Crypto exchanges Binance and Bybit have hinted at launching a new Solana-related product, sparking speculation that they may enter the Solana liquid staking market.

On Aug. 29, Binance’s official X account posted a cryptic “BNSOL” message followed by “coming soon” in a subsequent comment.

Shortly after, Bybit announced the introduction of a new product, “bbSol,” on its platform, stating:

“We are welcoming a new 👶 to the family #bbSOL.”

Although neither exchange provided specific details about the product, the crypto community quickly speculated that these posts indicate a move into Solana’s liquid staking sector, potentially through a partnership with the Solana-based liquid staking protocol Sanctum.

Neither Binance nor Bybit has responded to CryptoSlate’s request for comment as of press time.

Liquid staking

Unlike traditional staking, liquid staking allows users to earn additional yield while maintaining liquidity through a derivative token for DeFi activities. According to DefiLlama data, protocols in this sector collectively manage over $42 billion in crypto, with Ethereum-focused Lido leading the market.

However, interest in Solana liquid staking has recently surged, driven by the growing DeFi activities on the Solana blockchain.

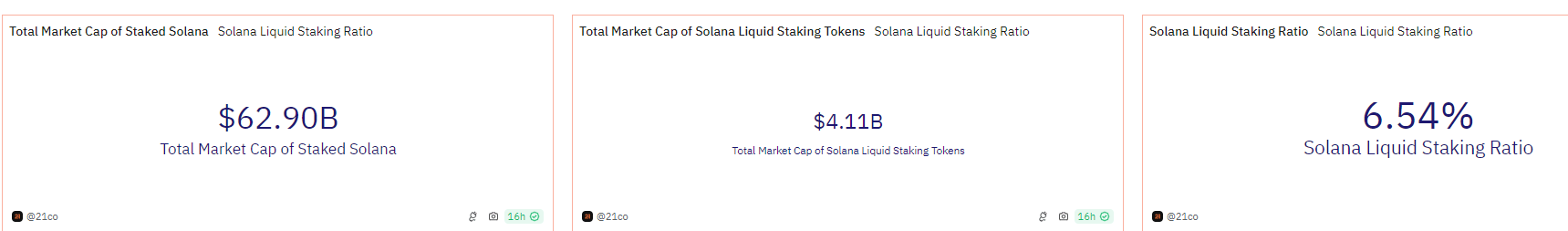

Data from Dune Analytics shows that more than $4 billion of SOL tokens are currently staked via liquid staking platforms. However, this accounts for only about 7% of the total market cap of staked Solana tokens, which stood at $62 billion at the time of writing.

This gap suggests significant growth potential in Solana’s liquid staking market. If Binance and Bybit launch SOL-based liquid staking products, it could further accelerate the sector’s expansion and drive retail access to the market.

Notably, Tom Wan, an analyst at 21Shares, previously noted that the sector’s growth could have a broader impact on Solana’s DeFi ecosystem. He stated:

“The boom in LSTs can definitely fuel the DeFi growth on Solana!”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  MemeCore

MemeCore  Rain

Rain  Bittensor

Bittensor