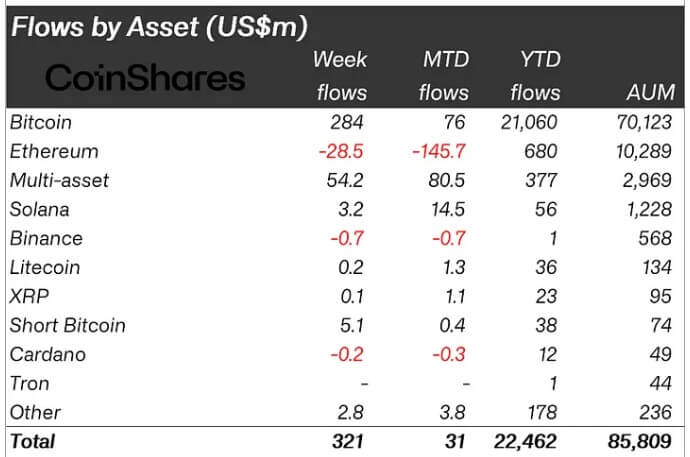

Digital asset investment products saw inflows for the second consecutive week this month, with investors pouring $321 million into the industry, according to CoinShares‘ latest weekly report.

This influx boosted the total assets under management (AuM) for crypto exchange-traded products (ETPs) by 9%, bringing the total to $85.8 billion. The overall investment product volume also increased to approximately $9.5 billion.

James Butterfill, head of research at CoinShares, linked this positive trend to the Federal Reserve’s recent decision to cut interest rates by 50 basis points. He explained:

“This surge was likely driven by the Federal Open Market Committee (FOMC) comments last Wednesday, which took a more dovish stance than anticipated, including a 50 basis point interest rate cut.”

Bitcoin, US dominate flows

A breakdown of the flows showed that Bitcoin-based investment products led the inflows, generating $284 million in net gains globally last week. Notably, major crypto funds from firms like BlackRock, Bitwise, Fidelity, ProShares, and 21Shares contributed to this rebound, collectively adding $321 million in net inflows.

The positive price momentum for Bitcoin also attracted investors with bearish sentiment, who allocated $5.1 million to short-Bitcoin funds.

Ethereum faced its fifth consecutive week of outflows, totaling $29 million. This trend stems from ongoing withdrawals from Grayscale’s ETHE product and declining interest in new offerings.

According to Farside data, ETHE experienced outflows between $13 million and $18 million for three straight days last week, overshadowing minor inflows from other products, including Grayscale’s Mini-Trust.

Meanwhile, Solana maintained its current positive trend, adding $3.2 million in inflows last week. This flow can also be linked to the announcements of several traditional financial institutions announcing plans to launch financial services on the network during the latest Solana Breakpoint event in Singapore.

Other large-cap altcoins, including XRP and Litecoin, saw combined inflows of $300,000.

Across regions, the US unsurprisingly emerged as the leading contributor to last week’s inflow, accounting for $277 million, followed by Switzerland with $63 million.

In contrast, Germany, Sweden, and Canada experienced outflows of $9.5 million, $7.8 million, and $2.3 million, respectively.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  Hedera

Hedera  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle