Quick Take

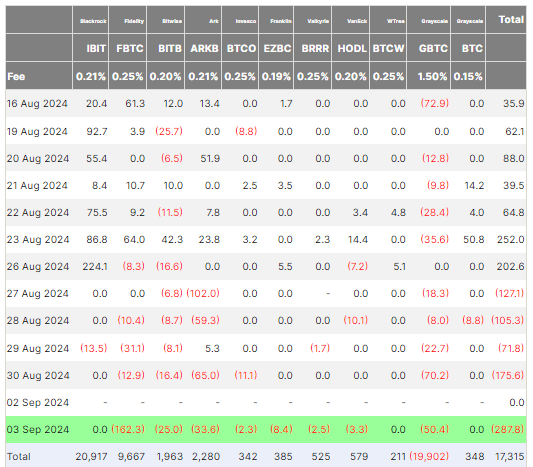

Farside data shows that Bitcoin ETFs experienced a significant outflow of $287.8 million on Sept. 3, marking the largest outflow since May 1, when $563.7 million exited the market.

Eight ETF issuers recorded outflows, highlighting a broad retreat from Bitcoin ETF investments. Among the hardest hit was Fidelity’s FBTC, which saw a $162.3 million outflow, and Grayscale’s GBTC, with $50.4 million leaving the fund. Bitwise’s BITB ETF lost $25.0 million, while ARK’s ARKB ETF experienced a $33.6 million outflow.

Notably, BlackRock’s IBIT ETF saw neither inflows nor outflows. Over the last five trading days, Bitcoin ETFs have experienced a cumulative outflow of $767.6 million, equivalent to around 4% of total net flows, now at $17.3 billion.

Ethereum ETFs also faced outflows, amounting to $47.4 million. Grayscale’s ETHE fund saw an outflow of $52.3 million, though this was slightly offset by Fidelity’s FETH ETF, which recorded a $4.9 million inflow. Overall, total outflows for Ethereum ETFs have now reached $524.8 million, according to Farside data.

Bitcoin is down 4% in the past five days, trading around $56,500.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  WETH

WETH  Ethena USDe

Ethena USDe  Canton

Canton  Zcash

Zcash  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USD1

USD1  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Dai

Dai  sUSDS

sUSDS  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  Tether Gold

Tether Gold  MemeCore

MemeCore