On-chain data shows the Bitcoin long-term holders, or so-called “diamond hands,” have transferred a total of 669,000 BTC over the past month.

Bitcoin Long-Term Holders Have Sold Big In Past 30 Days

As explained by CryptoQuant Netherlands community manager Maartunn in a post on X, the Bitcoin network has observed multiple transactions involving a large amount of dormant coins.

Transfers involving old coins are attributed to the “long-term holder” (LTH) cohort. The LTHs refer to the BTC investors who have been holding onto their coins since more than 155 days ago.

Statistically, the longer an investor holds onto their coins, the less likely they become to sell or transfer the tokens at any point. As such, the LTHs are considered the more resolute part of the market.

These HODLers don’t easily sell due to this strong conviction and swiftly ride past both periods of downtrends and uptrends. The short-term holders (STHs), who make up for the rest of the sector, are the ones who make panic moves during such periods.

As the LTHs don’t often sell, the times that they do participate in distribution can be all the more note-worthy. One way to track whether these holders are selling or not is through their 30-day “net position change,” which is a metric that keeps track of the net amount exiting or entering the cohort.

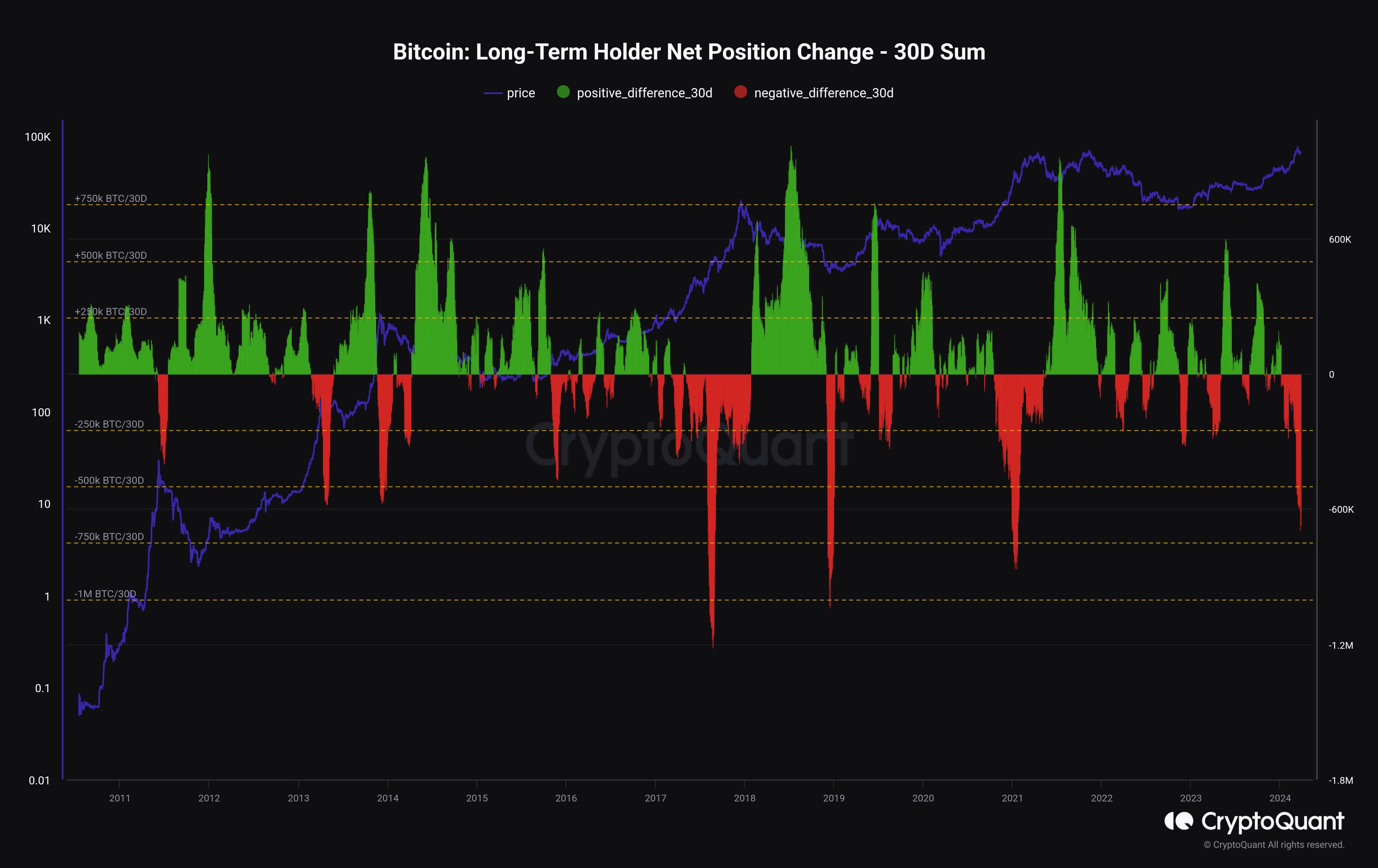

Below is the chart shared by Maartunn that reveals the trend in this Bitcoin indicator over the history of the cryptocurrency:

The value of the metric appears to have been highly negative in recent days | Source: CryptoQuant

As displayed in the above graph, the 30-day net position change of the Bitcoin LTHs has assumed a deep red value recently. In the past month, these HODLers have removed 669,000 BTC from their wallets.

Something to keep in mind is that when it comes to accumulation, the net position change has a delay attached to it. This is because the LTH supply only increases 155 days after the purchase has been made, since the newly bought coins have to first mature enough to be a part of this age group.

In the case of distribution, though, the same is obviously not true, since any coins that get transferred on the blockchain have their age reset back to zero instantly.

The recent negative net position spike for the LTHs is quite big. To put things into perspective, the BTC amount that these diamond hands have transacted with this spike is equal to around $44.7 billion in the US Dollar, a staggering value.

It would seem that the latest events of the cryptocurrency, which have included a brand new all-time high (ATH) and a crash, have forced even these diamond hands to break their streak.

From the chart, it’s visible that the LTHs have sold big when new Bitcoin ATHs have been set in the past bull rallies as well. Interestingly, though, the peak of these spikes has only coincided with a price top partway through each run, and not the actual cycle peak.

In BTC-scale, the negative 30-day net position spike from the LTHs has been smaller this time than both that observed during the 2017 and 2021 bull runs. This is only the case so far, however, as it’s unclear whether the peak LTH net distribution has ended or not.

BTC Price

Bitcoin has been making another attempt at recovery during the past few days as its price has now surged back towards the $67,000 level.

Looks like the price of the asset is trying to make recovery | Source: BTCUSD on TradingView

Featured image from Vasilis Chatzopoulos on Unsplash.com, CryptoQuant.com, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor