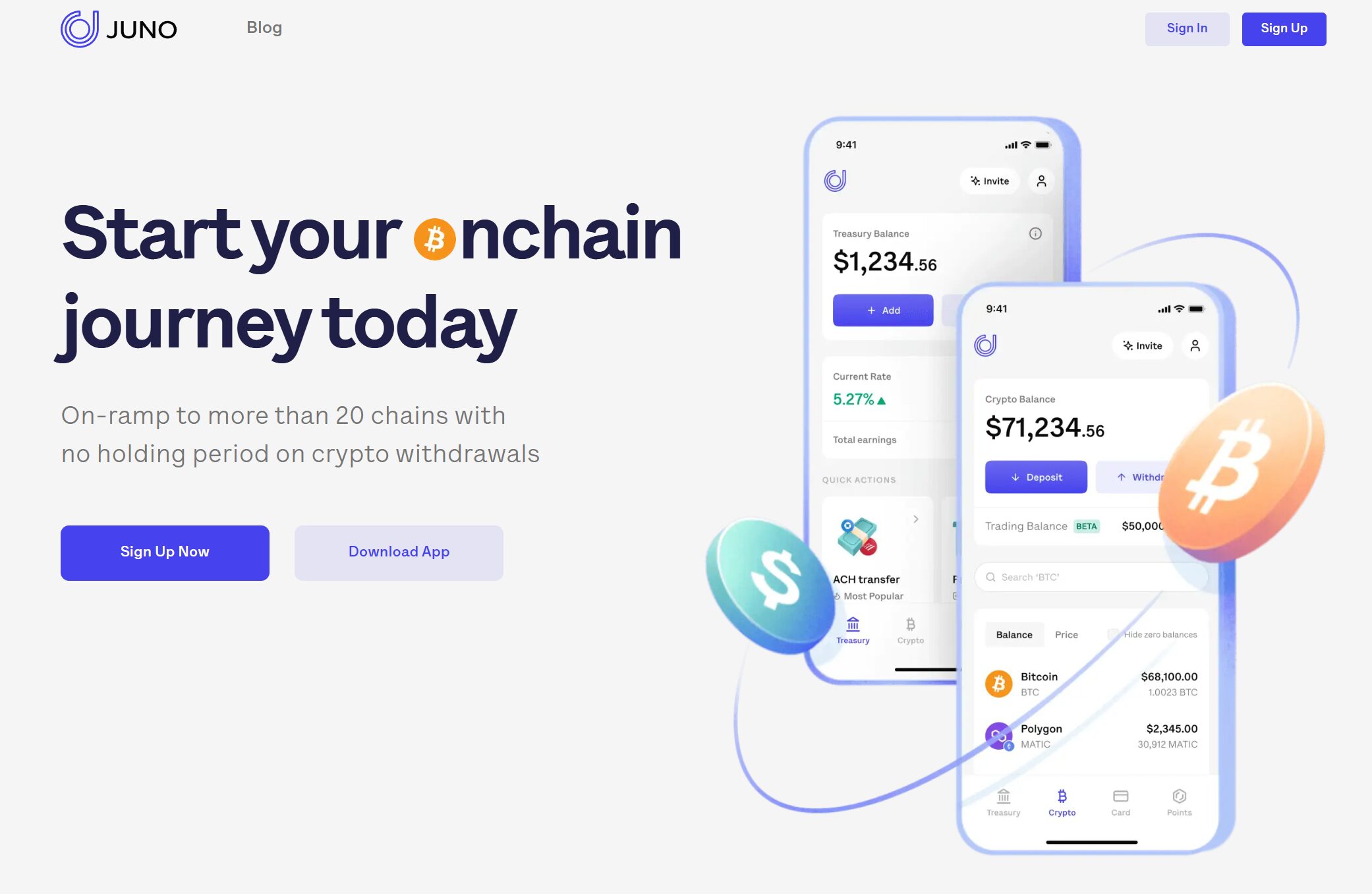

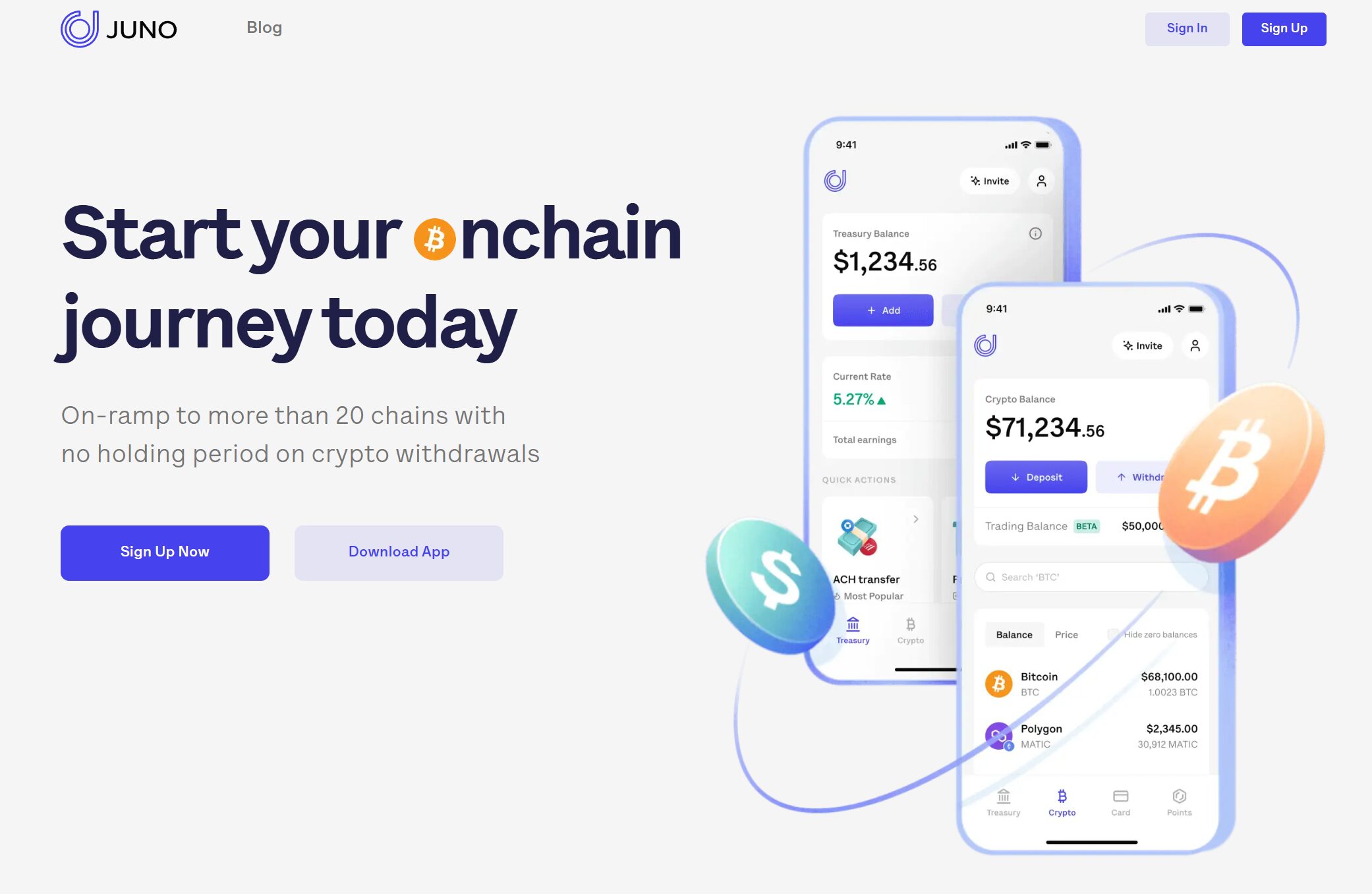

4. Juno

Juno Bank offers crypto-friendly services to individual and corporate crypto users. The highlights include enabling customers to operate separate accounts, stake their crypto, apply for crypto loans, and participate in other crypto trading activities. A crypto-backed debit card allows customers to make flexible payments using fiat or cryptocurrencies for products and services in different currencies. The services offered include crypto accounts, bank accounts, cryptocurrency staking options, money transfer, exchange, digital asset trading, and crypto borrowing and lending features. The bank is modernizing its services and now uses artificial intelligence (AI) and machine learning (ML) models for service personalization.

Top Crypto-Friendly Banks in the USA

Whether you’re just starting or have an experienced hand in crypto trading, locating the best crypto-friendly banks in the USA may mean the difference between your success and failure. Since your choice makes a big difference, the following are the top banks in the USA supporting cryptocurrencies:

1. JPMorgan Chase

JPMorgan Chase is one of the leading crypto-friendly banks offering services to several digital assert firms and cryptocurrency exchanges. The firm prioritizes regulatory compliance and risk management and provides institutional-grade research on crypto markets, which helps its users make informed investment decisions. Besides serving leading cryptocurrency exchanges and crypto-focused firms, the bank excels in compliance and risk management and provides detailed research data on crypto markets. However, note that it only offers limited crypto-related services.

2. Customers Bank

The Pennsylvania-based Customers Bank offers a blockchain-based platform that enables customers to make USD payments 24/7. Customers Bank Instant Token (CBIT) platform has attracted various crypto asset firms, mainly stablecoin issuers and cryptocurrency exchanges. The CBIT system facilitates 24/7 USD transfers and instant settlements with no transfer limits for cryptocurrency exchanges. The bank primarily serves institutional customers and offers limited services to retail crypto investors.

3. Ally Bank

Established in 2009, Ally Bank specializes in offering online banking and investment services. While the firm doesn’t support direct crypto buying, it provides indirect crypto exposure via special crypto products like Bitcoin futures ETFs, crypto trusts, and crypto-related stocks. Users of Ally Bank can benefit from transfers between bank accounts and external exchanges, which can facilitate entry to crypto trading. Ally Bank is certified as a secure, reliable, and insured institution but doesn’t offer direct exposure to crypto trading, DeFi, or staking services.

4. Evolve Bank & Trust

Evolve Bank & Trust was founded in 2015 and mainly offers business and personal banking ending services and mortgage solutions. The bank partnered with MasterCard in 2021 and started a program to facilitate hassle-free cryptocurrency card transactions in the United States using a US dollar-backed stablecoin. The bank’s customers can send and receive USD from FinCEN-regulated crypto exchanges and enjoy robust infrastructure for stablecoin-backed payments designed for crypto-focused businesses. However, the firm doesn’t provide crypto custody, trading, or wallet services.

5. Capital One

Capital One Bank offers a wide array of banking services in the United States, from corporate banking to auto loans, credit cards, and current and savings accounts. A subsidiary of Capital One Financial Corporation, the bank is one of the USA’s biggest crypto-friendly banks. This crypto-friendly bank offers a highly-rated mobile app besides being served by an extensive ATM network; over 70,000 fee-free Capital One, MoneyPass, and Allpoint ATMs, and 450 branches and 50 Capital One Cafes. Users are allowed face-to-face banking and advice, but there is potential for hidden fees for specific accounts or services.

Top Crypto-Friendly Banks in Europe

1. AMINA Bank (Switzerland)

AMINA Bank (formerly SEBA Bank) offers a range of services, starting with traditional services like loans and savings accounts. However, the group strongly focuses on integrating cryptocurrencies into all its other offerings. The bank’s services aim to bridge the gap between traditional and emerging crypto assets and are available to institutional and individual clients. AMINA Bank is fully licensed by Switzerland’s Financial Market Supervisory Authority (FINMA), which means it operates as a crypto bank within regulatory standards.

2. SolarisBank (Germany)

The German Fintech firm offers banking-as-a-service solutions by enabling companies to integrate its services into their products without a license. SolarisBank is listed as a crypto-friendly bank offering payment processing, bank accounts, and lending, allowing clients to incorporate crypto solutions. German financial authorities license the bank.

3. Bank Frick (Liechtenstein)

Bank Frick is a privately owned universal bank that made history by becoming Europe’s first bank to initiate blockchain banking. The bank regulated by Liechtenstein’s Financial Market Authority (FMA) offers personalized and innovative banking solutions and grants them controlled access to crypto assets like cryptocurrencies or tokenized assets. Bank Frick’s services include regulated blockchain banking, crypto asset custody supporting initial coin offerings (ICOs) and tokenization of assets. Other services include classic banking, blockchain banking, fund and capital markets, payment services, and business loans.

4. Clear Junction (UK-based, Europe-wide)

Clear Junction is headquartered in the UK but has a Europe-wide reach. It facilitates cross-border payments for remittance operators, cryptocurrency exchanges, and other crypto services companies. The company specializes in helping companies integrate fiat gateways by eliminating bureaucratic overheads. Clear Junction has its wings spread over 180 countries, and it specializes in monitoring transactions and risk assessment for businesses that seek instant settlement in multiple jurisdictions.

5. Januar (Denmark)

Januar is Denmark’s pioneering institution integrating traditional fiat banking and cryptocurrencies, specializing in risk management and regulatory compliance. The firm became the first crypto-focused institution to receive a payment institute license from the Danish government, highlighting its capability to navigate the crypto market’s complex spaces. Januar offers customized services that combine traditional finance systems with cryptocurrencies and is pioneering in reshaping the future of finance.

Top Crypto-Friendly Banks in the United Kingdom

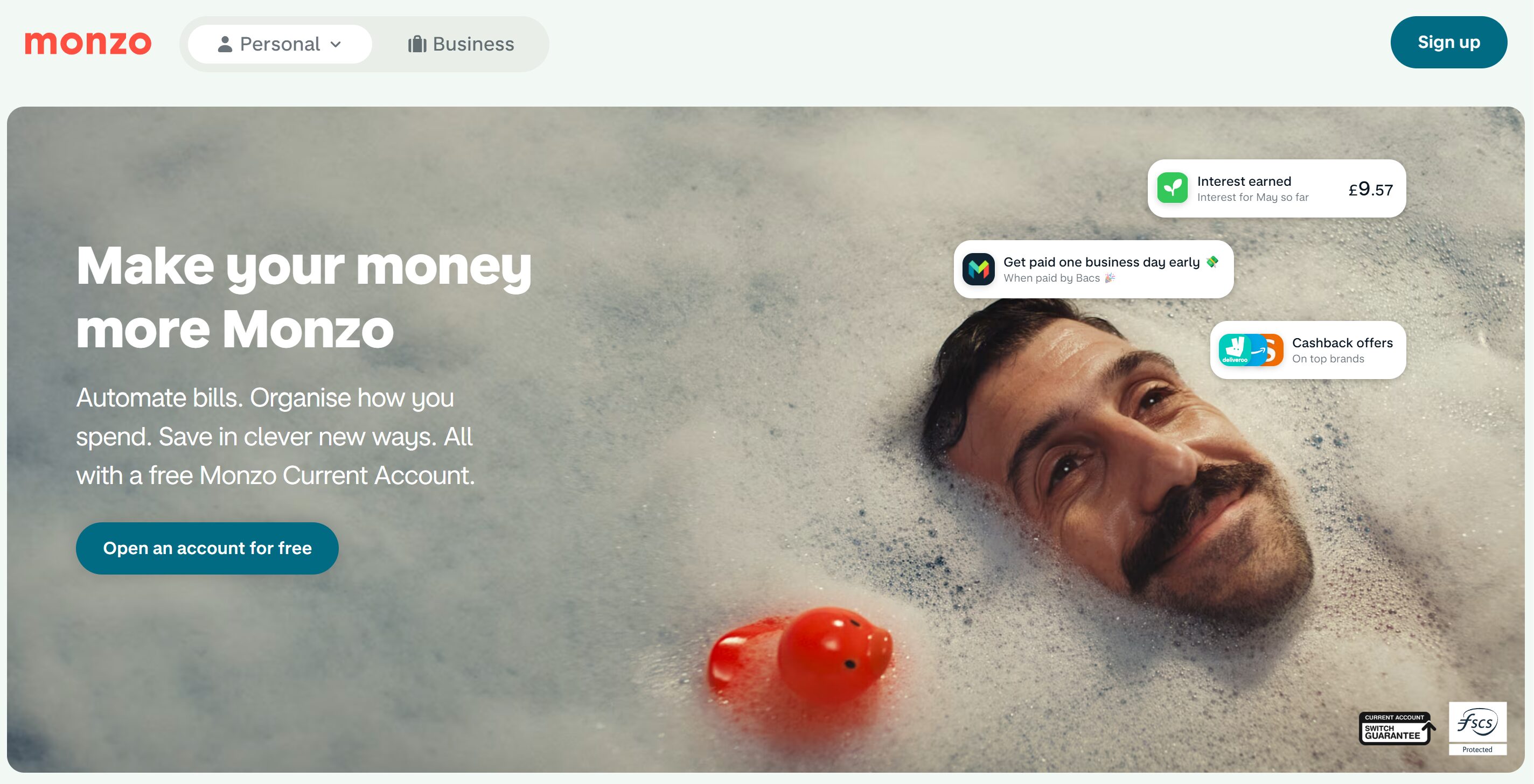

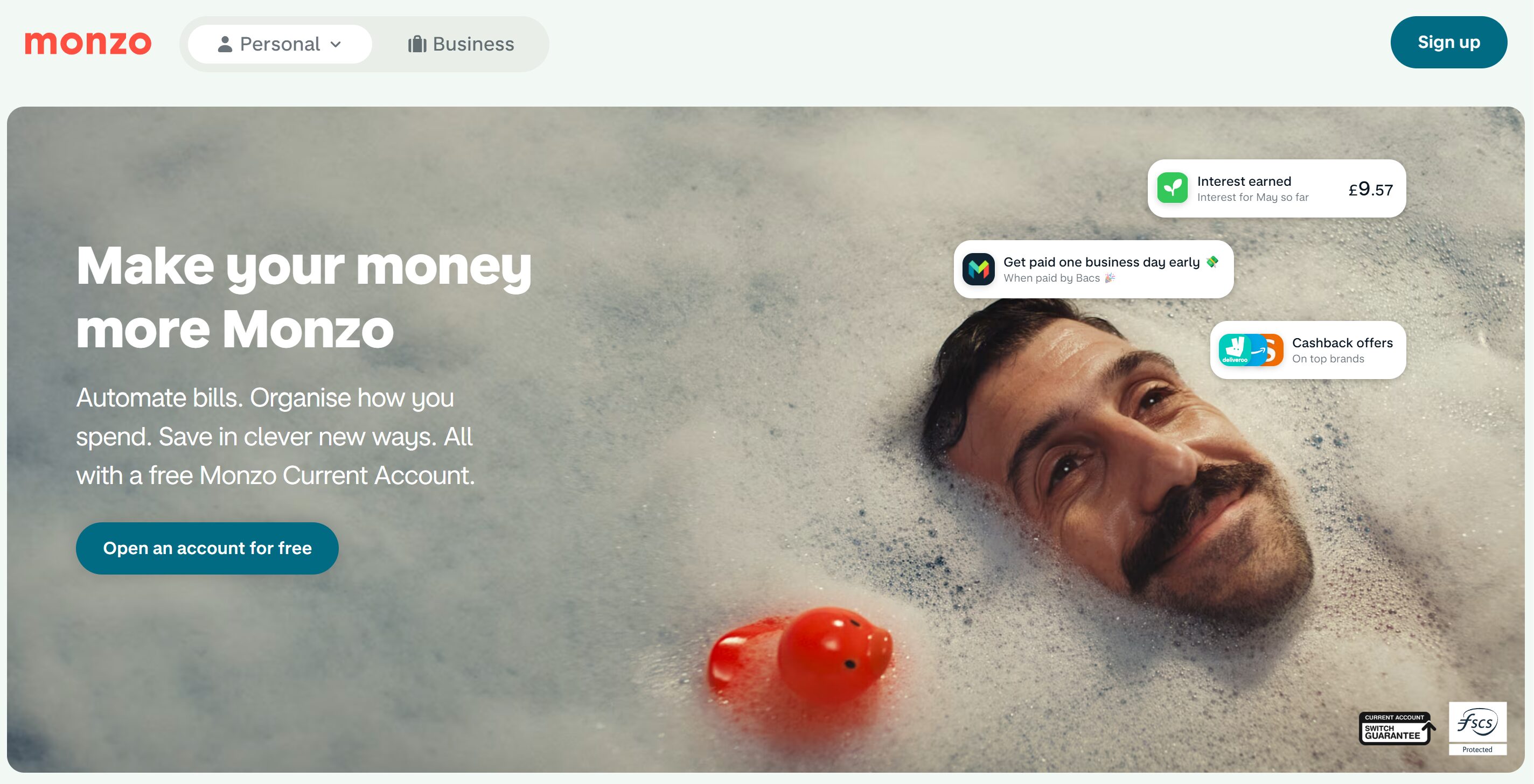

1. Monzo

Founded in 2015, Monzo Bank prioritizes a mobile-first approach with a strong customer engagement culture. The bank doesn’t provide crypto trading or wallet services but instead supports transfers to and from cryptocurrency exchanges, which means its services are crypto-integrated and not crypto-compatible. Users can transfer funds from exchanges, enabling them to make crypto investments within the UK regulatory boundaries. The firm supports instant transaction notifications using advanced security controls such as card freezing to give users who need to make crypto transfers an added layer of security.

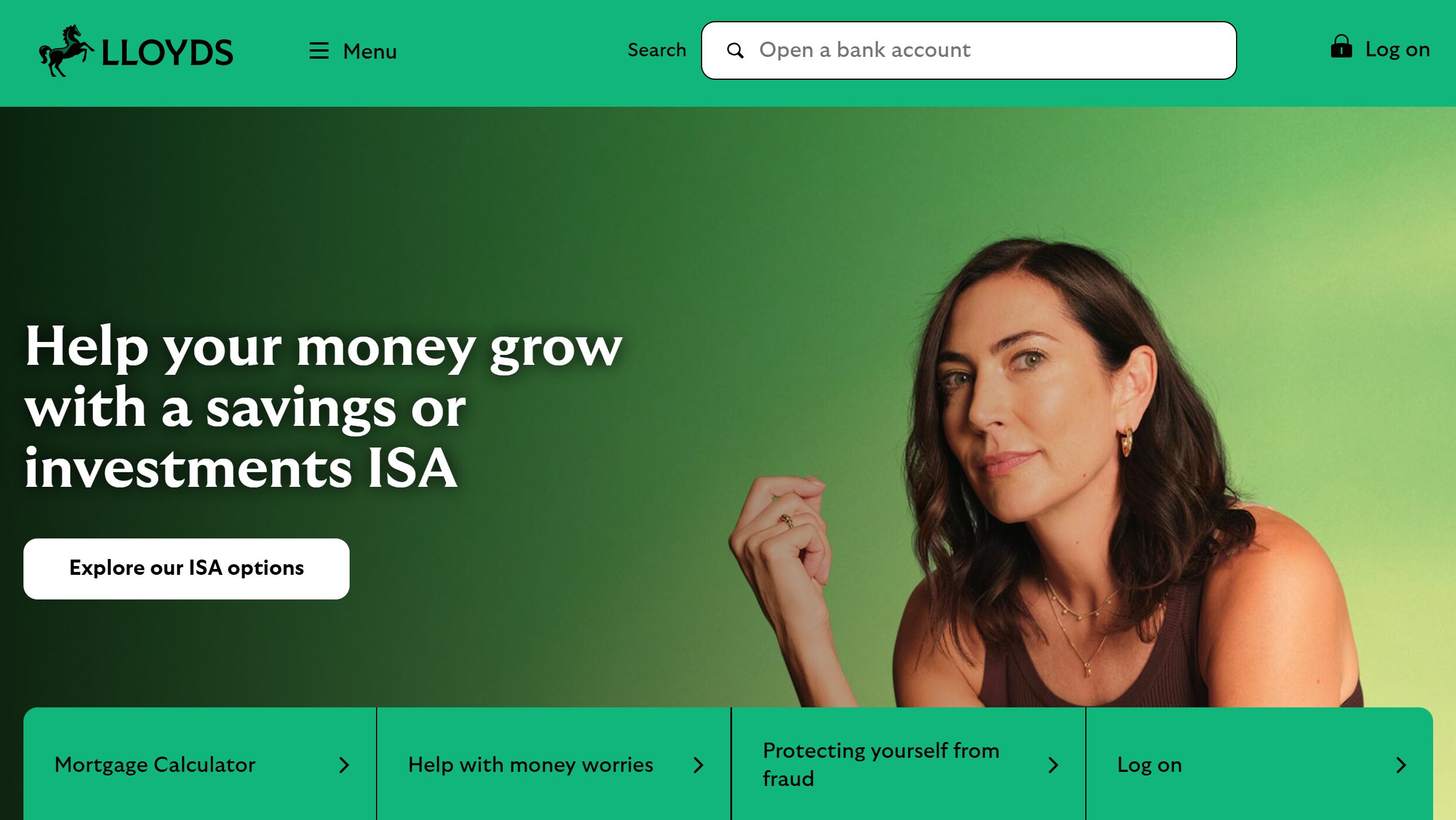

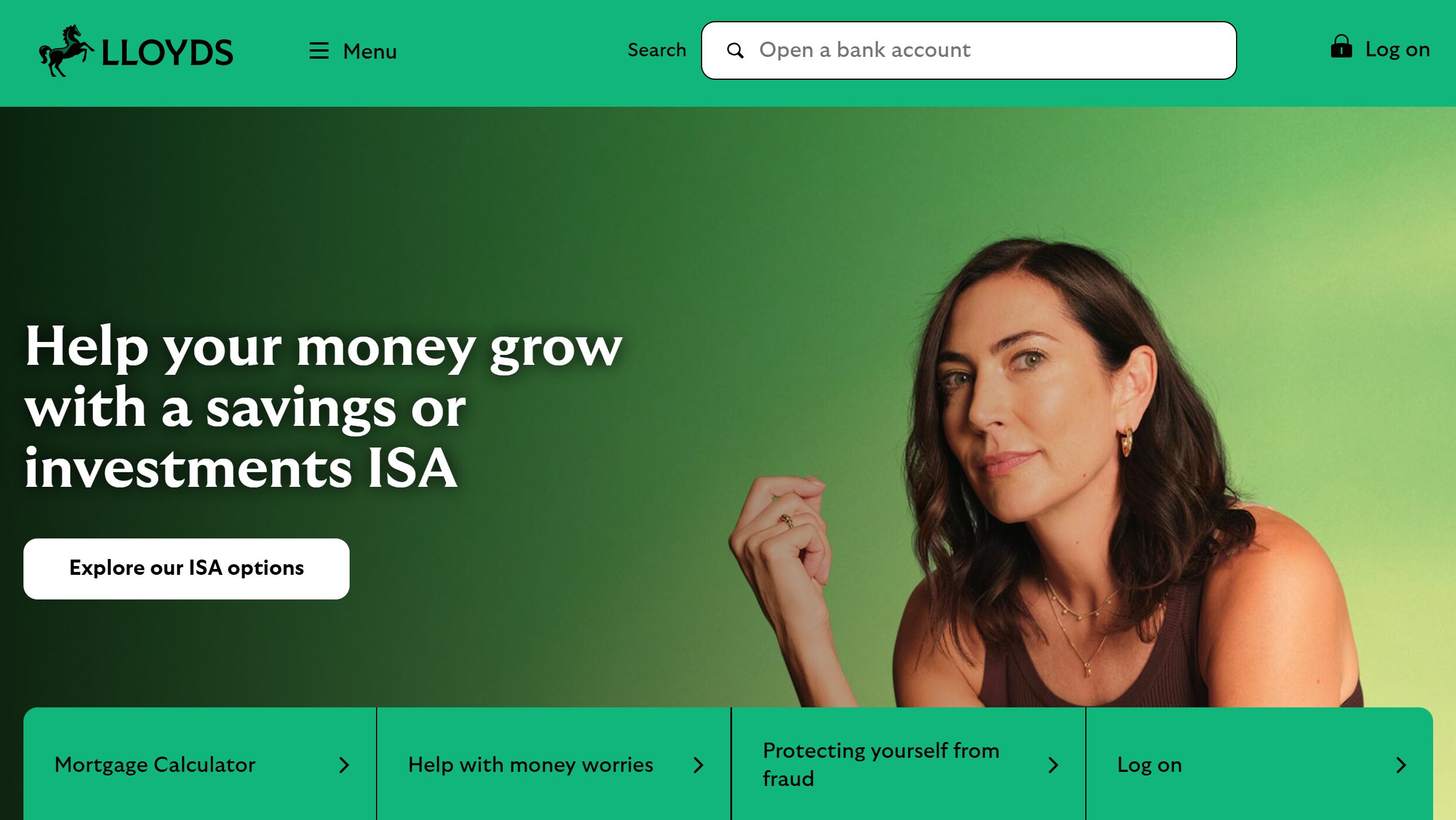

2. Lloyds Banking Group

Lloyds Banking Group has been in business since 1765 and has a strong presence within the UL retail and commercial banking sector. The bank may not necessarily offer direct access to digital assets but is considered among the best crypto banks for enabling customers to transfer funds to FCA-registered crypto exchanges seamlessly. It covers them by taking clients through a complete verification upon transaction request—the bank’s customers to access regulated crypto exchanges with zero restrictions while maintaining oversight for security. Long-standing reputation and regulatory compliance give crypto customers the confidence to keep their fiat banking with a trusted institution while exploring crypto opportunities externally.

3. NatWest

NatWest is among banks that support crypto in the UK but takes a relatively conservative approach, which includes placing several restrictions on transactions to and from cryptocurrency exchanges. The bank facilitates transfers to regulated cryptocurrency exchanges under strict supervision, ensuring customers know the security risks of crypto-related transactions. NatWest customers have the privilege of safely engaging in cryptocurrency trading but within regulated limits. The firm is renowned for employing top-grade security measures to safeguard customer funds. However, crypto-customers cannot use credit cards to make purchases, reducing the number of available payment options.

4. Metro Bank

Metro Bank is a UK-based financial institution that offers limited options for customers to receive but not send cryptocurrencies. The bank’s customers used to send crypto assets, but the bank has since discontinued the service, citing security concerns and fraud risks. This means that users can only receive crypto transfers from exchanges but cannot deposit such funds through Metro Bank.

Top Crypto-Friendly Banks in Asia-Pacific

1. DBS Bank (Singapore)

Besides being a leading bank in Singapore, DBS Bank also holds the slot of the crypto-pioneer institution among banks within the Asia-Pacific region. DBS launched its own DBS Digital Exchange (DDEx) in 2020 to facilitate trading cryptocurrencies and other digital assets. It supports six major cryptocurrencies, including Bitcoin, Ethereum, XRP, and others, alongside four fiat currencies. Additionally, the bank offers accredited crypto services for both individual and institutional investors, allocating at least $600 million annually to explore emerging technologies such as blockchain and digital assets.

2. SBI Sumishin Net Bank (Japan)

The SBI Sumishin Net Bank is a leading light among banks that support crypto in Japan. It combines traditional and blockchain-based banking. The services offered include digital banking for loans, deposits, and settlements using cutting-edge technologies like blockchain and AI. By focusing on technological innovation, SBI Sumishin Net Bank has become the point of reference for Japan’s tech-savvy investors who want to manage traditional and crypto assets in a regulated banking environment.

3. Mizuho Bank (Japan)

A member of the Mizuho Financial Group, Mizuho Bank is a Japanese institution that offers a wide range of crypto-asset services using third-party custody. The bank mainly serves Asia-based institutional crypto investors, asset managers, and hedge funds with corporate investment needs. With an asset base of 24 million users and supporting major cryptocurrencies and stablecoins USDT, USDC, and GUSD, the company also provides tokenization, lending, and asset management services for institutional digital asset holders. Mizuho Bank is a fully registered member of the Financial Services Agency (FSA) and the Federation of Bankers Associations of Japan (FBAJ).

Global and Cross-Border Banking Solutions for Crypto

Fiat Republic

The Fiat Republic bridges crypto-focused businesses and their traditional banking partners. The firm connects numerous banking service providers, meaning users don’t have to deal with individual institutions. The bank aims to address the de-banking issue, ensuring that crypto ventures enjoy a predictable flow of fiat currencies when needed. Fiat Republic provides a unified risk management and compliance cover, meaning companies just entering the crypto space can escape a lot of red tape. The bank is highly recommended for companies seeking smooth fiat-to-crypto cross-border transactions between the United States, the UK, and the Eurozone.

BCB Group

BCB Group is a financial institution licensed and regulated by the UK’s Financial Conduct Authority (FCA) and links crypto-focused businesses with established banking networks. The firm caters mainly to cryptocurrency exchanges and large institutional clients, offering then an active OTC desk in addition to liquidity, settlement networks, and specialized payment services using the multiple fiat currencies it supports. Crypto businesses prefer using the BLINC network to enable real-time settlement, especially for clients dealing with high-volume traders.

Pros and Cons of Crypto-Friendly Banks

Pros

There are numerous crypto friendly banks pros about institutions that accept cryptocurrency deposits, including:

- Simplicity: Crypto banks simplify the process of using cryptocurrency payments, especially for beginners, ensuring their clients enjoy hassle-free services.

- Efficiency: Crypto-friendly banks lack withdrawal restrictions that are common with traditional banks that serve crypto exchanges through streamlined services.

- Support Crypto Business: Crypto banks support the development of crypto businesses by enabling them to access traditional banking services in a regulated environment.

- Accessibility: Most banks that accept crypto offer mobile applications that enable users to access their services 24/7 via iOS/Android smartphones and tablets.

Cons

With all the good stuff that we get from crypto-friendly banks, there are a few crypto friendly bank cons of concern to note, including:

- High fees: Compared to traditional banks, most banks that accept cryptocurrency deposits charge relatively higher costs for their services.

- Limited functionality: Different crypto banks offer only a small segment of crypto-focused services, and it isn’t easy to find one bank offering all of these services under one roof.

- Work in progress: Crypto-friendly banks operate in a dynamic and ever-evolving environment, meaning they are also on the lookout for regulatory developments globally, which could create some instability in the segment.

Future Trends for Crypto-Friendly Banking

The crypto banking sector continues to make great strides, with new, bigger players showing interest in joining in 2025 following the regulatory developments taking place, especially under the Trump administration in the US. As traditional actors join the growing list of banks that support crypto, they could introduce a new range of services and make the market more competitive.

Moreover, experts believe banks could strengthen their market reach and influence when they introduce hardware wallets with inbuilt apps that enable clients to have straightforward access to crypto storage and transfer capabilities. The ongoing interest by international banks will soon mean that it will soon be possible to operate international crypto accounts where digital asset transfers can be executed seamlessly.

Currently, there is great potential to introduce advanced trading tools that enable sophisticated cryptocurrency traders and investors to use algorithmic trading bots alongside margin trading for either options or futures and crypto ETFs through crypto-friendly banks. Integrating additional functionalities like real-time market data and analytics will greatly improve user experience and enhance adoption.

As crypto banking becomes more secure and user-friendly, it will be able to cater to a broader user base, especially with the increasing transparency and the anticipated clear regulatory frameworks that will enhance transparency and consumer protection.

Conclusion

As digital assets continue to mainstream, you can expect the list of banks that accept cryptocurrency deposits to grow as they want to catch up with their clients who have already won over the crypto community. While some banks may not allow you to buy crypto through your account, there’s soon going to be a chance that they could be linked to a crypto-related service one way or the other.

If you are a firm crypto believer, you can rest assured that very soon, there will be a right crypto friendly bank near you that will adopt crypto-related things since it is almost obvious now that digital assets will become a big part of the future of finance. Eric Trump, the son of US President Donald Trump, is on record telling banks that they risk becoming obsolete in 10 years if they fail to adopt cryptocurrencies. That means that if his prediction is right, banks that support crypto have a bright future, while those that refuse to change could find it hard to survive.

FAQs

Why is choosing the right crypto-friendly bank important?

You must be careful when looking for a financial partner like a crypto-friendly bank because not all crypto banks are created equal. Significant differences exist between the fees and rates offered for accessible accounts and services and whether they have an easy-to-use interface. You also need to look for specific features and whether you can move your funds between crypto and fiat currencies without any restrictions.

Which banks accept cryptocurrency deposits?

Numerous banks now facilitate cryptocurrency transactions, but only a limited number accept deposits. Most crypto-friendly banks allow customers to buy, sell, or hold crypto in their accounts by integrating with leading exchanges, while others offer tailor-made crypto services. Among the banks that accept crypto deposits are Revolut, Ally Bank, and Monzo, which allow customers to use their accounts with external crypto exchanges. Other banks, like Xapo Bank and Cashaa, dedicate their banking services to crypto businesses.

Are crypto-friendly banks safe to use?

Crypto-friendly banks are relatively safe to use as they offer a secure way for their customers to interact with cryptocurrencies. However, users must be careful as there are always risks and limitations associated with crypto banks, which offer a bridge between traditional banking and the emerging digital world of crypto currencies.

Are crypto transactions with these banks taxable?

As with all crypto-based transactions, income tax becomes applicable when you sell the asset and receive either cash or units of another cryptocurrency. At this point, you are counted to have realized the gains and have a taxable event. However, the finer details will vary from one country to another.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor