Nasdaq and NYSE have reportedly shelved plans on Bitcoin ETF options, proving a massive dampener for all those investors looking for more accessible cryptocurrency trading.

This comes in as both the exchanges have called back their applications meant to list and trade options based on Bitcoin ETFs. In a move that we could say is surprisingly not what most people expected, a debate on whether options trading in this terrain has been stirred in the crypto community.

Regulatory Hurdles

The landscape of regulation has been pretty much constant in terms of a challenge for crypto innovation. It has taken the industry almost a decade of effort to get spot Bitcoin ETFs approved, and the road to options trading is still full of hurdles.

The US Securities and Exchange Commission has been very careful, and the recent withdrawals by Nasdaq and NYSE only underline the difficulties involved in the process. Industry players had earlier gauged that options could come as early as the end of 2024, but recent events seem to indicate otherwise.

NASDAQ & NYSE have joined CBOE in withdrawing their applications for allowing options to trade on the Bitcoin ETFs. I’m expecting them to re-file over the coming days or weeks like we saw from CBOE. https://t.co/8trtqNBVTx pic.twitter.com/YC1U2SgAVA

— James Seyffart (@JSeyff) August 15, 2024

James Seyffart, a Bloomberg ETF analyst, is one of the optimistic voices who thought options trading may commence anytime soon. He claimed that the SEC had a cut-off for decisions on several applications, which included filings for options on Bitcoin ETFs.

But the fact that has been opened up by the recent withdrawals following those announcements is that exchanges are growing risk-averse in a yet-developing regulatory environment. It represents a tinge of uncertainty brought into play for investors eyeing options as a trading strategy.

Market Reactions

The market reacted cautiously but with some strength to this news. Notably, the price of Bitcoin recently rebounded above the $70,000 level from prior selling pressures attributed to ETF-related outflows.

Analysts have noted that this might have a bearing on trading dynamics, particularly on Bitcoin’s price. According to investors and analysts, the recent uptick in the value of Bitcoin, attributed to the easing ETF outflows and favorable macroeconomic environment, may ultimately turn out to be not good enough to sustain investor confidence if options trading does not resume.

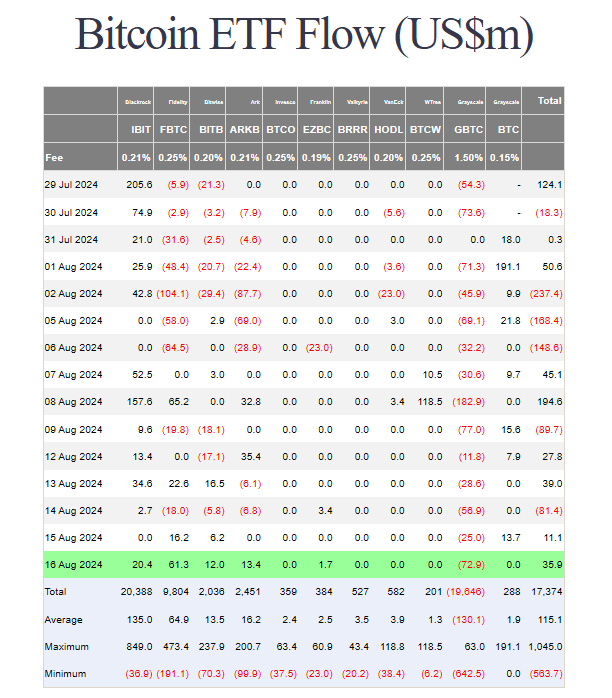

Source: Farside Investors

Bitcoin ETF flows were positive Thursday after net outflows the previous day, according to data from Farside Investors. Outflows from the Grayscale Bitcoin Trust slowed to $25 million, while Grayscale’s Bitcoin Mini Trust BTC pegged in $13.7 million following two days of flat flows.

According to the analysts at Swan Bitcoin, the SEC may well be biding its time to see more market stability before the rollout of additional products. The analysts are of the opinion that the agency is cautious about the current Bitcoin price fluctuations, which might make trading options slightly complex.

Looking Ahead

Bitcoin ETF options have been developing, but their future is uncertain. In fact, some have even said that by the end of 2024, the matter would be resolved. However, on the other hand, it is thought that the regulation is much more complex than what it actually seems at first and that till 2025, a clearer guideline can become developed.

Featured image from Pexels, chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Pepe

Pepe