On-chain data shows the Bitcoin mining hashrate has continued its decline as the price of the cryptocurrency itself has seen a setback.

7-Day Average Bitcoin Mining Hashrate Down Over 8% Since All-Time High

The “mining hashrate” refers to an indicator that keeps track of the total amount of computing power that miners have currently connected to the Bitcoin blockchain. This metric is generally considered to represent the current situation of the BTC miners.

When the value of the indicator rises, it means new miners are joining the network and/or old ones are expanding their facilities. Such a trend implies the chain is looking attractive to these chain validators.

On the other hand, a decline in the metric suggests some miners have decided to disconnect from the network, potentially because they are no longer finding BTC mining to be profitable.

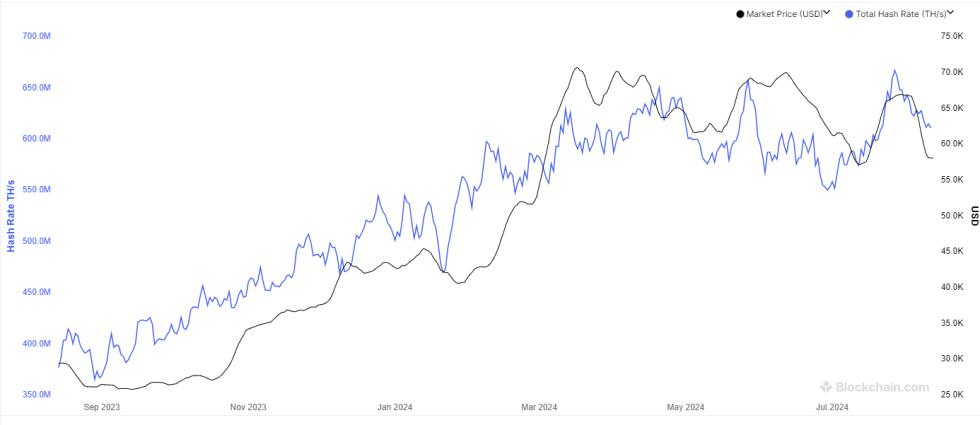

Now, here is a chart that shows the trend in the 7-day average Bitcoin mining hashrate over the past year:

Looks like the 7-day average value of the metric has gone through a decline in recent days | Source: Blockchain.com

As displayed in the above graph, the 7-day average Bitcoin mining hashrate had surged to a new all-time high (ATH) near the end of last month, but since then, it has been observing a constant decline.

The ATH occurred as the BTC price rallied up, and the drawdown in the metric coincided with a period of bearish momentum for cryptocurrency. The reason behind this close relationship is the fact that miner revenue is very much tied to the asset’s price.

These chain validators make their income from two sources, transaction fees and block subsidy, but the latter of the two has historically dominated their revenue.

The block subsidy, which miners receive as compensation for solving blocks on the network, is given out at a fixed BTC value and also at a more or less fixed time interval. This means that the only variable related to it is the USD price of the cryptocurrency.

When the asset’s value goes up, so does that of these rewards, and hence, that of the miner revenue. As such, miners tend to follow the coin’s trajectory when it comes to adding or removing hashrate.

Interestingly, though, while Bitcoin had recovered above the $62,000 level earlier, the hashrate didn’t see any reversal, perhaps because the miners didn’t think the increase would last. Indeed, they may have been right, as the asset has retraced some of its recovery during the past day.

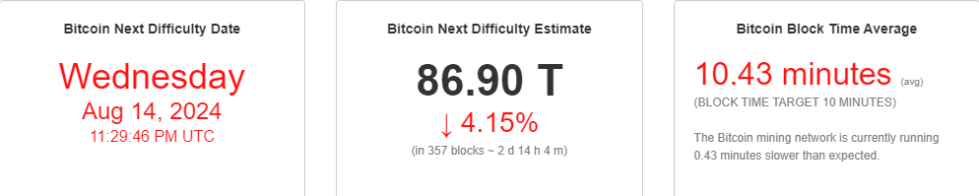

One consequence of the constant mining hashrate drawdown is that the network is set to see a negative difficulty change in its next scheduled adjustment.

The next estimated change in the BTC mining difficulty | Source: CoinWarz

The difficulty is a feature of the Bitcoin blockchain that controls how hard miners would find it to mine on the network. The existence of the difficulty is what allows for the block subsidy to be given out at fixed intervals.

When the miners add hashrate, they naturally become faster at mining, and thus, they churn out blocks at a faster pace. To counteract this, the network ups the difficulty just enough to slow the miners down to the standard 10 minutes per block rate.

As the miners have been decreasing their hashrate recently, the block time has been slower than usual. The Bitcoin blockchain will now decrease the difficulty by over 4% to make things easier for the validators.

BTC Price

At the time of writing, Bitcoin is trading at around $59,700, up more than 19% over the past week.

The price of the asset appears to have gone down over the last day or so | Source: BTCUSD on TradingView

Featured image from Dall-E, Blockchain.com, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Pepe

Pepe