Onchain Highlights

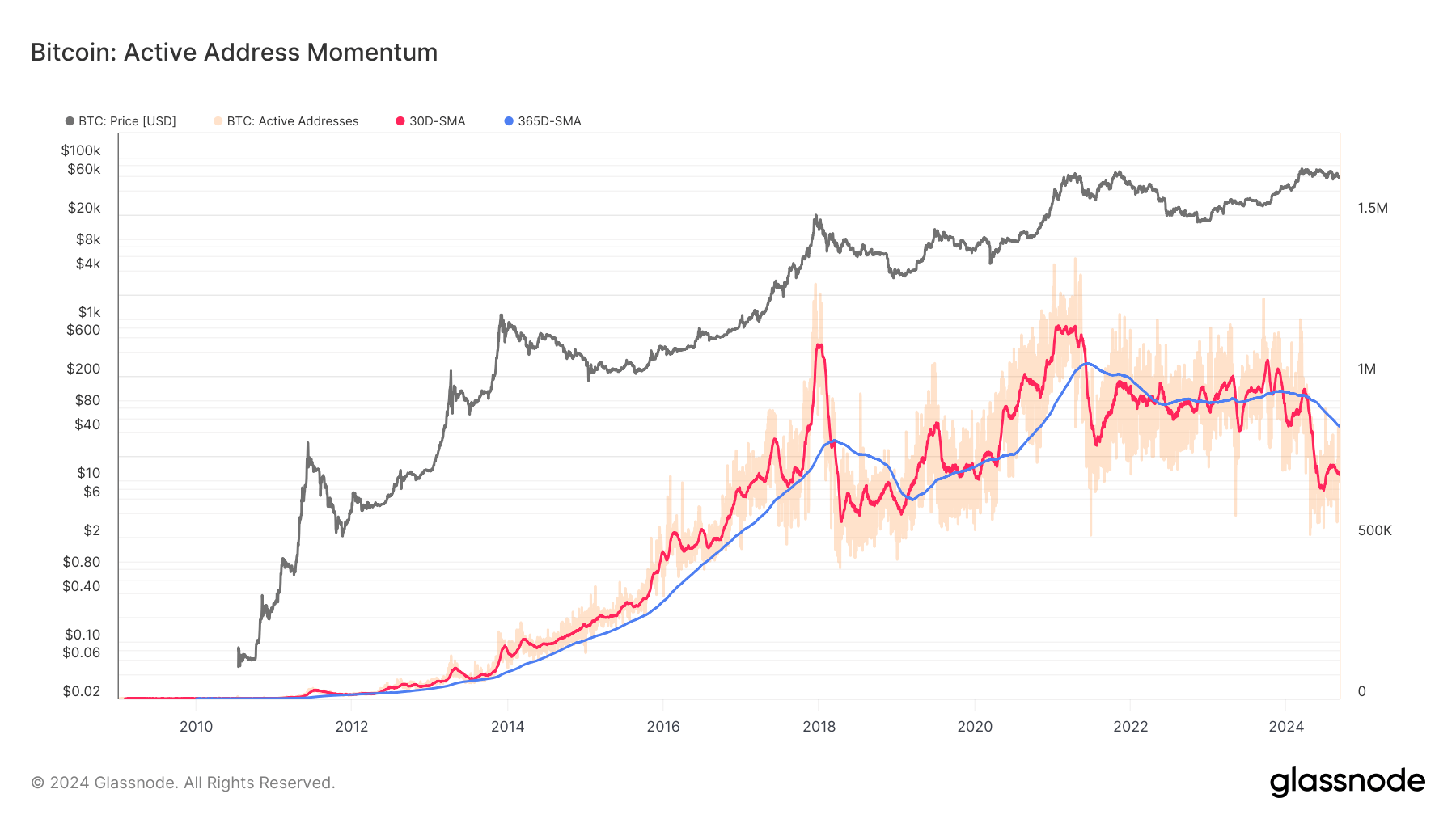

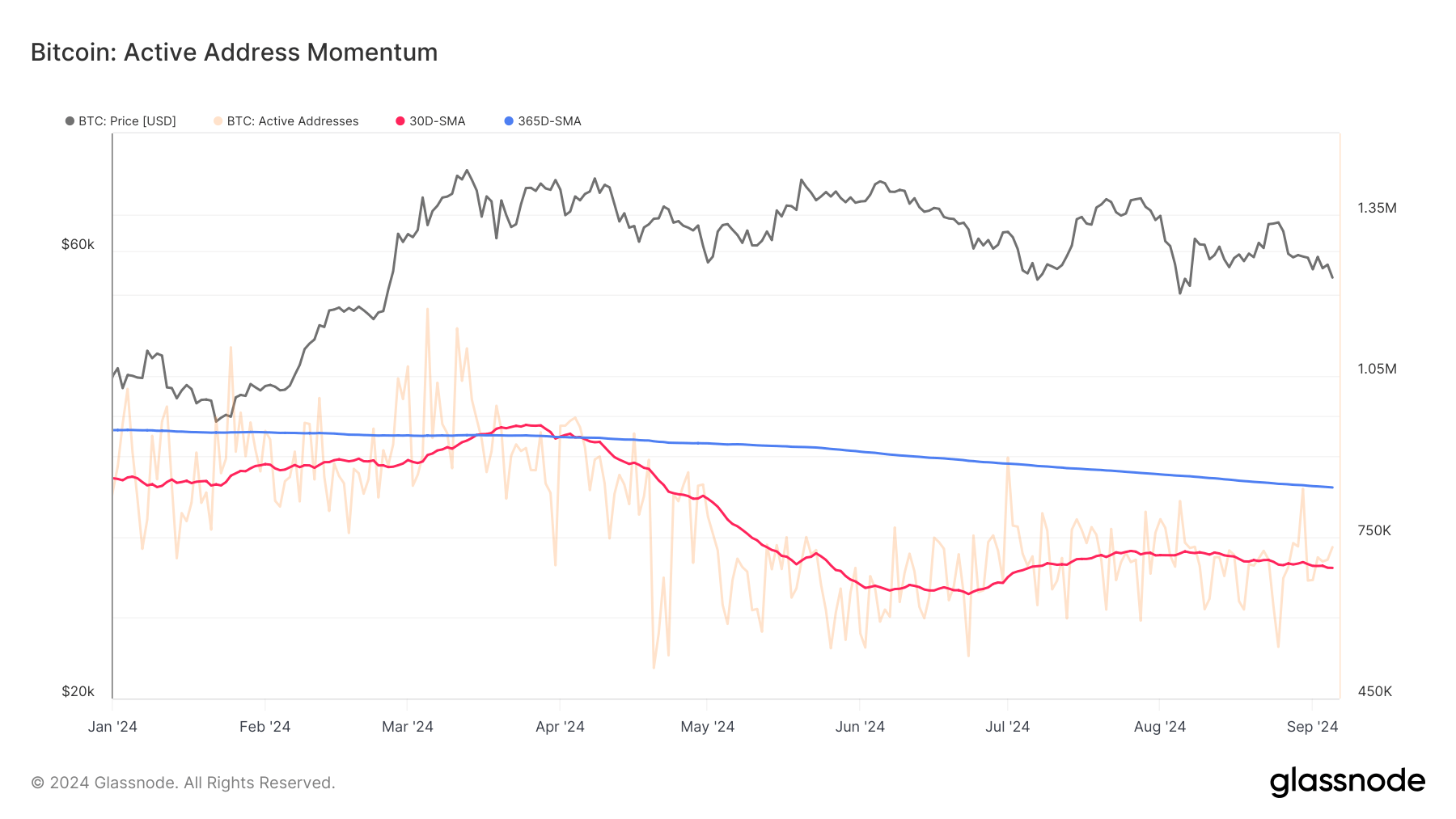

DEFINITION: This metric, compares the monthly average 🔴 of new addresses against the yearly average 🔵 to underline relative shifts in dominant sentiment and help identify when the tides are turning for network activity.

Monthly 🔴 > Yearly 🔵 indicates an expansion in on-chain activity, typical of improving network fundamentals and growing network utilization.

Monthly 🔴 < Yearly 🔵 indicates a contraction in on-chain activity, typical of deteriorating network fundamentals and declining network utilization.

Bitcoin’s active address momentum shows a sustained decline through 2024, particularly in the months following the April halving event. The 30-day simple moving average (SMA) of active addresses has fallen below the 365-day SMA, marking a contraction in network activity.

Historically, similar trends were observed in 2018 and 2021, following Bitcoin’s major price peaks. During those periods, active addresses also fell, aligning with broader market cooldowns.

Glassnode data highlights that the monthly average of active addresses during 2024 has remained below the yearly average, pointing to declining user engagement. This trend echoes the downturn seen in mid-2018 when Bitcoin’s price corrected after its 2017 bull run.

Despite short-term price rallies, network activity has not rebounded in line with previous cycles. The contraction in active addresses, coupled with this year’s post-halving phase, suggests waning network demand for blockspace, potentially indicating a broader cooling of Bitcoin’s user base.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Dai

Dai  Shiba Inu

Shiba Inu  USDT0

USDT0  PayPal USD

PayPal USD  Uniswap

Uniswap  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  Canton

Canton  Polkadot

Polkadot  USD1

USD1  Bitget Token

Bitget Token  Rain

Rain  Tether Gold

Tether Gold