Quick Take

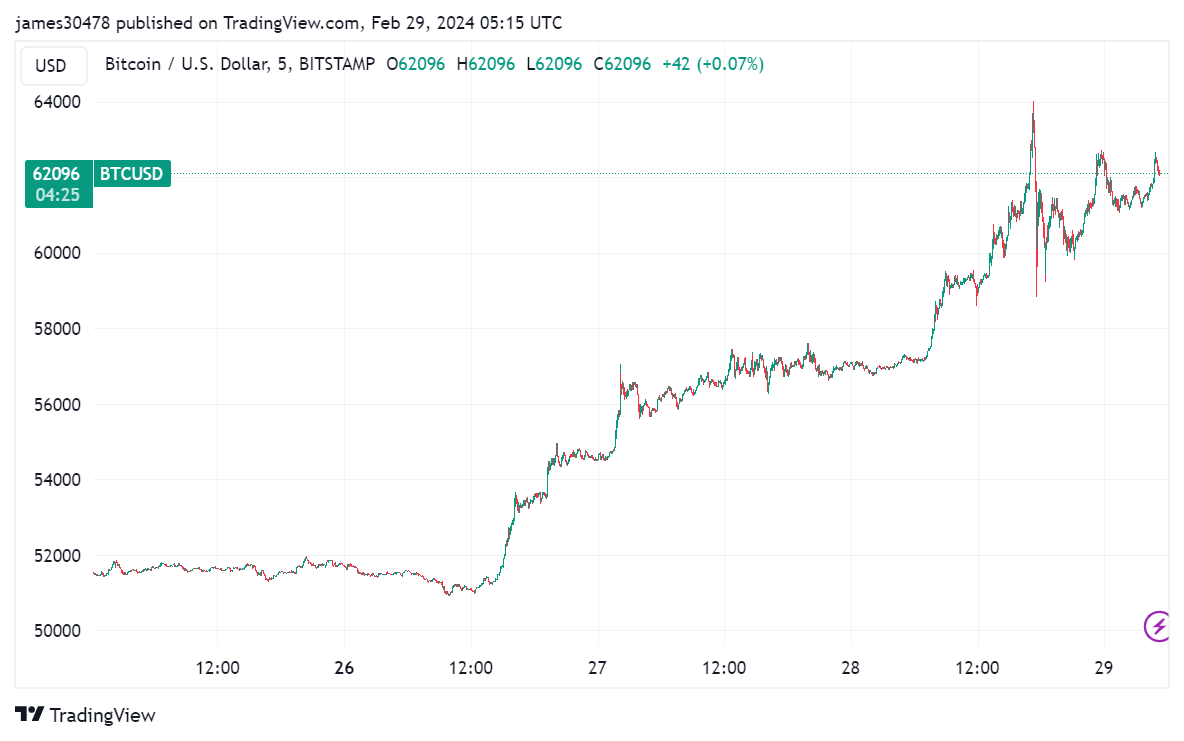

In a wild 24-hour ride, Bitcoin’s value underwent a rollercoaster of fluctuations, skyrocketing to a peak of $64,000, subsequently plunging to $59,000, before making a recovery to above $60,000.

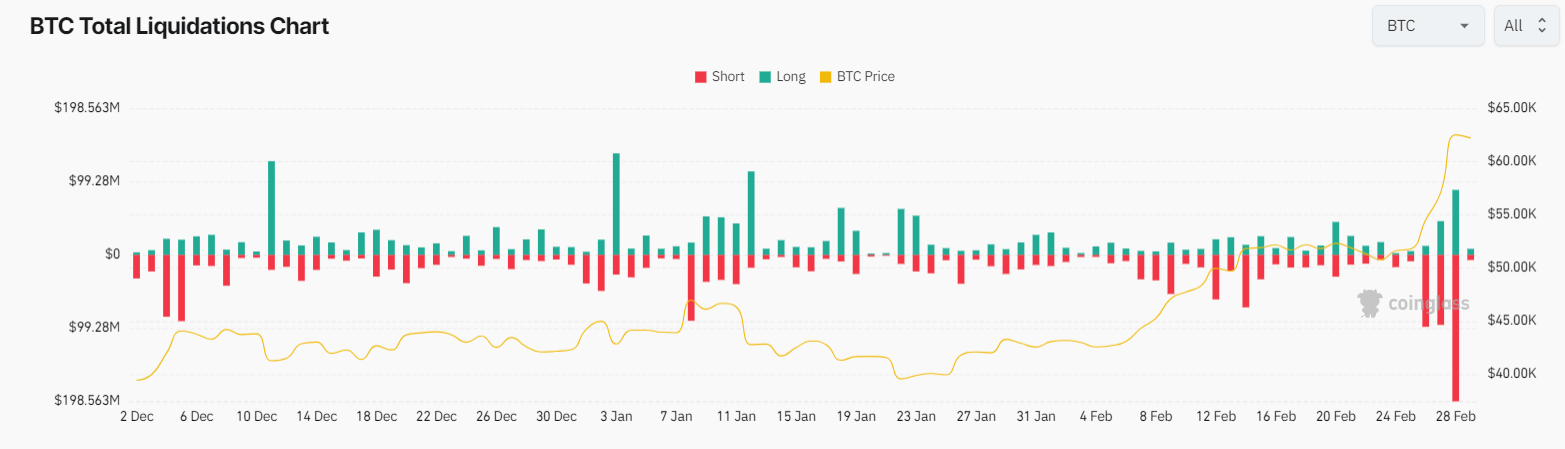

This climb triggered a wave of liquidations, totaling roughly $800 million in the digital asset ecosystem, according to Coinglass. During Bitcoin’s ascent, short positions were battered, while then long positions got liquidated due to Coinbase’s technical snag.

According to Coinglass, the $300 million liquidation in Bitcoin, split between roughly $200 million shorts and $100 million longs, represents the largest short liquidation event in the past three months.

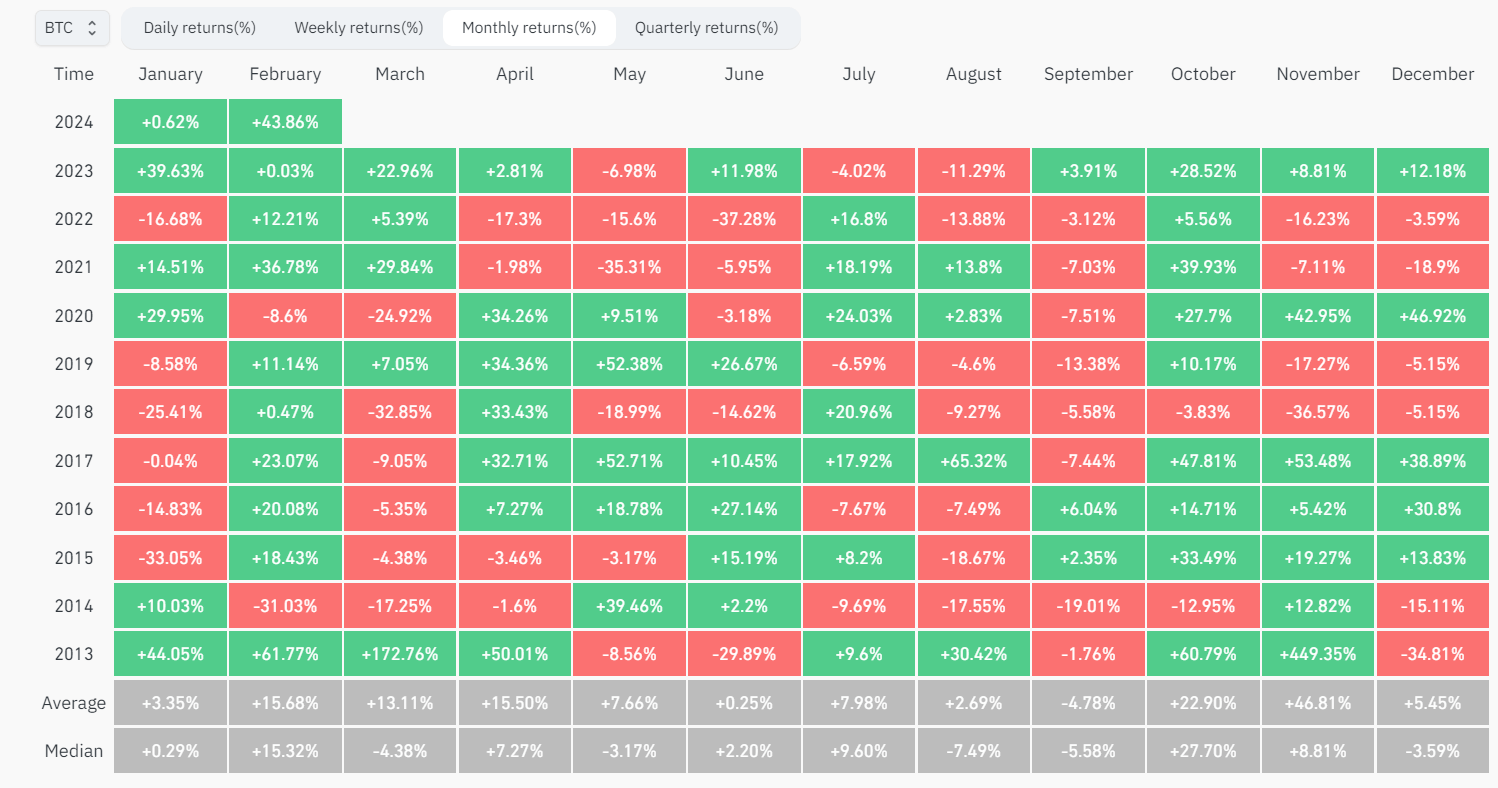

Looking beyond the tumultuous 24 hours, Bitcoin continues its upward trend, notching a 44% gain in February alone. If the momentum holds through the last day of the month, Bitcoin will close with six consecutive months of gains – a monthly performance not seen since December 2020, according to Coinglass.

The post Bitcoin eyes six-month winning streak amid $300 million in BTC liquidations appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor