As Bitcoin faces strong headwinds, breaching two critical support levels at $60,000 and $56,500 in quick succession, it may, on the surface, appear that fear is gripping the market. There are reasons to be afraid, especially for coin holders leveraging BTC in decentralized finance (DeFi) protocols, looking to take out loans using the asset as their collateral.

Fear Is Yet To Grip The Bitcoin Market

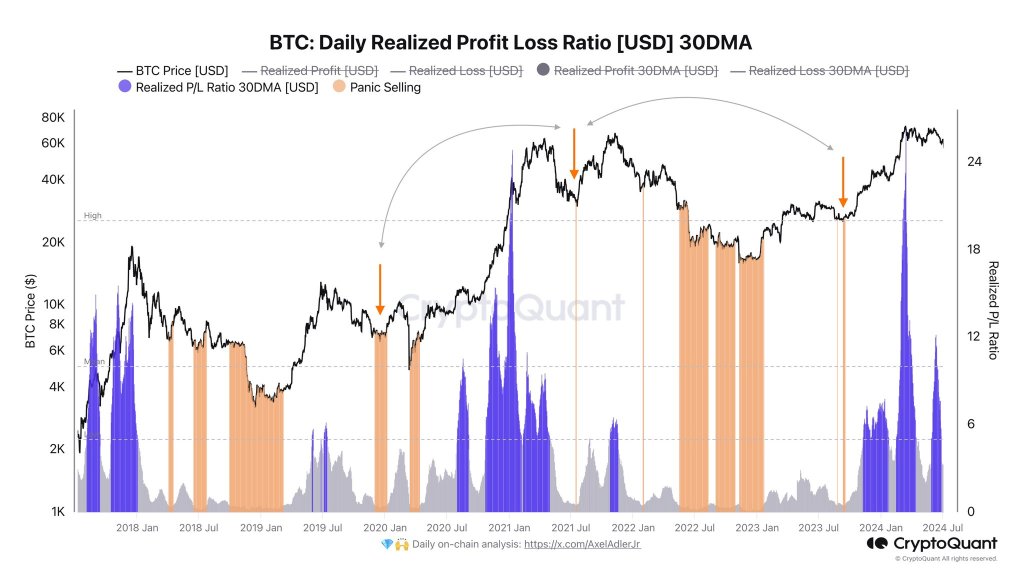

Even as prices plunge, one on-chain analyst, taking to X, argues that the market is relatively composed and fear and panic haven’t fully gripped it yet. Pointing to the Bitcoin Daily Realized Profit Loss ratio, the analyst said that unless there is an uptick in the number of addresses in red, pointing to panic selling, the market can withstand more losses.

Per the analyst’s assessment, the absence of “panic selling” bars suggests that investors are still processing the current events. Even as prices crater below $56,500, the market, the analyst added, can fall to as low as $47,000, a level that “doesn’t look as terrible as it did three weeks ago when we were at 70,000.”

Related Reading

Nonetheless, amid this necessary correction, the analyst added that the shakeout should be slower. In this way, there will be a more orderly market correction.

As of July 5, Bitcoin fell nearly 30% from all-time highs and is under immense selling pressure. Following the drop below $56,500 earlier today, it is evident that the coin is now within a bear breakout formation. The sell-off forced prices from the March to May 2024 range. This signals a new phase after expansions in Q1 2024 when the coin roared to $73,800.

Analysts expect more losses with sellers in the driving seat and Bitcoin within a bear breakout formation. Thus far, the immediate support is at $50,000 and $45,000, marking January 2024 highs.

Best Time To Buy Bitcoin? Wait For This Signal

While the drop is forcing investors to seek refuge in stablecoins, another analyst thinks this could be the best time to scoop more BTC at a discount. Taking to X, the analyst pointed out several fundamental factors that paint a long-term bullish picture.

Related Reading: This Dormant Bitcoin Wallet Holding $6.8 Million BTC Just Reactivated, Are They Selling?

Some of these tailwinds include the availability of spot Bitcoin exchange-traded funds (ETFs). There’s also regulatory clarity in the United States ahead of the highly contested presidential election. At the same time, the analyst is convinced the upcoming $16 billion payout by FTX trustees would be a net positive for optimistic BTC bulls.

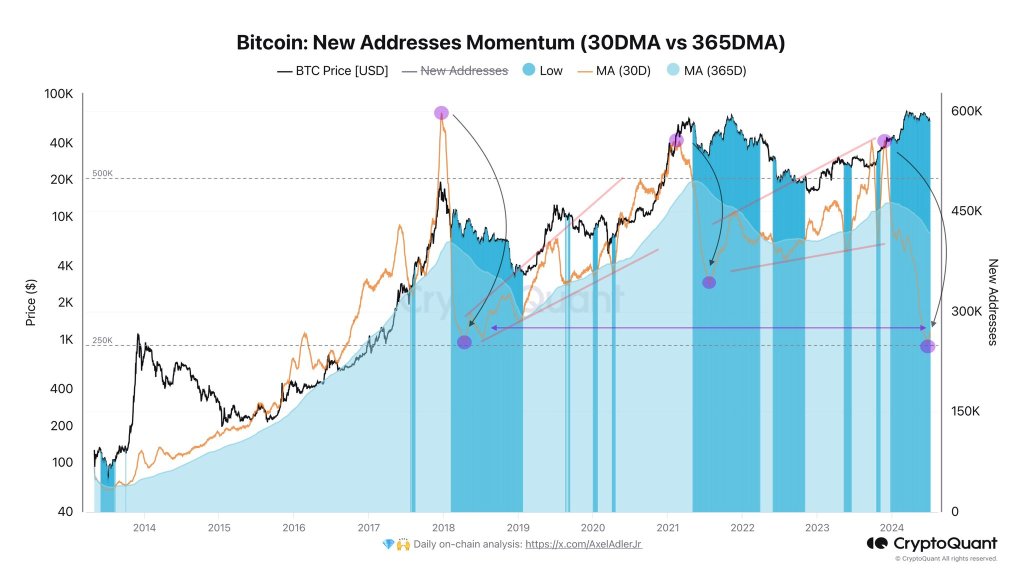

Even so, before there is stability and this week’s sell-off countered, there must be an uptick in new addresses. Once this is observed, it would mean that new investors are pouring in, creating demand for the coin. For now, prices are plunging, and fewer addresses are being created.

Feature image from DALLE, chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Dai

Dai  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Pepe

Pepe