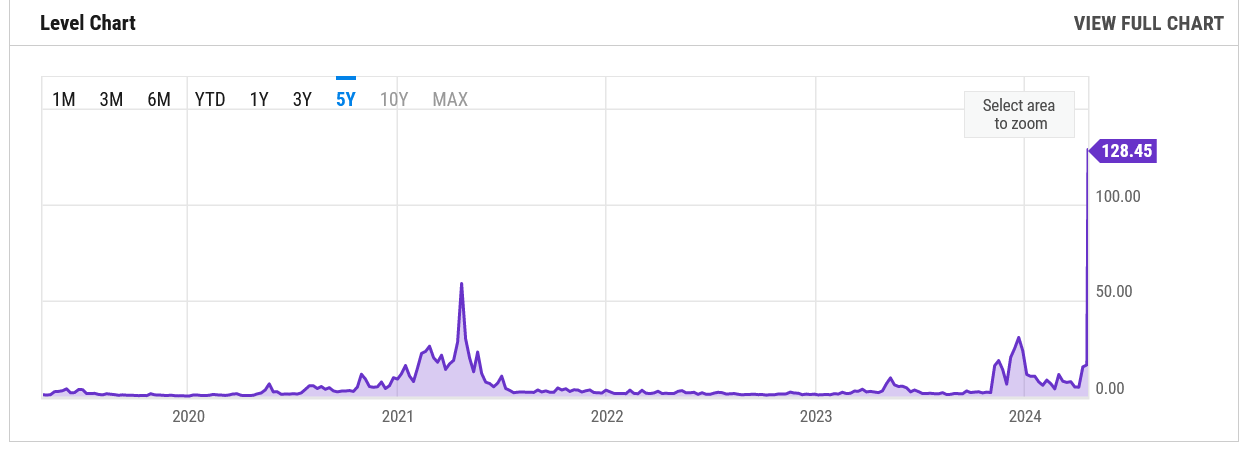

On April 20, Bitcoin experienced an unprecedented surge in block fees, reaching a staggering average of $128. This surge coincided with the fourth Bitcoin halving event, compensating for the reduced block subsidy miners faced. Merely a day later, on April 21, the average fees on Bitcoin plummeted sharply to $8-10 for medium-priority transactions, marking a significant decrease from the previous day’s record high.

Average daily transaction fee on Bitcoin over the last 5 years. Source: Y Charts

Average daily transaction fee on Bitcoin over the last 5 years. Source: Y Charts

Record Breaking Fee Revenue

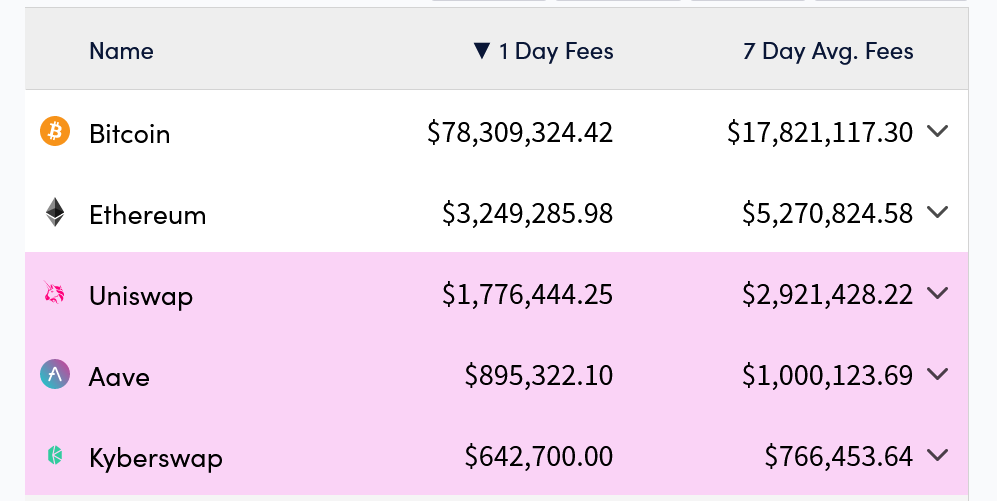

The day of the halving saw Bitcoin rake in $78.3 million in total fees, surpassing Ethereum by over 24 times, as reported by Crypto Fees. Notably, a single block at height 840,000 rewarded a miner with an astounding 37.7 Bitcoin, equivalent to $2.4 million, making it a historic moment for the network.

Block 840,000 witnessed remarkable demand, driven by enthusiasts of memecoins and non-fungible tokens (NFTs) vying to secure rare satoshis using the Runes protocol. This resulted in 3050 transactions being included in the block, with users paying an average of nearly $800 each.

Largest fees by blockchains and decentralized finance projects on April 20. Source: Crypto Fees

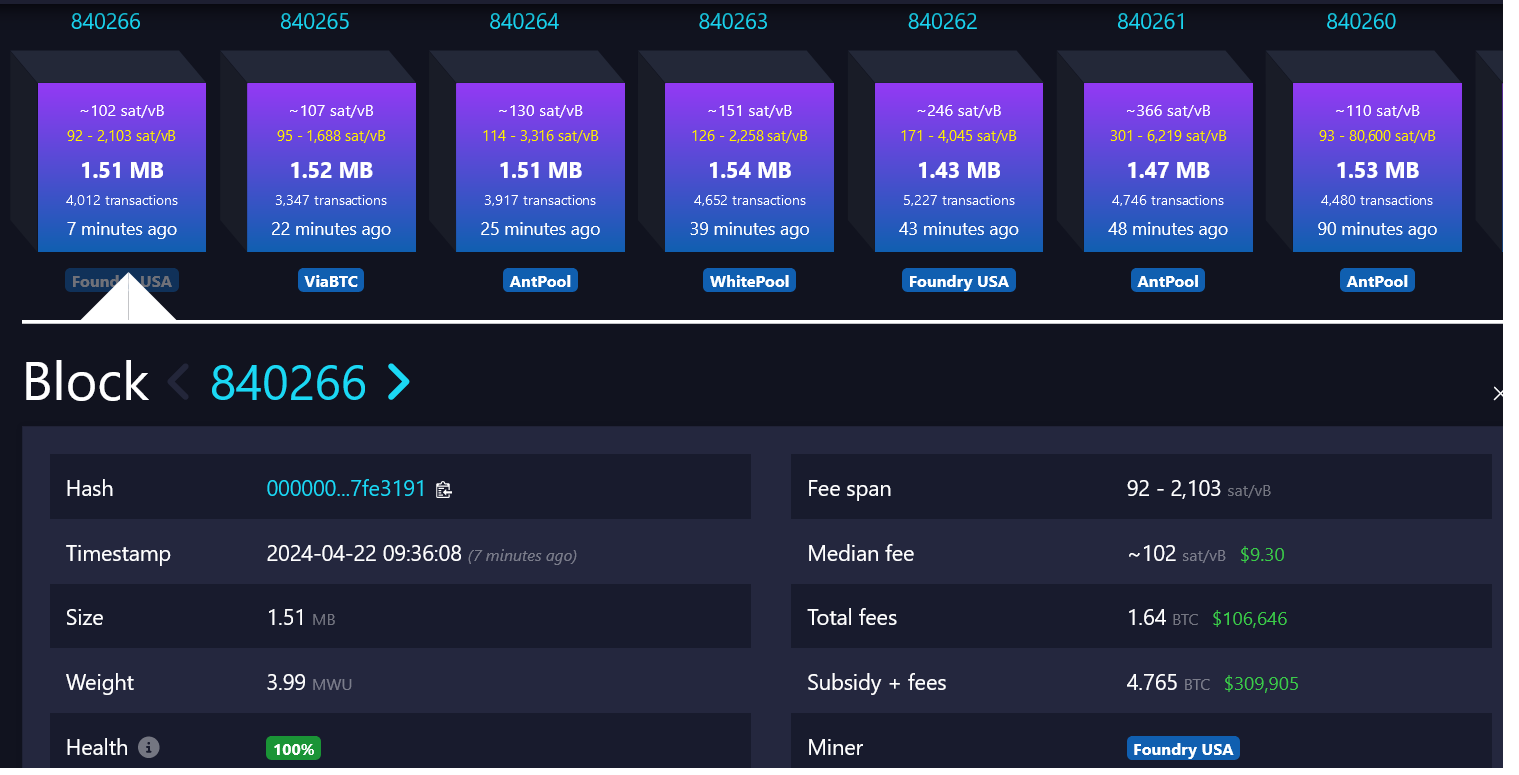

The elevated block fees persisted until approximately block 840,200 before gradually declining to around 1-2 Bitcoin, as observed on mempool.space.

Impact of Halving on Miners

Initially shielded by the substantial block fee payouts, miners were somewhat insulated from the halving of the block subsidy from 6.25 Bitcoin to 3.125 Bitcoin. However, with the average block fee now below 3.125 Bitcoin, miners are feeling the impact more acutely.

Source: Total fees for block 840,266 came out at 1.64 BTC. With the new block subsidy of 3.125, total rewards came out at 4.76 BTC. Source: mempool.space

For six consecutive days leading up to April 20, Bitcoin outpaced Ethereum in fee revenue, with a 7-day average of $17.8 million, highlighting its dominance in this aspect.

Despite the events, the Bitcoin halving did not cause any material fluctuations in the crypto price. Bitcoin value has remained relatively stable, witnessing a modest 1.5% increase since the halving to reach $64,840, according to CoinGecko.

Final Thoughts

In short, the Bitcoin network fee dynamics during the halving showcased both the resilience and volatility inherent in its decentralization. From record highs to swift declines, the landscape of Bitcoin fees continues to evolve, reflecting the intricate interplay between network demand, miner incentives, and market forces.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  Ethena USDe

Ethena USDe  Zcash

Zcash  Sui

Sui  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Litecoin

Litecoin  Hedera

Hedera  USDT0

USDT0  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  Dai

Dai  sUSDS

sUSDS  Canton

Canton  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  PayPal USD

PayPal USD  USD1

USD1  Polkadot

Polkadot  Uniswap

Uniswap  Rain

Rain  Mantle

Mantle  MemeCore

MemeCore  Bitget Token

Bitget Token  Aave

Aave