Bitcoin has broken above the $52,000 mark as data shows that institutional traders have continued to apply their buying pressure on the asset.

Bitcoin Coinbase Premium Is Notably Positive Right Now

According to CryptoQuant founder and CEO Ki Young Ju, institutional brokers have been buying on Coinbase to fulfill their clients’ Bitcoin purchase orders.

The metric of interest here is the “Coinbase Premium Index,” which keeps track of the percentage difference between the BTC prices listed on cryptocurrency exchanges Coinbase and Binance.

The former is popularly known to be used by American institutional entities, while the latter has a more global user base. As such, this metric can provide us with hints about the differences in these two demographics’ buying and selling behaviors.

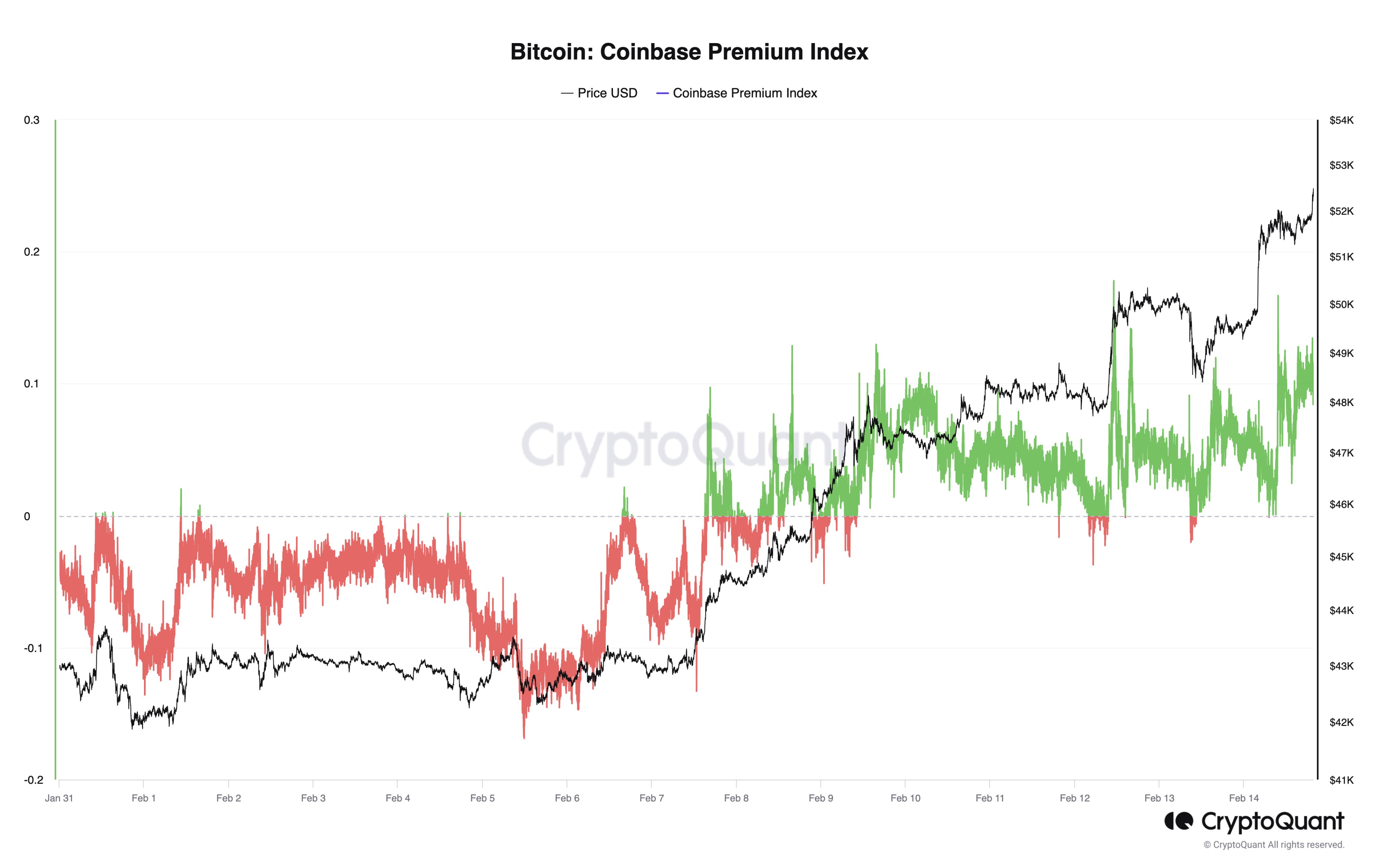

Here is a chart that shows the trend in the Coinbase Premium Index for Bitcoin over the past couple of weeks:

The value of the metric seems to have been quite positive in recent days | Source: @ki_young_ju on X

The graph shows that the Bitcoin Coinbase Premium Index has been mostly at positive levels during the past week. This would suggest that the price listed on Coinbase has stayed higher than on Binance.

Such a condition forms when the buying pressure from the former’s users is greater than that of the latter. Alternatively, it can also appear when the selling pressure on the former is just lower.

The latest positive values, though, have occurred as the Bitcoin price has been marching up, meaning that net buying has been taking place in the market. As such, the green Coinbase Premium Index suggests the presence of relatively high buying pressure from US-based institutional traders.

During the first week of the month, the indicator had been negative, and the price had been consolidating sideways. As the metric rose towards positive levels, however, this latest Bitcoin run kicked off, implying these large entities’ role in the market right now.

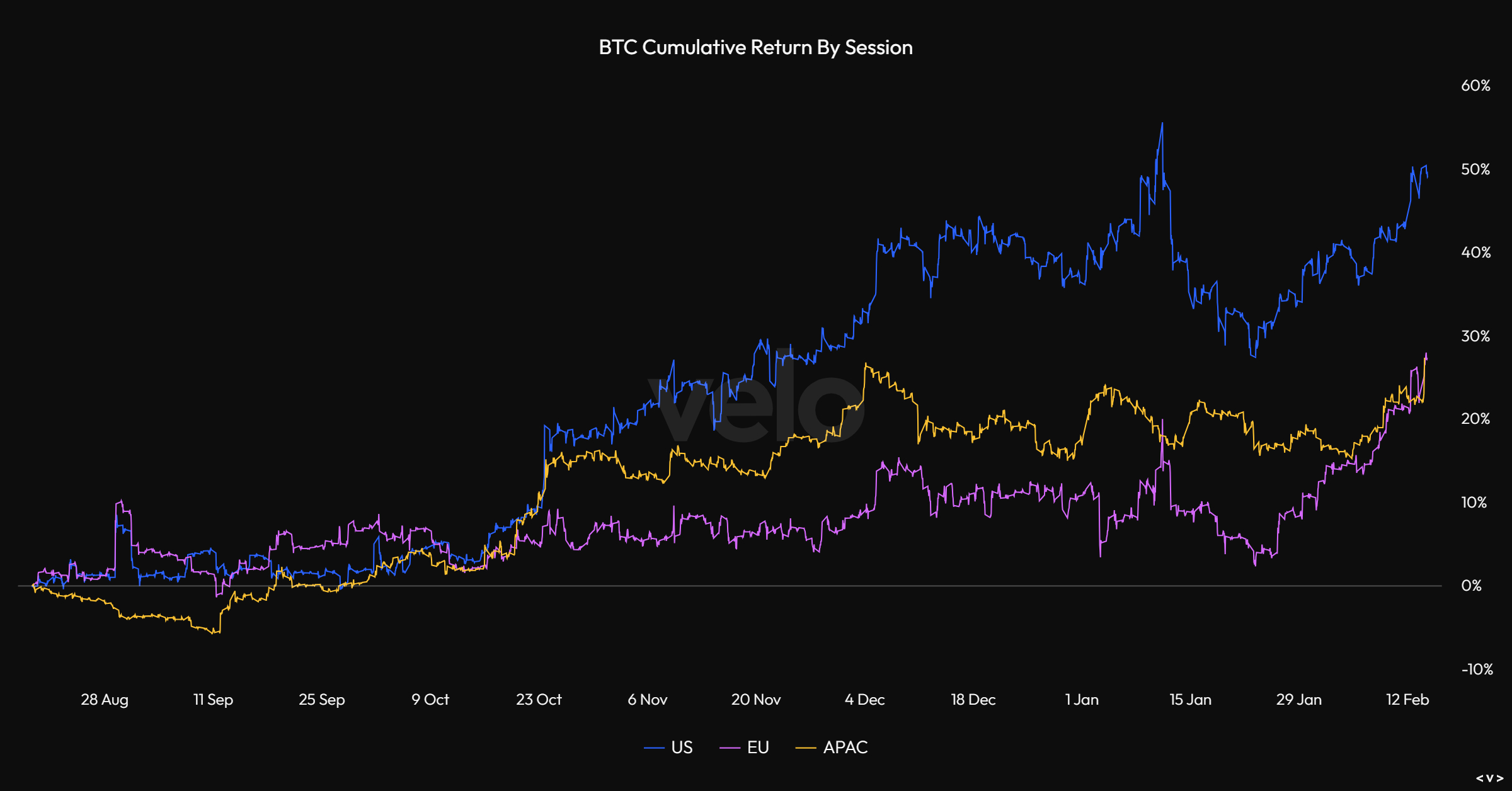

The data of the cumulative returns broken down by session also indicates that American investors have indeed been the drivers behind the price rally. Below is a chart shared by Reflexivity Research co-founder Will that shows this trend.

The data for the cumulative returns by session for the asset over the last few months | Source: @WClementeIII on X

It would appear that Bitcoin has observed the most positive returns during American trading hours over the last few months, further confirming the presence of exceptional buying pressure from US-based entities.

Given the relationship that institutional behavior on Coinbase and the BTC price has held recently, the premium could be to watch in the coming days, as staying positive could potentially mean a continuation of the rally. At the same time, a dip into the negative territory would suggest these entities have taken to selling.

BTC Price

Following the latest continuation to the rally, Bitcoin has now broken above the $52,000 mark, as the chart below shows.

Looks like the asset's price has been rapidly going up over the last few days | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, CryptoQuant.com, VeloData.app, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Pepe

Pepe