Despite reaching new 2024 highs and nearing 2021’s peak, Willy Woo, an on-chain analyst, argues that the true Bitcoin bull market has yet to begin. In a post on X, Woo is buoyant, saying that the recent surge is a mere “warm-up” before a larger rally.

TradFi Is In “For A Shock”: Analyst

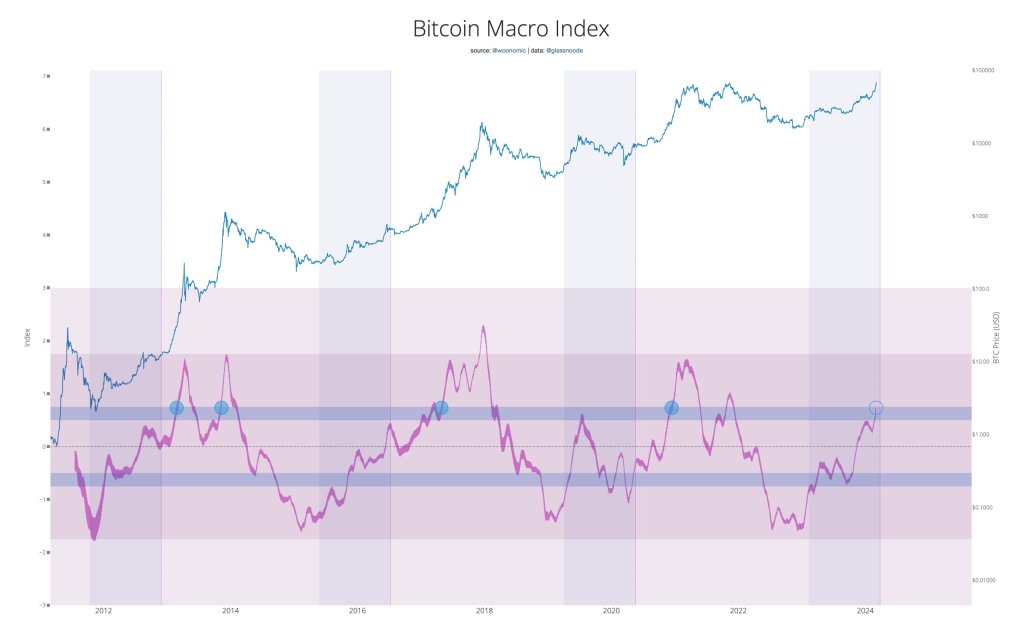

Citing events in the Bitcoin Macro Index, the analyst contends that even with BTC breaking records as it climbs higher, it is not backed by “full fundamentals.” This outlook is because BTC prices remain below a crucial level on the index. If this level is broken, Woo warns, the traditional market will be in “for a shock.”

The Bitcoin Macro Index is a composite indicator considering on-chain and macroeconomic factors. While on-chain activities like hash rate and transactions are crucial, Bitcoin is now intertwined with the global financial system.

As such, the index was designed to provide a holistic preview of the Bitcoin market, going beyond just price movements. To ensure this is captured, the index integrates readings of macroeconomic data, including inflation, labor market conditions, and interest rates, mainly from the United States.

Woo observes that though Bitcoin prices are at record highs, the coin is yet to break above a key level of the index. Currently, the index is consolidating horizontally, diverging from the sharp increment in Bitcoin prices.

However, this can change rapidly if the index breaks higher, depending on on-chain and macro events, including interest rate decisions in the United States.

Eyes On The Fed, Will Bitcoin Rally To Record Highs?

So far, eyes are on the United States Federal Reserve (Fed) and whether they will shift their monetary policy from hawkish to dovish. Taking a dovish stance means the central bank will consider slashing interest rates from current levels.

Often, reducing interest rates translates to a more accommodating economy, flush with more capital in circulation. Historically, this tends to support crypto and stock markets. However, the question is whether or not the Fed will decrease interest rates for the first time since the sharp increase throughout 2021 and early 2022.

Before the Fed decides on interest rates, BTC continues to rally. Since mid-January 2024, following the approval of multiple Bitcoin exchange-traded funds (ETFs), the industry has had record-breaking inflows. BlackRock’s product, IBIT, has since received over $10 billion and could rise even higher as BTC prices rally.

Feature image from Canva, chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor