Signals often get lost in the noise. Discord alpha groups, paid newsletters, and influencer tips can feel like shortcuts, but they rarely provide a lasting edge. The real edge is public, transparent, and always available: on-chain data.

This guide lays out a proven, step-by-step system to help you track highly profitable smart money wallets, analyze their behavior, and build a watchlist that evolves with the market. You don’t need insider connections. You need better eyes. Let’s get started.

What Is Smart Money?

Smart money refers to individual wallets or entities that demonstrate a consistent track record of outperforming average market returns. These actors often possess superior research capabilities, disciplined risk management strategies, and early access to valuable information. As a result, their on-chain activities frequently precede and predict significant market movements.

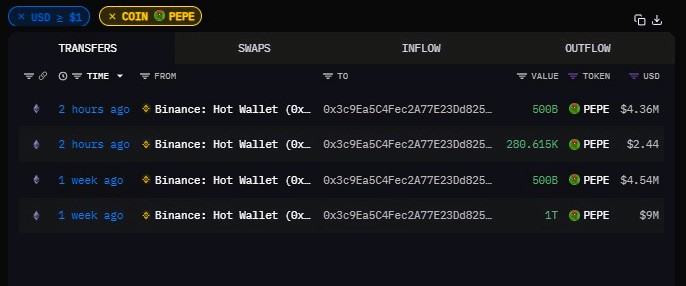

One recent example is a smart money wallet 0x3c…757 accumulated large amounts of $PEPE. On May 8th, the most recent transfer involved an additional 500 billion PEPE, approximately $4 millions. Since then, the wallet’s position value has appreciated significantly, with on-chain analysts estimating unrealized gains of over $17 million.

By monitoring smart money behavior, investors can gain a more data-driven perspective into where capital is flowing and which assets are gaining traction among sophisticated participants. It allows early identification of trend formation, token rotations, and shifts in risk sentiment, such as transitions from stablecoins into small-cap tokens.

More importantly, tracking smart money helps replace speculative hype with informed conviction. Instead of reacting to social media chatter or price pumps, investors can analyze the wallets that may be responsible for initiating those moves, thus positioning themselves ahead of the broader market.

A Step-by-Step On-Chain Strategy

Step 1: Identify Momentum Tokens

To begin identifying tokens likely to attract or already backed by smart money, navigate to CoinGecko and select the “Gainers & Losers” section.

Apply the 30-day performance filter to isolate assets that have demonstrated consistent upward momentum over a meaningful timeframe.

Prioritize tokens that exhibit substantial price growth over the past month, backed by verifiable decentralized exchange (DEX) volume. You can verify this by clicking the “Markets” tab on CoinGecko to assess the liquidity and trading venues.

Be cautious of assets showing exaggerated green candles on minimal volume, as these are often illiquid and susceptible to manipulation.

The objective at this stage is to identify tokens exhibiting both upward price action and healthy liquidity, signals that often indicate early interest from sophisticated investors rather than short-term speculative hype.

Step 2: Analyze the Token on DexScreener

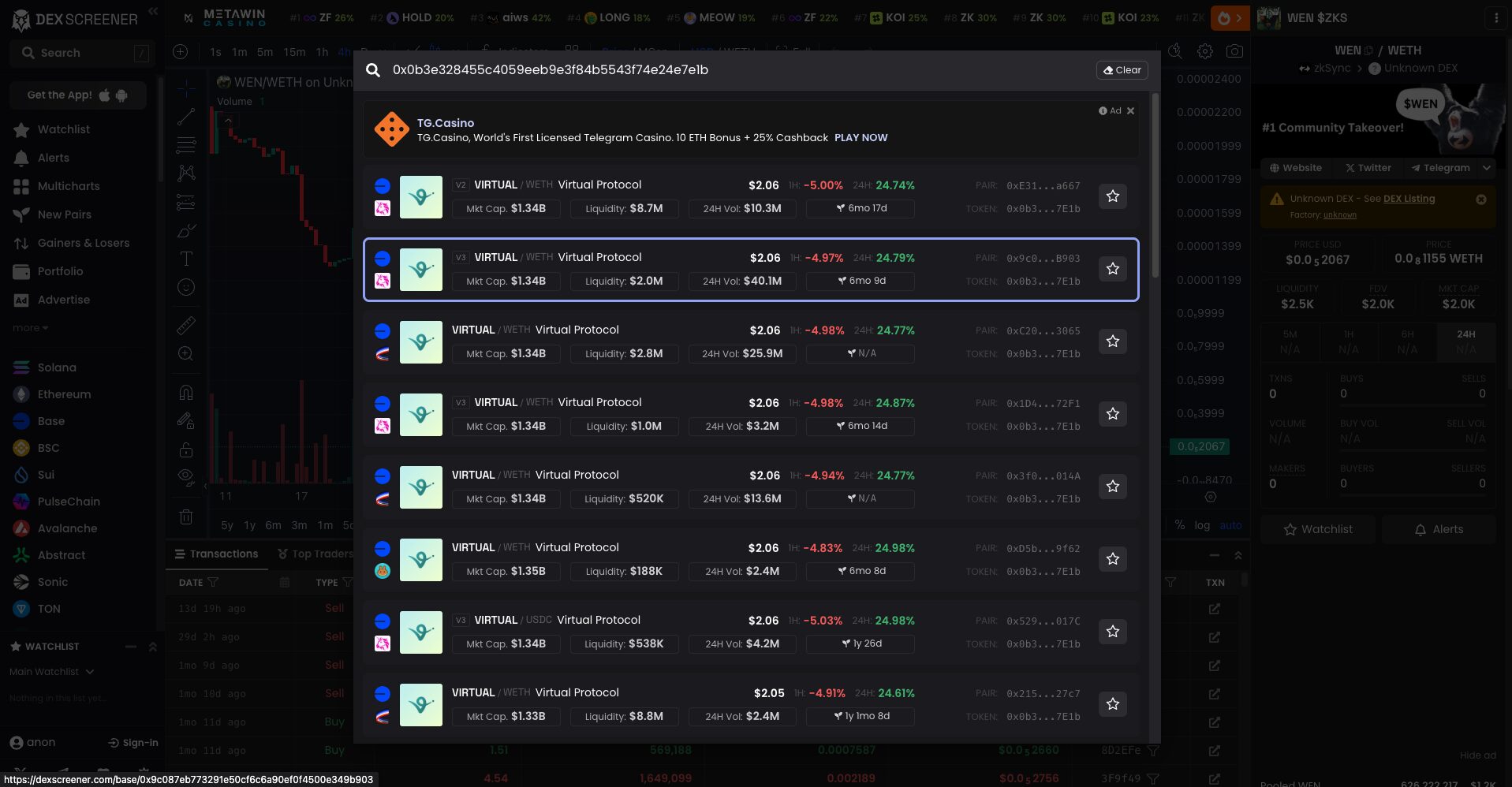

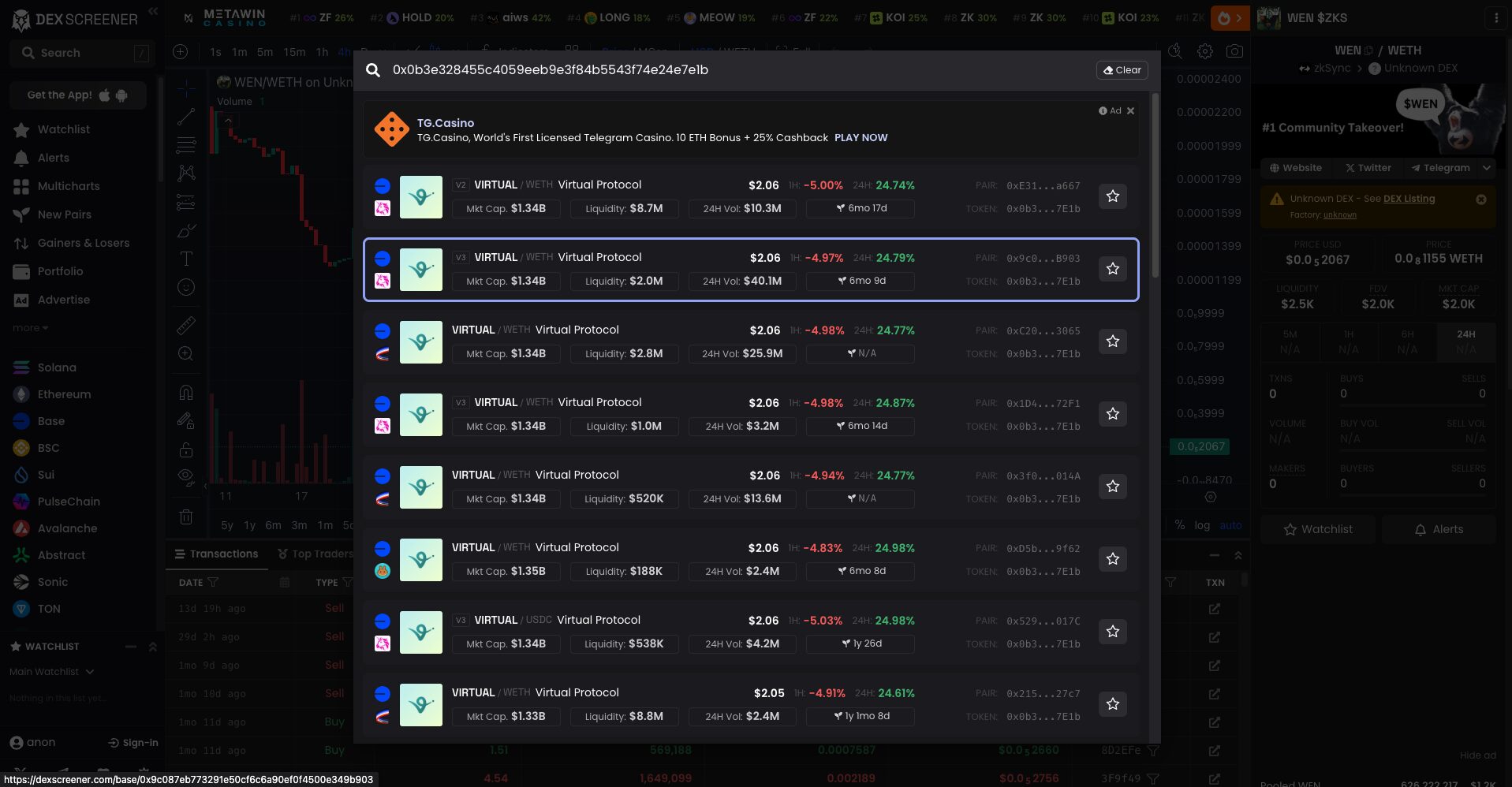

Once you’ve identified a promising token from CoinGecko, the next step is to analyze its trading activity in real time.

Copy the contract address directly from CoinGecko (never search manually, as many fake tokens are designed to exploit this step).

Paste the address into DexScreener and select the trading pair with the highest volume and liquidity.

Step 3: Discover Top Traders

Navigate to the “Top Traders” tab on DexScreener – a feature many miss.

Sort by PnL (Profit and Loss). Look for:

- Massive returns (e.g., $400 → $40K, or $9K → $800K)

- Consistent behavior across multiple tokens

Click into high-performing wallets to inspect them further. DexScreener will redirect you to chain explorers like Etherscan or BaseScan.

Step 4: Investigate Wallet Behavior

To evaluate the strategy and positioning of high-performing traders, use analytics platforms such as DeBank for EVM-compatible chains or Sonarwatch for Solana. These tools offer a comprehensive, real-time overview of individual wallets.

When reviewing a wallet, focus on the following metrics:

- Overall net worth and asset distribution.

- Chain activity to determine where they are most active.

- Current portfolio composition, particularly whether they are in stablecoins (risk-off) or volatile assets (risk-on).

- Behavioral patterns, such as consistent rotation into low-cap assets or conservative rebalancing into stables.

Understanding a wallet’s strategic posture is more important than simply noting the tokens it holds. By identifying directional bias and recurring allocation themes, you gain insight into intent, not just inventory.

Step 5: Build a Dynamic Watchlist

Select 3 to 5 wallets that demonstrate a high realized profit and loss (PnL) alongside consistent, strategic trading patterns. These are your primary signals for identifying recurring alpha-generating behavior.

Develop a custom tracking system – this can be as simple as a spreadsheet or a dashboard tool, to observe these wallets over time. The key components of your tracker should include:

- Ongoing monitoring of their portfolio allocations

- Identification of overlapping positions across wallets, which may suggest emerging trends or coordinated rotations

- Behavioral analysis of entry and exit patterns to understand timing, conviction, and position sizing

Above all, treat these wallets as learning models, not trading templates. Avoid mirroring trades without context. The objective is to study their approach, extract repeatable insights, and apply that knowledge to refine your own decision-making framework.

To deepen your analysis and improve tracking efficiency, consider integrating tools such as Arkham Intelligence (for wallet profiling and behavioral clustering), CoinGecko or DEXTools (for token metrics and real-time market data), and blockchain explorers like Etherscan, BaseScan, or Solana Explorer (for manual transaction tracing).

These platforms provide critical context and verification when analyzing smart money behavior, especially across multiple chains.

Best Smart Money Wallets with High Profit in 2025

To accelerate your learning and provide concrete reference points, here are some wallets that have demonstrated substantial realized profits and consistent trading success over the past six months.

These examples are curated based on transparency, performance, and cross-chain relevance. While you should not blindly copy them, tracking their behavior can help you better understand the dynamics of smart capital allocation in real time.

EVM Wallets:

- 0x3b7443cc9a4e4c4ce435b873f4e1dde36929ce71 – $3M+ PnL | Win rate: 75%

- 0x3004892cf2946356e8e4570a94748afdff86681c – $800K+ PnL | Win rate: 80.27%

- 0x000461a73d3985eef4923655782aa5d0de75c111 – $700K+ PnL | Win rate: 54.97%

Solana Wallets:

- ATmKENkRrL1JQQnoUNAQvkiwgjiHKUkzyncxTGxyzQL1 – $30M+ PnL | Win rate: 52.65%

- HUpPyLU8KWisCAr3mzWy2FKT6uuxQ2qGgJQxyTpDoes5 – $10M+ PnL | Win rate: 73.56%

- FVxeFYgyT4GC6D7gaLkMSu2qtSJfw2N4RVPZowi2A64Y – $9.5M+ PnL | Win rate: 53.56%

Conclusion

This guide has outlined a practical, replicable approach to identifying, tracking, and learning from high-performing wallets across chains. By leveraging public tools, disciplined observation, and a bias toward data over hype, you can transform your research workflow and start spotting emerging trends before they hit the mainstream.

Ultimately, the edge isn’t about following others, it’s about understanding how the best think, and refining your own approach accordingly.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Canton

Canton  Ethena USDe

Ethena USDe  Stellar

Stellar  WETH

WETH  Zcash

Zcash  Litecoin

Litecoin  USD1

USD1  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Hedera

Hedera  Dai

Dai  Shiba Inu

Shiba Inu  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Tether Gold

Tether Gold  Uniswap

Uniswap  Mantle

Mantle